Wafer Handling Robots Market Size 2024-2028

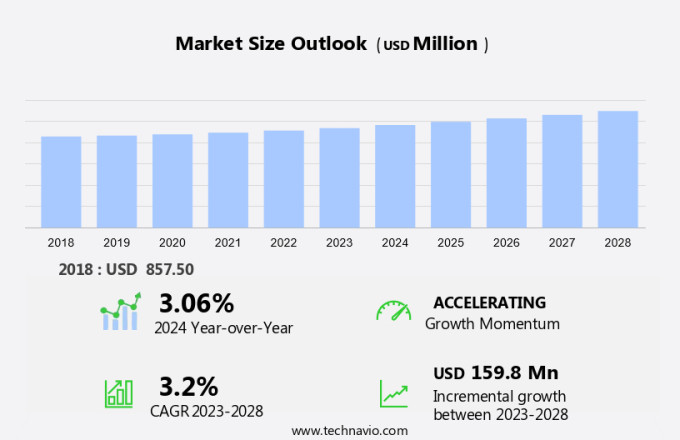

The wafer handling robots market size is forecast to increase by USD 159.8 million at a CAGR of 3.2% between 2023 and 2028. The market is driven by the advancements in semiconductor processing, leading to the increased demand for high-precision wafer handling solutions. Innovations in electronics manufacturing have resulted in the need for super-precise wafer cleaning, cutting, and packaging processes. High-speed wafer handling robots, such as SCARA (Selective Compliance Assembly Robot Arm), frog leg robots, and four-bar linkage robotics, are increasingly being adopted to meet the demands of the industry. The reliability of these robots is crucial, as any malfunction can lead to significant downtime and production losses. Moreover, the semiconductor industry's focus on vacuum-based wafer handling systems is a growing trend, as they offer improved handling and contamination control. The high cost of deployment for these advanced systems can be a challenge for smaller players in the market. However, the benefits of increased productivity, improved quality, and reduced labor costs make wafer handling robots an essential investment for semiconductor manufacturers.

The semiconductor industry is a critical sector driving innovation and growth in various industries, including automotive, consumer electronics, and industrial automation. Semiconductor manufacturing processes involve handling and processing semiconductor wafers, which are the foundation for integrated circuits, microdevices, and other semiconductor components. Wafer handling robots play a crucial role in ensuring the accuracy, throughput, and process repeatability in semiconductor fabrication. Contamination is a significant risk in semiconductor manufacturing, as even minute particles can impact the performance and reliability of the final product. Wafer handling robots are designed to minimize the risk of contamination by employing advanced technologies and operating in cleanroom environments. These robots are engineered for super precision and high speed performance, making them indispensable in semiconductor fabs. Wafer handling robots are integral to various stages of semiconductor manufacturing, including wafer cleaning, wafer packaging, wafer cutting, and other related processes.

The demand for wafer handling robots is driven by the increasing production of smart devices and electronic gadgets. The proliferation of hybrid vehicle, factory automation, IoT devices, and other advanced technologies relies on the semiconductor industry's ability to produce high-quality components. Wafer handling robots contribute to this goal by ensuring the accuracy and repeatability of semiconductor manufacturing processes. In summary, wafer handling robots are essential tools in the semiconductor industry, enabling the production of high-quality semiconductor components for various applications. Their ability to minimize contamination risk, enhance throughput, and ensure process repeatability makes them indispensable in semiconductor fabrication. The growing demand for smart devices and electronic gadgets is expected to fuel the continued growth of the market.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Atmospheric

- Vacuum

- End-user

- Foundries

- Integrated device manufacturers

- Geography

- APAC

- China

- South Korea

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Product Insights

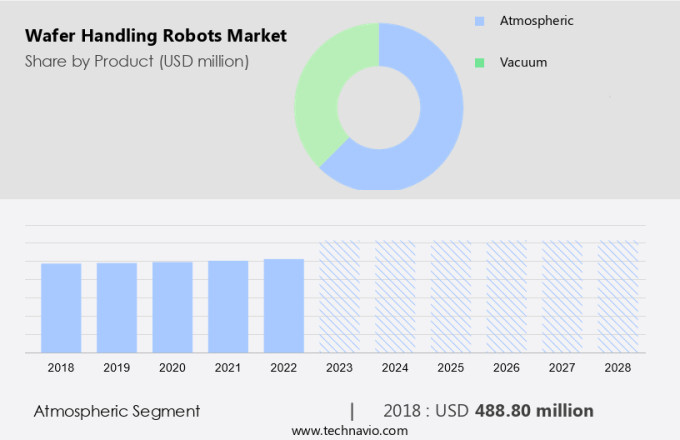

The atmospheric segment is estimated to witness significant growth during the forecast period. Wafer-handling robots have gained significant importance in the semiconductor industry, particularly in handling materials such as Aluminium, Plastics, Composites, and Ceramics, due to their ability to minimize particle contamination and maintain superior surface finishes. These robots are increasingly being used in tools that operate in atmospheric pressure conditions, which include inspection and metrology systems and thermal processing tools. The demand for atmospheric wafer handling robots is expected to increase during the forecast period, as these tools become more prevalent in the semiconductor manufacturing process.

In fact, the atmospheric wafer handling robots segment is projected to hold a larger market share compared to vacuum wafer handling robots due to the growing requirement for such robotics to work with process and metrology tools that function in an atmospheric environment. Forward-thinking businesses in the Vacuum Microelectronics and Reliability (VMR) industry are incorporating these robots into their pitches, business plans, presentations, and proposals to showcase their commitment to innovation and advanced technology. MEMS accelerometers and switches are also being integrated with these robots to enhance their functionality and precision.

Get a glance at the market share of various segments Request Free Sample

The atmospheric segment accounted for USD 488.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

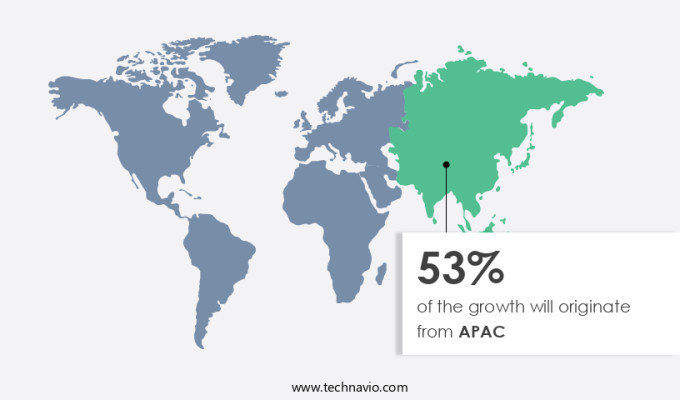

APAC is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the semiconductor industry, wafer handling robots play a crucial role in the production of integrated circuits and microdevices. These robots ensure accuracy and process repeatability during the handling of semiconductor wafers, which is essential for maintaining the quality of the final products. However, the use of these robots comes with the risk of contamination, which can negatively impact the processing equipment and reduce throughput. The market for wafer handling robots is experiencing significant growth, particularly in the Asia Pacific (APAC) region. Factors contributing to this growth include government initiatives, the increasing demand for automobiles, and the strong manufacturing sector in the region. China, India, Japan, and South Korea are the leading markets in the region, accounting for a substantial portion of the revenue. Manufacturers in the semiconductor industry are adopting wafer handling robots to address challenges such as outdated equipment and technology, unstable production, and reliance on manual labor.

However, the market faces challenges, including the slowdown of industrial production in China and the risk of company instability. Despite these challenges, the market is expected to continue growing due to the increasing demand for advanced technologies and consumer confidence in electronics. In conclusion, the market in the semiconductor industry is experiencing growth in the APAC region, driven by factors such as government initiatives and the strong manufacturing sector. China, India, Japan, and South Korea are the leading markets in the region. Manufacturers are adopting these robots to address challenges in production and ensure accuracy and process repeatability. However, the market faces challenges, including the slowdown of industrial production in China and the risk of company instability. Despite these challenges, the market is expected to continue growing due to the increasing demand for advanced technologies and consumer confidence in electronics.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Innovations in electronics and semiconductor manufacturing is the key driver of the market. The market has witnessed steady growth due to the rising demand for automation and robotic solutions in the semiconductor industry. Advanced packaging techniques, such as 3D stacking, wafer-level packaging, fan-out wafer-level packaging, and others, have necessitated the use of precise management systems for die positioning and substrate handling. These robots play a crucial role in handling delicate components, including wafers, interposers, and substrates, with utmost care. As the consumer electronics sector continues to evolve, there is a growing need for efficient and flexible manufacturing processes. Wafer handling robots offer a solution by automating repetitive tasks, reducing delivery times, and increasing the overall productivity of work cells.

The components that benefit from these systems include cylindrical geometries, circuit boards, and solar wafers; coils; switches and connectors; and electromagnetic components. During the forecast period, there will be an increasing demand for advanced wafer handling robots that can handle delicate components with high precision. Companies are investing in these systems to streamline their manufacturing processes and remain competitive in the market. By incorporating systems that can perform a variety of tasks, these organizations can increase the flexibility of their work cells and improve their overall efficiency.

Market Trends

Advancement in software capabilities is the upcoming trend in the market. The market is poised for growth during the forecast period, driven by the rising demand for semiconductor processing and the need for high-precision, high-speed wafer handling. companies are focusing on developing advanced software solutions to streamline the production process of wafers. These software offerings enable end-users to modify and expand their wafer production with ease. This allows for customization of the programming environment, ensuring seamless integration with specific applications. Furthermore, companies offer software packages for specialized tasks such as wafer cleaning, wafer cutting, and wafer packaging. The use of vacuum technology in these robots ensures reliable handling and packaging of wafers, making them indispensable in the semiconductor industry.

Market Challenge

The high cost of deployment is a key challenge affecting the market growth. Wafer handling robots have become increasingly essential in production facilities, particularly in the healthcare industry, due to their ability to enhance production capacities through advanced robotic technology. The integration of sensor technologies and vision systems, including laser sensors, significantly improves the precision and efficiency of the manufacturing process. However, the initial capital investment required for installing wafer handling robots can be substantial, encompassing expenses for fixtures, tooling, environmental systems, preventive maintenance, safety measures, operator training, and complementary peripheral equipment. Despite the high upfront costs, the strategic analysis reveals that wafer handling robots offer a substantial return on investment over a short period.

The technical advancements in robotic technology have led to the development of hybrid vehicles and factory automation solutions that streamline the manufacturing process and reduce labor costs. Cooperation between manufacturers and companies has also been instrumental in facilitating long-term contracts, enabling customers to reap the benefits of existing automated solutions. However, the adoption of wafer handling robots comes with customer switching costs, as replacing or repairing an installed robot can significantly impact day-to-day operations. Therefore, it is crucial for organizations to carefully consider the benefits and challenges before investing in this technology. In conclusion, the integration of wafer handling robots in production facilities represents a significant investment in technological advancement, offering substantial benefits in terms of increased production capacities and improved efficiency.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Adenso GmbH- The company offers Adenso WHR-VAC wafer handling robot in different version such as WHR-LARGE, WHR-EXTRA LARGE, and WHR-ULTRA LARGE.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Brooks Automation Inc.

- Daihen Corp.

- isel Germany AG

- JEL Corp.

- Kawasaki Heavy Industries Ltd.

- Kensington Laboratories LLC

- KUKA AG

- Ludl Electronic Products Ltd.

- Milara International Ltd.

- Moog Inc.

- Nidec Corp.

- Rexxam Co. Ltd.

- RORZE Corp

- Yaskawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Wafer handling robots play a crucial role in the semiconductor industry, where the production of integrated circuits, microdevices, and other electronic components relies on the precise handling of semiconductor wafers. The wafer handling process requires high levels of accuracy and contamination control to ensure the integrity of the wafers and the final products. The semiconductor industry is subject to unstable markets, consumer confidence fluctuations, and company instability, making the need for reliable and efficient wafer handling solutions essential. Advanced packaging techniques, such as 3D stacking, wafer-level packaging, and fan-out wafer-level packaging, require precision management during the handling process. Robotic technology, including SCARA robots, frog leg robots, and four-bar linkage robots, is widely used in semiconductor processing for wafer handling due to their high precision, reliability, and throughput capabilities.

Further, wafer handling robots are also used in other industries, such as vacuum microelectromechanical systems (MEMS) and photovoltaic manufacturing, where substrates, interposers, and other materials require careful handling. Capital investment in wafer handling robots and related processing equipment is a significant consideration for semiconductor companies and other organizations involved in the production of electronic devices. Technical advancements, such as super precision, high-speed handling, and vacuum integrity, are driving the demand for these robots in various applications, from consumer electronics and healthcare to factory automation and hybrid vehicles. Strategic analysis of the wafer handling robot market involves pitches, business plans, presentations, and proposals, as well as an understanding of the latest trends, such as miniaturization, IoT devices, and electrical components.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2024-2028 |

USD 159.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.06 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 53% |

|

Key countries |

China, Taiwan, US, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Adenso GmbH, Brooks Automation Inc., Daihen Corp., isel Germany AG, JEL Corp., Kawasaki Heavy Industries Ltd., Kensington Laboratories LLC, KUKA AG, Ludl Electronic Products Ltd., Milara International Ltd., Moog Inc., Nidec Corp., Rexxam Co. Ltd., RORZE Corp, and Yaskawa Electric Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch