Wi-Fi Hotspot Market Size 2024-2028

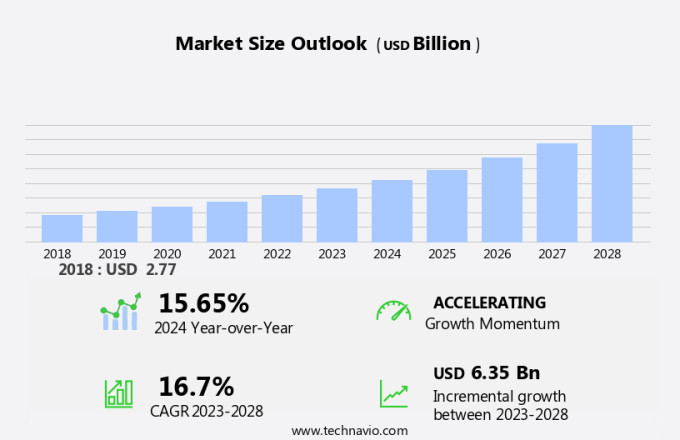

The Wi-Fi hotspot market size is forecast to increase by USD 6.35 billion at a CAGR of 16.7% between 2023 and 2028. In the dynamic telecom environment, the demand for wireless connectivity continues to grow as the number of wireless devices increases. Wireless hotspot controllers and gateways play a crucial role in managing and securing Wi-Fi networks, especially with the rise of cloud applications and the Internet of Things (IoT). The market is witnessing several trends, including the development of smart cities and the increasing deployment of public Wi-Fi hotspots. In-Car Wi-Fi is also gaining traction, enabling seamless connectivity for passengers and enhancing the in-vehicle entertainment experience.

However, these trends also bring challenges, such as rising security threats associated with Wi-Fi-enabled devices. Equipment manufacturers and large enterprises are investing in consulting services to address these challenges and ensure their wireless networks are secure and reliable. This market analysis report provides an in-depth analysis of the growth factors, trends, and challenges shaping the wireless hotspot market.

What will be the Wi-Fi Hotspot Market Size During the Forecast Period?

Wi-Fi hotspots have emerged as essential infrastructure for providing wireless connectivity to a multitude of devices, including laptops, tablets, and mobile phones. This infrastructure is increasingly being adopted in various public locations, such as libraries, airports, hotels, cafes, and large enterprises, to offer communication and entertainment services to users in a cost-effective manner. The proliferation of wireless technology has led to a growth in the deployment of Wi-Fi hotspots. These hotspots enable users to access the internet and various mobility applications seamlessly, making them indispensable in today's digital world.

Moreover, wireless devices, including laptops and tablets, have become the primary tools for both personal and professional use, necessitating the availability of reliable and secure Wi-Fi connections. Wi-Fi hotspots have revolutionized the way we communicate and access information. In public locations, Wi-Fi hotspots provide a convenient means for users to stay connected while on the go. For instance, in libraries, Wi-Fi hotspots enable students and researchers to access digital resources and collaborate with their peers. Similarly, in airports, Wi-Fi hotspots offer travelers the ability to check emails, browse the web, and stream media content while waiting for their flights. Hotels and cafes have also recognized the importance of Wi-Fi hotspots in providing a superior customer experience.

However, by offering free or paid Wi-Fi services, these establishments can attract and retain customers, thereby enhancing their brand reputation and revenue. Large enterprises and Small and Medium-sized Enterprises (SMEs) also benefit from Wi-Fi hotspots by enabling their employees to work remotely and collaborate effectively. Wi-Fi hotspots offer several advantages over traditional wired connections. They provide flexibility, as users can connect their devices from anywhere within the hotspot's range. Moreover, Wi-Fi hotspots offer improved security features, such as WPA2 encryption, to protect user data from unauthorized access. With the advent of Wi-Fi through the cloud, users can easily manage their Wi-Fi networks and monitor usage patterns, ensuring optimal performance and cost savings.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- IT and telecom

- Financial services

- Education

- Healthcare

- Others

- Component

- Wireless hotspot gateways

- Wireless hotspot controllers

- Mobile hotspot devices

- Geography

- North America

- Canada

- US

- APAC

- China

- Japan

- Europe

- Germany

- South America

- Middle East and Africa

- North America

By Application Insights

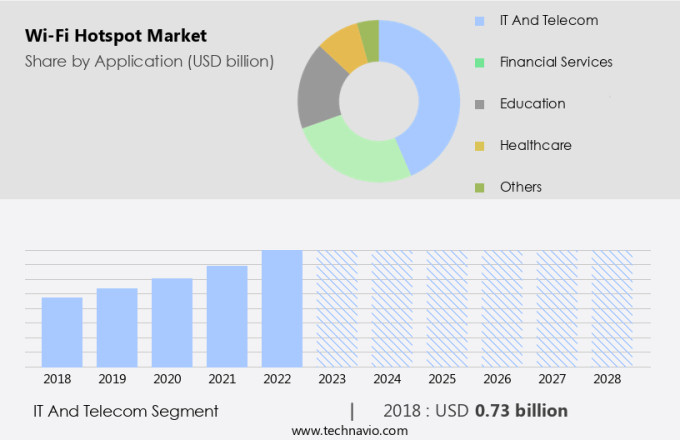

The IT and telecom segment is estimated to witness significant growth during the forecast period. The market caters to the increasing demand for seamless connectivity, particularly in the IT and telecom sector. The proliferation of mobile devices such as cell phones, tablets, and laptops has led to an escalating need for Wi-Fi technology to access data, communicate, and collaborate remotely. Airports and cafes are common hotspots for Wi-Fi usage, offering advanced features like advertising, captive portal solutions, and content filtering to enhance user experience.

Carrier Wi-Fi and authorized interception further ensure secure and reliable connectivity. Citizen involvement and authentication processes are crucial aspects of the market, ensuring secure and efficient access to Wi-Fi networks.

Get a glance at the market share of various segments Request Free Sample

The IT and telecom segment was valued at USD 0.73 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

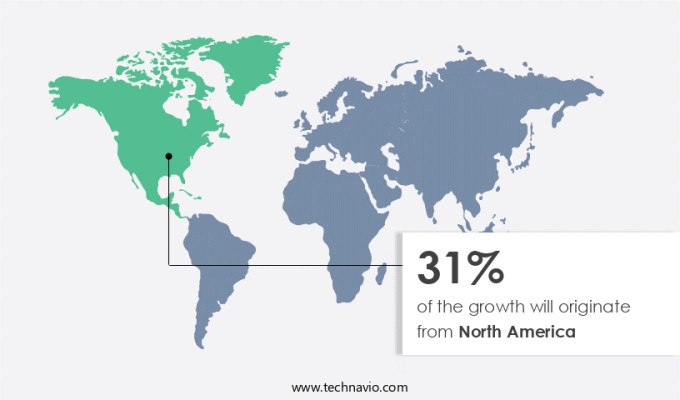

North America is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market has witnessed notable expansion in recent times, fueled by various factors that boost the demand for Wi-Fi hotspots in the region. Given the population's heavy dependence on technology and connectivity, Wi-Fi hotspots have become indispensable for both individuals and businesses. One of the primary catalysts for the growth of the North American market is the increasing prevalence of smartphones and other mobile devices. In North America, the US held the highest smartphone penetration rate in 2021.

Moreover, the penetration of the internet and the rise of public services and smart cities have further fueled the demand for Wi-Fi hotspots. Network operators have responded by deploying Wi-Fi hotspots in public locations such as airports, parks, and libraries to cater to the increasing demand for seamless network connectivity. Additionally, the retail industry has embraced Wi-Fi hotspots to enhance the shopping experience for customers and improve operational efficiency. The adoption of smart home appliances and tablets has also contributed to the market's growth.

Furthermore, regulatory compliance has become a crucial consideration for network operators in the North American market. Ensuring network performance and security in public locations and maintaining regulatory compliance are essential to attracting and retaining customers. As Wi-Fi hotspots become increasingly ubiquitous, their role in enabling remote work and supporting smart cities will continue to expand. In conclusion, the North American market is poised for continued growth, driven by the widespread adoption of smartphones, the penetration of the internet, and the increasing demand for public Wi-Fi hotspots in various industries. Network operators must prioritize network performance, regulatory compliance, and customer experience to remain competitive in this dynamic market.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increase in development of smart cities is the key driver of the market. In the modern era of technological advancement, the market holds significant importance, particularly in the context of the telecom and IT sectors. Telecom operators are increasingly investing in tailored services to cater to the needs of underprivileged communities and urban infrastructure development. The proliferation of Wi-Fi hotspots has become an integral part of this transformation, offering value-added services to consumers in various sectors. The advent of 5G technology and the Internet of Things (IoT) has expanded the scope of Wi-Fi infrastructure, enabling smart city applications. These applications demand a strong wireless network to handle complex outdoor environments and deliver essential services such as safety and security, education, waste and water management, traffic management, infrastructure management, and healthcare.

Moreover, Wi-Fi Technology plays a crucial role in enabling these applications, offering seamless connectivity to a multitude of smart devices and sensors. Moreover, Wi-Fi security software is essential to ensure data privacy and protection. The market is poised for growth, with the increasing adoption of wearables and other IoT devices. Government organizations and city planners recognize the potential of Wi-Fi hotspots in creating connected cities and improving the quality of life for citizens. As the world moves towards a more digitally connected future, the demand for reliable and secure Wi-Fi networks will only continue to grow.

Market Trends

The increasing number of public Wi-Fi hotspots is the upcoming trend in the market. Public Wi-Fi hotspots have become essential in today's digital world, providing Internet access in various public spaces such as airports, cafes, hotels, shopping malls, parks, and transportation hubs. The proliferation of mobile devices and the constant need to stay connected have fueled the demand for Wi-Fi access outside homes and offices. The expansion of public Wi-Fi hotspots goes beyond traditional locations, with smart city initiatives and municipal governments investing to enhance urban connectivity. To cater to this growing demand, market solutions have emerged, offering managed services, mobile hotspot devices, and mobility applications. Network performance and security are critical considerations in these solutions, with Wi-Fi security software and wireless hotspot controllers ensuring secure and reliable connections.

Moreover, professional services are available to help organizations deploy, manage, and optimize their Wi-Fi networks. The market continues to evolve, with innovative solutions such as Wi-Fi through cloud offering scalability and flexibility. As the need for seamless and secure Wi-Fi access continues to grow, the market is poised for significant expansion.

Market Challenge

The rising security threats associated with Wi-Fi-enabled devices is a key challenge affecting the market growth. In today's digital age, wireless connectivity has become essential for various wireless devices, from smartphones to laptops and IoT gadgets. With the proliferation of cloud applications and connected devices, ensuring secure wireless access is paramount. However, Wi-Fi hotspots, particularly public ones, pose potential security risks due to their open nature. Wi-Fi hotspot controllers and gateways play a crucial role in managing and securing wireless networks. These solutions offer encryption, access control, and other security features to mitigate cyber threats. Equipped with the latest wireless technology like WLAN, these devices ensure seamless and secure wireless connectivity. The dynamic telecom environment necessitates the need for consulting services to help organizations navigate the complexities of implementing and managing Wi-Fi hotspots.

However, equipment manufacturers continue to innovate, offering advanced security features to meet the growing demand for secure wireless connectivity. As privacy concerns escalate, prioritizing security in Wi-Fi hotspots is essential. The IoT's expansion increases the number of connected devices, making strong security measures a necessity. By implementing high-security features, organizations can protect their cloud information and maintain the integrity of their systems.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AT and T Inc.: The company offers Wi Fi hotspot such as AT and T United Express 2.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALE International

- Boingo Wireless Inc.

- Casa Systems Inc.

- Cisco Systems Inc.

- Cloud4Wi Inc.

- CommScope Holding Co. Inc.

- D Link Corp.

- Enea AB

- EnGenius Technologies Inc.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co. Ltd.

- Netgear Inc.

- Nokia Corp.

- Sierra Wireless Inc.

- Superloop Ltd.

- Syntegra Services

- Telefonaktiebolaget LM Ericsson

- Telstra Corp. Ltd.

- ZTE Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing demand for high-speed internet access in various industry verticals. Advanced features such as content filtering, data retention, and network management software are driving the adoption of Wi-Fi hotspots in public locations like airports, cafes, and high-traffic venues. The hospitality industry and education sector are also investing in Wi-Fi hotspots to enhance the user experience and support remote work and enterprise mobility. The competitive structure of the market is dynamic, with network operators and telecom companies offering carrier Wi-Fi services, while equipment manufacturers provide Wi-Fi hotspot devices and wireless technology solutions.

Further, the market is also witnessing the emergence of captive portal solutions, advertising opportunities, and value-added services to monetize the Wi-Fi hotspot infrastructure. The penetration of the Internet in developing economies and the digital transformation of industries like financial services and retail are expected to fuel the growth of the market. However, concerns around data theft, hacking attempts, and regulatory compliance are creating a need for Wi-Fi security software and authentication processes. The future estimations suggest that the market will continue to expand as the number of mobile subscribers and mobile devices increases. The Internet of Things (IoT) and connected devices are also expected to contribute to the growth of the market, with smart cities, smart home appliances, and wearables requiring wireless connectivity.

Furthermore, the market is a growing and dynamic industry, driven by the need for high-speed internet access and advanced features in various industry verticals. The market is competitive, with network operators, telecom companies, and equipment manufacturers offering a range of Wi-Fi hotspot solutions, consulting services, and managed services to meet the evolving needs of businesses and consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.7% |

|

Market growth 2024-2028 |

USD 6.35 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.65 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 31% |

|

Key countries |

US, Canada, China, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ALE International, AT and T Inc., Boingo Wireless Inc., Casa Systems Inc., Cisco Systems Inc., Cloud4Wi Inc., CommScope Holding Co. Inc., D Link Corp., Enea AB, EnGenius Technologies Inc., Hewlett Packard Enterprise Co., Huawei Technologies Co. Ltd., Netgear Inc., Nokia Corp., Sierra Wireless Inc., Superloop Ltd., Syntegra Services, Telefonaktiebolaget LM Ericsson, Telstra Corp. Ltd., and ZTE Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch