Water And Wastewater Treatment Equipment Market Size 2025-2029

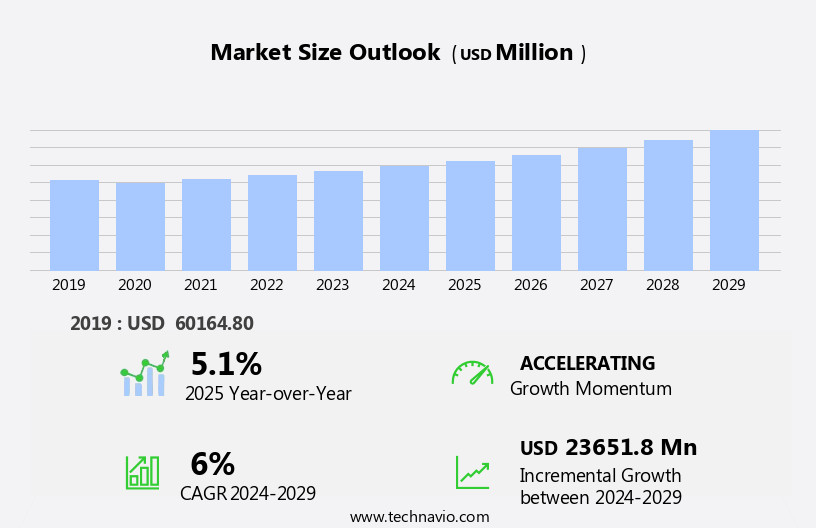

The water and wastewater treatment equipment market size is forecast to increase by USD 23.65 billion at a CAGR of 6% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. Firstly, the increasing global concerns over water scarcity and the resulting health issues are driving the demand for advanced water treatment solutions. Plant-based water treatment technologies, such as membrane filtration and chlorine disinfection, are gaining popularity as they offer sustainable and eco-friendly alternatives to traditional methods. Additionally, the integration of renewable energy sources, such as solar and wind power, in water treatment plants is a major trend, reducing the reliance on fossil fuels and lowering operational costs. Furthermore, the construction industry's growing focus on sustainability and the increasing demand for plastic-free packaging are also boosting the market for water and wastewater treatment equipment.

- However, the high cost of industrial water treatment equipment remains a challenge for small and medium-sized enterprises, limiting their adoption. Another challenge is the presence of grease and other contaminants in wastewater, requiring specialized equipment for effective treatment. Overall, the market for water and wastewater treatment equipment is expected to continue growing due to these trends and challenges, particularly in power generation, desalination, and industrial applications.

What will be the Size of the Water And Wastewater Treatment Equipment Market During the Forecast Period?

- The market encompasses the production and supply of technologies used to address the growing demand for clean water and effective wastewater management. This market caters to both municipal and industrial applications, focusing on water treatment and wastewater treatment, as well as emerging areas such as saline water treatment and water reuse. Deteriorating water resources and increasing water quality concerns in developing areas drive market growth. Industrialization and urbanization further expand the market's reach, as stringent environmental regulations and the need to mitigate environmental pollution become priorities. Technological advancements in activated sludge treatment, biological treatment, and membrane filtration continue to shape the market landscape.

- Health challenges associated with contaminated water, including gastrointestinal disorders, reproductive disorders, and neurological disorders, underscore the importance of this market. Health-conscious consumers and regulatory bodies push for innovative solutions to ensure the safety and sustainability of water resources.

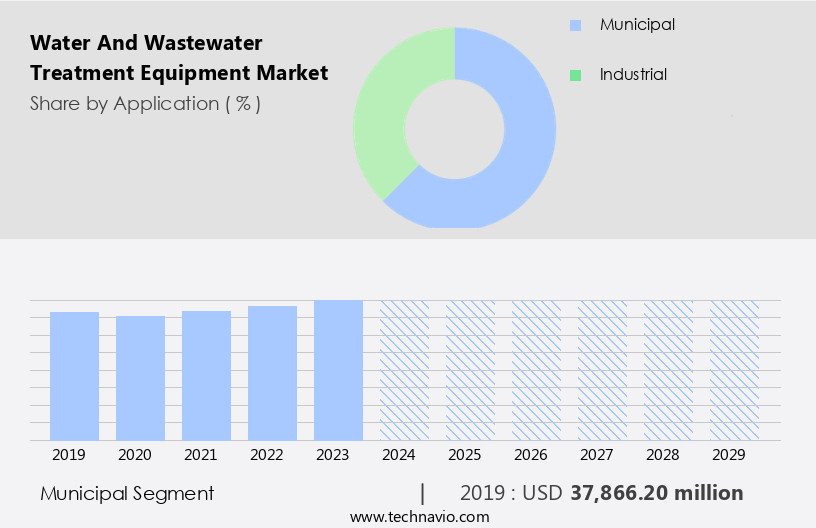

How is this Water And Wastewater Treatment Equipment Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Municipal

- Industrial

- Type

- Primary treatment

- Secondary treatment

- Tertiary treatment

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Middle East and Africa

- South America

- APAC

By Application Insights

- The municipal segment is estimated to witness significant growth during the forecast period.

The market encompasses a significant portion of municipal applications, which is the largest market segment. This segment caters to wastewater treatment plants and drinking water suppliers, utilizing equipment for disinfecting municipal water and treating effluents to restore water bodies. The volume of water treated in municipal applications is substantial, and the demand for equipment is persistent. The primary objective of water treatment in this context is to eliminate contaminants and render the water suitable for basic use. The growth of the market for municipal applications is driven by the increasing need for clean and potable water and the requirement for sludge dewatering in sewage treatment plants.

Key trends include the adoption of advanced technologies like membrane filtration, ozonation, and ultraviolet disinfection, as well as stricter environmental regulations. Additionally, consumer health consciousness, aging water infrastructure, and deteriorating water resources are significant factors fueling market growth. The market is anticipated to expand further due to urbanization, industrialization, and the need for water reuse and desalination.

Get a glance at the market report of share of various segments Request Free Sample

The Municipal segment was valued at USD 37.87 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is driven by the increasing scarcity of freshwater resources, particularly in developing areas such as Asia Pacific (APAC), which is home to the largest population. Strict environmental regulations, including the Environmental Protection Law of China, the Water Resources Law, and the Water Pollution Prevention and Control Law, are being enforced to promote the proper use of water and maximize the benefits of wastewater treatment. Governments are investing in infrastructure expansion and upgradation, as well as the installation of new treatment plants, to address the challenges of aging water infrastructure and contaminated water. Consumer health consciousness and the need for clean drinking water are also significant factors driving market growth.

Technologies such as membrane filtration, membrane separation, and membrane technologies, as well as disinfection technologies like chlorine gas, ozonation, and ultraviolet disinfection, are being adopted to ensure the production of potable water and mitigate environmental pollution. Energy consumption and emissions are key concerns, with innovations in technologies such as fuel cells and renewable energy sources being explored to improve sustainability. The market is expected to continue growing due to the rising urban population, industrialization, and increasing disposable income, as well as the need for water reuse and recycling to address physical water scarcity and plastic waste.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Water And Wastewater Treatment Equipment Industry?

Rising global concerns regarding water scarcity is the key driver of the market.

- The global water crisis, driven by deteriorating water resources and increasing population, is fueling the demand for advanced water and wastewater treatment equipment. The Food and Agriculture Organization estimates that by 2025, approximately 1.8 billion people will reside in water-scarce regions, and two-thirds of the world population could face water stress. To ensure clean drinking water and address industrial wastewater treatment needs, various treatment technologies such as activated sludge treatment, biological treatment, chemical treatment, membrane filtration, and membrane separation are being adopted.

- Disinfection technologies, including chlorine gas, ozonation, and ultraviolet disinfection, are also gaining popularity due to their effectiveness in eliminating contaminants and ensuring water quality. Environmental concerns and stringent regulations are pushing the market towards more sustainable and energy-efficient solutions. Innovative technologies like membrane technologies, fuel cells, and desalination equipment are being explored to reduce emissions and minimize environmental effects. The market is also witnessing growth in developing areas due to infrastructure expansion and industrialization. Consumer health consciousness and sensible drinking practices are further driving the demand for drinking water services and systems. The market is expected to face challenges due to the high energy consumption and cost associated with water treatment, but federal support and wastewater projects are expected to mitigate these challenges.

What are the market trends shaping the Water And Wastewater Treatment Equipment Industry?

Increasing waterborne diseases and health issues is the upcoming market trend.

- Water pollution poses significant risks to both the environment and human health due to the introduction of unwanted materials such as industrial waste, human and animal waste, garbage, and sewage effluents into water sources. Climate change-induced floods and droughts further exacerbate these issues, leading to increased health risks. For example, flooding can disperse fecal contaminants, increasing the risk of waterborne diseases like cholera. Conversely, water shortages due to droughts can increase the risks of diarrheal diseases. These health challenges have heightened consumer health consciousness, leading to a growing demand for clean drinking water and effective water treatment solutions. Water treatment technologies, including biological treatment and chemical treatment, play a crucial role in addressing these issues.

- Biological treatment technologies, such as activated sludge treatment, utilize microorganisms to break down organic matter in wastewater. Disinfection technologies, including chlorine gas, ozonation, and ultraviolet disinfection, help eliminate pathogens and ensure the production of potable water. Membrane filtration and membrane separation technologies, like membrane equipment and membrane technologies, are also essential for water reuse and desalination. The aging water infrastructure in developing areas and industrialized countries necessitates infrastructure expansion and renovation or rebuilding. Strict environmental regulations and the need for sustainability have become stumbling blocks for the water treatment industry, driving innovation in energy-efficient technologies such as fuel cells and membrane technologies. Global water consumption is increasing, and the demand for innovative packaging solutions, such as Plant-based water, is growing.

What challenges does the Water And Wastewater Treatment Equipment Industry face during its growth?

High cost of industrial water treatment equipment is a key challenge affecting the industry growth.

- Water and wastewater treatment equipment is a vital sector encompassing various applications and serving industries with diverse sizes and complexities. Equipment costs can significantly vary due to factors such as system complexity and capacity. For instance, a boiler feedwater treatment system, which ranges from simple, low-flow systems to high-end, high-capacity equipment, can cost anywhere from USD45,000 for a low-flow system to millions of dollars for high-capacity, high-pressure applications. Raw water treatment equipment, essential for removing contaminants from raw water sources, can cost between USD 975,000 and USD 3 million for a standard 200 to 1,000 gallons per minute (GPM) capacity system, depending on the flow rate and water quality.

- These costs can fluctuate across industries, with municipal and industrial applications requiring different treatment technologies like activated sludge treatment, biological treatment, chemical treatment, and membrane filtration. The increasing consumer health consciousness, aging water infrastructure, deteriorating water resources, and environmental pollution necessitate the expansion and renovation of water treatment infrastructure. This includes infrastructure expansion, installation, and upgradation, and wastewater treatment projects. Strict environmental regulations and the need for sustainable technologies are driving innovation in disinfection technologies, such as ozonation, UV equipment, and chlorine gas, as well as membrane separation and membrane technologies. Moreover, the rising disposable income in developing areas and urbanization are creating opportunities for water reuse and desalination equipment.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AccessTech Engineering Pte Ltd - The company specializes in providing a range of water and wastewater treatment solutions, encompassing Carbon Filtration Systems, Softener Systems, Commercial Reverse Osmosis Systems, Deionizer Systems, Industrial Reverse Osmosis Systems, and Multi Media Filtration Systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accesstech Engineering Pte Ltd

- AllWater Technologies Ltd.

- Aries Chemical Inc.

- Axon Group

- Cortec Corp.

- DeZURIK Inc.

- Fluence Corp. Ltd.

- Ingersoll Rand Inc.

- KURARAY Co. Ltd.

- Metito Group

- Ringwood Environmental Inc.

- Samco Technologies Inc.

- SUEZ SA

- Sulzer Ltd.

- Thermax Ltd.

- VA Tech Wabag Ltd.

- Veolia Water Technologies

- WOG Group

- Xylem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of technologies and processes designed to ensure the provision of clean drinking water and the proper management of wastewater. With the increasing awareness of consumer health consciousness and the deteriorating state of water resources worldwide, the demand for advanced water treatment solutions is on the rise. Biological treatment, which relies on microorganisms to break down organic matter, is a key technology in the water treatment sector. This method is particularly effective in treating industrial wastewater and is gaining popularity in developing areas due to its cost-effectiveness and environmental sustainability. However, the energy consumption associated with biological treatment can be a stumbling block, leading to the exploration of alternative energy sources such as fuel cells.

Moreover, chemical treatment, which involves the addition of chemicals to alter the properties of water, is another common method used in water treatment. Chlorine gas, for instance, is widely used for disinfection purposes due to its effectiveness in killing bacteria and viruses. However, the environmental effects of chlorine gas, including the production of harmful disinfection by-products, have led to the development of alternative disinfection technologies such as ozonation and ultraviolet disinfection technologies. Membrane technologies, including membrane filtration and membrane separation, are increasingly being used in water treatment due to their ability to remove contaminants with high efficiency.

Furthermore, membrane filtration, for example, can remove particles as small as 0.01 microns, making it an effective solution for treating contaminated water. Membrane separation, on the other hand, is used to separate water from wastewater streams, making it an essential component of wastewater treatment systems. The aging water infrastructure in many parts of the world presents a significant challenge to the water treatment industry. Renovation or rebuilding of water treatment plants and water mains is necessary to ensure the delivery of clean drinking water and prevent water loss. This infrastructure expansion is also driven by stringent environmental regulations aimed at reducing emissions and minimizing the environmental impact of water treatment processes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 23.65 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, Japan, India, Canada, UK, South Korea, Germany, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Water And Wastewater Treatment Equipment Market Research and Growth Report?

- CAGR of the Water And Wastewater Treatment Equipment industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the water and wastewater treatment equipment market growth of industry companies

We can help! Our analysts can customize this water and wastewater treatment equipment market research report to meet your requirements.