US Laundry Facilities And Dry Cleaning Services Market Size 2025-2029

The US laundry facilities and dry cleaning services market size is forecast to increase by USD 5.22 billion at a CAGR of 5.9% between 2024 and 2029.

- The Laundry Facilities and Dry Cleaning Services Market is experiencing significant growth, driven by the rising urbanization and increasingly busy lifestyles of consumers. With more people living in cities and leading active professional lives, the demand for convenient and efficient laundry and dry cleaning services is on the rise. Additionally, companies in this market are adopting inorganic growth strategies such as mergers and acquisitions to expand their footprint and enhance their offerings. However, this market is not without challenges. Rising operating and labor costs are putting pressure on profit margins, necessitating innovative business models and operational efficiencies. Companies must navigate these challenges effectively to capitalize on the market's potential and stay competitive.

-

Environmental sustainability is a growing concern in the market, leading to the adoption of eco-friendly detergents, energy-efficient appliances, water conservation, and water recycling. Laundry facilities come in various forms, including coin-operated laundries, commercial laundries, and laundry franchises. Strategic partnerships, automation, and technology integration are some of the key areas of focus for market participants seeking to differentiate themselves and meet evolving consumer demands. Overall, the Laundry Facilities and Dry Cleaning Services Market presents significant opportunities for growth and innovation, particularly for those companies able to effectively address the challenges presented by rising costs and increasing competition.

What will be the size of the US Laundry Facilities And Dry Cleaning Services Market during the forecast period?

- The laundry facilities and dry cleaning services market encompasses the provision of professional garment care solutions, including both laundry and dry cleaning services. This market exhibits strong growth, driven by various factors. Seasonal variations and changing fashion trends influence consumer demand, particularly during peak seasons. High-end garment care services catering to brand loyalty and disposable income segments continue to gain traction. Mobile technology and remote monitoring enable increased operational efficiency and customer convenience. Valet laundry and delivery services catering to busy lifestyles are on the rise. Sustainable practices and eco-friendly solutions are becoming increasingly important, driving innovation in laundry technology and equipment.

- Price competitiveness remains a key consideration, with cost optimization and return on investment shaping business models. Predictive maintenance and IoT laundry technology facilitate preventive measures and improve service quality. Customer satisfaction, online reviews, and digital transformation are crucial factors influencing market penetration and growth. Lifestyle trends, social media influence, and business model innovation are shaping the competitive landscape. Smart laundry and connected laundry services offer convenience and personalization, while dry cleaning equipment advances enable faster turnaround times. The industry is witnessing consolidation, with larger players acquiring smaller players to expand their reach and enhance their value proposition.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Laundry

- Dry-cleaning

- Duvet clean

- Service Type

- Self-service

- On-demand

- Full-service

- End-user

- Residential

- Commercial

- Industrial

- Geography

- US

- North America

- US

By Service Insights

The laundry segment is estimated to witness significant growth during the forecast period. The laundry services market encompasses industrial laundry services, pressing services, and self-service laundries. Industrial laundries cater to large-scale textile care needs, providing services like washing, drying, and fabric care for industries such as hospitality and healthcare. On-premise laundry solutions involve washing machines and tumble dryers installed in commercial establishments for self-service or attended washing. Dry cleaning, a popular alternative to traditional laundry methods, offers services like stain removal, wrinkle removal, and fabric care for various materials, including wedding dresses, leather, and specialty items.

These services cater to different customer segments, offering solutions like laundry management systems, customer loyalty programs, online ordering, and laundry automation. Specialty cleaning services, such as rug cleaning and fur cleaning, add to the market's diversity. Professional garment care, including ironing services and high-speed washers, ensures pristine appearance for corporate uniforms and other professional attire. The market is further driven by the increasing demand for fabric softeners, wet cleaning, and dry cleaning services. With the growing emphasis on energy efficiency and reducing carbon footprint, the market is expected to continue its growth trajectory during the forecast period.

Get a glance at the market share of various segments Request Free Sample

The Laundry segment was valued at USD 6975.90 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

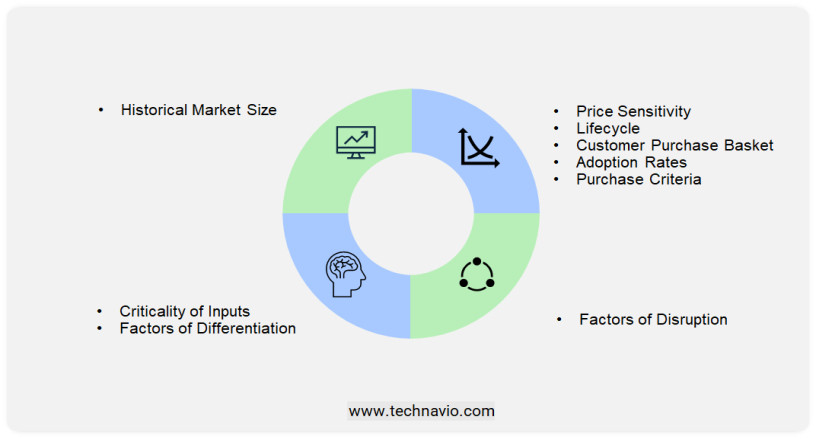

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of US Laundry Facilities And Dry Cleaning Services Market?

- Rising urbanization and increasingly busy lifestyles is the key driver of the market.

- The laundry facilities and dry cleaning services market in the US is experiencing significant growth due to the increasing urban population and the rise of dual-income households. According to World Bank data, approximately 83% of the US population lived in urban areas in 2023, leading to a high demand for convenient and efficient laundry solutions. With both partners working, time for household chores becomes limited, making services that offer convenience and time savings an attractive option.

- This market trend is expected to continue as urbanization increases and work-life balance becomes a priority for many households.

What are the market trends shaping the US Laundry Facilities And Dry Cleaning Services Market?

- Growing adoption of inorganic growth strategies is the upcoming trend in the market.

- The laundry facilities and dry cleaning services market in the US is witnessing an uptick in strategic collaborations and mergers as companies seek to expand their reach and improve offerings. For instance, on October 31, 2024, Presso announced a strategic partnership with WASH Multifamily Laundry Systems. Under this collaboration, Presso's innovative 5-minute Press and Refresh machines will be introduced at select WASH Laundry Route Services locations. This integration of Presso's eco-friendly garment care technology, which utilizes pressurized steam and all-natural revitalization sprays, into WASH Multifamily Laundry Systems' extensive network serving multifamily properties and hotels, aims to modernize traditional dry cleaning services.

- By offering on-demand garment pressing and odor removal, this collaboration provides a cost-effective and convenient alternative for residents while creating new revenue opportunities for property managers.

What challenges does US Laundry Facilities And Dry Cleaning Services Market face during the growth?

- Rising operating and labor costs is a key challenge affecting the market growth.

- The laundry facilities and dry cleaning services market in the US faces escalating operational costs, posing a significant challenge for businesses. Labor expenses, which account for a substantial portion of operating costs, have seen a notable increase. According to the US Bureau of Labor Statistics (BLS), the Employment Cost Index (ECI) for wages and salaries in private industry rose by 4.3% year-over-year as of Q4 2023.

- Furthermore, certain states, including California, New York, and Washington, have implemented higher minimum wages, with some regions reaching USD16 per hour starting from January 1, 2025. These rising labor costs, coupled with utility expenses and regulatory compliance, put pressure on laundromats and dry cleaners to maintain profitability.

How can Technavio assist you in making critical decisions?

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 2ULaundry Inc.

- ByNext Inc.

- CD One Price Cleaners

- Comet Cleaners Franchise Group LLC

- CSC ServiceWorks Inc.

- HappyNest

- Huntington Cleaners and Shirt Laundry

- Lapels Dry Cleaning

- Laundryheap Ltd.

- Marberry Cleaners and Launderers

- Martinizing International LLC

- Mulberrys Garment Care

- Press Technologies Inc.

- Rinse Inc.

- Sage Cleaners

- Tide Cleaners

- WASH Multifamily Laundry Systems LLC

- Yates Dry Cleaning

- ZIPS Franchising LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The laundry facilities and dry cleaning services market encompasses a broad range of offerings designed to meet the textile care needs of various industries and consumers. Industrial laundry services and pressing services cater to businesses requiring large-scale textile processing, including hospitals, hotels, and restaurants. On-premise laundry solutions enable businesses to manage their laundry operations internally, while coin-operated and self-service laundries cater to individual consumers. Environmental sustainability is a significant market trend, with eco-friendly detergents and energy-efficient appliances gaining popularity. Industrial laundries prioritize water conservation and carbon footprint reduction through water recycling and energy-efficient practices. Dry cleaning services, too, are embracing sustainability, with wet cleaning and eco-solvent technologies offering more environmentally friendly alternatives to traditional dry cleaning methods.

The hospitality industry relies heavily on laundry services for linen services and corporate uniforms, emphasizing the importance of fabric care, stain removal, and wrinkle removal. Specialty cleaning services cater to unique textile needs, such as leather cleaning, rug cleaning, and fur cleaning. Automation and technology play a crucial role in the industry, with laundry management systems, online ordering, and mobile apps streamlining operations and enhancing customer experience. Professional garment care extends beyond traditional laundry services, encompassing dry cleaning, ironing services, and fabric softeners. Dry cleaning services offer various fabric care solutions, including tumble dryers and high-speed washers, to ensure optimal results.

The healthcare facilities sector prioritizes textile care for patient comfort and infection control, while the healthcare industry's linen services ensure a clean and hygienic environment. The laundry franchise and dry cleaning franchise models have gained traction, offering entrepreneurs an opportunity to enter the market with established business systems and brand recognition. These franchises often provide access to laundry software, energy-efficient appliances, and laundry detergents, enabling franchisees to focus on customer service and growth. Customer loyalty programs and point-of-sale systems help businesses retain customers and streamline transactions. Automated systems and garment care services, such as wrinkle removal and stain removal, further enhance the customer experience.

As the market continues to evolve, innovation in textile care technologies and sustainability practices will remain key drivers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2025-2029 |

USD 5219.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US and North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch