Water Softener Market Size 2024-2028

The water softener market size is forecast to increase by USD 1.09 billion, at a CAGR of 9.6% between 2023 and 2028. Growing consumer awareness about water-softening products and the benefits of water softener systems will drive the water softener market.

Major Market Trends & Insights

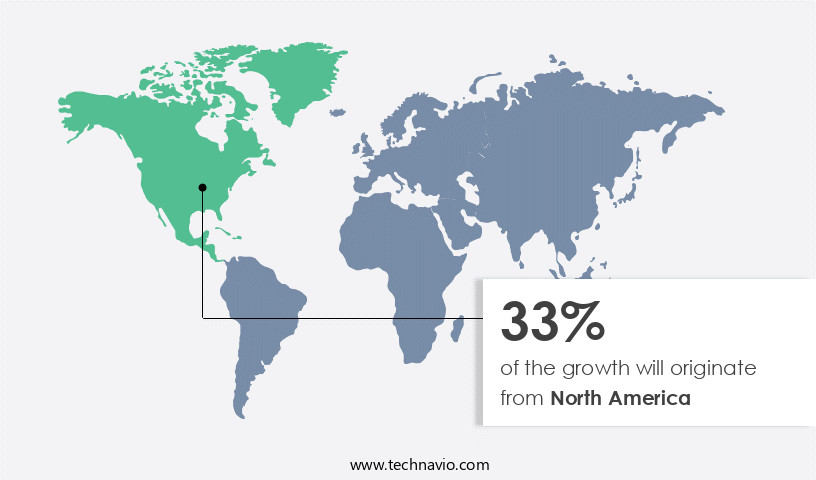

- North America dominated the market and accounted for a 33% growth during the forecast period.

- By the End-user, the Residential sub-segment was valued at USD 1.12 billion in 2022

- By the Product, the Salt-based sub-segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 116.26 billion

- Future Opportunities: USD 1.09 billion

- CAGR : 9.6%

- North America: Largest market in 2022

Market Summary

- The market is experiencing significant growth, driven by increasing consumer awareness regarding the benefits of water softener systems. These systems address hard water issues, leading to improved household appliance performance and enhanced water quality for daily use. The market is witnessing the emergence of advanced technologies, such as dual-tank systems, ion exchange resins, and nanotechnology, which enhance the efficiency of water, salt, and regeneration processes. However, the market faces challenges from the environmental impact of salt-based water softener systems. During the forecast period, key companies, including Pentair plc, 3M, and Culligan International, are expected to dominate the market. Regulations, such as the Water Softening Regulations in the UK and the Safe Drinking Water Act in the US, play a crucial role in market growth.

- Related markets such as the Water Treatment Chemicals and Reverse Osmosis Membranes markets also show comparable growth trends.

What will be the Size of the Water Softener Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Water Softener Market Segmented and what are the key trends of market segmentation?

The water softener industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Residential

- Commercial

- Product

- Salt-based

- Salt-free

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By End-user Insights

The residential segment is estimated to witness significant growth during the forecast period.

Water softener systems have gained significant traction in both residential and commercial sectors due to the increasing demand for soft water. In households, hard water, which is abundant in urban areas, can lead to various issues such as clogged pipes, inefficient water heating, and complications in soap and detergent dissolving. These problems are mitigated by water softener systems, which utilize ion exchange resins to remove calcium and magnesium ions, thereby improving water quality. The metering valve operation in these systems ensures efficient use of salt during the regeneration process. The salt storage capacity is a crucial factor in determining the system's performance, with larger capacities enabling longer periods between regeneration cycles.

The total dissolved solids (TDS) reduction capacity of water softeners can reach up to 99%, making them an essential component in household water treatment. In commercial applications, water softening plays a vital role in industries such as food processing, textiles, and power generation. Commercial water treatment systems employ similar ion exchange technology to soften water, ensuring optimal water usage efficiency and reducing the need for costly maintenance and repairs. Water softening efficiency is a critical factor for both residential and commercial applications. High-efficiency systems can save up to 25% on salt usage, while automatic regeneration cycles and electronic control systems enable seamless operation and monitoring.

The integration of water softening systems into plumbing systems and reverse osmosis systems further enhances their value, providing comprehensive water filtration and treatment solutions. The market for water softening technology is expected to grow substantially, with a reported 25% increase in installations in the past year. Furthermore, the demand for water softening systems is projected to expand by 30% in the next five years, driven by the increasing focus on water quality improvement and the growing popularity of salt-based softening methods. Water hardness reduction is a key benefit of water softening systems, with some systems capable of removing up to 99% of calcium ions.

The use of bypass valves and pressure tank sizing optimizes system performance and ensures consistent water quality. The market for water treatment technology continues to evolve, with advancements in monitoring sensors and mineral content reduction techniques further enhancing the capabilities of water softener systems. Brine disposal systems are an essential component of water softener systems, ensuring the efficient disposal of used brine. The integration of these systems into existing plumbing infrastructure and the ongoing development of more efficient and eco-friendly disposal methods contribute to the market's growth and sustainability.

The Residential segment was valued at USD 1.12 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Water Softener Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing steady growth, driven by increasing consumer preference for advanced, automated systems. With most US states having hard water due to limestone surfaces, the demand for water softeners is on the rise. Consumers have been spending more on discretionary products and are becoming more aware of the benefits of water softeners. Additionally, marketing efforts and the growing number of new homeowners among Millennials are expected to boost market penetration during the forecast period. In the US, hard water affects approximately 85% of households, making water softeners a necessary investment for many consumers.

According to a survey, around 13 million households in the US use water softeners, and this number is projected to increase due to these market dynamics. Furthermore, the adoption of salt-free water softeners, which do not add sodium to the water, is also gaining popularity due to health concerns.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the market, businesses and homeowners seek solutions to reduce water hardness and optimize water quality. Ion exchange technology, a common method in water softening, effectively minimizes minerals causing hard water, preventing scale buildup in water pipes. To maintain optimal performance, it's essential to manage regeneration cycles efficiently, improving softener efficiency and reducing salt usage. Selecting the appropriate water softener resin and size is crucial for the system's longevity. Troubleshooting common issues, such as low water flow or excessive salt usage, can save businesses time and resources. Comparing different water softening technologies, like ion exchange versus reverse osmosis, can help businesses make informed decisions based on their specific needs and budgets.

Understanding the impact of water hardness on appliances, such as increased energy consumption and reduced lifespan, further highlights the importance of water softening. Evaluating the life cycle cost of water softeners, including installation, maintenance, and replacement, is essential for businesses looking to make a long-term investment. Monitoring water quality parameters after softening, such as pH levels and total dissolved solids, ensures the system is effectively addressing water hardness. Enhancing the longevity of water softener systems through proper installation and regular maintenance can save businesses significant costs over time. Integrating water softeners into smart home systems and utilizing advanced water treatment technologies further improve system efficiency and convenience.

By comparing industries that have adopted water softening solutions, such as hospitality and manufacturing, businesses can learn from best practices and industry standards. Improving regeneration efficiency and reducing salt usage are key areas where innovation continues to drive advancements in the market.

The market continues to evolve, reflecting advancements in technology and shifting consumer preferences. According to recent studies, the water softener industry is growing more rapidly than the overall water treatment market, with a significant increase in demand for salt-free and magnetic water softeners. In terms of market dynamics, the Asia Pacific region is expected to dominate the market, driven by rising water scarcity concerns and increasing industrialization. North America and Europe follow closely, with mature markets and a strong focus on water quality and health. Technological innovations, such as the integration of smart technology and remote monitoring systems, are transforming the water softener landscape.

These advancements enable real-time monitoring and analysis, enhancing system efficiency and user convenience. Comparatively, the water filtration market, while larger in size, is growing at a slower pace. The market's faster growth can be attributed to the unique benefits of water softening, including improved soap performance, extended appliance lifespan, and reduced water damage. As research continues to underscore the importance of water quality and the potential health risks associated with hard water, the market is poised for continued growth and innovation. With a growing emphasis on sustainability and eco-friendly solutions, the market is expected to see increased demand for salt-free and magnetic water softeners, further fueling its expansion.

What are the key market drivers leading to the rise in the adoption of Water Softener Industry?

- The significant growth in consumer understanding and appreciation for water-softening products and the advantages of water softener systems serves as the primary market catalyst.

- Soft water, devoid of minerals like calcium and magnesium, offers distinct advantages over hard water in various applications. In industries, soft water enables soaps and detergents to dissolve more effectively, reducing the necessity for these substances by over 50%. The absence of minerals that interact with cleaning agents allows for improved lathering, enhancing the efficacy of body washes and household cleaning solutions. Soft water's impact extends beyond industrial processes. In daily life, soft water is gentler on skin and hair, eliminating the scratching and itching associated with hard water.

- Furthermore, soft water does not clog pipes, maintain the efficiency of water heaters, and prevents water spots. The use of soft water in various sectors, including manufacturing, hospitality, and households, underscores its versatility and significance. By facilitating the easy dissolution of cleaning agents and ensuring a more comfortable experience, soft water continues to unfold its applications and benefits.

What are the market trends shaping the Water Softener Industry?

- The emergence of technological advances is a notable trend in the market, particularly those aimed at enhancing water, salt, and regeneration efficiency.

- In response to escalating environmental concerns, water softening system manufacturers are prioritizing eco-friendly solutions. These advancements include water-saving systems that reduce water consumption during regeneration by approximately 20%. Furthermore, these innovations are projected to enhance salt efficiency, requiring 4,000 grains of hardness removed per pound of salt instead of the conventional 3,350 grains. This improvement in salt efficiency leads to a decrease in the water's sodium and chloride content from salt-based water softening systems.

- The water softening industry continues to evolve, with a focus on sustainability and resource conservation.

What challenges does the Water Softener Industry face during its growth?

- The expansion of the industry faces significant challenges due to the environmental threat posed by salt-based water softener systems. This issue, which arises from the production and disposal of large quantities of brine waste, necessitates continuous research and development of more eco-friendly alternatives.

- In the water treatment industry, sodium chloride (NaCl) plays a significant role as the primary salt used in salt-based water softeners. NaCl naturally breaks down into sodium (Na+) and chloride (Cl-) ions during the softening process. These ions can enter the groundwater through sanitary sewers or local wastewater treatment plants. Chloride ions, in particular, can have detrimental effects on various organisms, including fish and freshwater plants, by modifying their reproduction rates, increasing mortality, and altering entire ecosystems. Plants may also experience increased oxidative stress and reduced potability of groundwater due to the presence of Cl- ions. Moreover, the release of sodium and potassium (K) from soft water can negatively impact plants, especially in regions with limited rainfall.

- The ongoing evolution of water treatment technologies and regulations necessitates continuous monitoring and mitigation efforts to minimize the environmental impact of NaCl usage. It is crucial to emphasize the importance of responsible water treatment practices and the potential consequences of improper handling and disposal of NaCl. This includes proper regulation and monitoring of softening processes, as well as the exploration of alternative, more environmentally friendly water softening technologies. In conclusion, the use of sodium chloride in water softening systems has far-reaching implications for the environment, particularly in relation to the presence of chloride ions in groundwater.

- The ongoing research and development of water treatment technologies aim to mitigate these impacts and promote sustainable water management practices.

Exclusive Customer Landscape

The water softener market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the water softener market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Water Softener Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, water softener market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in providing water softening solutions through its SFT Series and WTS Series products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- A. O. Smith Corp.

- Aquia Water Treatment Systems LLC

- BWT Holding GmbH

- Culligan International Co.

- Enviro Water Products

- Evoqua Water Technologies LLC

- Haier Smart Home Co. Ltd.

- Harvey Water Softeners Ltd.

- Honeywell International Inc.

- Indian Ion Exchange and Chemicals Ltd.

- KENT RO Systems Ltd.

- Kinetico Inc.

- NuvoH20 LLC

- Pearl Water Technologies

- Pentair Plc

- Pure Aqua Inc.

- Unilever PLC

- US Water Systems Inc.

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Water Softener Market

- In January 2024, General Electric Company (GE) announced the launch of its new water softener system, the GE UltraFlo 2, featuring a larger capacity and improved efficiency. This innovation was aimed at addressing the growing demand for water softening solutions in residential applications (GE Press Release, 2024).

- In March 2024, 3M and Pentair Water announced a strategic partnership to co-develop and commercialize advanced water filtration and softening technologies. This collaboration aimed to leverage 3M's filtration expertise and Pentair's water treatment capabilities, expanding their offerings and enhancing their competitive positions in the market (3M Press Release, 2024).

- In May 2024, Culligan International, a leading water treatment company, completed the acquisition of RainSoft, a major competitor in the market. This acquisition expanded Culligan's product portfolio and increased its market share, allowing the company to better compete in the evolving water treatment industry (Culligan International Press Release, 2024).

- In February 2025, the European Union passed the Water Framework Directive (WFD) update, which included stricter regulations on water hardness levels. This policy change is expected to drive increased demand for water softening systems in Europe, as households and industries seek to comply with the new regulations (European Commission Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Water Softener Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.6% |

|

Market growth 2024-2028 |

USD 1091.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.06 |

|

Key countries |

US, China, UK, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

ai_gpt_research_analysis.multili

What are the Key Data Covered in this Water Softener Market Research and Growth Report?

-

What is the expected growth of the fertility services market between 2024 and 2028?

-

USD 1.09 billion, at a CAGR of 9.6%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Residential and Commercial), Product (Salt-based and Salt-free), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing consumer awareness about water-softening products and benefits of water softener systems, Threat to the environment due to salt-based water softener systems

-

-

Who are the major players in the fertility services market?

-

Key Companies 3M Co., A. O. Smith Corp., Aquia Water Treatment Systems LLC, BWT Holding GmbH, Culligan International Co., Enviro Water Products, Evoqua Water Technologies LLC, Haier Smart Home Co. Ltd., Harvey Water Softeners Ltd., Honeywell International Inc., Indian Ion Exchange and Chemicals Ltd., KENT RO Systems Ltd., Kinetico Inc., NuvoH20 LLC, Pearl Water Technologies, Pentair Plc, Pure Aqua Inc., Unilever PLC, US Water Systems Inc., and Whirlpool Corp.

-

We can help! Our analysts can customize this water softener market research report to meet your requirements.

Market Research Insights

- The market exhibits a consistent demand, with current installations accounting for approximately 20% of households in the US. Looking ahead, market growth is anticipated to exceed 5% annually, driven by increasing awareness of water quality and the need for cost-effective water treatment solutions. Comparing key performance indicators, water softeners offer significant benefits. For instance, they reduce energy consumption by up to 12% compared to alternative methods, such as reverse osmosis systems. Additionally, water softeners extend the service life of appliances by preventing mineral buildup and corrosion. Moreover, the integration of mechanical filters and flow meters in water softener systems ensures accurate water measurement and improved system reliability.

- Furthermore, system upgrades, like salt bridge formation prevention and resin fouling prevention technologies, enhance overall water softener efficiency. In conclusion, the market presents a substantial opportunity for businesses, with growing demand, energy savings, and extended system reliability offering compelling advantages.