Toilet Paper Market Size 2025-2029

The toilet paper market size is forecast to increase by USD 8.88 billion, at a CAGR of 4.4% between 2024 and 2029.

- The market is experiencing significant shifts driven by evolving consumer preferences and industry trends. With increasing concerns around health and hygiene, the demand for toilet paper is on the rise. This heightened focus on cleanliness and personal care is fueling market growth. Furthermore, companies are addressing sustainability concerns by adopting eco-friendly manufacturing processes, which is becoming a crucial differentiator for consumers. However, the market faces challenges as well. Fluctuating raw material prices pose a significant threat to profitability, requiring companies to closely manage their supply chains and costs.

- To capitalize on opportunities and navigate these challenges effectively, companies must stay agile and responsive to changing market dynamics. By focusing on sustainability, innovation, and cost management, they can position themselves for long-term success in the evolving market.

What will be the Size of the Toilet Paper Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its landscape. Wholesale distributors play a pivotal role in supplying bath tissue to various sectors, including convenience stores and private label brands. Product differentiation is a key driver, with sheet count, virgin pulp, and finishing & converting processes influencing consumer preferences. Septic safety and hygiene regulations are paramount, ensuring the production of premium and value-priced rolls that meet industry standards. Toilet paper rolls come in various sizes, from jumbo rolls to individual packs, catering to diverse usage frequencies. Online retail channels have disrupted traditional distribution networks, offering convenience and competitive pricing.

Recycled paper and sustainable forestry practices are gaining traction, aligning with environmental standards. The papermaking process involves raw material sourcing, pulp production, and automated manufacturing, all of which impact cost per roll and advertising spend. Brands strive for supply chain efficiency and FSC certification to maintain brand loyalty and cater to budget-conscious consumers. Hygiene standards extend to facial tissue, tissue paper, and paper towels, ensuring consumer safety and satisfaction. Marketing campaigns, ply count, and price elasticity continue to shape market trends, with industrial rolls and dispenser rolls catering to specific industries. Consumer preferences for eco-friendly and cost-effective options persist, driving innovation in the sector.

The ongoing unfolding of market activities underscores the continuous evolution of the toilet paper industry.

How is this Toilet Paper Industry segmented?

The toilet paper industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Residential

- Commercial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

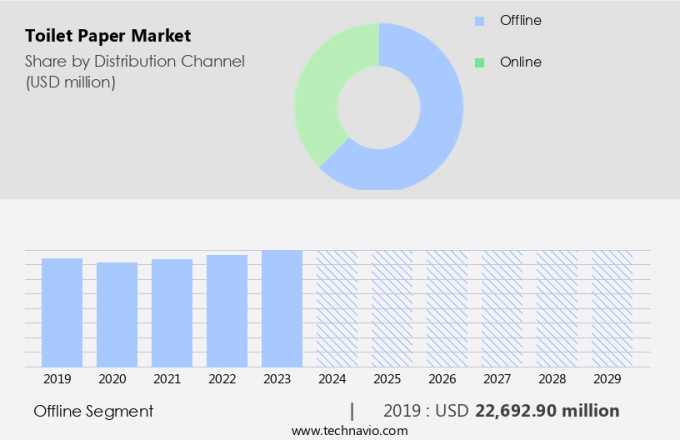

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, product innovation and private label offerings continue to shape consumer preferences. Wholesale distributors play a crucial role in supplying a broad range of toilet paper rolls to various distribution channels. Convenience stores and online retailers, in particular, have gained traction due to their convenience and accessibility. Product differentiation is achieved through factors such as sheet count, ply count, and the use of virgin pulp or recycled paper. Sustainable forestry and FSC certification are essential considerations for companies, as are hygiene regulations and septic safety. Marketing campaigns and automated manufacturing processes contribute to increased brand loyalty and value pricing strategies.

Bath tissue, facial tissue, and paper towels are produced using various pulp sources, including bamboo, and are available in jumbo rolls, individual packs, and bulk packs. The papermaking process involves finishing and converting stages, ensuring quality control and adherence to environmental standards. Cost per roll, advertising spend, and price elasticity influence supply chain efficiency and the competitiveness of premium and budget brands. Industrial rolls, hospitality rolls, and dispenser rolls cater to specific industries and usage frequencies. Overall, the market is characterized by evolving consumer preferences, diverse distribution channels, and a focus on sustainability and hygiene standards.

The Offline segment was valued at USD 22.69 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

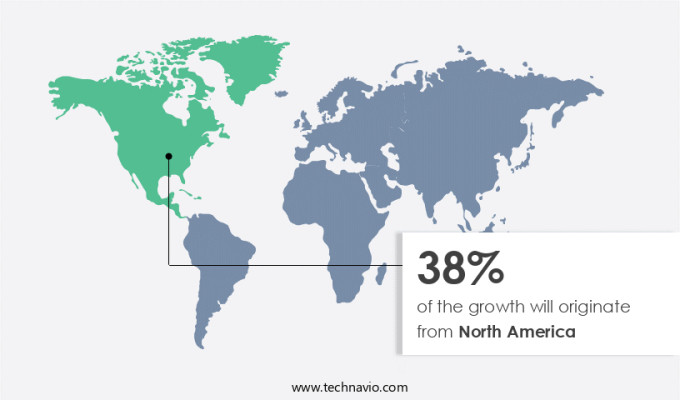

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is experiencing steady growth, with the US leading the charge. Market expansion is driven by the introduction of innovative products, the rise of online retail for household essentials, and heightened awareness of the importance of toilet paper. Health concerns, such as obesity and sedentary lifestyles, are also contributing factors, as hospitalizations increase the demand for hygiene products. In the US, premium toilet paper offerings, including scented, quilted, moisturized, and soft textures, are popular choices. Automated manufacturing processes and sustainable forestry practices are shaping the industry, with an emphasis on finishing and converting for improved product differentiation.

Distribution channels are expanding to include convenience stores and online retailers, catering to varying usage frequencies. Hygiene regulations and environmental standards are key considerations, with FSC certification and recycled paper options gaining traction. Cost-effective value pricing and quality control measures ensure consumer satisfaction, while jumbo rolls, individual packs, and industrial rolls cater to diverse market segments. Advertising spend and price elasticity influence market dynamics, with supply chain efficiency a priority for manufacturers. Facial tissue, tissue paper, and paper towels are related product categories experiencing similar trends.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Toilet Paper Industry?

- Concerns over health and hygiene are driving significant growth in the market, as consumers prioritize these factors in their purchasing decisions.

- The market is experiencing significant growth due to an increasing population and heightened awareness of hygiene in developing countries. This trend is particularly noticeable in emerging economies, such as those in the Asia Pacific region, where urbanization and rising disposable incomes are driving changes in consumer purchasing behavior. Manufacturers are capitalizing on this trend by expanding their market reach and introducing product innovations to meet the evolving needs of consumers. Product differentiation is a key strategy in the market, with manufacturers focusing on factors such as sheet count, virgin pulp, and finishing & converting to distinguish their offerings.

- Marketing campaigns and automated manufacturing processes are also important tools for companies looking to gain a competitive edge. Sustainable forestry practices are increasingly important to consumers, making the use of certified sustainable materials a significant consideration for manufacturers. Wholesale distributors and convenience stores play a crucial role in the supply chain, ensuring that toilet paper is readily available to consumers. Private label offerings are also gaining popularity due to their affordability and convenience. Overall, the market is expected to continue its growth trajectory, driven by changing consumer preferences and increasing demand for hygiene products.

What are the market trends shaping the Toilet Paper Industry?

- Sustainable manufacturing is increasingly being adopted by companies as the latest market trend. This shift towards more eco-friendly and efficient production processes is a professional and responsible response to growing consumer demand for sustainable products and corporate social responsibility.

- Toilet paper companies are prioritizing sustainability in their operations to address growing environmental concerns and meet hygiene regulations. They are investing in innovative packaging materials, such as plant-based plastics, to replace traditional plastic and reduce their carbon footprint. Additionally, companies are adopting sustainable manufacturing processes, including the sourcing of wood from renewable forests. For instance, Essity, a leading player in the market, has committed to using 85% renewable or recycled materials for its packaging by 2025 and making all plastic packaging 100% recyclable by the same year. These initiatives align with the increasing demand for eco-friendly products and the importance of adhering to hygiene regulations.

- Furthermore, distribution channels are expanding to include online retail and jumbo rolls to cater to varying usage frequencies. The market also offers premium brands and value pricing options to cater to diverse consumer preferences. Quality control remains a priority to ensure consistency and customer satisfaction. The papermaking process is continually evolving to produce high-quality toilet paper rolls while minimizing waste and optimizing production efficiency.

What challenges does the Toilet Paper Industry face during its growth?

- The volatility in raw material prices poses a significant challenge and impedes growth within the industry.

- Toilet paper is a fundamental hygiene product with retail packaging playing a crucial role in consumer decision-making. The ply count, a significant factor influencing consumer preferences, varies among brands, with some opting for higher ply counts for added softness and strength. The market caters to diverse segments, including budget brands and hospitality rolls, each with unique requirements. Raw material sourcing is a critical market dynamic. The global pulp production industry faces a shortage of recovered fiber, a key raw material for toilet paper manufacturing. The Technical Association of the Pulp and Paper Industry (TAPPI) reports that many countries are nearing the exhaustion stage of their paper pulp recovery.

- Consequently, there is a significant demand-supply imbalance, affecting the cost per roll and potentially impacting brand loyalty. Advertising spend and price elasticity are essential factors shaping the market. Brands invest heavily in marketing efforts to build brand recognition and consumer trust. Price elasticity, the responsiveness of quantity demanded to changes in price, influences consumer behavior. Understanding these dynamics is essential for businesses aiming to succeed in the market. In conclusion, the market is influenced by various factors, including raw material sourcing, ply count, brand loyalty, advertising spend, and price elasticity. The current global shortage of recovered fiber is a significant challenge, impacting the cost and availability of toilet paper.

- Staying informed about these market dynamics can help businesses make informed decisions and adapt to the evolving market landscape. Recent research suggests that the shortage of raw materials is expected to persist, emphasizing the need for continued monitoring and strategic planning.

Exclusive Customer Landscape

The toilet paper market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the toilet paper market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, toilet paper market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Asia Pulp and Paper APP Sinar Mas - The company provides an extensive selection of high-quality toilet paper options. Among these offerings are the Caprice Green Jumbo, Interfold, and Jumbo toilet paper rolls.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asia Pulp and Paper APP Sinar Mas

- Caprice Paper Products Pty Ltd.

- Cascades Inc.

- Clearwater Paper Corp.

- Empresas CMPC S.A.

- Essity AB

- Hengan International Group Co. Ltd.

- Kimberly Clark Corp.

- Koch Industries Inc.

- Kruger Inc.

- Matera Paper Co. Inc.

- Naturelle Consumer Products LTD.

- Orchids

- Seventh Generation Inc.

- Sofidel Group

- The Procter and Gamble Co.

- Traidcraft

- Unilever PLC

- Velvet CARE sp. z o.o.

- WEPA Hygieneprodukte GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Toilet Paper Market

- In March 2023, Procter & Gamble, a leading consumer goods company, introduced a new line of eco-friendly toilet paper called "Pampers Eco-Friendly Toilet Paper" in the US market. This product is made from 100% recycled materials and is expected to reduce the company's carbon footprint by 35,000 metric tons per year (Procter & Gamble press release, 2023).

- In June 2024, Kimberly-Clark and Unilever, two major players in the toilet paper industry, announced a strategic partnership to explore sustainable production methods and reduce their environmental impact. The collaboration aims to develop innovative toilet paper solutions using alternative raw materials and renewable energy sources (Reuters, 2024).

- In October 2024, Sofidel, an Italian toilet paper manufacturer, opened a new production plant in Romania, expanding its European market presence and increasing its annual production capacity by 50,000 tons (Bloomberg, 2024).

- In January 2025, the European Union passed a new regulation requiring all toilet paper manufacturers to use at least 50% recycled content in their products by 2027. This initiative is part of the EU's broader efforts to promote sustainability and reduce waste (European Parliament press release, 2025).

Research Analyst Overview

- The market experiences dynamic pricing strategies, with brands balancing cost and consumer expectations. Bio-based content gains traction, as consumers demand eco-friendly alternatives. Shelf life and inventory management are crucial factors, influenced by technological disruptions and advancements in moisture control and wet strength. Value-added features, such as antibacterial and antiviral properties, and post-consumer recycled content, impact brand equity. Carbon footprint and water footprint concerns drive the shift towards recyclable packaging and compostable options. Demand forecasting and roll length optimization are essential for efficient transportation logistics.

- Core size, sheet size, roll diameter, and disintegration time are key product attributes shaping consumer preferences. Brand image and customer reviews play a pivotal role in market differentiation. Water absorption rate and packaging material choices influence product life cycle and sustainability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Toilet Paper Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.4% |

|

Market growth 2025-2029 |

USD 8.88 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, China, Canada, Germany, India, Japan, Italy, UK, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Toilet Paper Market Research and Growth Report?

- CAGR of the Toilet Paper industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the toilet paper market growth of industry companies

We can help! Our analysts can customize this toilet paper market research report to meet your requirements.