Wire-To-Board Connector Market Size 2024-2028

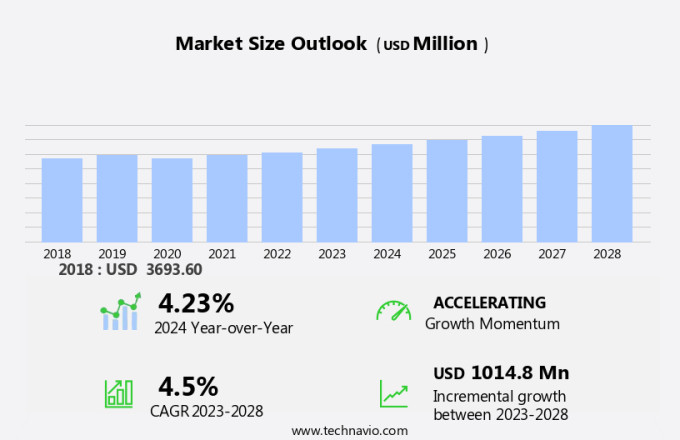

The wire-to-board connector market size is forecast to increase by USD 1.01 billion at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for high-speed connectivity in various sectors such as telecommunications and medical. The telecom sector's requirement for transmission bandwidth and miniaturization of electronic devices is driving the market's expansion. Additionally, the medical sector's reliance on advanced technology for diagnostics and treatment is increasing the need for reliable and durable wire-to-board connectors. Moreover, the adoption of HVAC system controls, robotics, office automation, smart speakers, and smart thermostats in residential and commercial applications is propelling the market's growth. The Industrial Internet of Things (IIoT) is also contributing to the market's expansion as industries seek to optimize their production processes and improve efficiency. However, challenges such as reliability and durability issues with wire-to-board connectors persist, necessitating the development of advanced materials and manufacturing techniques.

Market Analysis

The market is witnessing significant growth due to the increasing demand for electronic devices and automated assembly processes in various industries. These connectors play a crucial role in establishing a reliable electrical connection between wire and printed circuit boards (PCBs), enabling seamless data transmission and power supply. The electronics sector, including IoT technology applications, is a primary driver for the market. IoT applications such as HVAC systems, mobile devices, wearables, and smart meters, require efficient and reliable connectors to ensure proper functionality. In the IoT landscape, electricity, gas, and water metering systems are significant consumers of wire-to-board connectors.

Moreover, residential and industrial gas meters, as well as smart electricity meters, rely on these connectors to transmit data and receive power. These applications demand connectors with various voltage configurations and footprint patterns to accommodate diverse peripheral devices. Beyond the electronics sector, the automotive, medical, and telecom industries also contribute to the market's growth. In the automotive sector, connectors are essential for wiring and data transmission in advanced driver assistance systems (ADAS), electric vehicles (EVs), and hybrid vehicles. The medical sector uses these connectors in medical equipment and implantable devices, while the telecom sector requires them for network infrastructure and communication systems.

Further. flex circuits, chip-on-board, and wire bonding technologies are essential in the manufacturing of wire-to-board connectors. These technologies ensure high-performance, miniaturization, and reliability, making them suitable for various applications. In conclusion, the market is experiencing steady growth due to the increasing demand for electronic devices and automated assembly processes across various industries. The market's key applications include IoT technology, HVAC systems, mobile devices, wearables, smart meters, automotive, medical, and telecom sectors. Technological advancements, such as flex circuits, chip-on-board, and wire bonding, are crucial in meeting the market's demands for high-performance, miniaturization, and reliability.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Computer and peripherals

- Automotive

- Telecommunication

- Medical

- Others

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Application Insights

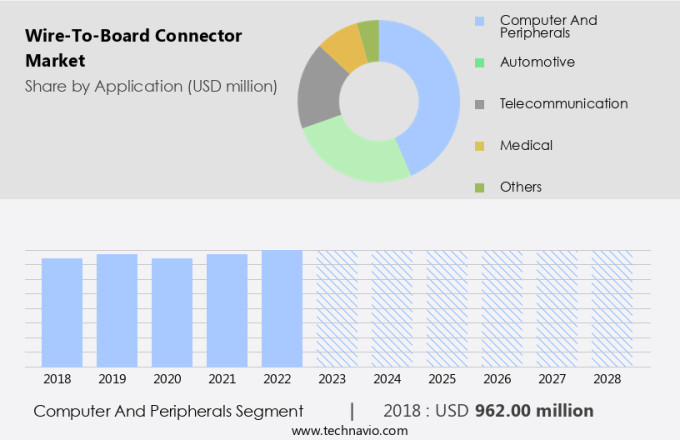

The computer and peripherals segment is estimated to witness significant growth during the forecast period. Wire-to-board connectors play a crucial role in establishing a connection between a wire and a printed circuit board (PCB), facilitating communication between various circuits. These connectors are extensively used in various sectors, including computers and peripherals, electric vehicles, medical technology, renewable energy projects, 5G technology, data centers, and IT infrastructure. In the computer industry, wire-to-board connectors are employed to link components such as the motherboard, uninterruptible power supply (UPS), and various input and output devices. Recently, Amphenol ICC unveiled its PCIe M.2 Gen5 connectors, which adhere to PCI-SIG PCIe M.2 5.0 specifications. These high-speed connectors support data rates of up to 32Gb/s and feature 67 gold-plated contacts on a 0.5mm

pitch. The increasing adoption of advanced technologies such as machine learning, electric vehicles, and wireless connectivity is driving the demand for high-performance wire-to-board connectors. Moreover, the growth of industries like medical technology, renewable energy projects, and 5G technology is further expanding the market potential. Waterproof and sealed connectors are gaining popularity in applications where environmental conditions pose a challenge. The integration of 5G technology and wireless connectivity in various industries is also fueling the demand for reliable and high-speed wire-to-board connectors. In the data center sector, the need for efficient and reliable connectivity solutions is driving the market growth. Overall, the market is poised for significant growth in the coming years, driven by the increasing adoption of advanced technologies and the expanding applications across various industries.

Get a glance at the market share of various segments Request Free Sample

The Computer and peripherals segment accounted for USD 962.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

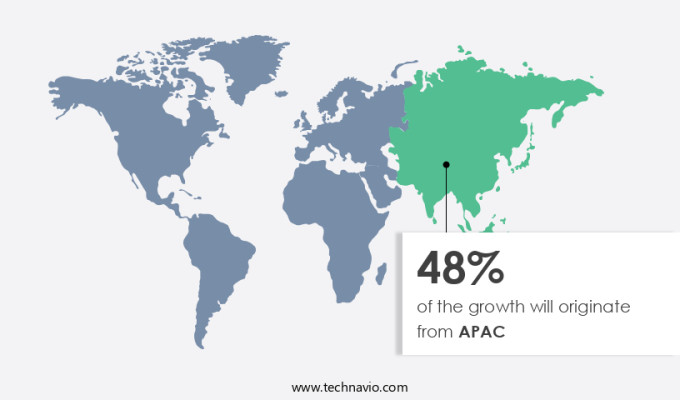

APAC is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific (APAC) is projected to experience continuous expansion over the upcoming years. This region houses a significant market share, with countries like China and Japan leading the growth. The automotive, military/defense, and industrial sectors are the primary consumers of wire-to-board connectors in APAC. The military and defense sector's presence of global key players and the high demand from various military establishments, particularly in China, significantly influence the market's growth. Furthermore, the increasing focus of major automobile manufacturers, such as General Motors, on electric vehicles (EVs) and hybrid electric vehicles (HEVs) will propel the market's growth in the region during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increased adoption of automotive electronics is the key driver of the market. The market is experiencing significant growth due to the increasing integration of electronics in various sectors, particularly in Internet of Things (IoT) technology. Connectors play a crucial role in IoT applications, such as HVAC systems, mobile devices, wearables, and data transmission in electronic devices. Automated assembly processes, including flex circuits and chip-on-board, rely heavily on wire-to-board connectors for efficient production. The automotive industry is a major consumer of wire-to-board connectors, with their usage in various electronic systems like navigation, steering, brake, and cruise control. These advanced electronic systems have become essential components in modern vehicles, contributing significantly to their manufacturing costs.

Moreover, stringent regulations on carbon emissions have led to the adoption of emission sensors, further increasing the demand for connectors in the automotive sector. In summary, the market is witnessing substantial growth due to the rising adoption of electronics in various industries, particularly in IoT applications and automotive systems. Connectors play a vital role in enabling seamless data transmission and efficient production processes, making them an indispensable component in modern electronic devices.

Market Trends

Miniaturization of electronic devices is the upcoming trend in the market. The electronic devices market has experienced significant growth due to technological advancements, leading to the production of smaller, more efficient devices. This trend is driven by consumer demand for reliable and compact electronics. The miniaturization of electronic devices is a result of efforts to reduce raw material costs and accommodate smaller assemblies in specific applications. Integrated circuits, which incorporate miniature components such as capacitors and transistors, have played a pivotal role in shrinking product sizes. Several industries, including the medical sector and telecom industry, require high-speed connectivity and transmission bandwidth, fueling the demand for advanced electronic components. HVAC system controls, robotics, office automation, smart speakers, and smart thermostats are among the applications that benefit from these technological advancements.

The Industrial Internet of Things (IIoT) is another sector that relies heavily on electronic devices for efficient data transmission and processing. Pitch size, the distance between the centers of two adjacent pins in a connector, is a crucial factor in the design and manufacturing of electronic devices. The pitch size continues to decrease as technology advances, enabling manufacturers to create smaller and more intricate devices. The use of high-speed connectors with smaller pitch sizes is essential for industries that require fast data transfer rates, such as telecommunications and medical devices. In conclusion, the miniaturization of electronic devices has been a significant trend in the industry, driven by technological advancements and consumer demand for compact, reliable electronics.

The medical sector, the telecom industry, and various other applications, including HVAC system controls, robotics, office automation, smart speakers, and smart thermostats, are all benefiting from these technological advancements. The reduction in pitch size is a critical factor in the design and manufacturing of these devices, allowing for smaller, more efficient assemblies.

Market Challenge

Reliability and durability issues with wire-to-board connectors is a key challenge affecting the market growth. The market faces challenges in ensuring the reliability and durability of its products due to various field conditions. Voltage fluctuations, temperature extremes, and mechanical forces can lead to damage and failures such as broken latches, misaligned joints, or overheating. These issues pose significant risks to both the connected device and the end user. Connector market growth is hindered by these reliability and durability concerns. In the context of smart meters for electricity, gas, and water, as well as industrial and residential gas meters, voltage configurations and footprint patterns are critical factors. A peripheral device's compatibility with these configurations and patterns is essential for seamless integration.

The automotive sector also relies on wire-to-board connectors for various applications, including powertrain and chassis systems. Designing connectors that can withstand the rigors of the automotive environment, such as vibration, temperature extremes, and moisture, is crucial. To address these challenges, manufacturers must focus on improving connector design, materials, and manufacturing processes. Ensuring compatibility with various voltage configurations and footprint patterns is also essential. By prioritizing reliability and durability, the market can overcome these hurdles and continue to grow.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co.: The company offers wire to board connector products such as four wall header and serial attached.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amphenol Corp.

- ERNI Deutschland GmbH

- Hon Hai Precision Industry Co. Ltd.

- HARTING Technology Group

- HIROSE ELECTRIC Co. Ltd.

- Japan Aviation Electronics Industry Ltd.

- J.S.T. MFG. Co. Ltd.

- Koch Industries Inc.

- Kyocera Corp.

- Norcomp Inc.

- Phoenix Contact GmbH and Co. KG

- Samtec Inc.

- TE Connectivity Ltd.

- WAGO GmbH and Co. KG

- Wurth Elektronik GmbH and Co. KG

- Yamaichi Electronics Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing demand for electronic devices in various sectors such as IoT technology, HVAC systems, mobile, wearables, and automotive. These connectors play a crucial role in data transmission between peripheral devices and electronic components in various applications. Flex circuits, chip-on-board, and wire bonding are some of the advanced assembly processes used in the manufacturing of these connectors. The market is witnessing a swell in demand for high-speed connectors for applications in industries like telecom, datacom, and automation. The IIoT revolution is driving the demand for wire-to-board connectors in sectors like manufacturing, transportation, and energy.

Further, smart meters for electricity, gas, and water are major applications in the residential and industrial sectors. Voltage configurations and footprint patterns are critical factors considered during the design and manufacturing process. Connectors are essential components in various sectors like automotive, medical, and military applications. High-speed connectors with waterproof and sealed designs are increasingly popular in applications requiring wireless connectivity. The market is also witnessing growing demand for connectors in data centers, IT infrastructure, and 5G technology. The market for wire-to-board connectors is expected to grow significantly in the coming years due to the increasing demand for advanced electronic devices and high-speed connectivity.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 1.01 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 48% |

|

Key countries |

US, China, South Korea, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Amphenol Corp., ERNI Deutschland GmbH, Hon Hai Precision Industry Co. Ltd., HARTING Technology Group, HIROSE ELECTRIC Co. Ltd., Japan Aviation Electronics Industry Ltd., J.S.T. MFG. Co. Ltd., Koch Industries Inc., Kyocera Corp., Norcomp Inc., Phoenix Contact GmbH and Co. KG, Samtec Inc., TE Connectivity Ltd., WAGO GmbH and Co. KG, Wurth Elektronik GmbH and Co. KG, and Yamaichi Electronics Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch