Wireless LAN Controller Market Size 2024-2028

The wireless LAN controller market size is forecast to increase by USD 533.1 million at a CAGR of 4.5% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing need for enhancing connectivity for business enterprises. The adoption of cloud-based technologies is another major trend driving market growth. In the US, the deployment of smart infrastructure, such as wireless access points for tablets, laptops, media-intensive devices, smartphones, and other consumer electronics, is driving the demand for wireless LAN controllers. Cloud-based wireless LAN controllers offer several benefits such as cost savings, easier deployment, and centralized management. However, the market is also facing challenges such as security vulnerabilities associated with wireless LAN controllers. With the increasing number of wireless devices and the growing complexity of networks, ensuring security is a major concern for organizations. As businesses continue to prioritize connectivity and security, the market is expected to experience steady growth In the coming years.

What will be the Size of the Wireless LAN Controller Market During the Forecast Period?

- The Wireless LAN (WLAN) controller market is experiencing significant growth due to the increasing adoption of the Internet of Things (IoT) and the proliferation of media-intensive devices such as tablets, laptops, smartphones, and media-intensive applications like video conferencing and augmented reality. These devices require high-bandwidth and low latency to support business-critical applications and enterprise mobility. Traditional WLAN architectures are being replaced by cloud-managed wireless networks, which offer centralized management, easier deployment, and cost savings. Access points and wireless access points are key components of WLAN infrastructure, with Wi-Fi 6e being the latest Wi-Fi protocol offering improved performance and capacity. Access point protocols play a crucial role in ensuring seamless connectivity and efficient network traffic management. Smart infrastructure, including WLAN controllers, is essential for enabling a connected business environment and enhancing user experience.

How is this Wireless LAN controller Industry segmented and which is the largest segment?

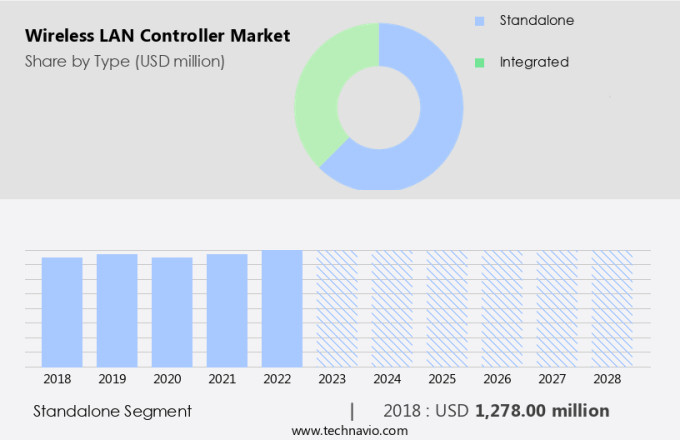

The wireless LAN controller industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Standalone

- Integrated

- Geography

- North America

- Canada

- US

- Europe

- UK

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Type Insights

- The standalone segment is estimated to witness significant growth during the forecast period.

Wireless LAN Controllers cater to various industries, including healthcare, manufacturing, retail, banking and finance, and transportation and logistics, with standalone models offering configuration, management, and support for wireless networks in enterprises of all sizes. These controllers provide scalability, resilience, and flexibility for service enterprises and large campuses, accommodating IoT devices such as smartphones, tablets, laptops, and media-intensive devices. Centralized controller-based designs offer advantages over standalone access points, enabling seamless network expansion. Wireless LAN Controllers are essential infrastructure for network infrastructure centers, supporting business-critical applications and high-bandwidth, low latency requirements in IT and telecom, manufacturing, and enterprise mobility settings. The integration of cloud-managed wireless networks and security functionalities enhances employee productivity, digital platforms, and operational costs, while accommodating new product development, cloud services, and managed switches, firewalls, and routers.

Get a glance at the Wireless LAN Controller Industry report of share of various segments Request Free Sample

The standalone segment was valued at USD 1.28 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 29% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing growth, particularly In the US and Canada, due to the increasing adoption of IoT technology In the IT sector. IoT applications necessitate numerous wireless LAN controllers for managing network infrastructure in enterprises. Centralized control over networking components, including wireless LAN controllers, is essential for businesses to improve network flexibility, performance, and productivity. Urbanization and digitization are also contributing factors, as businesses seek to accommodate the increasing number of networked devices and applications.

Companies of all sizes, from large enterprises to SMEs and SOHOs, require reliable and high-bandwidth network infrastructure for business-critical applications and employee productivity. Cloud-managed wireless networks and access points offer cost-effective solutions for managing network infrastructure, while maintaining security functionalities and reducing operational costs. Network infrastructure for industries such as healthcare, manufacturing, transportation and logistics, enterprise mobility, and large campuses also necessitates wireless LAN controllers for efficient network management.

Market Dynamics

Our wireless LAN controller market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Wireless LAN Controller Industry?

Enhancing connectivity for business enterprises is the key driver of the market.

- Wireless LAN controllers play a pivotal role in modern business infrastructure, particularly In the context of the Internet of Things (IoT) and digitization. These controllers enable seamless connectivity for various devices such as tablets, laptops, media-intensive devices, smartphones, and consumer electronics. With urbanization and the increasing need for smart infrastructure, the demand for reliable and high-bandwidth network solutions has grown. WLAN controllers offer centralized, distributed, and meshed network management solutions that cater to large enterprises, SMEs, SOHOs, and even residential settings. These solutions provide businesses with cost savings through cloud-based, access point based, virtual controller, and physical controller options. They offer low latency and support business-critical applications, ensuring employee productivity and efficient digital platforms. Cloud-managed wireless networks, managed switches, firewalls, routers, and wireless access points are essential components of these solutions. Security functionalities, such as encryption and access control, are also crucial. Bandwidth-intensive applications, including video conferencing, augmented reality, and smart devices, can be effectively managed with these controllers.

- Moreover, enterprises in various sectors, including IT and telecom, healthcare, manufacturing, transportation and logistics, and enterprise mobility, are increasingly adopting wireless LAN infrastructure. The integration of 4G & 5G technologies further enhances the capabilities of these solutions. The network infrastructure center plays a vital role in managing operational costs and ensuring IT teams can effectively manage network management solutions. Thus, wireless LAN controllers offer numerous benefits, including cost savings, flexibility, mobility, and improved productivity. They support the growing number of connected devices and the increasing demand for high-bandwidth applications in business settings. As remote work becomes more common, the need for reliable and efficient network solutions will only continue to grow.

What are the market trends shaping the Wireless LAN Controller Industry?

The adoption of cloud-based technologies is the upcoming market trend.

- The market is experiencing significant growth due to the integration of the Internet of Things (IoT), cloud computing, and data analytics. IoT enables wireless data transfer between various devices, including access points, tablets, laptops, media-intensive devices, smartphones, and consumer electronics. Cloud computing provides a network infrastructure center for managing and processing this data, allowing for real-time insights and improved business decision-making. In urbanized areas, digitization has led to an increase In the adoption of wireless LAN controllers for network management in industries such as IT and telecom, healthcare, manufacturing, transportation and logistics, and enterprise mobility. These industries require high-bandwidth, low latency, and business-critical applications, making wireless LAN controllers an essential component of their network infrastructure. Cloud-managed wireless networks have become increasingly popular due to their cost-effective nature and ease of deployment. These solutions offer centralized, distributed, and mesh architectures, allowing for scalability and flexibility. Security functionalities, such as managed switches, firewalls, and routers, ensure data protection and compliance with industry standards.

- Moreover, cloud service providers offer various Wi-Fi standards and network management solutions to cater to the needs of large enterprises, SMEs, SOHOs, and residential users. The integration of 4G & 5G technologies has further enhanced the capabilities of wireless LAN controllers, enabling remote work and supporting bandwidth-intensive applications such as video conferencing, augmented reality, and smart devices in business settings. The adoption of wireless LAN controllers is driven by the need for employee productivity, digital platforms, and operational cost savings. New product development and managed services offerings continue to expand the market, with offerings ranging from 2-port to 16-port controllers. Overall, the market is expected to continue its growth trajectory, driven by the increasing demand for smart infrastructure and the ongoing digitization of industries.

What challenges does the Wireless LAN Controller Industry face during its growth?

Security vulnerabilities associated with wireless LAN controllers is a key challenge affecting the industry growth.

- Wireless LAN Controllers have gained significant traction In the US market due to increasing digitization and urbanization, leading to the proliferation of Internet of Things (IoT) devices, consumer electronics, and media-intensive devices. These controllers offer centralized management of network infrastructure, enabling IT teams to efficiently manage bandwidth, ensure high-bandwidth and low latency for business-critical applications, and optimize operational costs. Access point protocols, such as 802.11ac Wave 2, ensure seamless connectivity for smartphones, tablets, laptops, and smart devices in various business settings, including enterprise mobility and remote work. Cloud-managed wireless networks have emerged as a cost-effective alternative to traditional Wi-Fi architectures, offering easy deployment, maintenance, and scalability. Cloud service providers offer security functionalities, including firewalls, routers, and managed switches, to mitigate risks associated with wireless networks.

- Moreover, SMEs and SOHOs can benefit from cloud-managed WLAN solutions, while large enterprises require centralized, distributed, or meshed networks for managing thousands of access points. Wi-Fi standards, such as 802.11ax (Wi-Fi 6), offer improved performance, security, and efficiency, making them suitable for bandwidth-intensive applications, such as video conferencing, augmented reality, and 4G & 5G technologies. Network management solutions provide IT teams with tools to monitor, troubleshoot, and optimize network performance, ensuring employee productivity and digital platforms' seamless operation. Despite the security threats, such as denial of service attacks, spoofing, and session hijacking, wireless LAN controllers continue to be an essential component of network infrastructure for businesses and service providers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wireless LAN controller market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALE International

- Allied Telesis Holdings KK

- Avaya LLC

- Belden Inc.

- Cisco Systems Inc.

- CommScope Holding Co. Inc.

- D Link Corp.

- Dell Technologies Inc.

- Extreme Networks Inc.

- Fortinet Inc.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co. Ltd.

- Juniper Networks Inc.

- LANCOM Systems GmbH

- Netgear Inc.

- Samsung Electronics Co. Ltd.

- ZTE Corp.

- Zyxel Communications Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The wireless Local Area Network (WLAN) controller market encompasses a range of solutions that enable organizations to manage and provide wireless connectivity to various devices. These solutions offer flexibility and scalability, allowing businesses to support an increasing number of connected devices and applications. WLAN controllers come in various forms, including standalone, integrated, and cloud-based options. Standalone controllers are physical devices that manage wireless access points (APs) within a local network. Integrated controllers, on the other hand, are built into access points or other network infrastructure components. Cloud-based controllers, as the name suggests, are managed through the cloud, allowing for centralized management of wireless networks from anywhere. WLAN controllers cater to diverse business needs, from small offices and home offices (SOHO) to large enterprises. They support a wide range of devices, from laptops and tablets to media-intensive devices and smartphones. The proliferation of the Internet of Things (IoT) and digitization has led to an increased demand for wireless connectivity, making WLAN controllers an essential component of modern business infrastructure.

Moreover, the market dynamics of the WLAN controller market are driven by various factors. The growing need for high-bandwidth, low-latency connectivity for business-critical applications is a significant factor. Traditional Wi-Fi architectures are being replaced by cloud-managed wireless networks, which offer easier deployment, lower operational costs, and improved security functionalities. Hardware procurement and maintenance costs are important considerations for businesses when choosing a WLAN controller solution. Smart controllers, which use machine learning and artificial intelligence to optimize network performance, are gaining popularity due to their ability to reduce operational costs and improve employee productivity. Security is another critical factor In the WLAN controller market. With the increasing number of connected devices and the growing threat of cyber attacks, businesses require strong security functionalities to protect their networks. WLAN controllers offer various security features, including firewalls, routers, and managed switches, to help businesses secure their wireless networks. The WLAN controller market is also influenced by the ongoing digitization and urbanization trends.

Thus, the need for reliable wireless connectivity in various business settings, such as healthcare, manufacturing, transportation and logistics, enterprise mobility, and large campuses, is driving demand for advanced WLAN controller solutions. In summary, the WLAN controller market is a dynamic and evolving landscape, driven by the growing demand for wireless connectivity and the need for high-performance, secure, and cost-effective solutions. WLAN controllers cater to diverse business needs, from small offices to large enterprises, and support a wide range of devices and applications. The market is influenced by various factors, including the need for high-bandwidth, low-latency connectivity, security, and operational costs.

|

Wireless LAN Controller Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 533.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, UK, China, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wireless LAN Controller Market Research and Growth Report?

- CAGR of the Wireless industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wireless LAN controller market growth of industry companies

We can help! Our analysts can customize this wireless LAN controller market research report to meet your requirements.