Vitamin B3 Market Size 2024-2028

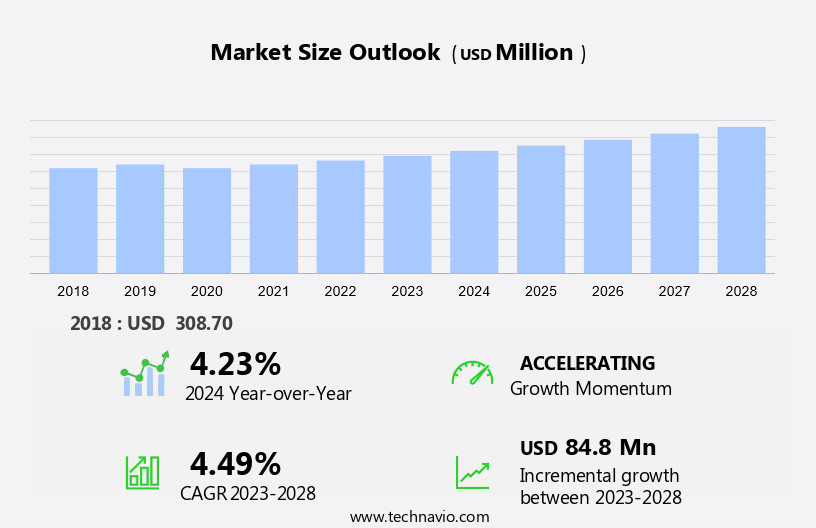

The vitamin B3 market size is forecast to increase by USD 84.8 million at a CAGR of 4.49% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends and factors. The increasing awareness of health and wellness, particularly In the US and North America, has led to a rise in consumer spending on vitamin supplements, including those derived from brown rice, a rich source of niacin or vitamin B3. In the animal feed industry, vitamin B3 is widely used as a feed additive to improve the growth and health of livestock, such as beef and poultry. In the food industry, vitamin B3 is used in various applications, including In the production of bread and meat processing, to enhance the nutritional value and shelf life of these products.

- Niacin is naturally present in various foods, such as tuna, salmon, vegetables, and other nutrient-rich sources. Moreover, the demand for vitamin B3 in cosmeceuticals and personal care products is also on the rise, as it is known to improve skin health and mental health. Avocado, mushroom, and salmon are among the natural food sources of vitamin B3, making them popular ingredients in various health and wellness products. Regulatory control on supplement usage limits, particularly In the US, is another factor driving the growth of the market. Overall, the market is expected to continue its growth trajectory due to these trends and factors.

What will be the Size of the Market During the Forecast Period?

- The market encompasses various forms of Niacin and Nicotinic Acid, essential pyridine carboxylic acids that play a crucial role in human and animal nutrition. Niacin, also known as Vitamin B3, is an organic compound integral to energy production and DNA repair. In human nutrition, it alleviates deficiency symptoms like nausea, anemia, headaches, tiredness, and improves cardiovascular health. In animal nutrition, it enhances growth and improves feed efficiency. Niacin is extensively used in pharmaceutical-grade supplements, available as powders, granular, and liquids. It is also employed as a feed additive for livestock and poultry. In the food industry, niacin is added to processed foods, including fortified packaged foods, to enhance nutritional value.

- Niacin and its amide form, Niacinamide, are also integral to cosmeceuticals due to their skin-enhancing properties. However, the increasing prevalence of high blood cholesterol and deficiency symptoms necessitates the growing demand for niacin supplements. Overall, the market is expected to witness steady growth, driven by its diverse applications in human and animal nutrition and the cosmetics industry.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Food grade

- Pharmaceutical grade

- Geography

- North America

- Canada

- US

- Europe

- Denmark

- Asia

- China

- India

- Rest of World (ROW)

- North America

By Type Insights

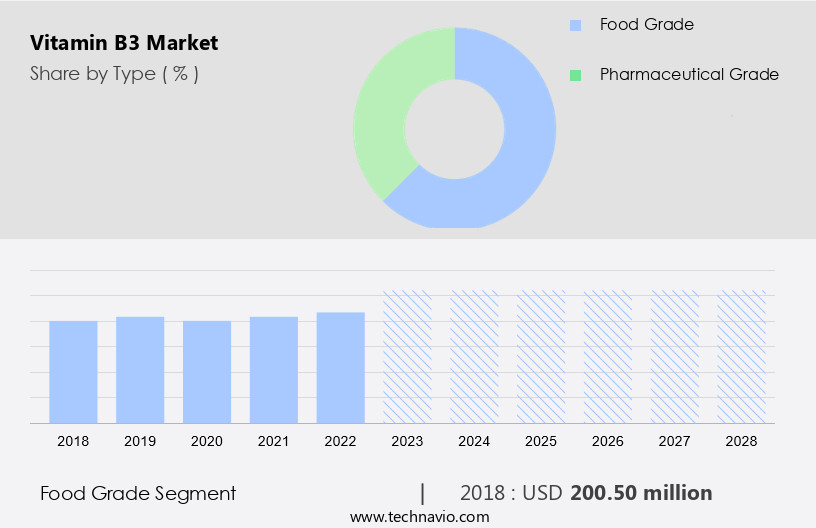

- The food grade segment is estimated to witness significant growth during the forecast period.

Vitamin B3, also known as niacin or nicotinic acid, is an essential organic compound in human and animal nutrition. It plays a crucial role in reducing high blood cholesterol levels and heart-related issues. Foods rich in vitamin B3 include red meat, poultry, fish such as tuna and salmon, brown rice, fortified cereals, and bread. Consumers prefer natural sources over supplements due to potential toxicity concerns. Vitamin B3 deficiency can lead to anemia, headaches, tiredness, and nausea. In the healthcare and animal nutrition segments, vitamin B3 is used In the form of niacin supplements, nicotinic acid, powder, granular, and liquid. The demand for vitamin B3 is increasing due to health consciousness, disease resistance, and changing consumer lifestyles.

Get a glance at the Vitamin B3 Industry report of share of various segments Request Free Sample

The food grade segment was valued at USD 200.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

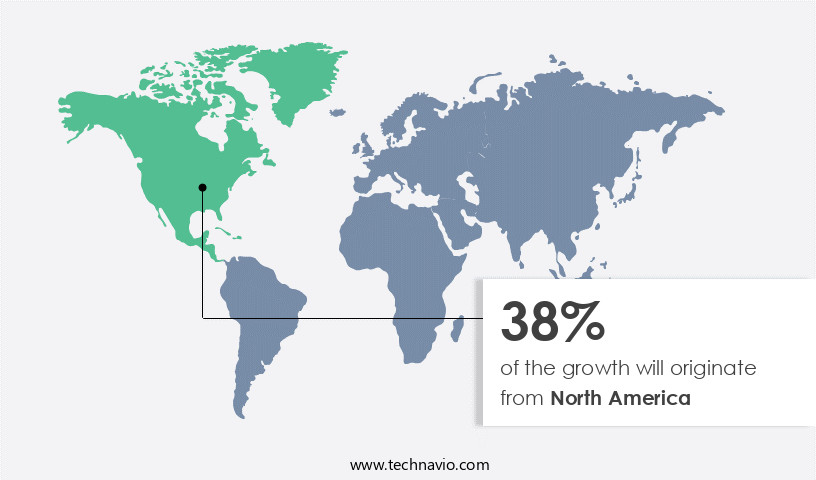

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing growth due to increasing consumer awareness of its health benefits. Vitamin B3, also known as niacin or nicotinic acid, is an organic compound essential for human and animal nutrition. It is found naturally in foods such as tuna, salmon, vegetables, and processed foods, but deficiency can occur. Niacin supplements are available in various forms, including powder, granular, and liquid, for those with deficiencies or for fortification purposes. Niacin plays a crucial role in human and animal health, aiding In the production of energy, reducing high blood cholesterol levels, and improving disease resistance. In the healthcare sector, it is used to treat conditions such as anemia, headaches, tiredness, and nausea.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Vitamin B3 Industry?

Increasing prevalence of vitamin B3 deficiency is the key driver of the market.

- The market is experiencing significant growth due to increasing consumer awareness regarding the importance of maintaining good health and preventing diseases. Vitamin B3, also known as niacin or nicotinic acid, is an essential organic compound that plays a crucial role in human and animal nutrition. It is used in various industries, including pharmaceuticals, feed additives, cosmeceuticals, and food fortification programs. Deficiency of vitamin B3 can lead to various health issues such as pellagra, dermatitis, dementia, and diarrhea. With changing consumer lifestyles, urbanization, and dietary diversification, the incidence of vitamin B3 deficiency is on the rise. This trend is driving the demand for niacin supplements, which are used to treat and prevent deficiency symptoms such as nausea, anemia, headaches, and tiredness.

- The processed food industry's reliance on fortified packaged foods and food regulatory bodies' focus on ensuring adequate nutrient intake through food fortification programs are also contributing to the market's growth. In addition, the development of product offerings in various forms, including powder, granular, and liquid, catering to diverse consumer preferences, is further fueling market expansion. The healthcare expenditure on nutritional products, including vitamin B3 supplements, is expected to continue rising as consumers prioritize disease resistance and overall health consciousness. The market's growth is also influenced by the increasing popularity of healthy food products and the growing demand for fortified feed products in animal nutrition.

What are the market trends shaping the Vitamin B3 Industry?

Increasing consumer spending on nutrient supplements is the upcoming market trend.

- The market is experiencing growth due to increasing consumer spending and the rising demand for nutrient-rich processed foods. With a growing population and urbanization, there is a significant increase In the consumption of packaged and dehydrated food products. This trend is particularly prominent among expatriates and working populations with hectic lifestyles. Vitamin B3, also known as niacin or nicotinic acid, is an essential organic compound that plays a crucial role in human and animal nutrition. It is used in various industries, including pharmaceuticals, feed additives, cosmeceuticals, and food fortification. Niacin and niacinamide are the two primary forms of vitamin B3 used In these industries.

- In the human nutrition segment, niacin supplements are used to treat and prevent deficiencies related to high blood cholesterol, anemia, headaches, tiredness, and other health issues. In animal nutrition, it is used as a feed additive to improve disease resistance and enhance growth. In the cosmeceutical industry, it is used in skincare products due to its antioxidant properties. The development of new product offerings, such as powder, granular, and liquid forms of vitamin B3, is expected to further fuel market growth. The healthcare expenditure on nutritional products and food regulatory bodies' focus on food fortification programs are also contributing factors.

What challenges does the Vitamin B3 Industry face during its growth?

Regulatory control on supplement usage limit is a key challenge affecting the industry growth.

- Vitamin B3, also known as niacin or nicotinic acid, is an essential organic compound In the B3 complex group. It plays a vital role in human and animal nutrition, particularly in energy production, DNA repair, and disease resistance. Niacin supplements are available in various forms, including powder, granular, and liquid, for use in human and animal nutrition, feed additives, cosmeceuticals, and fortified food products. Pharmaceutical-grade niacin is used to treat high blood cholesterol levels, while niacinamide is used to alleviate symptoms of anemia, headaches, tiredness, and other health issues. Niacin deficiency can lead to various health complications, including pellagra and dermatitis.

- In the US, the Food and Drug Administration (FDA) regulates the manufacturing and use of niacin supplements. The Recommended Dietary Allowances (RDAs) for niacin are 14 mg niacin equivalents (NE) for women, 16 mg NE for men, 18 mg NE for pregnant women, and 17 mg NE for lactating women. Consuming niacin supplements in excess of these recommended amounts can lead to side effects such as flushing. Niacin is found naturally in various food sources, including tuna, salmon, vegetables, and dairy products. Processed food products and food fortification programs have increased the availability of niacin In the diet.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agro Cool India Ltd.

- Brother Enterprises Holding Co. Ltd.

- ChromaDex Inc.

- Foodchem International Corp.

- Glanbia plc

- Jubilant Pharmova Ltd.

- Koninklijke DSM NV

- Lasons India Pvt. Ltd.

- Lonza Group Ltd.

- Merck KGaA

- Shandong Hongda Biotechnology Co. Ltd.

- Spectrum Laboratory Products Inc.

- TER HELL and Co. GmbH

- The Chemical Co.

- Twinlab Consolidated Holdings Inc.

- Vanetta Ltd.

- Veer Chemie and Aromatics Pvt. Ltd.

- Vertellus Holdings LLC

- Western Drugs Ltd.

- Yuki Gosei Kogyo Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Vitamin B3, also known as niacin or nicotinic acid, is an essential organic compound that plays a crucial role in various metabolic processes in both human and animal nutrition. This micronutrient is a vital component of the B-complex group, which is essential for the production of energy from food and the synthesis of certain amino acids and nucleotides. The global market for Vitamin B3 has been witnessing significant growth due to the increasing awareness of its health benefits and the rising demand for nutritional products. This trend is observed across various sectors, including human nutrition, animal nutrition, and cosmeceuticals.

Moreover, in the human nutrition segment, the demand for niacin supplements has been growing due to their ability to help address various health concerns. These include high blood cholesterol levels, anemia, headaches, tiredness, and nausea. Niacin and niacinamide are commonly used In the form of powder, granular, or liquid supplements to meet the daily recommended intake of this essential nutrient. The animal nutrition sector also relies heavily on Vitamin B3, particularly In the form of feed additives. This is to ensure that livestock and poultry receive adequate amounts of this nutrient In their diets. The use of Vitamin B3 in animal feed fortification has been shown to improve disease resistance, enhance growth, and promote overall health and productivity.

Furthermore, the cosmeceutical industry has also seen the development of Vitamin B3-based products. These include creams, lotions, and serums that help improve skin health and appearance by reducing inflammation, improving skin elasticity, and reducing the appearance of fine lines and wrinkles. The processed food industry has also been a significant contributor to the growth of the market. Fortified packaged foods, such as breakfast cereals, energy bars, and baked goods, are common sources of this nutrient. The increasing trend of urbanization and changing consumer lifestyles has led to a greater demand for convenient and nutritious food options, driving the growth of the processed food industry and, in turn, the market.

Despite the growing demand for Vitamin B3, there are challenges facing the market. One of the primary challenges is the lack of available ingredients to meet the increasing demand. This has led to the development of new production methods and technologies to increase the availability and affordability of this essential nutrient. Another challenge is the regulatory landscape for Vitamin B3-containing products. Food regulatory bodies have set strict guidelines for the use and labeling of Vitamin B3 in food and nutritional products. Compliance with these regulations can be costly and time-consuming, which may limit the entry of new players into the market.

In addition, the market is expected to continue growing due to the increasing awareness of its health benefits and the rising demand for nutritional products across various sectors. However, challenges such as the lack of available ingredients and regulatory compliance may limit the growth of the market. Despite these challenges, the future of the market looks promising, with ongoing research and development efforts aimed at addressing these challenges and expanding the applications of this essential nutrient.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

131 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.49% |

|

Market growth 2024-2028 |

USD 84.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Denmark, China, Canada, and India |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Vitamin B3 industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the vitamin b3 market growth of industry companies

We can help! Our analysts can customize this vitamin b3 market research report to meet your requirements.