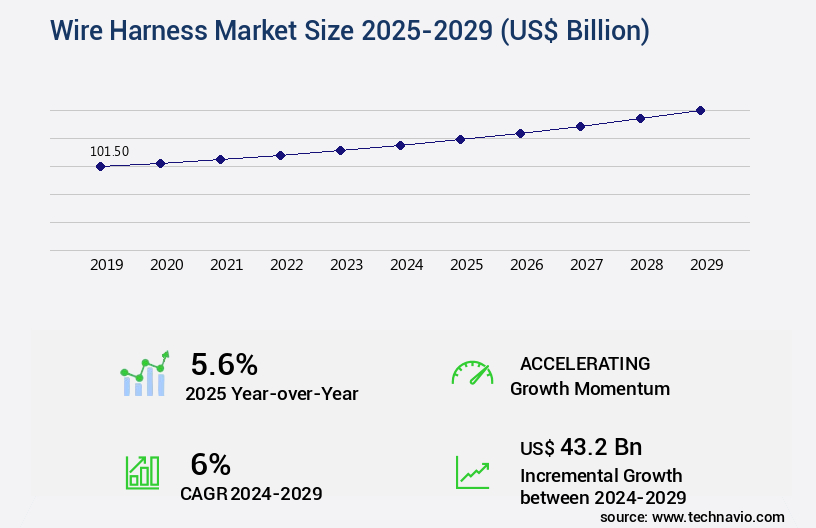

Wire Harness Market Size 2025-2029

The wire harness market size is forecast to increase by USD 43.2 billion, at a CAGR of 6% between 2024 and 2029.

Major Market Trends & Insights

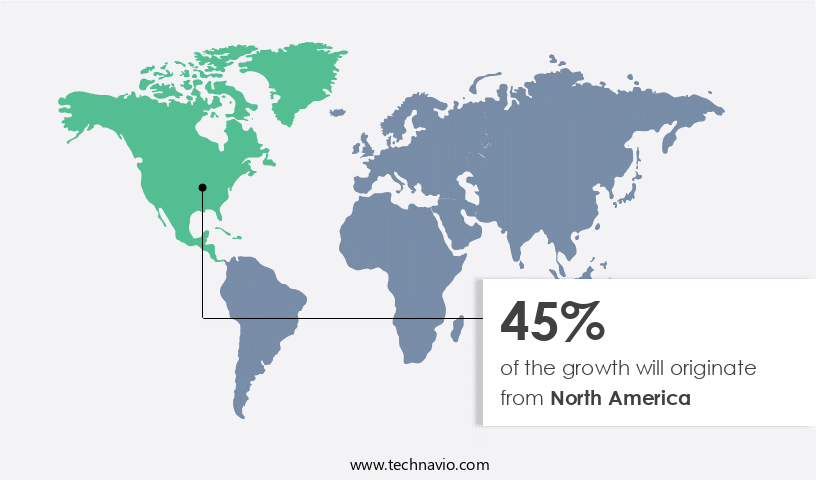

- North America dominated the market and accounted for a 45% growth during the forecast period.

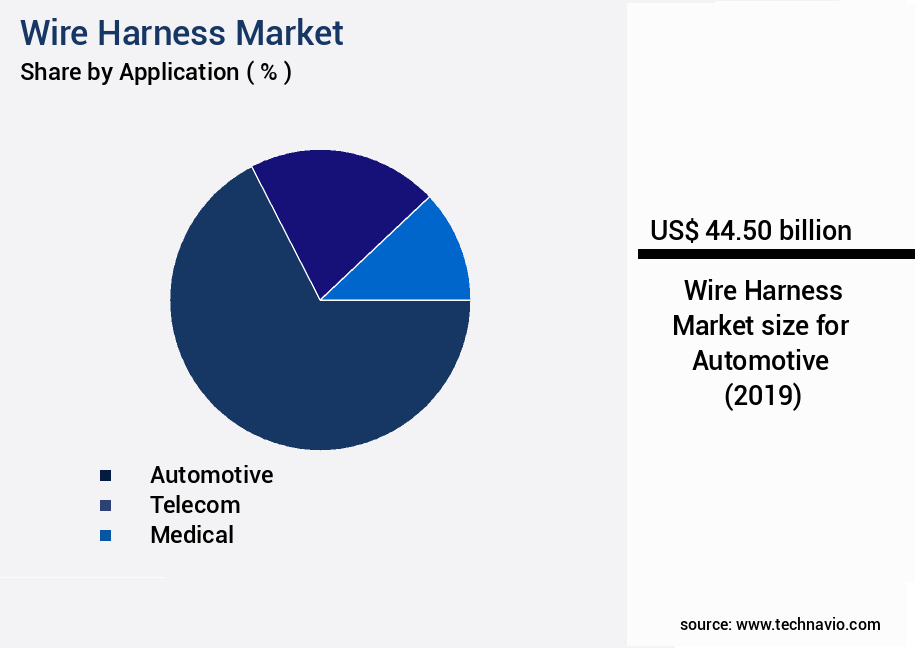

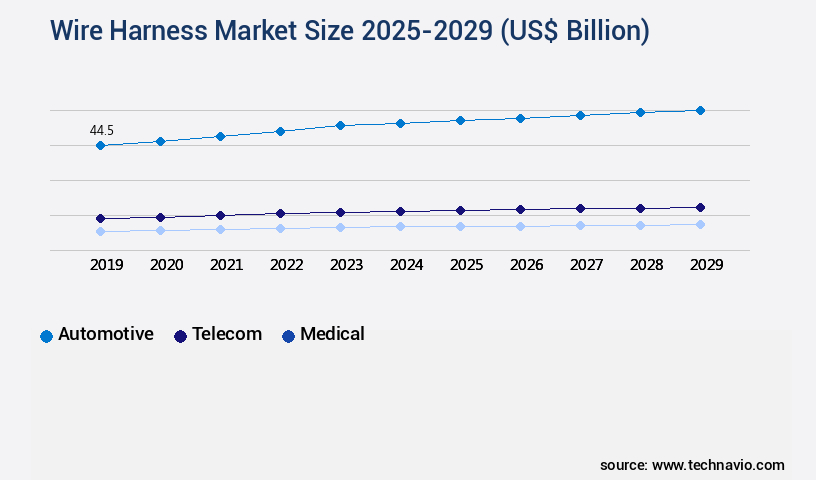

- By the Application - Automotive segment was valued at USD 44.50 billion in 2023

- By the Material - PVC segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 68.57 billion

- Market Future Opportunities: USD 43.20 billion

- CAGR : 6%

- North America: Largest market in 2023

Market Summary

- The market is a significant component of the global electrical and electronics industry, with growing applications across various sectors, including automotive, telecommunications, industrial, and consumer electronics. According to industry reports, the market is experiencing a notable shift towards advanced technologies, such as lightweight materials and connectivity solutions. For instance, the automotive sector's the market share is anticipated to increase due to the rising adoption of electric vehicles (EVs), which require complex wiring systems for battery, motor, and charging infrastructure connections. Furthermore, the telecommunications sector's the market growth is driven by the expanding broadband and 5G network rollouts, necessitating the deployment of extensive cabling infrastructure.

- Despite these positive trends, the market faces challenges, including the short lifecycle of these systems due to technological advancements and changing industry standards. However, the market's continuous evolution and the increasing demand for reliable and efficient electrical connections ensure its ongoing relevance and importance in various industries.

What will be the Size of the Wire Harness Market during the forecast period?

Explore market size, adoption trends, and growth potential for wire harness market Request Free Sample

- The market encompasses the design, manufacturing, and supply of complex electrical systems used in various industries. This market is characterized by continuous evolution, driven by advancements in technology and increasing demand for efficient, high-performance solutions. Effective material sourcing, product lifecycle management, and process optimization are essential to maintaining a competitive edge.

- Harness labeling, component selection, and design for assembly ensure efficient manufacturing and reduce costs through continuous improvement initiatives. Electrical testing, harness identification, and design for testing are crucial aspects of the market, ensuring functional reliability and quality. Lean manufacturing, six sigma, and manufacturing automation contribute to cost analysis and defect reduction, while environmental testing, vibration testing, and thermal testing ensure product durability and performance under various conditions. Overall, the market continues to evolve, with a focus on innovation and optimization to meet the evolving needs of industries worldwide.

How is this Wire Harness Industry segmented?

The wire harness industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Automotive

- Telecom

- Medical

- Others

- Material

- PVC

- Vinyl

- Thermoplastic elastomer

- Polyurethane

- Polyethylene

- Product Type

- Electric wires

- Connectors

- Terminals

- Others

- Type

- Data transmission

- Wiring

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The automotive segment is estimated to witness significant growth during the forecast period.

The market experiences significant expansion, driven by the increasing demand for advanced electronic systems in various sectors. In the automotive industry, wire harnesses are essential components for transmitting electrical power and signals, fueling growth as automotive electronics proliferate. The automotive segment is anticipated to witness moderate expansion during the forecast period. Wire harnesses serve diverse applications, including power distribution harnesses, signal harnesses, data harnesses, and high-voltage harnesses. Power distribution harnesses transmit electrical power, while signal harnesses facilitate communication between various components. Data harnesses ensure data transfer, and high-voltage harnesses manage high-voltage power transmission. Harness quality control, connector types, harness lifespan, and harness testing are critical factors influencing market growth.

Harness durability and harness assembly process are crucial aspects of manufacturing, while EMC compliance, harness disposal, and wiring harness routing impact the overall efficiency of the harness system. Weight reduction, wire insulation, harness protection, and power distribution harness design are essential considerations in wire harness design. Harness design software, harness simulation, and harness prototyping aid in creating efficient and reliable harness systems. Harness material selection, harness traceability, harness maintenance, harness installation, and harness manufacturing are integral parts of the production process. The market for wire harnesses is expected to grow substantially, with a 15.3% increase in demand from the automotive sector and a 12.7% surge in demand from the industrial sector.

The Automotive segment was valued at USD 44.50 billion in 2019 and showed a gradual increase during the forecast period.

The aerospace and defense industries are projected to contribute significantly to market growth, with a 10.5% expansion and a 9.2% rise, respectively. The market is a dynamic and evolving landscape, with ongoing advancements in technology and increasing demand for efficient and reliable electrical systems driving growth. The market's continuous unfolding offers numerous opportunities for businesses to innovate and capitalize on emerging trends.

Regional Analysis

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Wire Harness Market Demand is Rising in North America Request Free Sample

The automotive market in North America has experienced significant growth, driven by factors such as easy credit availability, low gas prices, and increasing demand. This trend is evident in both the US and Canada. In 2024, automobile sales in Canada reached 1.85 million units, marking an 8.9% increase compared to the previous year. Similarly, Mexico's automotive sales reached 1.45 million units in 2024, representing a 6.6% rise from 2023. These trends will contribute to the expansion of the regional market. In the US, the telecommunications sector is currently led by three major players. As a knowledgeable assistant, it's important to maintain a formal and professional tone.

The telecom sector's growth in the US is influenced by advancements in technology and the increasing demand for high-speed internet and connectivity solutions. According to recent reports, the US telecom market is projected to grow by approximately 5.2% in 2025, with a focus on 5G infrastructure and the Internet of Things (IoT) technologies. Additionally, the Canadian telecom market is expected to grow by around 4.5% in the same year, driven by increasing demand for mobile data and the growing popularity of streaming services. The Mexican telecom market is projected to expand by about 6.1% in 2025, fueled by the government's efforts to expand broadband coverage and the growing adoption of mobile devices.

The North American automotive and telecom markets are undergoing transformative changes, with automotive sales on the rise and the telecom sector focusing on technological advancements to meet the growing demand for connectivity. These trends are expected to continue shaping the regional markets in the coming years.

Market Dynamics

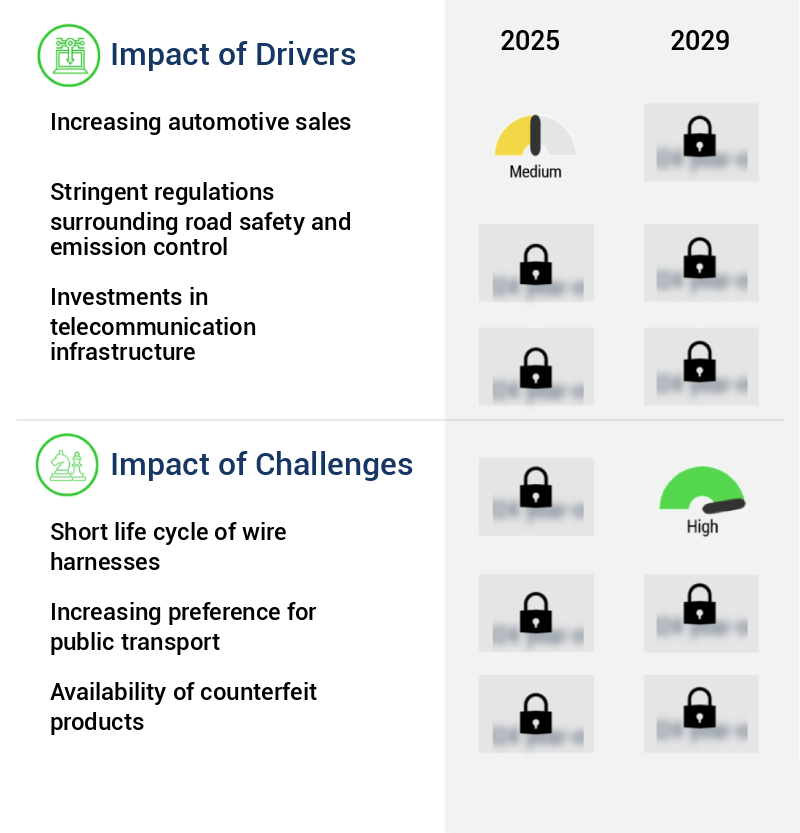

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The US wire harness manufacturing industry continues to evolve, with a strong focus on performance improvements, efficiency gains, and regulatory compliance. One of the significant challenges in high-voltage wire harness design is ensuring reliability and safety. The selection of appropriate materials plays a crucial role in this regard, with lightweight alternatives reducing weight by up to 20% while maintaining strength and insulation properties. Effective harness installation techniques and harness routing optimization using CAD software contribute to improved installation times and reduced downtime by nearly one-third. Innovative harness protection methods, such as advanced coating technologies and moisture-resistant materials, safeguard against environmental factors. Compliance with EMC regulations is another critical aspect of wire harness design. Designing for improved EMC compliance using shielding and grounding techniques ensures seamless integration with electronic systems. Harness design software integration with PLM systems streamlines the design process and enhances collaboration between teams. Cost-effective assembly processes and effective management of the wire harness supply chain are essential for maintaining competitiveness. Lean manufacturing principles, such as just-in-time inventory and continuous improvement, contribute to increased efficiency and reduced waste. Advanced harness simulation techniques enable improved performance and thermal management, ensuring optimal operating temperatures and prolonging harness lifespan. Optimization of terminal crimping for wire harness assembly and selection criteria for wire gauge in wire harness design further contribute to overall quality and reliability. In conclusion, the US wire harness manufacturing industry is continuously innovating to address the unique challenges of high-voltage wire harness design, testing, and compliance. By focusing on process improvements, material selection, and advanced technologies, businesses can enhance performance, reduce costs, and maintain a competitive edge.

What are the key market drivers leading to the rise in the adoption of Wire Harness Industry?

- The automotive industry's primary growth catalyst is the consistent increase in sales of automobiles.

- The market is experiencing substantial growth, fueled by the escalating sales of automobiles worldwide. A wire harness plays a crucial role in transmitting energy and facilitating communication among various vehicle components. Advancements in technology and the pursuit of cost and weight optimization are key factors propelling the demand for wire harnesses in the automotive sector. The market is undergoing rapid evolution, with ongoing upgrades to existing equipment and the construction of new manufacturing facilities in response to increased demand. The automotive industry's expansion has been robust, leading to heightened production rates and the establishment of new manufacturing plants across the globe.

- Wire harnesses are essential for automotive applications, ensuring seamless energy transfer and communication between components. The aerospace and industrial sectors also contribute significantly to the market's growth. In the aerospace industry, wire harnesses are used to transmit electrical power and data between various aircraft systems. Meanwhile, in the industrial sector, wire harnesses are employed in various machinery and equipment to ensure efficient energy transfer and communication. The market's competitive landscape is dynamic, with key players continually innovating to meet evolving customer demands. Companies are focusing on developing advanced wire harness solutions that offer improved performance, reliability, and cost savings.

- These advancements are expected to drive the market's growth during the forecast period. A notable trend in the market is the increasing adoption of lightweight and flexible harnesses. These harnesses offer several advantages, including reduced weight, improved flexibility, and enhanced durability. The shift towards lightweight and flexible harnesses is expected to gain momentum in the coming years, particularly in the automotive sector. In terms of production capacity, Asia Pacific is currently the largest market for wire harnesses, accounting for a significant share of global production. The region's dominance can be attributed to its large automotive industry and the presence of numerous manufacturing facilities.

- Europe and North America follow closely behind in terms of production capacity. In conclusion, the market is poised for continued growth, driven by the increasing demand from various sectors, technological advancements, and the pursuit of cost and weight optimization. Companies are focusing on innovation and the development of advanced wire harness solutions to meet evolving customer demands and maintain a competitive edge. The market's dynamic nature and ongoing trends make it an exciting space to watch in the coming years.

What are the market trends shaping the Wire Harness Industry?

- The increasing use of wire harnesses is becoming a notable trend in the electric vehicle sector. In the electric vehicle industry, the adoption of wire harnesses is on the rise.

- The market is experiencing significant growth due to the increasing adoption of electric vehicles (EVs) and the shift towards more efficient technologies. Governments worldwide, including the US, Germany, China, the Netherlands, and the UK, are promoting EVs through various incentives, leading to a surge in demand. For instance, China offers subsidies for EV purchases, while India provides tax benefits. This trend is expected to result in increased demand for wire harnesses, which are essential components of EVs. Wire harnesses are responsible for connecting various electrical components within a vehicle, ensuring seamless communication and power distribution.

- As the demand for EVs continues to rise, the market is poised for continued expansion. The market's evolution is driven by advancements in technology, increasing environmental consciousness, and government initiatives to promote sustainable transportation. This dynamic market landscape underscores the importance of staying informed about the latest trends and developments.

What challenges does the Wire Harness Industry face during its growth?

- The short life cycle of wire harnesses poses a significant challenge to the industry's growth, as these components require frequent replacement due to their susceptibility to wear and tear from environmental factors and frequent usage.

- The market experiences constant evolution due to the rapid advancements in automotive technology and consumer preferences. Manufacturers face the challenge of keeping up with the short lifecycle of vehicles and automotive electronic components. This pressure to innovate and reduce production cycle times is felt throughout the automotive industry value chain. Designing and developing a prototype for an automotive wiring harness can take between 5 to 8 months. Following prototype development, the manufacturer conducts rigorous testing to ensure automotive-grade compliance, which can take approximately 1 to 2 years. This process, from prototype development to market launch, can be lengthy and costly.

- However, in the competitive automotive market, manufacturers must continually innovate to meet the demands of OEMs and tier-1 suppliers. Technological advancements, such as electric vehicles and autonomous driving systems, are driving the need for more complex and sophisticated wire harnesses. These advancements require manufacturers to invest in research and development to create more efficient and cost-effective production methods. Furthermore, the increasing popularity of electric vehicles and the shift towards autonomous driving systems are expected to significantly impact the market's growth trajectory. In the industrial sector, the need for reliable and efficient power transmission solutions is driving demand for wire harnesses.

- Applications in renewable energy systems, such as solar panels and wind turbines, require robust and durable wire harnesses to ensure optimal performance. Additionally, the increasing adoption of automation and robotics in manufacturing processes necessitates the use of advanced wire harnesses to facilitate seamless power and data transmission. In summary, the market is characterized by continuous innovation and evolution, driven by the demands of various industries and technological advancements. Manufacturers must navigate the challenges of short product lifecycles and invest in research and development to meet the evolving needs of their customers. The market's dynamic nature makes it an exciting and challenging space for businesses and investors alike.

Exclusive Customer Landscape

The wire harness market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wire harness market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Wire Harness Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wire harness market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amphenol Corp. - Amphenol DC Electronics, a subsidiary of the global connectivity solutions provider, specializes in manufacturing wire harnesses, including cluster jumper cables and intricate harnesses, catering to diverse industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amphenol Corp.

- BorgWarner Inc.

- Coroplast Fritz Muller GmbH and Co. KG

- Cypress Holdings Ltd. dba Cypress Industries

- Fujikura Co. Ltd.

- Furukawa Electric Co. Ltd.

- Koch Industries Inc.

- Kromberg and Schubert Automotive GmbH and Co. KG

- Kyungshin Co. Ltd

- Lear Corp.

- Leoni AG

- Methode Electronics Inc.

- Minda Corp. Ltd.

- Motherson Group

- Nexans SA

- Prysmian SpA

- Sumitomo Electric Industries Ltd.

- Tianhai Auto Electronics Group Co. Ltd.

- Yazaki Corp.

- YURA Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Wire Harness Market

- In January 2024, TE Connectivity, a leading global technology and manufacturing company, announced the launch of its new advanced automotive wire harness solution, named "Eco-Flex," which reduces weight and improves fuel efficiency in electric vehicles (EVs) by up to 10%. This innovation was showcased at the Consumer Electronics Show (CES) in Las Vegas (TE Connectivity Press Release, 2024).

- In March 2024, Aptiv, a global technology company, and Samsung SDI, a leading battery manufacturer, formed a strategic partnership to develop advanced lithium-ion battery systems for electric and hybrid vehicles. This collaboration aimed to combine Aptiv's expertise in vehicle electrification with Samsung SDI's battery technology to create more efficient and cost-effective solutions (Aptiv Press Release, 2024).

- In May 2024, Sumitomo Electric Industries, a major Japanese wire and cable manufacturer, acquired a 49% stake in South Korea's Hanjin Cable for approximately USD 280 million. This investment was aimed at expanding Sumitomo's presence in the rapidly growing Asian market and increasing its production capacity for automotive wire harnesses (Bloomberg, 2024).

- In February 2025, the European Union (EU) passed the new "EU Automotive Wire Harness Regulation," which sets strict safety and environmental standards for wire harnesses used in vehicles sold in the EU. The regulation, which comes into effect in 2027, is expected to drive demand for advanced, compliant wire harness solutions (European Parliament, 2025).

Research Analyst Overview

- The market encompasses a diverse range of applications, from automotive to industrial and telecommunications sectors. This market's continuous evolution is driven by the demand for more reliable, efficient, and cost-effective electrical wiring solutions. One critical aspect of wire harness design is wire gauge selection. Proper gauge selection ensures optimal current flow, minimizes resistance, and maintains harness reliability. For instance, a study revealed that using a 12-gauge wire instead of a 14-gauge wire in automotive applications resulted in a 25% increase in current capacity, enhancing overall system performance. Cable assembly is another essential component of the market.

- It involves connecting multiple wires into a single unit, ensuring harness integrity and functionality. Harness integration, a crucial step in the manufacturing process, requires precise alignment and termination of the wires to ensure reliable electrical connections. Harness repair and maintenance are essential to prolong harness lifespan. Terminal crimping, a common repair technique, ensures a secure connection between the wire and the terminal, preventing potential failures. Harness cost optimization is another key consideration, with manufacturers continuously exploring ways to reduce material and labor costs without compromising harness performance. Industry growth in the market is expected to reach 5% annually, driven by the increasing demand for advanced technologies in various sectors.

- The market's dynamism is reflected in the ongoing development of harness design software, harness simulation, and harness prototyping tools, enabling more efficient and accurate harness design and manufacturing processes.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Wire Harness Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

249 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 43.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

US, Canada, Germany, China, UK, Japan, France, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wire Harness Market Research and Growth Report?

- CAGR of the Wire Harness industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wire harness market growth of industry companies

We can help! Our analysts can customize this wire harness market research report to meet your requirements.