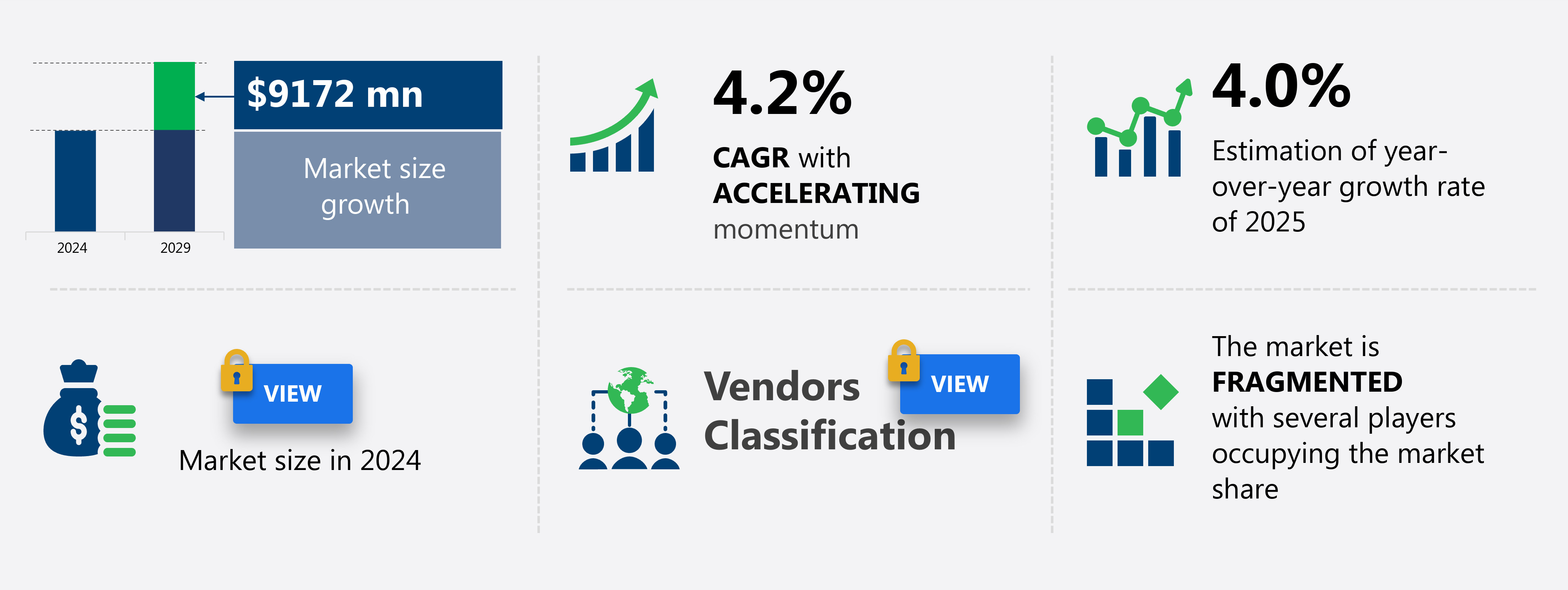

US Behavioral Health Market Size 2025-2029

The US behavioral health market size is forecast to increase by USD 9.17 billion at a CAGR of 4.2% between 2024 and 2029.

-

The market is experiencing significant growth, driven by the increasing prevalence of behavioral disorders and the advent of digital health solutions. Telehealth and telemedicine, including video conferencing, have become catalysts for delivering mental health services, particularly in areas with a shortage of skilled professionals. The use of digital software and tools is transforming the way mental health services are delivered, making them more accessible and convenient for patients. Furthermore, the legalization of marijuana for medicinal purposes in some US states is also impacting the market, as it provides an alternative treatment option for certain behavioral disorders.

-

These trends are expected to continue, as insurers increasingly cover telehealth services and technology continues to advance. However, challenges such as data security and privacy concerns, as well as the need for standardized telehealth regulations, must be addressed to ensure the effective and safe delivery of behavioral health services.

What will be the Size of the market During the Forecast Period?

-

The market encompasses a range of mental and emotional disorders, including forensic psychiatry, drug abuse, family therapy, perinatal mental health, interpersonal therapy, peer support, eating disorders, post-traumatic stress disorder, biopsychosocial assessment, stress management, public health, geriatric psychiatry, mindfulness-based stress reduction, autism spectrum disorder, attention-deficit/hyperactivity disorder, crisis hotlines, group therapy, healthcare access, holistic health, suicide prevention, support groups, psychotropic medications, opioid use disorder, community resources, developmental disabilities, health disparities, harm reduction, health equity, motivational interviewing, mood stabilizers, alcohol use disorder, and obsessive-compulsive disorder.

-

This vast market is driven by increasing awareness and acceptance of mental health issues, growing prevalence of mental disorders, and advancements in treatment methods. The market is expected to grow significantly due to the rising burden of mental health conditions, increasing healthcare spending, and the availability of new technologies and therapies. The market is also influenced by public health initiatives, policy changes, and societal trends towards holistic health and wellness.

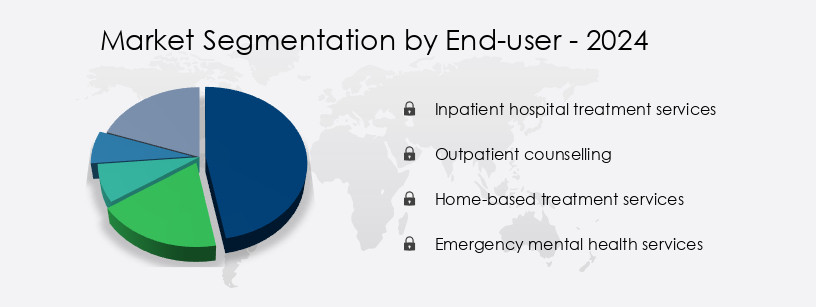

How is this market segmented, and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Inpatient hospital treatment services

- Outpatient counselling

- Home-based treatment services

- Emergency mental health services

- Type

- Substance abuse disorders

- Alcohol use disorders

- Eating disorders

- ADHD

- Others

- Age Group

- Adult

- Geriatric

- Pediatric

- Geography

- US

By End-user Insights

- The inpatient hospital treatment services segment is estimated to witness significant growth during the forecast period. Behavioral health services encompass a range of treatments for mental health conditions and substance use disorders. Inpatient hospital treatment, which includes medication management and regular check-ups, involves shorter stays compared to residential or home-based services. The high cost of inpatient hospital treatment is a significant factor, making it an essential component of the market. The prevalence of behavioral health conditions, such as anxiety, depression, substance use disorder, attention-deficit/hyperactivity disorder (ADHD), bipolar disorder, and more, is substantial in the US. The high number of hospital admissions due to substance abuse is expected to drive the growth of the inpatient hospital treatment segment during the forecast period.

- Care coordination, a critical aspect of behavioral health services, is facilitated through electronic health records and health information technology. Crisis intervention, trauma-sensitive care, and trauma-informed care are essential components of mental wellness and recovery support. Value-based care models, such as partial hospitalization and intensive outpatient programs, are increasingly being adopted to improve quality and reduce healthcare costs. Mental health policy, clinical trials, and behavioral health research are essential for advancing evidence-based practices, such as dialectical behavior therapy and cognitive behavioral therapy. Virtual care, employee assistance programs, patient education, and school-based services are also crucial components of the market. Machine learning, data analytics, and artificial intelligence are transforming behavioral health services by enabling personalized care, medication management, and stigma reduction.

- Cultural competence, access to care, and behavioral health workforce development are essential for addressing disparities and improving patient engagement. Mental health awareness, medication management, and recovery support are essential components of behavioral health services. Partial hospitalization, intensive outpatient programs, integrated care, and behavioral health software are key services that are transforming the industry. Behavioral health apps and addiction treatment are also gaining popularity as effective tools for delivering care.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our US Behavioral Health Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of US Behavioral Health Market?

- The increasing prevalence of behavioral disorders is the key driver of the market. Behavioral health issues, including substance use disorders and mental health concerns, are on the rise due to various societal and technological factors. Addictions, such as those related to drugs, alcohol, food, pornography, gaming, sex, work, and shopping, can significantly impact an individual's behavior and social functioning. The prevalence of behavioral disorders is particularly high among young adults aged 16 to 25, as they often have easier access to abusive substances. Drug and substance abuse are primary causes of behavioral disorders. Prescription drug addiction is also a growing concern. The healthcare reform has led to an increased focus on care coordination, electronic health records, and value-based care.

-

Mental health policy initiatives have trauma-sensitive care, mental wellness, and trauma-informed care. Virtual care, employee assistance programs, patient education, and behavioral health software are essential tools in addressing behavioral health issues. Clinical trials, medication management, and intensive outpatient programs are critical components of evidence-based practices. Behavioral health research, cultural competence, and access to care are essential for effective treatment. Crisis intervention, partial hospitalization, and residential treatment are crucial services for individuals with severe behavioral health issues. Quality improvement, data analytics, and machine learning are essential for enhancing patient engagement and reducing healthcare costs. Stigma reduction and behavioral health integration are vital for improving mental health awareness and school-based services.

-

Mental health apps, addiction treatment, and dialectical behavior therapy are innovative solutions for addressing behavioral health issues. Cognitive behavioral therapy, patient engagement, and recovery support are essential for long-term success. Medication management, health information technology, and medication management are crucial for effective treatment. The market is dynamic and complex, requiring a multifaceted approach to address the diverse needs of individuals with behavioral health issues. The integration of technology, evidence-based practices, and culturally competent care is essential for improving access to care and reducing healthcare costs.

What are the market trends shaping the US Behavioral Health Market?

- The advent of online counseling is the upcoming trend in the market. Behavioral health services are evolving with the increasing use of technology, including Care Coordination through Electronic Health Records and Crisis Intervention via telehealth platforms. Healthcare Reform policies prioritize Mental Health and Substance Use Disorder treatment, driving the integration of Behavioral Health Services into primary care. Value-Based Care models highlight quality improvement and patient engagement through Evidence-Based Practices like Dialectical Behavior Therapy and Cognitive Behavioral Therapy. Health Information Technology, such as Machine Learning and Data Analytics, support Behavioral Health Research and Mental Health Policy development. Virtual Care, including Employee Assistance Programs and Mental Health Apps, expand Access to Care for underserved populations.

-

Trauma-Sensitive Care and Trauma-Informed Care are crucial for treating complex conditions, while Medication Management and Recovery Support are essential components of Addiction Treatment. Mental Wellness initiatives promote Stigma Reduction and Cultural Competence, ensuring effective treatment for diverse populations. Behavioral Health Integration and Intensive Outpatient Programs provide comprehensive care for individuals with complex needs. Partial Hospitalization and Inpatient Services offer more intensive treatment options for severe conditions. Behavioral Health Software and Behavioral Health Services support the Behavioral Health Workforce in delivering effective care. Mental Health Awareness campaigns and School-Based Services increase early intervention and prevention efforts. Artificial Intelligence and Clinical Trials advance research and treatment methodologies. Integrated Care and Behavioral Health Research collaborations improve patient outcomes and reduce Healthcare Costs.

What challenges does US Behavioral Health Market face during the growth?

- A shortage of skilled professionals in medical sector is a key challenge affecting the market growth. The market in the US faces a significant challenge due to the insufficient number of skilled professionals to address the high demand for treatment. Factors contributing to this shortage include a lack of educational institutions offering specialized behavioral disorder therapy coursework, limited awareness of various addiction types, low compensation and benefits for behavioral health professionals, heavy workloads, and an indefinite career path. These issues result in high unmet demand, posing a barrier to market expansion. Care coordination, a crucial aspect of behavioral health services, relies on the effective use of Electronic Health Records (EHR) and Health Information Technology (HIT).

-

Crisis intervention, a critical component of mental health care, requires immediate access to patient data, making the shortage of skilled professionals even more detrimental. Mental health policy, value-based care, and trauma-informed care are key areas of focus in the market. Evidence-based practices, such as Dialectical Behavior Therapy (DBT) and Cognitive Behavioral Therapy (CBT), are increasingly being adopted to improve patient outcomes. To address the shortage of skilled professionals, efforts are being made to integrate behavioral health services into primary care settings and promote cultural competence within the behavioral health workforce. Telehealth and virtual care, including mental health apps and employee assistance programs, are also being employed to expand access to care.

-

Behavioral health research, clinical trials, and medication management are essential components of the market. Quality improvement, access to care, and patient engagement are key priorities to ensure the effective delivery of behavioral health services. Machine learning and data analytics are being used to improve patient care and reduce healthcare costs. Stigma reduction and trauma-sensitive care are also crucial initiatives to enhance mental wellness and recovery support. Inpatient services, outpatient services, residential treatment, and partial hospitalization programs offer various levels of care for individuals with behavioral disorders. Integrated care and behavioral health software are essential tools to facilitate the delivery of comprehensive care.

-

The market in the US is experiencing significant growth, driven by the increasing awareness of mental health issues and the adoption of evidence-based practices. However, the shortage of skilled professionals remains a significant challenge, necessitating the exploration of innovative solutions, such as telehealth, cultural competence, and data analytics, to expand access to care and improve patient outcomes.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecasts, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

2Morrow Inc. - The company offers behavioral health solutions such as digital health and wellbeing programs to employers, states, and health plans.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 2Morrow Inc.

- Acadia Healthcare Co. Inc.

- AHS Management Co. Inc.

- American Addiction Centers

- Centers For Behavioral Health LLC

- Core Solutions Inc.

- CuraLinc Healthcare

- EPIC Behavioral Healthcare

- HCA Healthcare Inc.

- Holmusk USA Inc.

- Impact Suite

- Integrated Behavioral Health

- Meditab Software Inc.

- Netsmart Technologies Inc.

- Oracle Corp.

- Promises Behavioral Health LLC

- Pyramid Healthcare Inc.

- QUALIFACTS SYSTEMS LLC

- Sevita

- Universal Health Services Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of services and interventions aimed at promoting mental wellness and addressing various mental health conditions. This market is characterized by continuous evolution and innovation, driven by the growing recognition of the importance of mental health in overall healthcare. One significant trend in the behavioral health landscape is the increasing adoption of technology to enhance care coordination and improve patient outcomes. Electronic health records (EHRs) have become a standard tool for healthcare providers, enabling seamless information exchange and facilitating more effective care delivery. Additionally, crisis intervention services are being augmented with virtual care solutions, allowing for timely intervention and support for individuals in need.

Another factor shaping the market is the ongoing push for value-based care and quality improvement. Mental health policy reforms have highlighted the need for evidence-based practices and integrated care models, leading to increased investment in research and development of new treatment modalities. Trauma-sensitive care and trauma-informed care approaches are gaining traction, with a focus on culturally competent services that cater to diverse populations. Substance use disorder treatment is another critical area within the market. Behavioral health services, such as inpatient and outpatient programs, are essential for addressing the complex needs of individuals dealing with addiction. Medication management and recovery support are key components of effective substance use disorder treatment, with medication-assisted treatment (MAT) gaining popularity due to its evidence-based approach.

The behavioral health workforce plays a crucial role in delivering high-quality services. There is a growing emphasis on workforce development, training, and retention to ensure a sufficient supply of skilled professionals. Machine learning and data analytics are being leveraged to enhance patient engagement and improve clinical trials, contributing to more personalized and effective care. Mental health awareness campaigns and employee assistance programs are essential initiatives aimed at reducing stigma and increasing access to care. School-based services are another critical area, with a focus on early intervention and prevention to promote positive mental health outcomes for students. The market is also witnessing the integration of artificial intelligence (AI) and health information technology to streamline operations, improve patient outcomes, and reduce healthcare costs.

Intensive outpatient programs and partial hospitalization offer flexible care options for individuals requiring more intensive support. The market is undergoing significant transformation, driven by various factors, including technology adoption, mental health policy reforms, and the evolving needs of diverse populations. The focus on value-based care, quality improvement, and evidence-based practices is leading to innovative solutions and improved patient outcomes. The integration of AI and health information technology is further enhancing the delivery of behavioral health services, making them more accessible and effective.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Market Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.2% |

|

Market growth 2025-2029 |

USD 9.17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.0 |

|

Key countries |

US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch