Wireless Antenna Market Size 2024-2028

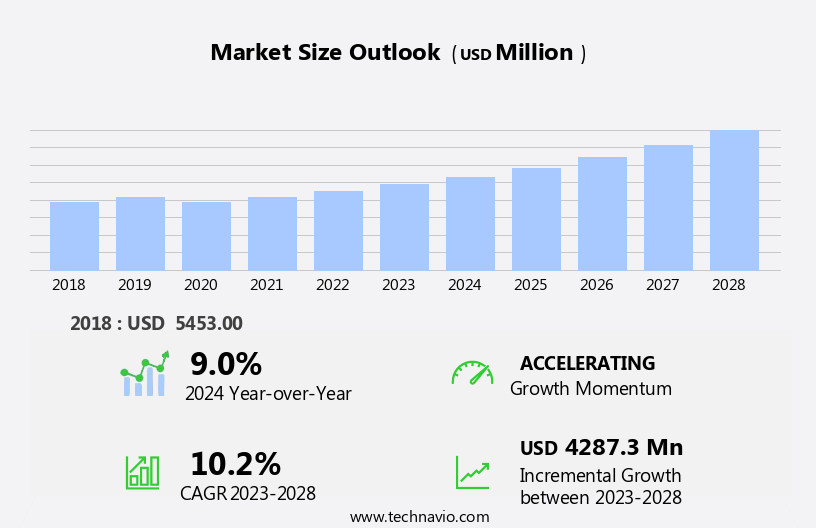

The wireless antenna market size is forecast to increase by USD 4.29 billion at a CAGR of 10.2% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing trend of Internet of Things (IoT) technology and the surge in 5G investments. The IoT market is projected to reach unprecedented heights, driving the demand for wireless antennas in various applications, from smart homes to industrial automation. Furthermore, the global 5G market is anticipated to reach a value of over USD600 billion by 2027, fueling the need for advanced wireless antenna solutions to support the high-speed connectivity and low latency requirements of 5G networks. However, the market faces challenges as well. One of the primary obstacles is the lack of infrastructure and connectivity, particularly in developing regions.

- This issue hampers the widespread adoption of wireless technologies, including those that rely on antenna solutions. Another challenge is the complexity and cost associated with implementing advanced antenna technologies, such as massive MIMO and beamforming, which are essential for 5G networks. Companies seeking to capitalize on market opportunities and navigate these challenges effectively must focus on innovation, collaboration, and strategic partnerships to overcome these obstacles and meet the evolving demands of the market.

What will be the Size of the Wireless Antenna Market during the forecast period?

- The market continues to evolve, driven by the ever-advancing wireless communication technologies and their diverse applications across various sectors. Antenna design plays a crucial role in optimizing network coverage and signal amplification for 5G networks, LTE networks, and other cellular and satellite systems. Polarized antennas, omnidirectional antennas, and directional antennas each offer unique benefits for wireless connectivity, while SMA and TNC connectors ensure seamless integration. Signal strength and interference mitigation are paramount for reliable data transmission in wireless communication. Antenna radiation patterns and impedance are essential factors in antenna optimization, with multi-band and beamforming antennas offering enhanced efficiency and coverage.

- Wi-Fi networks and IoT applications further expand the market's reach, with RF engineering and wireless standards shaping the future of antenna technology. Antenna installation, maintenance, and testing are ongoing concerns for telecommunications infrastructure, with antenna simulation and antenna connector solutions streamlining the process. Antenna gain, circular polarization, and dual-band capabilities cater to the varying needs of wireless technology, while antenna SWR and F-type connectors ensure optimal performance. The dynamic nature of the market ensures continuous innovation and adaptation to meet the evolving demands of the industry.

How is this Wireless Antenna Industry segmented?

The wireless antenna industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Communication

- Aerospace and defense

- Automotive

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

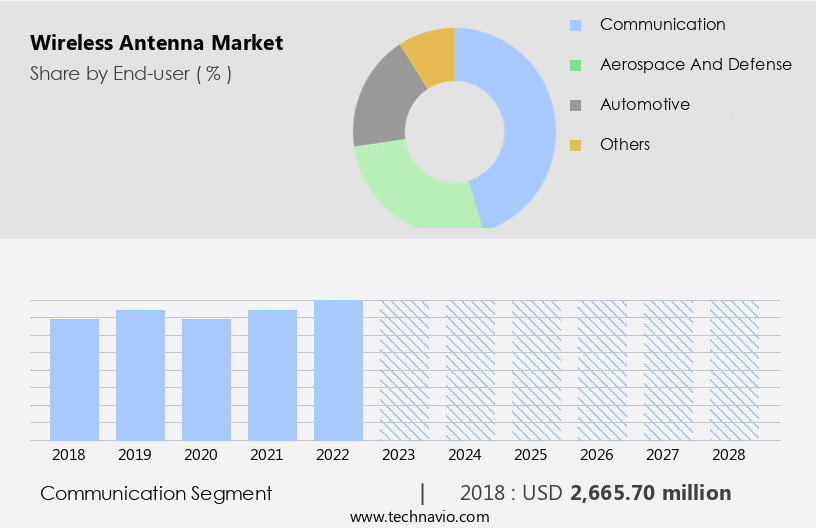

By End-user Insights

The communication segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing adoption of advanced wireless technologies, such as 5G networks and LTE, in communication devices. Antenna design plays a crucial role in enabling seamless wireless connectivity, and manufacturers are focusing on developing efficient and optimized antenna solutions to cater to the expanding consumer electronics industry, particularly in developing countries like India and China. Omnidirectional and directional antennas, including polarized and circularly polarized options, are used in various applications, from cellular networks and satellite communications to Wi-Fi and RFID systems. These antennas are designed to provide optimal network coverage, signal amplification, and interference mitigation, ensuring reliable data transmission and wireless communication.

Multi-band and beamforming antennas, as well as high-gain and low-gain options, cater to diverse wireless standards and applications, such as IoT and wireless technology. Antenna optimization, simulation, and testing are essential to maintaining efficient wireless connectivity and ensuring compatibility with various wireless communication infrastructure. RF engineering and antenna maintenance are crucial aspects of the market, ensuring the longevity and performance of wireless antenna systems.

The Communication segment was valued at USD 2.67 billion in 2018 and showed a gradual increase during the forecast period.

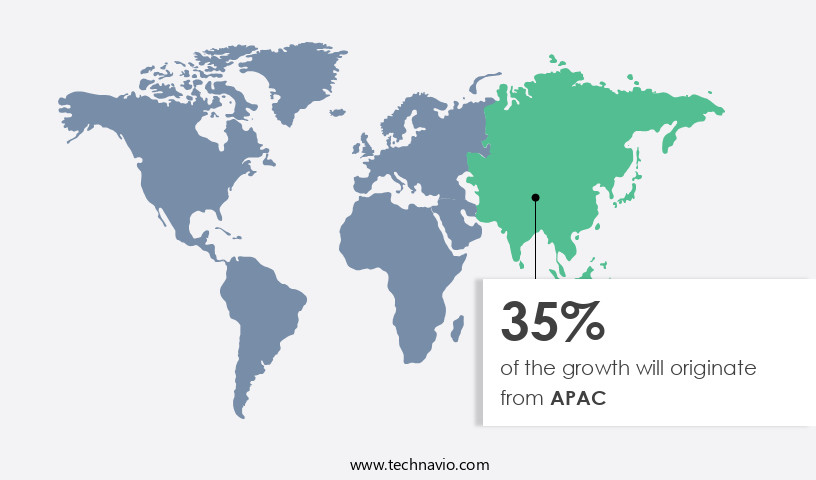

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing demand for high-speed broadband access networks and the proliferation of online applications and social media. Approximately 80% of enterprises in the region utilize connected products and services, which rely on cloud platforms and data analytics for business efficiency. The Internet of Things (IoT) has fueled the need for efficient and reliable communication networks to support optimal business operations. 5G networks and Long-Term Evolution (LTE) networks are driving the market for antenna design, with TNC and SMA connectors essential for network coverage and signal amplification. Omnidirectional and directional antennas, including cellular and satellite antennas, cater to various network requirements.

Polarized antennas and multi-band antennas ensure optimal antenna radiation pattern and impedance for diverse wireless applications. Beamforming antennas and antenna optimization enhance antenna efficiency and signal strength, while antenna simulation and testing are crucial for antenna connector and wireless connectivity. Interference mitigation and wireless technology advancements, such as data transmission in cellular networks and RFID antennas in wi-fi networks, are essential for maintaining wireless communication and telecommunications infrastructure. Microwave antennas, high-gain antennas, and linear polarization cater to diverse antenna gain and wireless standards. Circular polarization and dual-band antennas provide additional functionality, ensuring seamless wireless communication for various industries and applications.

Antenna swr and f-type connector are essential for maintaining antenna performance and wireless communication integrity. In summary, the market in North America is thriving due to the increasing demand for high-speed wireless connectivity and the proliferation of IoT applications. Antenna design, network coverage, signal amplification, and optimization are crucial factors driving market growth. Antenna connectors, wireless standards, and antenna testing are essential for maintaining wireless communication and telecommunications infrastructure integrity.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Wireless Antenna Industry?

- The increasing prevalence of the Internet of Things (IoT) technology is the primary catalyst fueling market growth.

- The market is experiencing significant growth due to the increasing demand for wireless connectivity in various industries, including cellular networks and Wi-Fi networks. The market is driven by the proliferation of wireless standards such as 5G and Wi-Fi 6, which require advanced antenna technologies to ensure optimal network performance. Low-gain antennas, n-type connectors, circular polarization, and dual-band antennas are becoming increasingly popular in the market due to their ability to enhance wireless signal strength and reduce interference. Antenna simulation and antenna connector technologies are also gaining traction to improve antenna design and performance. Moreover, the Internet of Things (IoT) is fueling the demand for wireless antennas in various applications, including RFID antennas and wireless sensors.

- The IoT ecosystem requires reliable and efficient wireless connectivity to enable seamless communication between devices, making antennas a crucial component. The market dynamics are influenced by several factors, including technological advancements, regulatory frameworks, and consumer preferences. Antenna manufacturers are investing heavily in research and development to meet the evolving demands of the market and stay competitive. In conclusion, the market is poised for growth due to the increasing adoption of wireless technologies and the need for efficient and reliable wireless connectivity. Antenna manufacturers are focusing on innovation and collaboration to meet the demands of various industries and applications.

What are the market trends shaping the Wireless Antenna Industry?

- The investment landscape is shifting towards 5G technology, with a notable rise in funding for 5G projects representing the current market trend. This upward trend in 5G investments signifies a significant commitment to the future of advanced connectivity solutions.

- The global wireless communications industry is experiencing significant growth with the rollout of 5G technology. With estimated data download speeds of 10,000 Mbps, 5G is poised to revolutionize the telecommunications infrastructure. This technological advancement has led to increased investments in 5G network infrastructure, which grew by 39% to USD19.1 billion in 2021. The demand for these investments is driven by the need for improved signal strength and antenna bandwidth to support 5G's high-speed data transfer. Directional antennas, such as those utilizing linear polarization, are essential components in mitigating interference in wireless communication systems. RF engineering plays a crucial role in designing and testing these antennas to ensure optimal performance.

- Antenna SWR (Standing Wave Ratio) and f-type connectors are critical specifications in the development of these components. The market for 5G antenna modules, multimode modems, base stations, and RF products is expected to grow substantially during the forecast period. The advancements in wireless technology necessitate robust antenna solutions to meet the demands of the 5G network infrastructure. Antenna testing and optimization are essential to ensure seamless integration and harmonious operation within the 5G ecosystem.

What challenges does the Wireless Antenna Industry face during its growth?

- The absence of sufficient infrastructure and connectivity poses a significant challenge to the expansion and growth of various industries.

- The market is experiencing significant growth due to the increasing demand for high-speed Internet connectivity, particularly for IoT devices and the rollout of 5G networks. Antenna design plays a crucial role in enhancing network coverage and signal amplification for various applications, including cellular networks like LTE and satellite communications. Omnidirectional antennas and polarized antennas are commonly used for cellular antennas, while SMA and TNC connectors ensure a secure connection.

- The radiation pattern of antennas is a critical factor in determining their efficiency and effectiveness in transmitting and receiving signals. As the world moves towards advanced communication technologies, the demand for wireless antennas is expected to increase, driving market growth.

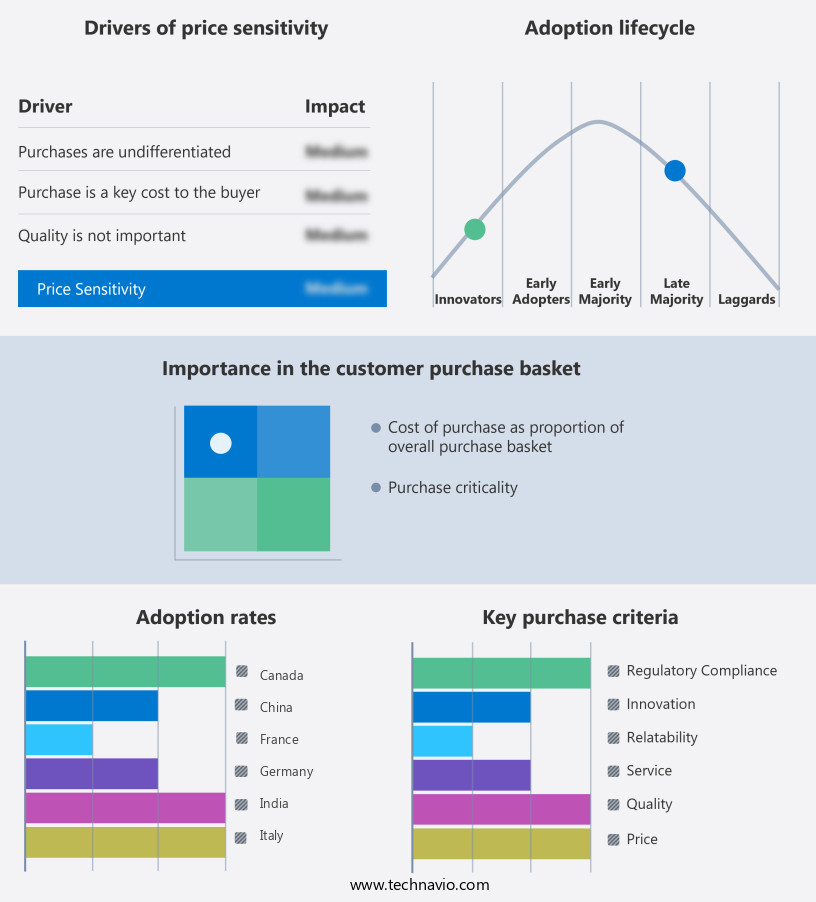

Exclusive Customer Landscape

The wireless antenna market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wireless antenna market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wireless antenna market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AccelTex Solutions - The company specializes in advanced wireless communication solutions, featuring a versatile antenna system. This innovative technology integrates a Common Data Link Radio (iCDL), CDL Portable Ground System, CDL Exportable Radio System, and Light Airborne Multipurpose Systems. The iCDL ensures secure and reliable data transmission, while the portable and exportable radio systems offer flexibility in deployment. The light airborne multipurpose systems enable seamless integration with various platforms, expanding connectivity capabilities. This comprehensive antenna system caters to diverse applications, delivering superior performance and enhancing overall communication efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AccelTex Solutions

- Alpha Wireless Ltd.

- BAE Systems Plc

- BOUYGUES

- Broadcom Inc.

- Cisco Systems Inc.

- CommScope Holding Co. Inc.

- FIAMM Componenti Accessori FCA Spa

- Huawei Technologies Co. Ltd.

- Ignion SL

- IMC Microwave Industries Ltd.

- Infinite Electronics International Inc.

- Johanson Technology Inc.

- Linx Technologies

- MP Antenna Ltd.

- Octane Wireless

- Rohde and Schwarz GmbH and Co. KG

- SkyWave Antennas

- Viasat Inc.

- Yageo Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Wireless Antenna Market

- In February 2023, Intel Corporation, a leading technology company, announced the launch of its new 5G millimeter wave (mmWave) antenna modules, designed to enhance wireless network coverage and capacity for 5G devices. These antennas are expected to significantly improve the performance of 5G networks in densely populated areas (Intel Press Release, 2023).

- In July 2024, Nokia and Qualcomm Technologies entered into a strategic partnership to develop and integrate advanced antenna technologies into Nokia's 5G radio access network (RAN) products. This collaboration aims to improve network efficiency, coverage, and capacity, making 5G services more accessible to a larger user base (Nokia Press Release, 2024).

- In October 2024, Qorvo, a leading RF solutions provider, completed the acquisition of RF Micro Devices, a major antenna technology company. This acquisition expanded Qorvo's product portfolio and strengthened its position in the market, enabling the company to offer a broader range of antenna solutions for various applications (Qorvo Press Release, 2024).

- In March 2025, the European Union (EU) approved new regulations to boost the deployment of 5G networks and related antenna infrastructure. The regulations aim to streamline the approval process for antenna installations and reduce deployment costs, making it easier for telecom companies to expand their 5G networks across the EU (European Commission Press Release, 2025).

Research Analyst Overview

The market is experiencing significant activity and trends, driven by the increasing adoption of connected vehicles, wireless backhaul for 5G deployment, and the expansion of smart cities and industrial automation. Software-defined radios and network slicing are enabling more efficient bandwidth utilization, while security protocols and data analytics ensure network performance and protect against potential threats. Massive MIMO and phased arrays are enhancing network capacity and coverage, particularly in urban areas. Satellite communication and edge computing are extending wireless connectivity to remote locations.

Adaptive antennas and beam steering are improving spectrum management and enabling cognitive radio technology. Antenna arrays and microwave links are essential components of these advanced wireless systems, supporting various applications from wearable technology to wireless sensor networks. Overall, the market is a dynamic and evolving landscape, shaping the future of communication and technology.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Wireless Antenna Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.2% |

|

Market growth 2024-2028 |

USD 4287.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.0 |

|

Key countries |

US, Canada, China, Japan, Germany, India, UK, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wireless Antenna Market Research and Growth Report?

- CAGR of the Wireless Antenna industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wireless antenna market growth of industry companies

We can help! Our analysts can customize this wireless antenna market research report to meet your requirements.