Web Performance Market Size 2024-2028

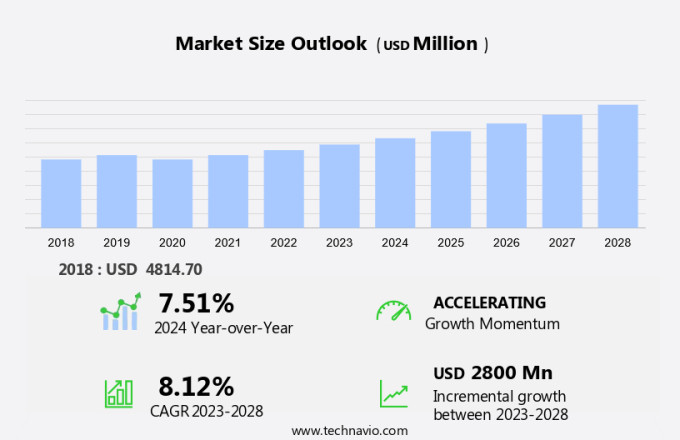

The web performance market size is forecast to increase by USD 2.8 billion, at a CAGR of 8.12% between 2023 and 2028. The market is experiencing significant growth, driven by the increasing use of advanced web technologies and the expanding Internet user base. Key trends include the demand for mobile web performance solutions due to the rise in mobile internet usage, as well as the integration of security services such as Web Application Firewall as a Service (WAFaaS) and multi-factor authentication to enhance security. Sectors like media and entertainment, healthcare, transportation, logistics and manufacturing are major contributors to the market's growth, as they rely heavily on web applications for business operations. However, high deployment costs and the increasing number of cyber attacks pose challenges to market growth. The need for faster web performance and security measures is becoming crucial for businesses to maintain a competitive edge and provide a seamless user experience.

Market Analysis

The market is experiencing significant growth due to the increasing reliance on the Internet for business operations and consumer engagement. The e-commerce industry, in particular, is driving the demand for improved web performance as online sales continue to stream. Content Delivery Networks (CDNs) play a crucial role in delivering content quickly and efficiently, especially for large media files such as images. IT and telecom sectors are also investing heavily in web performance to enhance user experience. E-commerce sites, media and entertainment, healthcare, logistics and transportation, and the SME sector are some of the key industries leveraging web performance technologies.

Moreover, mobile devices have further complicated the digital landscape, necessitating optimization for various screen sizes and mobile-specific protocols like Transmission Control Protocol (TCP) and Hypertext Transfer Protocol (HTTP). Search engine optimization, user experience, and privacy laws are critical factors influencing web performance. Tools like SolarWinds and AppDynamics help monitor and optimize web performance, while Hypertext Markup Language (HTML) and HTTP/2 enable faster content delivery. Mobile penetration continues to rise, making it essential for businesses to prioritize web performance to cater to the growing mobile user base.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On premise

- Cloud

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- Middle East and Africa

- South America

- North America

By Deployment Insights

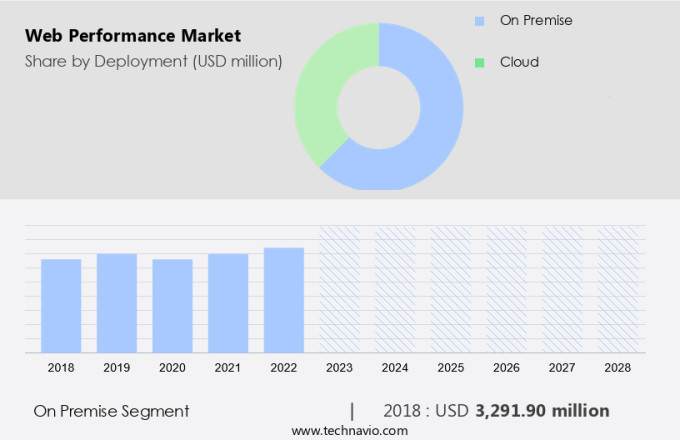

The on premise segment is estimated to witness significant growth during the forecast period. The market witnessed significant growth in 2023, with on-premises solutions holding the largest market share. This model necessitates substantial investments for product purchases, installation, maintenance, and upgrades. Additionally, organizations must hire and train an in-house IT workforce to support users, which can be costly for small and medium-sized enterprises (SMEs). Despite the expense, large enterprises, primarily those dealing with sensitive data, prefer the on-premises model due to its enhanced security features. This model ensures end-to-end quality control and eliminates third-party involvement, making it a popular choice for organizations concerned with data security. In the dynamic digital landscape of the e-commerce industry, web performance solutions, such as those offered by SEMrush and application delivery controllers, play a crucial role in ensuring optimal website performance on both desktop and mobile devices.

Security breaches can lead to significant financial losses and reputational damage, making the need for reliable web performance solutions more pressing than ever.

Get a glance at the market share of various segments Request Free Sample

The on-premise segment was valued at USD 3.29 billion in 2018 and showed a gradual increase during the forecast period.

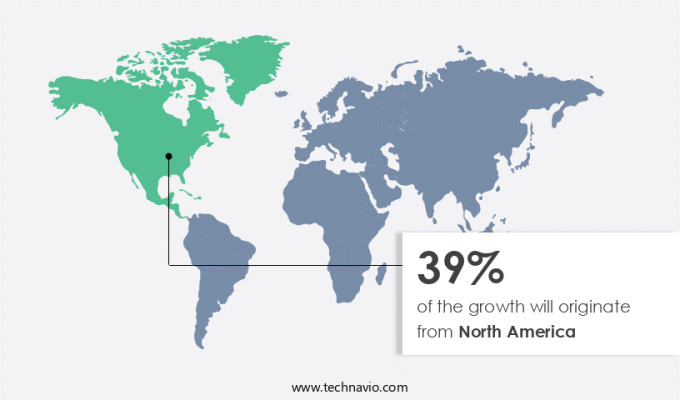

Regional Insights

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the dynamic digital landscape of North America, particularly in the US, the e-commerce industry is experiencing significant growth. This expansion is driven by several factors, including the increasing number of cybersecurity breaches and the transition from traditional IT systems to cloud-based services. As more businesses move online and rely on web applications, the need for reliable web performance solutions becomes increasingly crucial. Application delivery controllers (ADCs) from companies like SEMrush are essential components in ensuring optimal web performance and security. The growing number of IT firms and start-ups in the region is also fueling the demand for these solutions.

Moreover, government initiatives and regulations on cybersecurity are further expected to boost market growth in the future. The use of mobile devices for online shopping and browsing is another significant trend, making web performance solutions an indispensable part of the digital ecosystem.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rising number of cyber attacks is the key driver of the market. The e-commerce industry and IT and telecom sectors are increasingly relying on content delivery networks (CDNs) to ensure optimal web performance and deliver high-quality user experiences. With the proliferation of images and rich media content, the need for efficient content delivery has become more critical than ever. According to recent studies, the use of CDNs can significantly improve website loading times and enhance user engagement.

Further, SolarWinds and appdynamics are among the leading providers of web performance solutions, offering real-time performance monitoring and analytics. TotalRetail and Google Lighthouse Score are other notable tools that help businesses assess and improve their website performance. As cybersecurity threats continue to evolve, SMEs must prioritize web performance to safeguard their digital assets and maintain customer trust.

Market Trends

Demand for mobile web performance solutions is the upcoming trend in the market. In today's digital age, the growing number of mobile Internet users necessitates swift and efficient web performance. With the expansion of various networks such as 5G, LTE, 3G, and 2G, more individuals can access the web at affordable costs. This trend is particularly significant in the E-Commerce Industry, where quick loading times are essential for customer satisfaction. Content Delivery Networks (CDNs) have emerged as a popular solution for enhancing web performance. These networks distribute content to users from servers located in their geographic regions, reducing latency and improving load times. SolarWinds, AppDynamics, and Google Lighthouse Score are among the tools used by IT and Telecom companies and SMEs to assess web performance and optimize their online presence.

Moreover, the total retail and other industry reports indicate that web performance significantly impacts user experience and sales conversions. As a result, businesses are investing in web performance solutions to meet the increasing demands of mobile users. For instance, Google's Lighthouse Score is a free tool that provides valuable insights into web performance and suggests improvements. By focusing on web performance, companies can deliver a seamless user experience and maintain a competitive edge in the market.

Market Challenge

High deployment costs is a key challenge affecting the market growth. The E-Commerce Industry and IT and Telecom sectors are increasingly relying on content delivery networks (CDNs) to enhance web performance and provide faster load times for images and other media. However, the adoption of CDNs and other web performance solutions comes with significant expenses. The total cost of implementation includes software licensing fees, system design and customization, training, and ongoing maintenance. Hiring dedicated IT personnel to manage the solution adds to the financial burden.

Moreover, understanding the intricacies of web performance solutions necessitates continuous learning and skill development, resulting in additional, often hidden, costs. Companies, particularly SMEs, may find it challenging to absorb these expenses. Tools like SolarWinds, AppDynamics, TotalRetail, and Google Lighthouse Score can help optimize web performance, but their integration and usage require expertise and resources.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Akamai Technologies Inc. - The company offers web performance solutions to boost performance and UX by enabling developers to build web applications closer to end-users.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AT and T Inc.

- Broadcom Inc.

- Cavisson Systems Inc.

- CDNetworks Inc.

- Cisco Systems Inc.

- Cloudflare Inc.

- DigitalOcean Holdings Inc.

- DreamHost LLC

- Dynatrace Inc.

- Equinix Inc.

- F5 Inc.

- International Business Machines Corp.

- New Relic Inc.

- Nippon Telegraph and Telephone Corp.

- Open Text Corporation

- Radware Ltd.

- SolarWinds Corp.

- TransUnion

- WPEngine Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

In today's digital landscape, web performance plays a crucial role in the success of businesses, particularly in the e-commerce industry. With the increasing usage of mobile devices and the internet, delivering high-quality, fast, and secure digital experiences is essential for customer engagement, conversion rates, and online presence. Web performance solutions, such as Content Delivery Networks (CDNs), Application Delivery Controllers (ADCs), and edge cloud platforms, have emerged as essential components of the digital infrastructure. CDNs help improve website performance by caching and delivering content from servers located closer to end-users, reducing latency and enhancing user experience. In the e-commerce sector, this translates into faster loading times for product images and web pages, leading to increased customer satisfaction and sales.

Moreover, web performance is also critical for industries like media and entertainment, healthcare, logistics and transportation, manufacturing, and IT and telecom. Security breaches and cyber threats pose significant risks, necessitating solutions that ensure data integrity and privacy, such as multi-factor authentication and WAFaaS. Web technologies, like Transmission Control Protocol (TCP), Hypertext Transfer Protocol (HTTP), and Hypertext Markup Language (HTML), also play a role in web performance. The e-commerce industry, in particular, benefits from optimizing Google Lighthouse score, Semrush analysis, and industry benchmarks to improve user experience and search engine rankings. Moreover, the digital landscape is evolving, with cloud deployment models like community and public cloud and on-premises solutions offering businesses flexibility and scalability. Internet usage and mobile penetration continue to grow, making web performance a top priority for businesses across industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.12% |

|

Market Growth 2024-2028 |

USD 2.80 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.51 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 39% |

|

Key countries |

US, Germany, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Akamai Technologies Inc., AT and T Inc., Broadcom Inc., Cavisson Systems Inc., CDNetworks Inc., Cisco Systems Inc., Cloudflare Inc., DigitalOcean Holdings Inc., DreamHost LLC, Dynatrace Inc., Equinix Inc., F5 Inc., International Business Machines Corp., New Relic Inc., Nippon Telegraph and Telephone Corp., Open Text Corporation, Radware Ltd., SolarWinds Corp., TransUnion, and WPEngine Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch