Truck Clutch Market Size 2024-2028

The truck clutch market size is forecast to increase by USD 3.57 billion, at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for newer generation commercial vehicles. The emergence of advanced transmission systems, such as triple-clutch transmissions, is also driving market growth. However, the market faces challenges from technological constraints, leading to vehicle recalls. Friction products, including ball bearings, play a crucial role in the smooth functioning of truck clutches. Additionally, the growing adoption of variable cam timing systems and the integration of software in automotive components are expected to create opportunities for market growth. The e-commerce sector, particularly in logistics and e-commerce, is a significant end-user for commercial vehicles, further boosting market demand. Furthermore, the increasing use of LED lighting in commercial vehicles is expected to fuel market growth in the automotive lighting sector.

What will be the Size of the Truck Clutch Market During the Forecast Period?

- The market encompasses the production and sale of clutches for heavy-duty vehicles, serving both commercial and personal applications. Manual transmissions remain a significant segment due to their widespread use in commercial trucks and their ability to provide superior performance and durability. However, the rise of automatic and automated manual transmissions is gaining traction, driven by consumer preferences for ease of use and improved fuel efficiency.

- Market size is influenced by the sales of vehicles and the increasing living standards that necessitate the use of reliable transportation. Clutch materials, including ceramic and organic, continue to evolve, offering enhanced durability and better overall performance. Despite these trends, potential challenges include the increasing complexity of clutches and the need for continuous innovation to meet evolving industry demands.

How is this Truck Clutch Industry segmented and which is the largest segment?

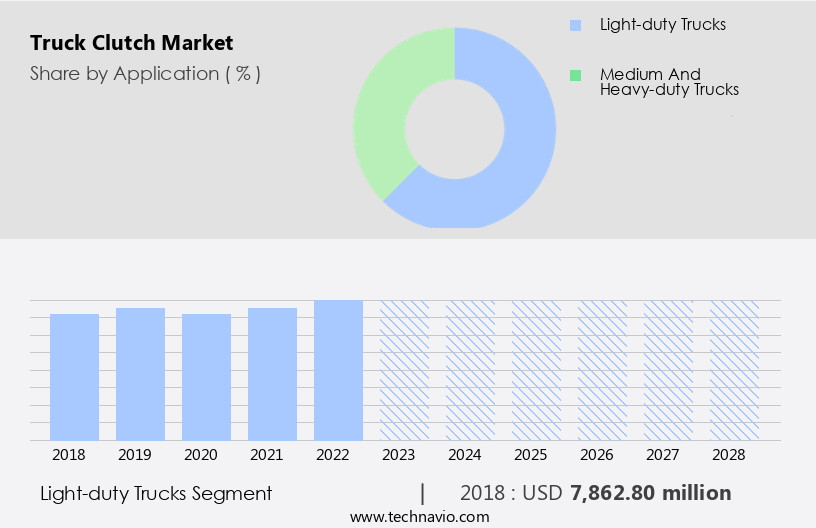

The truck clutch industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Light-duty trucks

- Medium and heavy-duty trucks

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Application Insights

- The light-duty trucks segment is estimated to witness significant growth during the forecast period.

The market encompasses the production and sale of clutch components for light-duty trucks, primarily used for commercial and personal applications. In developed markets like North America and Europe, pickup trucks hold a significant share of vehicle sales. Collaboration between component manufacturers and original equipment manufacturers (OEMs) has led to the launch of new light-duty truck models and increased adoption in various industries. Potential pitfalls, such as regulatory shifts and stringent emission standards, necessitate breakthrough technological advancements. Integration capabilities, including dual-clutch transmissions and automated manual transmissions, cater to shifting preferences. Regulatory authorities enforce strict rules on vehicle efficiency, promoting the use of sustainable technologies like electric vehicles and innovative clutch systems.

Materials and designs play a crucial role in enhancing clutch longevity and performance. Regulatory support from government bodies and regulatory authorities ensures the implementation of stringent rules for vehicle efficiency, lightweight materials, thermal performance, and sustainability. The market landscape includes various types of clutch systems, including traditional clutches, single-speed transmission systems, and advanced clutch mechanisms. Electric powertrains, mild hybrid solutions, and internal engine modes are gaining popularity, with simulated clutch systems and electric motorcycles also emerging.

Get a glance at the market report of share of various segments Request Free Sample

The light-duty trucks segment was valued at USD 7.86 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Asia Pacific region, driven by improving socioeconomic conditions in countries like China, Japan, and Australia, is experiencing significant growth in the automotive industry, particularly in the market. Commercial applications, particularly in e-commerce logistics and construction and mining industries, are primary drivers of this growth. In response to increasing demand, manufacturers of automotive transmission components are expanding their operations. For instance, BorgWarner's January 2019 expansion of its production facility in India for advanced engine timing and variable cam timing systems caters to the rising need for heavy-duty trucks in Southeast Asia. Regulatory shifts towards stricter vehicle emissions standards and the integration of sustainable technologies, such as electric powertrains and automated manual transmissions, are also influencing market trends.

Additionally, the preference for improved drivability, performance, and durability in both commercial and personal use vehicles is fueling innovation in clutch designs, materials, and components. Regulatory authorities, such as government bodies, are enforcing stringent rules to ensure vehicle efficiency and sustainability, leading to the adoption of ultrahigh efficiency motors, automatic transmissions, and lightweight materials. The market is expected to continue growing due to the increasing popularity of dual-clutch transmissions, mild hybrid solutions, and hybrid models, as well as the development of advanced clutch mechanisms and internal engine modes.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Truck Clutch Industry?

Demand for newer generation commercial vehicles is the key driver of the market.

- The market, including trucks, has experienced substantial growth due to the increase in industries such as construction, logistics, agriculture, and transportation. This expansion has led to a heightened focus on safety, comfort, and efficiency in commercial vehicles, resulting in strong sales. Stringent emission regulations have further fueled demand for fuel-efficient commercial vehicles, driving the adoption of hybrid drivetrains. In response to the need for driver comfort and convenience, automated manual transmissions have been integrated into new commercial vehicle models at an accelerated rate. Breakthrough technological advancements have also influenced the market. Innovative clutch systems, such as dual-clutch transmissions and automated manual transmissions, have gained popularity due to their improved efficiency, torque capacity, and drivability.

- Additionally, the shift towards electric vehicles and sustainable technologies has led to the development of innovative clutch systems for electric powertrains. Clutch Industries and UniClutch are among the key players in the market, offering a range of clutch components designed for durability, performance, and longevity. Regulatory shifts, driven by government bodies and regulatory authorities, have led to stricter rules regarding vehicle efficiency and emissions. In response, manufacturers are focusing on lightweight materials, thermal performance, and sustainability to meet these requirements. The integration of advanced all-wheel drive and four-wheel drive systems, mild hybrid solutions, and internal engine modes has also impacted the market.

What are the market trends shaping the Truck Clutch Industry?

Emergence of triple-clutch transmission system is the upcoming market trend.

- The market is experiencing significant advancements, with automatic transmissions, such as dual-clutch and triple-clutch systems, gaining popularity for their improved performance, efficiency, and driving comfort. Notably, the automotive industry and Tier-1 suppliers are investing heavily In the development of triple-clutch transmission systems. For instance, General Motors and Ford Motor Company are focusing on the new generation 11-speed triple-clutch transmission, which promises superior efficiency and minimal wastage. This innovation involves advanced software, machinery, and algorithm design to keep engines running at maximum efficiency. Regulatory shifts towards stricter vehicle emissions standards and the inflating living standards are driving the demand for more efficient and sustainable technologies.

- Integration capabilities of these advanced clutch systems with electric powertrains, mild hybrid solutions, and automated manual transmissions are also contributing to their growing popularity. The market is expected to witness further breakthroughs with the emergence of innovative clutch systems, such as simulated clutch systems and electric motorcycles. Regulatory authorities are providing regulatory support to promote vehicle efficiency, sustainability, and lightweight materials, such as organic and thermal performance materials. The market offers a range of product offerings, including manual transmissions, dual-clutch transmissions, automated manual transmissions, and advanced clutch mechanisms for internal engine modes. The focus on sustainability and automotive lighting technologies, such as ultrahigh efficiency motors, is also influencing the market dynamics.

What challenges does the Truck Clutch Industry face during its growth?

Technological constraints resulting in vehicle recalls is a key challenge affecting the industry growth.

- The market encompasses the integration of advanced technological advancements in clutch systems for commercial and personal use trucks. These innovations include dual-clutch transmissions, automated manual transmissions, and innovative clutch systems, which offer improved efficiency, torque capacity, and clutch longevity. However, these complex systems come with potential pitfalls, such as vulnerability to malfunctions, raising concerns for both component manufacturers and OEM truck manufacturers due to liability-sharing business models. Regulatory shifts, driven by government bodies and stricter rules on vehicle emissions and sustainability, have led to the adoption of sustainable technologies like electric powertrains and mild hybrid solutions. This trend is further fueled by inflating living standards and the increasing preference for performance and durability.

- Manufacturers have responded by offering product offerings that cater to these demands, focusing on efficiency, thermal performance, and sustainability. These advancements also extend to electric vehicles and motorcycles, as well as traditional clutches and single-speed transmission systems. Moreover, the integration of advanced all-wheel drive and four-wheel drive systems, along with internal engine modes and simulated clutch systems, further enhances the truck market's growth. The development of ultrahigh efficiency motors, automatic transmissions, and organic and manual transmission systems further strengthens the market's competitive landscape. Regulatory support from authorities plays a crucial role in shaping the market's future, with stringent rules on vehicle efficiency and lightweight materials becoming increasingly important.

Exclusive Customer Landscape

The truck clutch market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the truck clutch market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, truck clutch market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB SKF

- BorgWarner Inc.

- Eaton Corp. Plc

- EXEDY Corp.

- H.R. Clutch

- Phoenix Friction Products

- Schaeffler AG

- Setco Auto Systems Pvt Ltd

- The Gear Centre Group

- Tremec Corp.

- Valeo SA

- Wuhu Hefeng clutch Co. Ltd.

- ZF Friedrichshafen AG

- Zhejiang Tieliu Clutch Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a critical component of the automotive industry, playing a significant role In the transmission of power from the engine to the wheels. This market is subject to various market dynamics that influence its growth and development. One potential pitfall In the market is the increasing complexity of vehicle systems. With the integration of advanced technologies such as automated manual transmissions and dual-clutch transmissions, the design and manufacturing of clutches have become more intricate. This complexity can lead to higher production costs and longer development cycles, potentially impacting the competitiveness of some players In the market. However, breakthrough technological advancements continue to emerge, offering opportunities for innovation and differentiation. The global Truck Clutch Market is experiencing significant growth, driven by the rising adoption of automobiles, especially commercial vehicles. The sales of automotive vehicles, particularly in emerging economies, have led to increased demand for truck clutches. However, the market is also influenced by the shift to fuel-efficient vehicles and automated transmissions, including automatic and automated manual transmissions.

Functionalities in commercial vehicles, such as predictive maintenance in trucking, have become essential for fleet management. Technological advancements in truck clutches, including improved durability and efficiency, have further boosted market growth. However, issues related to product recalls and safety concerns have posed challenges for manufacturers. The market is expected to continue growing, fueled by the commercial use of trucks and the increasing popularity of automated transmissions. The demand for fuel-efficient clutches is also expected to increase as governments impose stricter emissions regulations. In conclusion, the Truck Clutch Market is poised for growth, with supply and demand levels remaining strong amidst the shifting landscape of the automotive industry.

For instance, the development of sustainable technologies, such as electric powertrains, is gaining momentum. These systems require specialized clutches that can handle the unique demands of electric vehicles, presenting new opportunities for companies In the clutch industry. Regulatory shifts also impact the market. Stringent regulations regarding vehicle emissions and sustainability are driving the adoption of more efficient technologies. Government bodies are increasingly supporting the development and implementation of these regulations, creating a favorable environment for companies that can offer products that meet these requirements. Moreover, inflating living standards and the growing preference for personal use vehicles, particularly in commercial applications, are expected to boost demand for trucks with high torque capacity and durability.

In addition, the ride experience and drivability offered by advanced clutch systems are also becoming increasingly important factors in consumer purchasing decisions. Clutch components, such as materials and designs, are continually evolving to meet the demands of the market. Lightweight materials and ultrahigh efficiency motors are becoming more common, while thermal performance and sustainability are key considerations. The clutch industries are responding to these market dynamics with a range of product offerings. Traditional clutch systems are being complemented by innovative designs, such as simulated clutch systems and advanced all-wheel drive systems. Mild hybrid solutions and hybrid models are also gaining popularity, requiring specialized clutches that can handle the unique demands of these powertrains.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 3.57 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, US, Germany, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Truck Clutch Market Research and Growth Report?

- CAGR of the Truck Clutch industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the truck clutch market growth of industry companies

We can help! Our analysts can customize this truck clutch market research report to meet your requirements.