Welding Power Supply Market Size 2024-2028

The welding power supply market size is forecast to increase by USD 2.99 billion, at a CAGR of 6.6% between 2023 and 2028.

- The market is driven by the increasing adoption of energy-efficient inverter-based welding power supplies, which offer improved power efficiency and reduced energy consumption. This trend is particularly prominent in industries with high welding requirements, such as automotive and construction. Another key driver is the growing utilization of magnesium alloys in the automotive industry, which necessitates the use of specialized welding power supplies capable of handling the unique properties of magnesium. However, the market also faces intense competition, with numerous players vying for market share. Companies must differentiate themselves through product innovation, cost competitiveness, and customer service to gain a competitive edge.

- Additionally, regulatory compliance and safety standards pose challenges, requiring continuous investment in research and development to ensure products meet evolving industry requirements. To capitalize on market opportunities and navigate challenges effectively, companies should focus on developing energy-efficient, cost-effective, and versatile welding power supplies that cater to the diverse needs of various industries.

What will be the Size of the Welding Power Supply Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution and dynamic nature, driven by advancements in technology and the diverse applications across various sectors. Solid wire and flux-cored wire continue to dominate the welding process landscape, with pulse welding and arc welding being key techniques. The welding gun, control panel, and welding feeder are essential components of the welding power source, ensuring optimal performance and safety. Heavy equipment manufacturing and pipeline construction rely heavily on welding for production and maintenance. Weld bead quality and strength are paramount in these industries, with welding automation and non-destructive testing playing crucial roles in ensuring consistency and reliability.

Repair and maintenance applications also benefit from the versatility of welding, with resistance welding and synergic welding being popular methods. Projection welding and welding clamping techniques are used in various industries, including automotive manufacturing and aerospace, to create precise and strong welds. Energy industry applications require specialized welding processes, such as DC power supply and helium gas welding, for their unique demands. Weld inspection, certification, and safety standards are essential in maintaining the integrity of welded structures and ensuring the highest quality. Welding processes, including welding torch and helmet technology, continue to advance, with weld penetration, seam tracking, and welding apparel innovations enhancing productivity and safety.

The market's ongoing unfolding is shaped by the interplay of various factors, including weld fatigue, welding process control, and energy efficiency. Mixed gases and their applications in welding further expand the market's scope and complexity.

How is this Welding Power Supply Industry segmented?

The welding power supply industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Automotive

- Construction

- Shipbuilding

- Aerospace and defense

- Others

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

.

By End-user Insights

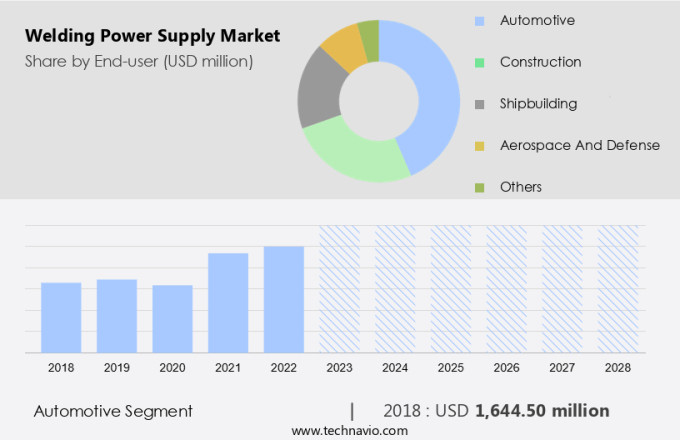

The automotive segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the increasing demand from various industries, particularly automotive manufacturing and aerospace. The automotive industry's focus on producing lighter, stronger, and fuel-efficient vehicles using advanced materials has led to the adoption of efficient welding techniques for producing lighter weld joints. The automotive segment is expected to dominate the market during the forecast period. The aerospace industry also contributes to the market's growth due to the high demand for lightweight and durable components in aircraft manufacturing. Advancements in welding technologies, such as synergic welding, pulse welding, and resistance welding, have improved weld penetration and seam tracking, ensuring higher weld strength and quality.

The energy industry also utilizes welding power supplies for pipeline construction and repair and maintenance. Welding safety is a significant concern in the industry, leading to the development of welding safety standards and the use of welding apparel, gloves, and helmets. Non-destructive testing techniques, such as ultrasonic testing and radiographic testing, are employed to ensure weld quality and detect weld defects, including weld fatigue and distortion. The market also includes the use of various gases, such as argon, helium, and carbon dioxide, in welding processes. Welding automation and the integration of welding power supplies with control panels, wire feeders, and welding guns have streamlined the manufacturing process and increased productivity.

In the automotive industry, spot welding and projection welding are widely used for assembling various components. The market is expected to continue its growth trajectory due to the increasing demand from various industries and the continuous advancements in welding technologies.

The Automotive segment was valued at USD 1.64 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

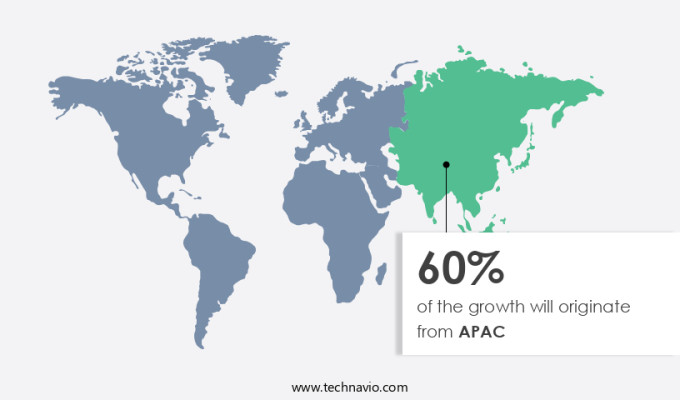

APAC is estimated to contribute 60% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in the Asia Pacific (APAC) region. APAC is anticipated to be the largest market and is expected to expand at a notable rate from 2023 to 2028. The expansion of end-user industries such as automotive manufacturing, construction, and power in APAC is driving the demand for welding equipment. In addition, several government and public-private partnership (PPP) projects aimed at infrastructure development in the region, like the Philippines' planned investment of over USD400 billion, further boost the market. Welding processes such as solid wire, flux-cored wire, pulse welding, and synergic welding are integral to various industries.

Automotive manufacturing relies on resistance welding and arc welding for vehicle production. Aerospace manufacturing utilizes welding techniques for aircraft assembly, while the energy industry employs welding for pipeline construction and power generation. Welding safety is a crucial aspect of the market, with safety standards and certifications ensuring the quality and durability of welds. Welding processes like arc welding, MIG, TIG, and spot welding require protective equipment, including welding gloves, helmets, and torches. Ultrasonic testing (UT), radiographic testing (RT), and visual inspection are essential for weld quality control. The market encompasses various components, including welding control panels, wire feeders, power sources, and welding cables.

Helium gas, argon gas, and carbon dioxide (CO2) are commonly used welding gases. Tungsten electrodes are utilized in TIG welding, while mixed gases are employed in MIG welding. Welding automation and welding apparel are emerging trends in the market. Welding automation enhances productivity and reduces labor costs, while welding apparel ensures the safety and comfort of welders. Weld distortion, weld fatigue, and weld strength are essential considerations in welding process control. The market also caters to repair and maintenance, projection welding, and heavy equipment manufacturing. The market's growth is influenced by factors like increasing industrialization, urbanization, and infrastructure development.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Welding Power Supply Industry?

- Inverter-based welding power supplies are a significant market driver due to their energy efficiency advantages.

- Inverter-based welding power supplies offer several advantages over traditional transformer-style power sources. While transformer-style power sources are larger and draw a substantial amount of power, inverter-based power supplies have a lower power draw and greater flexibility. For instance, a 350-amp conventional TIG power source consumes 128 amps of input power under a rated load of 230-volt single-phase power. In contrast, a comparable TIG inverter only draws 32 amps. This difference enables companies to add more welding machines and workstations without expanding or building in additional power infrastructure. Welding safety standards are essential in various industries, including the energy sector.

- Welding processes such as TIG and MIG require welding gases like argon and carbon dioxide (CO2). Weld fatigue, a critical issue in welding, can be mitigated through non-destructive testing (NDT) techniques like radiographic testing (RT) and welding process control. Tungsten electrodes are commonly used in TIG welding, while CO2 is often used as a shielding gas in MIG welding. Proper welding cable selection is crucial to ensure efficient power transfer and prevent potential hazards. Inverter-based power sources also help reduce weld distortion, ensuring better quality welds. In conclusion, the adoption of inverter-based welding power supplies offers several benefits, including lower power consumption, flexibility, and improved weld quality.

- Welding safety standards, gas selection, and proper cable selection are essential considerations for welding processes. The energy industry relies heavily on welding and requires continuous innovation to address challenges like weld fatigue and distortion.

What are the market trends shaping the Welding Power Supply Industry?

- The use of magnesium alloys is becoming increasingly popular in the automotive welding industry, representing a significant market trend. This material's adoption offers several advantages, including lightweight properties and enhanced fuel efficiency, making it an attractive option for automakers.

- The market is experiencing significant growth due to the increasing demand for visual inspection technologies in various industries, such as heavy equipment manufacturing and pipeline construction. The use of advanced welding equipment, including welding torches and helmets, enables precise and efficient welding processes, ensuring the highest weld strength and quality. Welding automation is another key trend driving market growth, as it increases productivity and reduces labor costs. Technologies like projection welding and resistance welding, which utilize ac power supplies and mixed gases, are gaining popularity due to their ability to produce strong welds with minimal distortion.

- In the realm of repair and maintenance, welding plays a crucial role in extending the life cycle of equipment and infrastructure. The need for efficient and cost-effective welding solutions is driving innovation in the market, with a focus on developing more robust and immersive welding processes that are harmonious with different materials and applications. Magnesium alloys, which are lighter than steel and aluminum, are increasingly being used in industrial applications, particularly in the automotive industry, due to their potential to significantly reduce vehicle weight and improve energy efficiency. The development of magnesium alloys for welding purposes is a promising area of research, as it could lead to even greater weight reductions and improved weld strength.

- In conclusion, the market is poised for continued growth due to the increasing demand for advanced welding technologies in various industries, as well as the ongoing research and development efforts aimed at improving the efficiency, strength, and versatility of welding processes.

What challenges does the Welding Power Supply Industry face during its growth?

- The intense competition prevalent in the industry poses a significant challenge to its growth.

- The market experiences intense competition among various companies, with major players like COLFAX and Fronius holding a significant market share. Companies are focusing on innovation to maintain their position, as new entrants emerge, driven by cost-conscious end-users in industries such as automotive manufacturing and welding training. In this market, solid wire and flux-cored wire continue to dominate, with applications in arc welding and pulse welding.

- The welding control panel, welding wire feeder, welding gun, and welding power source are essential components. Safety measures, including welding gloves and ultrasonic testing (UT), are crucial in this industry. Despite the competitive landscape, the market growth remains steady, driven by the increasing demand for efficient and cost-effective welding solutions.

Exclusive Customer Landscape

The welding power supply market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the welding power supply market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, welding power supply market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ador Welding Ltd. - The company provides an advanced iQ auto plus ultrasonic generator welding power supply, catering to the demands of the automotive, aerospace, packaging, and textile industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ador Welding Ltd.

- AXXAIR

- Dukane IAS LLC

- Enovis Corp.

- Fronius International GmbH

- GALA GAR SL

- HBS Bolzenschweiss Systeme GmbH and Co. KG

- Illinois Tool Works Inc.

- Jasic Technology Co., Ltd.

- Kemppi Oy

- KUHTREIBER Ltd.

- MTM Power Messtechnik Mellenbach GmbH

- Orbitec GmbH

- Panasonic Holdings Corp.

- Rinco Ultrasonics AG

- Telwin Spa

- The Lincoln Electric Co.

- Weber Ultrasonics AG

- XP Power

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Welding Power Supply Market

- In February 2024, Esab, a leading global manufacturer of welding and cutting equipment, introduced its new Gen4 TIG (Tungsten Inert Gas) welding power supply, the CyroFlex 350i. This innovative product offers increased power density and improved arc stability, setting a new standard in the welding industry (Esab Press Release, 2024).

- In May 2024, Linde plc, a world-class gases and engineering company, announced a strategic partnership with Fronius, an Austrian manufacturer of welding technology. This collaboration aims to develop advanced welding solutions that integrate Linde's gases with Fronius' power sources, enhancing productivity and efficiency for their customers (Linde Press Release, 2024).

Research Analyst Overview

- The market is characterized by ongoing efforts to optimize welding processes and minimize defects. Protective gases, such as shielding gases and welding gases, play a crucial role in this regard, shielding the weld zone from atmospheric contaminants during various welding processes like TIG welding, MIG welding, and Flux-cored arc welding. Incomplete fusion, a common welding defect, can be mitigated through process optimization and the use of appropriate filler metals and welding consumables. Output current, duty cycle, and electrode classification are essential factors in selecting the right welding power supply for specific applications. Weldability testing is another critical aspect of the market, ensuring the quality of welded joints and identifying potential issues such as slag inclusion and welding defects.

- Plasma cutting and waterjet cutting are alternative processes that offer advantages in certain applications, while welding automation software streamlines production and enhances efficiency. Welding metallurgy continues to evolve, with advancements in welding processes and the development of new alloys and filler metals. Pulsed MIG welding, for instance, offers improved weld quality and reduced spatter. Shielding gases and welding consumables are continually being refined to cater to the evolving needs of the industry. Overall, the market is dynamic, with a focus on innovation, efficiency, and quality.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Welding Power Supply Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market growth 2024-2028 |

USD 2993.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.0 |

|

Key countries |

China, US, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Welding Power Supply Market Research and Growth Report?

- CAGR of the Welding Power Supply industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the welding power supply market growth of industry companies

We can help! Our analysts can customize this welding power supply market research report to meet your requirements.