Tris Nonylphenyl Phosphite Market Size 2024-2028

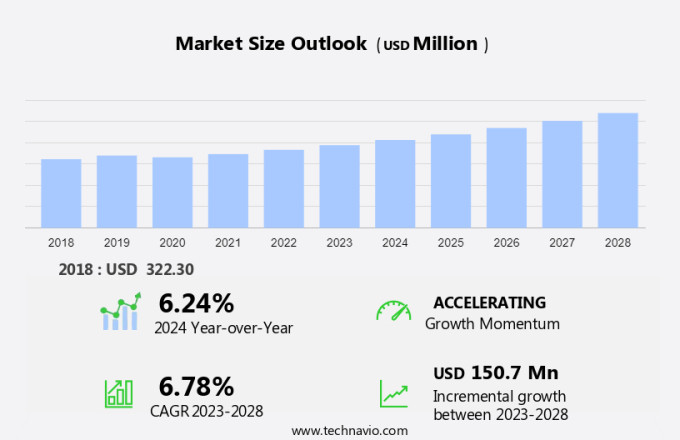

The tris nonylphenyl phosphite market size is forecast to increase by USD 150.7 million at a CAGR of 6.78% between 2023 and 2028. The Tris Nonylphenyl Phosphite (TNPP) market is experiencing significant growth due to the increasing demand for plastic additives in various industries, particularly in petrochemicals. Developing countries are driving this demand as they expand their manufacturing sectors, leading to an increase in plastic production. However, the market is also facing challenges, including the volatility of raw material prices, which can impact the industrial value of plastic-based products. TNPP, a type of phosphite ester, is widely used as a plastic additive in the manufacturing of polypropylene and other plastics. As natural gas production continues to increase, the availability of raw materials for plastic manufacturing is expected to remain steady, providing a stable foundation for market growth.

Tris nonylphenyl phosphite (TNPP) is a chemical compound that has gained significant importance in various industries due to its unique properties. This phosphite ester is primarily used as an antioxidant in the production of resins and polymers, enhancing their heat stability and resistance to extraction. The petrochemical industry relies heavily on TNPP for the manufacturing of packaging materials. In food packaging applications, TNPP plays a crucial role in ensuring the longevity and integrity of PVC bottles, food wrapping, and sealing gaskets. Its antioxidant properties prevent the degradation of these materials, thus extending their shelf life and maintaining the quality of the contained products.

Moreover, TNPP is extensively used in the plastic manufacturing sector, particularly in synthetic rubbers, abs plastics, thermoplastic polymers, polyester, polyethylene, and polypropylene. Its addition to these materials improves their overall performance by enhancing their heat stability and resistance to oxidation. In the realm of personal care products, TNPP is employed as an antioxidant in the production of flavors, fragrances, and other additives. Its role in these applications is essential for maintaining the stability and shelf life of these products, ensuring consumer satisfaction. Tris nonylphenyl phosphite is also used in the production of natural gas and other industrial applications.

Furthermore, its unique properties make it an indispensable additive in various industries, from packaging to plastic manufacturing and beyond. However, it is important to note that TNPP contains nonylphenol, a chemical that has been linked to endocrine disruption in aquatic species. This concern arises due to the potential for nonylphenol to interact with estrogen and androgen receptors. Despite this, the use of TNPP is regulated, and efforts are being made to develop alternative antioxidants to minimize the environmental impact. In conclusion, Tris nonylphenyl phosphite is a versatile chemical compound that plays a vital role in various industries, from packaging and plastic manufacturing to personal care products and natural gas production. Moreover, its unique properties, particularly its heat stability and resistance to extraction, make it an essential additive in these applications. However, the potential environmental concerns associated with its use necessitate ongoing research and development to find alternative antioxidants.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Stabilizers

- Petrochemicals

- Rubber

- End-user

- Plastics and rubber industry

- Chemical industry

- Adhesives and sealants industry

- Others

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Application Insights

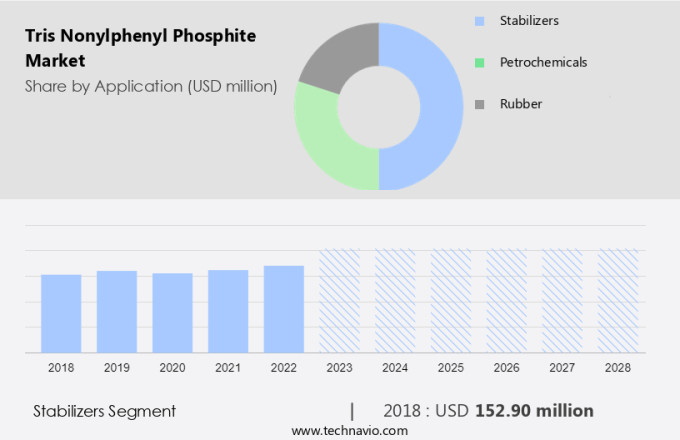

The stabilizers segment is estimated to witness significant growth during the forecast period. Tris nonylphenyl phosphite is a crucial additive used in various industries, including plastics, coatings, adhesives, and sealants, as well as pharmaceuticals. This chemical compound functions as a stabilizer, which is an intentional addition to polymers to mitigate environmental impacts, such as heat and UV radiation. Stabilizers are essential in the production and usage stages of plastics, enhancing the production process and extending the lifespan of plastic products. Moreover, they facilitate easier recycling of plastic products. In 2023, the stabilizer segment accounted for the largest share of The market and is expected to maintain its dominance during the forecast period.

Moreover, Valtris Specialty, a leading supplier of tris nonylphenyl phosphite, caters to diverse industries with its innovative solutions. The versatility of tris nonylphenyl phosphite in chemical recycling technologies further boosts its market growth. By incorporating this additive, manufacturers can improve product quality, reduce waste, and contribute to a more sustainable future.

Get a glance at the market share of various segments Request Free Sample

The stabilizers segment accounted for USD 152.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Tris Nonylphenyl Phosphite (TNPP) market in North America is projected to lead the global market due to the increasing demand from end-use industries such as petrochemicals. The market growth can be attributed to technological advancements and innovative product applications. In the US, where per capita consumption of plastic and fertilizer is significantly higher than in developing economies, the demand for TNPP as a stabilizer in various applications is on the rise. The packaged food industry in the US is a major consumer of TNPP as it is used as a joint compound to improve the quality and shelf life of various food products.

Furthermore, the developing petrochemical industry in North America is expected to fuel the market growth in the region. TNPP is widely used as a stabilizer in various industries including construction, plastics, and agriculture, making it a valuable shareholder in the market.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Developing countries to boost demand for plastic additives is the key driver of the market. The global market for Tris Nonylphenyl Phosphite (TNPP) has experienced significant growth due to increasing construction activities and urbanization in developing regions like APAC, the Middle East, and Latin America. This growth is driven by the demand for plastic additives in various industries, including packaging, petrochemicals, and engineering medical devices. TNPP's unique properties, such as heat stability and extraction resistance, make it an ideal choice for these applications. In the packaging industry, TNPP is used as an antioxidant to enhance the durability and longevity of resins used in food packaging. In the automotive sector, TNPP is employed in the manufacturing process to improve heat stability and resistance to extraction, making it a crucial component in the production of automotive parts.

Furthermore, the expanding automotive industry and rising purchasing power in emerging economies have fueled the demand for electronic appliances, leading to an increased usage of TNPP in their production. In conclusion, the global TNPP market is witnessing substantial growth due to the expanding construction industry, increasing urbanization, and rising demand for plastic additives in various industries, including packaging, petrochemicals, and electronics. Its unique properties, such as heat stability and extraction resistance, make it an essential ingredient for various applications, further boosting its demand.

Market Trends

Growing demand for TNPP in petrochemicals is the upcoming trend in the market. The petrochemical industry is a significant consumer of Tris Nonylphenyl Phosphite (TNPP), with its demand driven by TNPP's ability to enhance the stability of polypropylene during plastic manufacturing. TNPP's role in the petrochemical sector is essential due to its capacity to prevent color fading and ensure processing stability in chemical reactions. This desirable trait makes TNPP an indispensable raw material in the petrochemical industry. Moreover, the minor price fluctuations of TNPP have contributed to its extensive use in the petrochemical sector. The petrochemical industry is poised for substantial capacity expansion in the next 4-5 years to cater to the growing demand from end-users.

In addition, the industry's expansion is expected to be particularly pronounced in emerging economies like India. TNPP's importance in the petrochemical sector can be attributed to its role as a plastic-based raw material in natural gas production. Its use in plastic manufacturing and chemical processes enhances the industrial value of these products by ensuring their stability and longevity. Overall, TNPP's inherent qualities and minor price variations make it a preferred choice for plastic producers in the petrochemical industry.

Market Challenge

Volatility in raw material prices is a key challenge affecting the market growth. The Tris Nonylphenyl Phosphite (TNPP) market is experiencing challenges due to the volatility in the pricing of petroleum-based raw materials. The demand for TNPP in applications such as PVC bottles, food wrapping, sealing gaskets, synthetic rubbers, ABS plastics, thermoplastic polymers, polyester, and polyethylene is increasing in emerging economies. However, the prices of carrier compounds and resins in these additives, which are derived from petroleum, are subject to fluctuations based on natural gas and crude oil prices. The price instability of Brent crude oil, which was at USD82, has forced companies in the oil and gas industry to adopt cost-saving measures such as workforce reductions and rig idling.

Furthermore, this volatility in oil prices has impacted the TNPP market, as the raw materials used in its production are heavily reliant on petroleum derivatives. Despite these challenges, the TNPP market is expected to grow due to its essential role in enhancing the performance and functionality of plastic products. The market is anticipated to expand at a steady pace, driven by the increasing demand for plastic additives in various industries.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ADEKA Corp. - The company offers tris nonylphenyl phosphite such as CAS 26523 78 4.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adishank Chemicals Pvt. Ltd.

- Alfa Chemical Co. Ltd.

- BOCSCI Inc.

- Cymit Quimica S.L.

- Dover Chemical Corp.

- Galata Chemicals LLC

- Gulf Stabilizers Industries

- Hangzhou Keying Chem Co. Ltd.

- Kuilai Chemical Co.

- LEAP CHEM Co. Ltd.

- PCC Rokita SA

- Sagechem Ltd.

- Sandhya Organic Chemicals Pvt. Ltd.

- Songwon Industrial Co. Ltd.

- Sterling Auxiliaries Pvt. Ltd.

- Wego Chemical Group Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Tris nonylphenyl phosphite is a chemical compound widely used as an antioxidant in various industries, including plastic manufacturing. It provides heat stability and extraction resistance to resins, PVC bottles, food wrapping, sealing gaskets, synthetic rubbers, abs plastics, and thermoplastic polymers. This chemical is extensively used in the production of polyester, polyethylene, and polypropylene. The petrochemical industry is a significant consumer of tris nonylphenyl phosphite due to its role in enhancing the industrial value of plastics. The demand for this chemical is driven by the increasing production of plastic-based raw materials and the growing need for stable and durable plastics in various applications.

Furthermore, Tris nonylphenyl phosphite is also used in coatings, adhesives, sealants, pharmaceuticals, flavors, fragrances, personal care products, and even in the production of aquatic species feed. The chemical's ability to improve the heat stability of plastics makes it an essential ingredient in packaging applications, particularly in food packaging. The changing lifestyle and increasing health awareness have led to a rapid rate of growth in the demand for tris nonylphenyl phosphite. However, concerns over its potential endocrine disruption properties, including its ability to interact with estrogen and androgen receptors, have led to regulatory scrutiny. The prevalence of diseases related to male fertility, testicular weight, and endocrine disruption has fueled research into alternative stabilizers and technologies for chemical recycling. Despite these challenges, the developing economy and positive growth in various industries are expected to drive the demand for tris nonylphenyl phosphite in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 150.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.24 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 39% |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ADEKA Corp., Adishank Chemicals Pvt. Ltd., Alfa Chemical Co. Ltd., BOCSCI Inc., Cymit Quimica S.L., Dover Chemical Corp., Galata Chemicals LLC, Gulf Stabilizers Industries, Hangzhou Keying Chem Co. Ltd., Kuilai Chemical Co., LEAP CHEM Co. Ltd., PCC Rokita SA, Sagechem Ltd., Sandhya Organic Chemicals Pvt. Ltd., Songwon Industrial Co. Ltd., Sterling Auxiliaries Pvt. Ltd., and Wego Chemical Group Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch