Tokenization Market Size 2024-2028

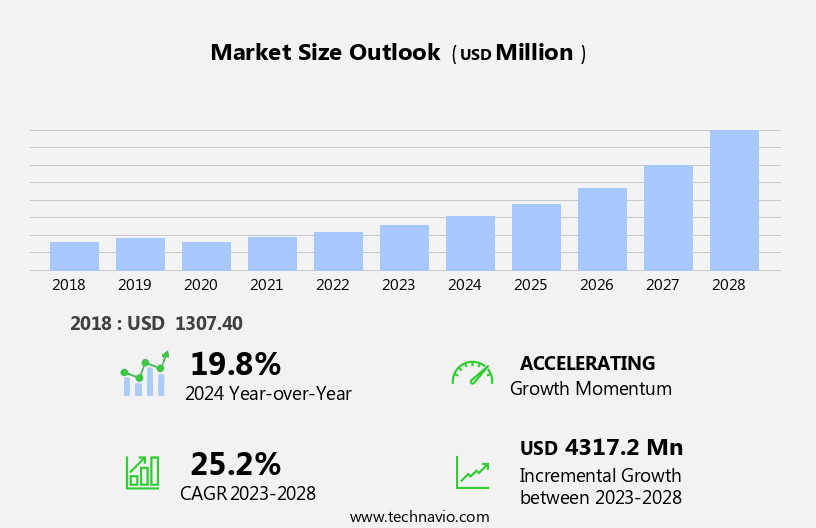

The tokenization market size is forecast to increase by USD 4.32 billion at a CAGR of 25.2% between 2023 and 2028.

What will be the Size of the Tokenization Market During the Forecast Period?

How is this Tokenization Industry segmented and which is the largest segment?

The tokenization industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premises

- Cloud

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Deployment Insights

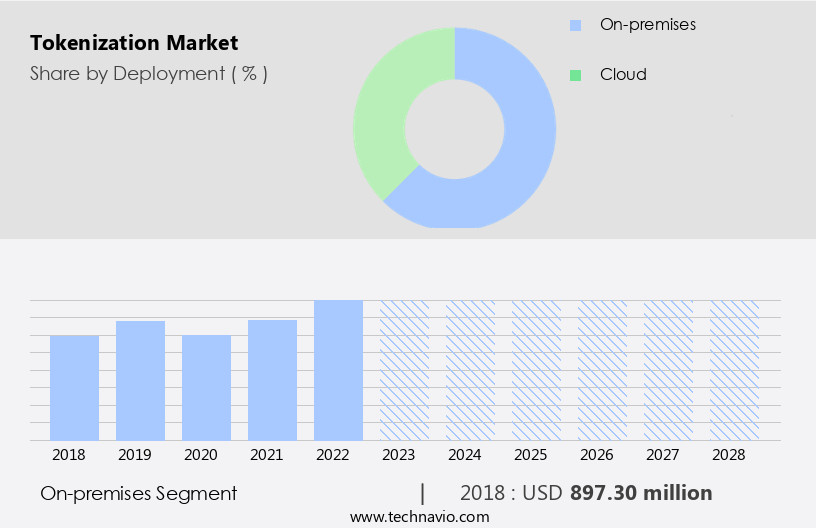

- The on-premises segment is estimated to witness significant growth during the forecast period.

Tokenization is a critical aspect of payment security for businesses, particularly those In the eCommerce and financial sectors. This process involves replacing sensitive financial data, such as credit card numbers, with non-sensitive placeholders or tokens. On-premises servers have long been the traditional deployment model for tokenization infrastructure. In this setup, companies own and manage their servers and storage units, which are typically located in secure, climate-controlled facilities. However, managing on-premises servers requires specialized IT support and ongoing maintenance, including user access policies, security patches, and antivirus software. Businesses must also ensure data protection against cyber attacks, which can result in negative financial impacts from data theft or breaches.

With the rising demand for tokenization solutions, cloud-based options have emerged as an alternative to on-premises servers. These solutions offer easier integration, affordability, and compliance with various regulations. Despite the benefits, organizations must consider the complexities of management and user adoption processes. Additionally, businesses must prioritize training programs for their workforce to ensure reliable implementation and maintenance. Ultimately, the choice between on-premises and cloud-based tokenization depends on an organization's internal systems, reliability, and compliance scope.

Get a glance at the Tokenization Industry report of share of various segments Request Free Sample

The On-premises segment was valued at USD 897.30 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

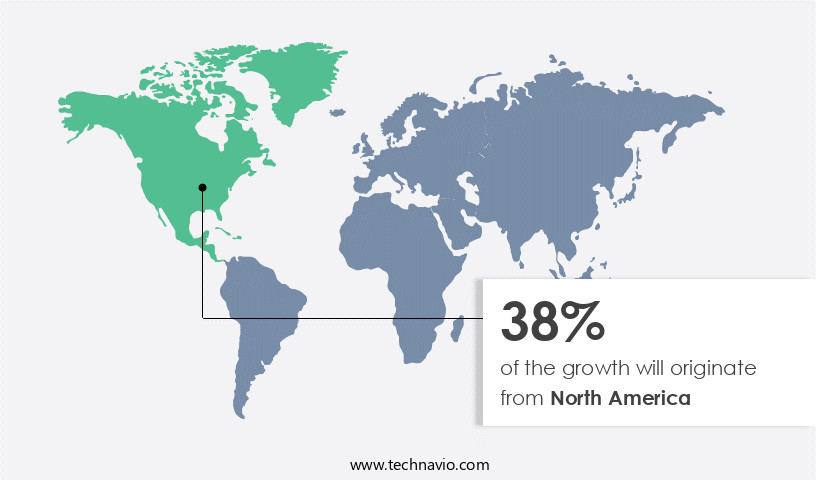

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market holds significant potential In the tokenization industry due to its technologically advanced economies and increasing smartphone usage. With a growing number of mobile and cloud solutions, payment systems are integrating with social media apps, fostering a co-dependent and intelligent economy. The young and socially active population In the region is driving the e-commerce payment market growth, subsequently increasing the demand for tokenization. This process reduces the risk of data breaches and theft by replacing sensitive payment information with non-sensitive placeholders or tokens. Despite the complexities in management and integration, tokenization is gaining popularity among businesses, particularly online ones, due to its affordability and compliance with security standards.

The increasing number of cyber attacks and data breaches has emphasized the need for payment security solutions, further fueling the demand for tokenization. SMEs and large enterprises alike are adopting tokenization to protect their payment information, mitigate risks, and maintain organizational reliability. The implementation of tokens in credit and debit cards, POS machines, and internal systems is essential for businesses to ensure data protection and prevent negative financial impacts. Cloud-based tokenization offers scalability and flexibility, making it a preferred solution for businesses with mobility restrictions or offices in multiple locations. The coronavirus pandemic has accelerated the adoption of contactless payments, further increasing the demand for tokenization.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Tokenization Industry?

Rising number of online transactions is the key driver of the market.

What are the market trends shaping the Tokenization Industry?

Growing demand for cloud-based services is the upcoming market trend.

What challenges does the Tokenization Industry face during its growth?

System integration and interoperability issues is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The tokenization market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tokenization market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, tokenization market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

American Express Co. - The company provides a comprehensive tokenization solution encompassing a secure token vault, payment token issuance, and lifecycle management for secure online transactions. This service ensures the protection of sensitive payment data during digital transactions by replacing it with unique, non-sensitive tokens. By implementing this tokenization approach, businesses can enhance security and streamline payment processing, ultimately improving customer experience and reducing the risk of fraud.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Express Co.

- AsiaPay Ltd.

- BLUEFIN PAYMENT SYSTEMS LLC

- Entrust Corp.

- Fiserv Inc.

- Futurex

- HelpSystems LLC

- Ingenico Group SA

- IntegraPay Pty Ltd.

- Lookout Inc.

- Marqeta Inc.

- Mastercard Inc.

- Meawallet AS

- Open Text Corp.

- Paragon Payment Solutions

- SafeNet Assured Technologies LLC

- TokenEx

- VeriFone Inc.

- Visa Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing demand for secure and efficient digital payment solutions. This trend is driven by various factors, including the complexities of integrating digital payment systems into existing financial expenditures and the need to reduce the risk of data breaches and theft. Tokenization is an automation technique used to replace sensitive data, such as credit card information, with non-sensitive placeholder tokens. These tokens retaIn the original data's length and structure, making them suitable for use in various applications, including ecommerce and contactless payments. The rising demand for tokenization is driven by several factors.

One of the primary reasons is the increasing number of cyber attacks targeting financial institutions and small and medium-sized enterprises (SMEs). These attacks can result in negative financial impacts, including data breaches and theft of personal data. Another factor driving the growth of the market is the shift towards cloud-based solutions. Cloud-based tokenization offers several advantages, including reduced implementation costs, easier integration, and improved scalability. However, it also presents new challenges, such as data protection and compliance with various security and regulatory standards. The implementation of tokenization requires careful planning and management. Organizations must ensure that their internal systems are reliable and capable of handling the new technology.

This may involve training employees, investing in new hardware and software, and implementing new compliance standards. One of the challenges of tokenization is affordability. Smaller organizations may not have the resources to invest in new payment security products or to hire external experts to help with implementation. Additionally, the complexity of the technology can make it difficult for some organizations to adopt, particularly those with limited technical expertise. Despite these challenges, the benefits of tokenization are clear. By replacing sensitive data with non-sensitive tokens, organizations can significantly reduce the risk of data breaches and theft. This is particularly important In the current business environment, where mobility restrictions and the coronavirus pandemic have increased the reliance on online transactions.

Moreover, tokenization offers several other advantages, including improved operational efficiency, reduced transaction processing times, and increased customer trust. It also enables organizations to comply with various security and regulatory standards, such as real-time screening and compliance with card issuers' obligations. In conclusion, the market is experiencing significant growth due to the increasing demand for secure and efficient digital payment solutions. While there are challenges associated with the implementation and management of tokenization, the benefits are clear. Organizations that invest in this technology will be well-positioned to meet the evolving needs of their customers and to stay ahead of the competition.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 25.2% |

|

Market growth 2024-2028 |

USD 4317.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

19.8 |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Tokenization Market Research and Growth Report?

- CAGR of the Tokenization industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the tokenization market growth of industry companies

We can help! Our analysts can customize this tokenization market research report to meet your requirements.