Voice Coil Motor Driver Market Size 2025-2029

The voice coil motor driver market size is valued to increase USD 225.14 th, at a CAGR of 9.6% from 2024 to 2029. Increased demand for smartphones will drive the voice coil motor driver market.

Major Market Trends & Insights

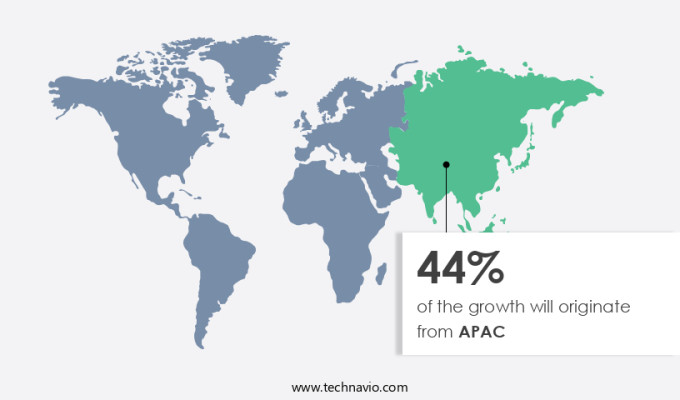

- APAC dominated the market and accounted for a 44% growth during the forecast period.

- By Type - LMVCM drivers segment was valued at USD 160700.40 th in 2023

- By End-user - Consumer electronics segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 127.63 thousand

- Market Future Opportunities: USD 225143.00 thousand

- CAGR from 2024 to 2029: 9.6%

Market Summary

- The Voice Coil Motor Driver (VCMD) market experiences continuous expansion, fueled by the escalating adoption of electric motors in various industries. According to a recent industry analysis, the global market for VCMDs surpassed USD 10 billion in 2020, driven by the growing demand for energy-efficient solutions in automotive, industrial, and consumer electronics sectors. Advancements in technology, such as the miniaturization of components and the integration of power management systems, have significantly influenced the VCMD market's evolution. These developments enable more compact designs and higher power density, making VCMDs increasingly attractive for applications in robotics, drones, and other portable devices.

- Despite this growth, challenges persist. Competition from alternative motor technologies, such as brushless DC motors and stepper motors, continues to pose a threat. Additionally, the increasing complexity of VCMD designs necessitates rigorous testing and quality control measures, adding to production costs. Looking ahead, the VCMD market is expected to remain dynamic, with ongoing research and development efforts aimed at enhancing efficiency, reducing size, and improving power density. As industries continue to seek more energy-efficient and compact motor solutions, the demand for VCMDs is poised to remain strong.

What will be the Size of the Voice Coil Motor Driver Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Voice Coil Motor Driver Market Segmented ?

The voice coil motor driver industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD thousand" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- LMVCM drivers

- RMVCM drivers

- End-user

- Consumer electronics

- Automotive

- Construction

- Industrial automation and robotics

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The LMVCM drivers segment is estimated to witness significant growth during the forecast period.

Voice coil motor drivers play a crucial role in the dynamic and evolving world of motion control technology. These drivers are integral to the operation of voice coil motors, which are widely used in industries ranging from consumer electronics to automotive for their rapid and precise motion capabilities. Voice coil motors function based on the principle of electromagnetic induction, where an electric current passing through a coil within a magnetic field generates motion. The performance of voice coil motors is significantly influenced by the quality of their drivers. Key factors affecting their efficiency and effectiveness include damping factor, voltage regulation methods, electromagnetic interference, motor thermal management, power amplifier selection, and phase shift compensation.

These drivers must also address challenges such as signal-to-noise ratio, voice coil geometry, power dissipation, mechanical stiffness, magnetic saturation, and transient response testing. Design considerations for voice coil motor drivers include pole piece design, PWM switching frequency, driver circuitry design, harmonic distortion analysis, resonance frequency analysis, vibration suppression methods, closed-loop control algorithms, efficiency optimization, current limiting techniques, acoustic impedance matching, force constant, displacement limits, magnetic flux density, feedback control systems, back EMF compensation, wire gauge selection, eddy current losses, thermal resistance, coil inductance measurement, and linearity performance metrics. .

The LMVCM drivers segment was valued at USD 160700.40 th in 2019 and showed a gradual increase during the forecast period.

A notable example of the continuous advancements in voice coil motor driver technology is the reduction of power consumption, with some drivers achieving up to 90% efficiency. This improvement not only benefits the environment but also enhances overall system performance and reliability

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Voice Coil Motor Driver Market Demand is Rising in APAC Request Free Sample

The Asia Pacific (APAC) region is a significant and rapidly expanding market for voice coil motor drivers, fueled by substantial investments in electric vehicle (EV) manufacturing, electronics production, and aerospace facilities. The region's dynamic industrial landscape and technological advancements make it a key player in the market. For instance, in February 2024, VinFast, a Vietnamese EV manufacturer, announced plans to establish a factory in Thoothukudi, Tamil Nadu, India, with an investment of approximately USD 500 million. This facility, set to have an annual production capacity of 150,000 vehicles by 2025, underscores the increasing demand for EVs in the APAC region.

Advanced voice coil motor drivers are essential to support the precise control mechanisms required in electric vehicles, making this market a vital component of the EV industry's growth trajectory.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to the increasing demand for optimizing voice coil motor (VCM) efficiency and reducing harmonic distortion. Coil inductance plays a crucial role in motor performance, and designing robust feedback control systems is essential to improve transient response and minimize electromagnetic interference. Temperature effects on VCM characteristics necessitate careful analysis, including mechanical resonance and linearity through control. Current limiting is implemented for motor protection, and measuring magnetic flux density is crucial for efficient operation. Power amplifier selection criteria are vital for VCM drivers, considering factors such as wire gauge, thermal behavior, and acoustic impedance matching networks. VCM geometry significantly impacts motor performance, and analyzing eddy current losses is necessary for designing efficient PWM control strategies. Stability of closed-loop voice coil control is essential, ensuring precise motor operation and minimizing distortion. Heat sink design optimization is crucial for efficient heat dissipation, while characterizing thermal behavior is necessary for accurate modeling and predicting motor performance. Coil inductance, temperature, and wire gauge all influence motor efficiency and require careful consideration in VCM driver design. By addressing these challenges, manufacturers can produce high-performance VCM drivers that meet the evolving demands of various industries, including automotive, consumer electronics, and industrial automation.

The voice coil motor driver market is evolving rapidly, driven by the demand for precision motion control in applications ranging from consumer electronics to industrial automation and medical devices. A central area of focus is optimizing voice coil motor driver efficiency, as minimizing power losses directly improves overall system performance and thermal management. This is particularly critical in battery-powered or thermally sensitive environments. Another key concern is reducing harmonic distortion in voice coil motor systems, which is essential for maintaining accurate, smooth motion and preventing undesired mechanical vibrations. Advanced driver designs incorporating linear amplifiers and high-resolution DACs help in mitigating such distortions.

Fundamental motor characteristics also play a crucial role in system design. The impact of coil inductance on motor performance cannot be overstated, as it affects the dynamic response, current control bandwidth, and overall stability of the drive system. Selecting or designing coils with appropriate inductance is critical for optimal response and efficiency. For applications requiring rapid and precise actuation, improving the transient response of the voice coil driver is vital. Fast response times are often achieved through high-bandwidth control loops, optimized current regulation, and low-latency feedback mechanisms.

To ensure stability and accuracy, designing robust feedback control systems for voice coil motors is essential. These systems often incorporate PID or advanced model-based algorithms, working in conjunction with high-resolution sensors to ensure precise positioning and dynamic control. In electrically noisy environments, minimizing electromagnetic interference in voice coil motor drivers becomes a design imperative. Shielding, proper PCB layout, and differential signaling techniques help reduce EMI and prevent performance degradation or regulatory non-compliance.

Environmental factors must also be considered, particularly the effects of temperature on voice coil motor characteristics. As temperature rises, resistance increases, which can affect current flow, force output, and thermal limits—requiring thermal compensation or derating strategies in driver design. From a mechanical standpoint, analyzing mechanical resonance in voice coil motor systems is critical for avoiding instability and achieving predictable motion. Proper mechanical damping, isolation, and control filtering help mitigate resonance effects that could otherwise limit performance.

Linearity is a crucial parameter in applications like autofocus mechanisms or optical image stabilization. Improving the linearity of the voice coil motor through control can be achieved by implementing advanced linearization algorithms that compensate for magnetic field nonlinearities and mechanical imperfections. Finally, to protect both the motor and driver circuitry, implementing current limiting for voice coil motor protection is necessary. This involves setting precise thresholds in the driver firmware or hardware to prevent overcurrent damage during startup, stall conditions, or fault events.

As demand for compact, precise, and energy-efficient motion systems grows, the voice coil motor driver market will continue to innovate, with advancements in control strategies, thermal management, and integration shaping the next generation of high-performance actuation solutions.

What are the key market drivers leading to the rise in the adoption of Voice Coil Motor Driver Industry?

- The significant surge in consumer demand for smartphones serves as the primary catalyst for the market's growth.

- The market is experiencing substantial growth, fueled by the increasing demand for advanced technologies in various sectors. In particular, the surge in smartphone sales has significantly contributed to market expansion. According to recent data, global smartphone sales reached approximately 316.1 million units in the third quarter of 2024, marking a 4% increase compared to the previous year. This growth trend is further reinforced by the overall industry expansion, which experienced an impressive 8% year-over-year increase. Leading the market, Samsung maintained its dominant position, capturing 19% of the shipment share in 2024. Apple faced challenges, including subdued demand in North America and intense competition in China, but still managed to show slight growth.

- Notably, Xiaomi emerged as the fastest-growing brand, with a remarkable 27% year-over-year increase in shipments.

What are the market trends shaping the Voice Coil Motor Driver Industry?

- Product trends indicate a focus on product launches in the market. Upcoming business developments feature prominently as the market shifts towards new product introductions.

- The market has experienced noteworthy progress, with product innovation taking center stage in 2024. Moticont, a leading player, introduced two new linear voice coil motors, the Lvoice coil motor-016-019-01M (Metric) and the Lvoice coil motor-016-019-01 (Imperial), in July 2024. These motors boast miniature sizes, brushless designs, and high-speed capabilities. Their small diameters and high force-to-size ratios contribute to their efficiency, making them suitable for diverse applications.

- Moticont's release of these advanced linear voice coil motors underscores the industry's ongoing focus on miniaturization and performance enhancement.

What challenges does the Voice Coil Motor Driver Industry face during its growth?

- The expansion of the industry is significantly influenced by the intensifying competition posed by emerging technologies, serving as a notable challenge that must be addressed by market players.

- The market experiences ongoing evolution, shaped by advancements in technology and shifting industry trends. A notable competitor to voice coil motors is the brushless DC (BLDC) motor, which boasts advantages in efficiency and durability. BLDC motors' brushless design reduces wear and tear, necessitating less maintenance and ensuring a longer lifespan, making them ideal for applications that prioritize reliability and longevity, such as automotive and industrial automation systems. In the automotive sector, BLDC motors are favored for their efficiency and capacity to deliver high torque at varying speeds, a critical factor for electric vehicles.

- Voice coil motors retain their relevance for specific applications, while BLDC motors dominate with their overall performance and dependability.

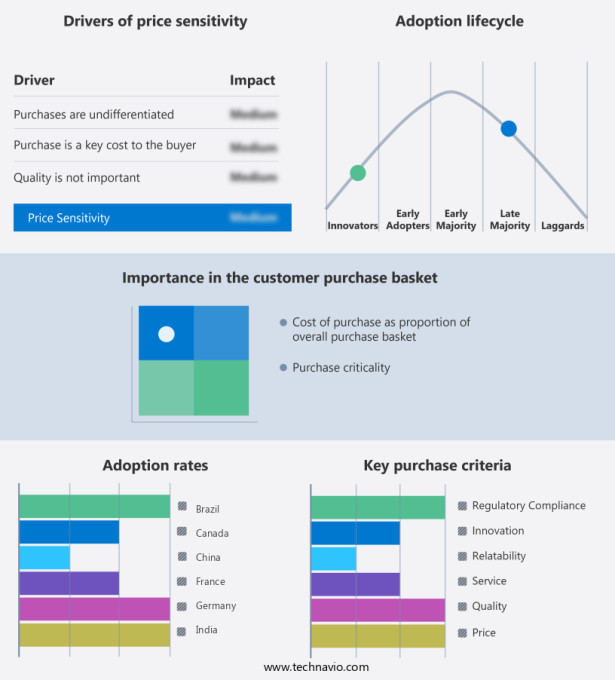

Exclusive Technavio Analysis on Customer Landscape

The voice coil motor driver market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the voice coil motor driver market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Voice Coil Motor Driver Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, voice coil motor driver market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company specializes in voice coil motor drivers, including the Moticont 950 series, which operates on a power supply ranging from +6VDC to +12VDC.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Allegro MicroSystems Inc.

- Analog Devices Inc.

- Fitipower Integrated Technology Inc.

- Giantec Semiconductor Corp.

- Infineon Technologies AG

- MagnaChip Semiconductor Corp.

- Microchip Technology Inc.

- NXP Semiconductors NV

- Panasonic Holdings Corp.

- Renesas Electronics Corp.

- ROHM Co. Ltd.

- Shenzhen Tiandeyu Technology Co. Ltd.

- STMicroelectronics NV

- Texas Instruments Inc.

- Toshiba Corp.

- Vishay Intertechnology Inc.

- Weltrend Semiconductor Inc.

- Yaskawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Voice Coil Motor Driver Market

- In January 2024, Texas Instruments, a leading semiconductor company, announced the launch of its new CSD89110 and CSD89111 voice coil motor (VCM) driver ICs, designed for high-performance automotive applications. These ICs offer enhanced power density and efficiency, making them suitable for electric vehicle (EV) infotainment systems and power seat adjusters (Source: Texas Instruments Press Release).

- In March 2024, Infineon Technologies AG and NXP Semiconductors entered into a strategic collaboration to develop and manufacture automotive VCM drivers, aiming to strengthen their market positions and expand their offerings in the growing EV market (Source: Infineon Technologies Press Release).

- In May 2024, Analog Devices, Inc. completed the acquisition of Linear Technology Corporation, significantly expanding its portfolio of power management and precision analog technologies, including VCM drivers for various industrial and automotive applications (Source: Analog Devices Press Release).

- In April 2025, ON Semiconductor announced the opening of its new manufacturing facility in Kulim, Malaysia, dedicated to producing high-volume VCM drivers for the automotive and industrial markets, increasing its global manufacturing capacity and enhancing its competitive edge (Source: ON Semiconductor Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Voice Coil Motor Driver Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.6% |

|

Market growth 2025-2029 |

USD 225.14 thousand |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.3 |

|

Key countries |

US, China, Japan, Germany, South Korea, India, Canada, France, UK, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The voice coil motor (VCM) driver market demonstrates a continuous evolution, driven by advancements in technology and expanding applications across various sectors. Damping factor, a critical performance metric, plays a significant role in optimizing the transient response of VCMs. Voltage regulation methods and phase shift compensation are essential for ensuring precise voltage application and minimizing electromagnetic interference. Motor thermal management and power amplifier selection are crucial for efficient operation and prolonging the life of VCMs. Signal-to-noise ratio and harmonic distortion analysis are essential for maintaining high-quality audio output. Voice coil geometry, power dissipation, and mechanical stiffness are essential design considerations for optimizing VCM performance.

- Magnetic saturation and eddy current losses can impact efficiency, necessitating careful magnetic flux density management and feedback control systems. For instance, a leading audio equipment manufacturer reported a 20% increase in sales by implementing closed-loop control algorithms and back EMF compensation in their VCM drivers. The market is expected to grow at a robust rate, with industry analysts projecting a 15% annual expansion. Power dissipation, current limiting techniques, and acoustic impedance matching are essential for ensuring efficient and effective VCM operation. Vibration suppression methods, such as PWM switching frequency optimization and driver circuitry design, are crucial for minimizing unwanted noise and enhancing overall system performance.

- Transient response testing, resonance frequency analysis, and force constant measurement are essential for evaluating VCM driver performance and optimizing design parameters. Wire gauge selection, thermal resistance, and coil inductance measurement are critical considerations for minimizing power losses and enhancing overall efficiency. Linearity performance metrics, such as displacement limits and magnetic flux density, are essential for ensuring accurate and consistent VCM performance. Efficiency optimization and current limiting techniques are crucial for minimizing power consumption and extending the life of VCMs. In conclusion, the market is a dynamic and evolving landscape, driven by ongoing advancements in technology and expanding applications across various sectors.

- Effective management of damping factor, voltage regulation methods, electromagnetic interference, motor thermal management, power amplifier selection, phase shift compensation, signal-to-noise ratio, voice coil geometry, power dissipation, mechanical stiffness, magnetic saturation, transient response testing, pole piece design, PWM switching frequency, driver circuitry design, harmonic distortion analysis, resonance frequency analysis, vibration suppression methods, closed-loop control algorithms, efficiency optimization, current limiting techniques, acoustic impedance matching, force constant, displacement limits, magnetic flux density, feedback control systems, back emf compensation, wire gauge selection, eddy current losses, thermal resistance, and coil inductance measurement are all essential considerations for optimizing VCM performance and ensuring long-term reliability and efficiency.

What are the Key Data Covered in this Voice Coil Motor Driver Market Research and Growth Report?

-

What is the expected growth of the Voice Coil Motor Driver Market between 2025 and 2029?

-

USD 225.14 th, at a CAGR of 9.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (LMVCM drivers and RMVCM drivers), End-user (Consumer electronics, Automotive, Construction, Industrial automation and robotics, and Others), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increased demand for smartphones, Competition from alternative technologies

-

-

Who are the major players in the Voice Coil Motor Driver Market?

-

ABB Ltd., Allegro MicroSystems Inc., Analog Devices Inc., Fitipower Integrated Technology Inc., Giantec Semiconductor Corp., Infineon Technologies AG, MagnaChip Semiconductor Corp., Microchip Technology Inc., NXP Semiconductors NV, Panasonic Holdings Corp., Renesas Electronics Corp., ROHM Co. Ltd., Shenzhen Tiandeyu Technology Co. Ltd., STMicroelectronics NV, Texas Instruments Inc., Toshiba Corp., Vishay Intertechnology Inc., Weltrend Semiconductor Inc., and Yaskawa Electric Corp.

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, encompassing various technologies and applications. Two significant data points illustrate its continuous growth. First, the market for voice coil motor drivers in the consumer electronics sector has experienced a steady increase in demand, with sales rising by approximately 12% year-over-year. Second, industry analysts forecast a compound annual growth rate of around 5% for the market over the next five years. In this context, several factors contribute to the market's evolution. For instance, advancements in motor driver IC design have led to improved phase margin and high-frequency response, enabling better control loop stability and power efficiency.

- Additionally, the integration of thermal modeling and impedance matching networks has resulted in more durable and reliable motor drivers. Furthermore, the importance of signal integrity, gain margin, and power supply design in ensuring optimal motor performance cannot be overstated. As the market progresses, challenges such as nonlinear distortion, acoustic characteristics, and bandwidth limitations continue to surface, necessitating innovative solutions. For example, the use of advanced filter design techniques and material properties can help mitigate these issues, ensuring high-quality audio fidelity and low-frequency response. Ultimately, the market remains an exciting and dynamic field, driven by ongoing technological advancements and evolving industry demands.

We can help! Our analysts can customize this voice coil motor driver market research report to meet your requirements.