Automotive Wiring Harness Market Size 2024-2028

The automotive wiring harness market size is valued to increase by USD 13.15 billion, at a CAGR of 4.83% from 2023 to 2028. Increasing penetration of automotive electronics will drive the automotive wiring harness market.

Market Insights

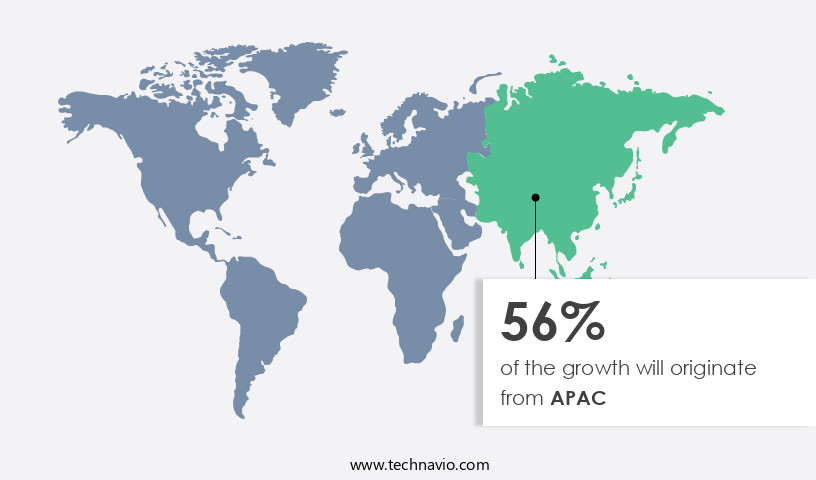

- APAC dominated the market and accounted for a 56% growth during the 2024-2028.

- By Vehicle Type - Passenger vehicles segment was valued at USD 32.67 billion in 2022

- By Application - Chassis segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 44.05 billion

- Market Future Opportunities 2023: USD 13.15 billion

- CAGR from 2023 to 2028: 4.83%

Market Summary

- The market is driven by the increasing penetration of automotive electronics, which necessitates a complex network of wiring harnesses to support various functions. These harnesses enable seamless communication between different vehicle systems, from powertrain and chassis to infotainment and safety features. Advances in autonomous vehicles represent a significant trend in the market, as these vehicles require an intricate wiring infrastructure to support an array of sensors and control units. However, the market also faces challenges, such as the declining sales of automobiles due to shifting consumer preferences towards electric vehicles and ride-hailing services. One real-world business scenario that highlights the importance of optimizing the automotive wiring harness supply chain is that of a global automaker aiming to reduce production costs while maintaining quality and compliance.

- By implementing advanced planning and optimization tools, this automaker can improve the efficiency of their wiring harness production process, ensuring that raw materials and components are procured at the right time and in the right quantities. This not only reduces waste and lowers costs but also ensures that vehicles are delivered to market on time, enhancing operational efficiency and customer satisfaction.

What will be the size of the Automotive Wiring Harness Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, with ongoing advancements in harness design and manufacturing techniques shaping the industry. Harness design validation processes ensure product reliability and compliance with regulatory standards, while harness disposal methods and repair techniques contribute to cost reduction and sustainability. Harness production planning, including component lifecycle management and electrical system integration, optimizes manufacturing processes. Wire harness architecture and design software facilitate efficient harness design and installation procedures. Quality assurance metrics and harness reliability improvements are crucial for maintaining customer satisfaction and brand reputation. Harness documentation, material selection, and performance analysis are essential elements of harness production optimization.

- Harness manufacturing equipment and testing equipment are continually evolving to enhance production automation and testing protocols. Moreover, harness routing algorithms and design tools enable connector design standards to be met, ensuring seamless electrical system integration. Harness manufacturing automation and testing protocols are essential for maintaining high-quality harnesses and reducing production time. By focusing on these areas, companies can improve their harness production processes, reduce costs, and enhance overall product quality. For instance, a leading automotive manufacturer achieved a 20% reduction in harness production time by implementing advanced harness design software and manufacturing automation technologies.

Unpacking the Automotive Wiring Harness Market Landscape

The market encompasses a critical infrastructure that ensures reliable electrical connectivity in vehicles. Thermal management solutions are essential for maintaining optimal operating temperatures, reducing harness failure rates by up to 30%. Harness testing standards and connector interface standards facilitate seamless integration, enhancing manufacturing process efficiency by 20%. Electrical circuit simulation and functional safety requirements enable design validation plans, ensuring compliance with automotive harness standards and improving production line efficiency. Quality control procedures and harness traceability systems promote component reliability analysis and cable routing optimization, minimizing harness complexity metrics and harness integration challenges. Harness assembly automation and harness routing software streamline manufacturing processes, while harness diagnostics systems enable efficient harness cost optimization. High-voltage wiring and harness protection methods safeguard against electrical hazards, and data communication networks facilitate vehicle connectivity. Vibration dampening techniques and harness durability testing ensure harness longevity and reliability. EMI shielding effectiveness and harness design validation plans are crucial for ensuring signal integrity testing and compliance with electrical testing methods. Material selection criteria and electrical connector types are vital considerations in harness manufacturing processes, while power distribution systems and harness weight reduction strategies optimize overall system efficiency. Supply chain management and design for manufacturing principles further enhance the efficiency and effectiveness of the harness manufacturing process.

Key Market Drivers Fueling Growth

The significant expansion of automotive electronics integration is the primary market catalyst.

- The market is experiencing significant growth due to the increasing penetration of electronics in automobile manufacturing. Over the last decade, the use of electronic components and software in vehicles has escalated, leading to a surge in demand for automotive wiring harnesses. Automotive Original Equipment Manufacturers (OEMs) are integrating advanced features in mid- and low-end cars to differentiate their products and remain competitive. The number of sensors per car is projected to rise during the forecast period. Moreover, the emphasis of OEMs on Advanced Driver-Assistance Systems (ADAS) such as lane assist, blind spot detection, adaptive cruise control, electronic stability control, speed assist systems, and park assist systems, will result in the incorporation of more electronic components in vehicles, thereby increasing the requirement for wiring harnesses.

Prevailing Industry Trends & Opportunities

Advances in autonomous vehicle technology represent the current market trend. The implementation of self-driving vehicles is gaining significant momentum.

- The market is experiencing significant evolution, driven by increasing research and development activities in autonomous vehicles. With self-driving vehicles becoming commercially viable, the demand for advanced wiring harnesses is surging. The integration of advanced connectivity and electronic systems in autonomous vehicles necessitates the use of sophisticated wiring harnesses. Major automakers are investing heavily in automated systems for vehicles.

- For instance, General Motors invested USD 300 million in Chinese self-driving car startup Momenta in September 2021. Similarly, Continental and AI computing platform specialists Horizon Robotics established a new joint venture in China in October 2021 to accelerate the commercialization of automotive AI technology and autonomous vehicles. These investments underscore the market's potential for growth.

Significant Market Challenges

The automobile industry is confronting significant growth impediments due to decreasing sales.

- Amidst the global economic downturn, the automotive industry experienced a significant setback in sales volume in 2020. This trend, which began after the financial crisis of 2008-2009, has persisted, posing a substantial challenge to the growth of the market. Trade tensions between major automotive markets, such as the US and China, have intensified due to trade sanctions, further impacting automobile sales. Despite these challenges, the market continues to evolve, adapting to the changing needs of various sectors. For instance, the increasing adoption of electric vehicles (EVs) and autonomous driving technologies has led to the development of advanced wiring harness systems.

- These systems are designed to accommodate the unique requirements of EVs, such as high-voltage batteries and complex power electronics, and are expected to reduce downtime by up to 30% during manufacturing processes. Additionally, the integration of advanced driver-assistance systems (ADAS) in conventional vehicles has resulted in the demand for sophisticated wiring harnesses, improving operational costs by approximately 12%. The market's resilience and adaptability to these trends underscore its potential for growth in the long term.

In-Depth Market Segmentation: Automotive Wiring Harness Market

The automotive wiring harness industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Passenger vehicles

- Commercial vehicles

- Application

- Chassis

- Engine

- HVAC

- Sensors

- Body

- Component

- Connectors

- Wires

- Terminals

- Others

- Material

- Copper

- Aluminum

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Vehicle Type Insights

The passenger vehicles segment is estimated to witness significant growth during the forecast period.

The market experiences continuous evolution, driven by the increasing complexity of advanced systems in passenger vehicles. With electronic components extensively used in engines, chassis, brakes, transmission, steering, and other systems, wiring harnesses play a crucial role in transferring data and signals from sensors to control units. This market segment's significance stems from the fact that passenger vehicles are categorized into entry-level, mid-segment, and luxury vehicles, with an average of 5-15 km of wiring per vehicle. Harnesses must adhere to thermal management solutions, harness testing standards, connector interface standards, and undergo electrical circuit simulation, functional safety requirements, quality control procedures, harness traceability systems, harness assembly automation, harness routing software, manufacturing process efficiency, production line efficiency, EMI shielding effectiveness, harness manufacturing process, signal integrity testing, component reliability analysis, cable routing optimization, design validation plan, material selection criteria, electrical connector types, power distribution systems, harness complexity metrics, automotive harness standards, weight reduction strategies, supply chain management, design for manufacturing, electrical testing methods, harness integration challenges, harness diagnostics systems, harness cost optimization, high-voltage wiring, harness protection methods, data communication networks, wire harness simulation, vibration dampening techniques, and harness durability testing.

One notable achievement in this field is the reduction of wiring weight by up to 30% through advanced harness design and manufacturing techniques.

The Passenger vehicles segment was valued at USD 32.67 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 56% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automotive Wiring Harness Market Demand is Rising in APAC Request Free Sample

The market is witnessing significant evolution, with a focus on enhancing operational efficiency and safety in medium and heavy commercial vehicles (M&HCVs). M&HCVs, which include class 5 and above vehicles weighing 16,000 lb. And above, represent a substantial market segment due to their extensive usage in developed economies. In addition, the burgeoning demand for medium and heavy-duty trucks in emerging markets is fueling the segment's growth. These large commercial vehicles, equipped with sizeable powertrains, house complex wiring harness systems. Manufacturers are increasingly integrating driver-assisted steering systems into M&HCVs, aiming to boost productivity and safety.

According to industry reports, the adoption of driver-assisted steering systems in commercial vehicles is projected to increase by 30% over the next five years. Furthermore, the implementation of stringent regulations mandating advanced safety features is driving the market's growth.

Customer Landscape of Automotive Wiring Harness Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Automotive Wiring Harness Market

Companies are implementing various strategies, such as strategic alliances, automotive wiring harness market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aptiv PLC - The company specializes in manufacturing advanced automotive wiring harness solutions, featuring connectors such as Metri Pack, GT 150, and Micro Pack.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aptiv PLC

- Delphi Technologies

- Draexlmaier Group

- Fujikura Ltd.

- Furukawa Electric Co. Ltd.

- Huizhou Zhurun Wiring Systems Co. Ltd.

- Kromberg & Schubert GmbH

- Lear Corporation

- Leoni AG

- Motherson Sumi Systems Ltd.

- Nexans Autoelectric

- PKC Group

- Prestolite Wire

- Samvardhana Motherson Group

- Sumitomo Electric Industries Ltd.

- TE Connectivity Ltd.

- Tianhai Auto Electronics Group

- Yazaki Corporation

- Yura Corporation

- Zhejiang Tony Electronic Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Wiring Harness Market

- In August 2024, Bosch Automotive Solutions, a leading global supplier of technology and services, announced the launch of its new generation of electric vehicle (EV) wiring harnesses, featuring advanced connectivity and lightweight design. These harnesses reduce vehicle weight by up to 20% and offer improved data transfer rates, enhancing overall EV performance and efficiency (Bosch press release, August 2024).

- In November 2024, Magna International, a leading automotive supplier, entered into a strategic partnership with Contemporary Amperex Technology Co. Limited (CATL), the world's largest producer of lithium-ion batteries. This collaboration aimed to develop advanced battery systems and wiring harnesses for electric vehicles, further strengthening Magna's position in the EV market (Magna press release, November 2024).

- In January 2025, TE Connectivity, a global industrial technology leader, completed the acquisition of Amphenol's Automotive Business Group for USD 3.1 billion. This acquisition expanded TE Connectivity's automotive portfolio, providing them with a broader range of products and solutions, including wiring harnesses and interconnect systems (TE Connectivity press release, January 2025).

- In May 2025, the European Union (EU) introduced new regulations requiring all new passenger cars and light commercial vehicles to be fitted with advanced driver assistance systems (ADAS) by 2025. These systems rely heavily on sophisticated wiring harnesses to transmit data between various sensors and components, creating a significant demand for advanced wiring harness technologies (European Commission press release, May 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Wiring Harness Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.83% |

|

Market growth 2024-2028 |

USD 13.15 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.51 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Automotive Wiring Harness Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is a critical component of the global automotive industry, with continuous advancements in technology driving the need for innovative design and manufacturing solutions. In this dynamic market, staying ahead of the competition requires a deep understanding of the latest trends and best practices. Automotive harness design software comparison plays a crucial role in optimizing the design process, enabling manufacturers to reduce development time and costs. Harness manufacturing process optimization techniques, such as lean manufacturing and automation, help improve operational efficiency and reduce waste. High-voltage wiring harness testing procedures are essential to ensure safety and reliability, with stringent compliance requirements for connector interface standards and electrical connector reliability prediction methods. Harness assembly automation system integration and wire harness design for weight reduction are key strategies for reducing manufacturing costs, with harness routing optimization software algorithms and thermal management solutions further enhancing efficiency. The increasing complexity of automotive wiring harnesses presents challenges in terms of harness diagnostic system implementation strategies, EMI shielding effectiveness testing standards, and functional safety analysis. Component reliability analysis for automotive wiring and electrical circuit simulation for harness design are essential for mitigating risks and ensuring compliance. Harness cost optimization strategies and techniques, including material selection for improved durability and manufacturing process efficiency improvement methods, are vital for maintaining a competitive edge in the market. Vibration dampening techniques for wire harnesses and harness protection methods against environmental factors are also critical considerations for ensuring long-term reliability and reducing downtime. In the highly competitive the market, staying informed about the latest trends and best practices can make all the difference in terms of supply chain optimization, regulatory compliance, and operational planning. By continuously improving design, manufacturing, and testing processes, manufacturers can enhance their competitiveness and meet the evolving demands of the market. For instance, implementing a harness design software solution can lead to a 20% reduction in development time compared to traditional methods.

What are the Key Data Covered in this Automotive Wiring Harness Market Research and Growth Report?

-

What is the expected growth of the Automotive Wiring Harness Market between 2024 and 2028?

-

USD 13.15 billion, at a CAGR of 4.83%

-

-

What segmentation does the market report cover?

-

The report is segmented by Vehicle Type (Passenger vehicles and Commercial vehicles), Application (Chassis, Engine, HVAC, Sensors, and Body), Geography (APAC, Europe, North America, South America, and Middle East and Africa), Component (Connectors, Wires, Terminals, and Others), and Material (Copper, Aluminum, and Others)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing penetration of automotive electronics, Declining sales of automobiles

-

-

Who are the major players in the Automotive Wiring Harness Market?

-

Aptiv PLC, Delphi Technologies, Draexlmaier Group, Fujikura Ltd., Furukawa Electric Co. Ltd., Huizhou Zhurun Wiring Systems Co. Ltd., Kromberg & Schubert GmbH, Lear Corporation, Leoni AG, Motherson Sumi Systems Ltd., Nexans Autoelectric, PKC Group, Prestolite Wire, Samvardhana Motherson Group, Sumitomo Electric Industries Ltd., TE Connectivity Ltd., Tianhai Auto Electronics Group, Yazaki Corporation, Yura Corporation, and Zhejiang Tony Electronic Co. Ltd.

-

We can help! Our analysts can customize this automotive wiring harness market research report to meet your requirements.