Wood-Plastic Composites Market Size 2024-2028

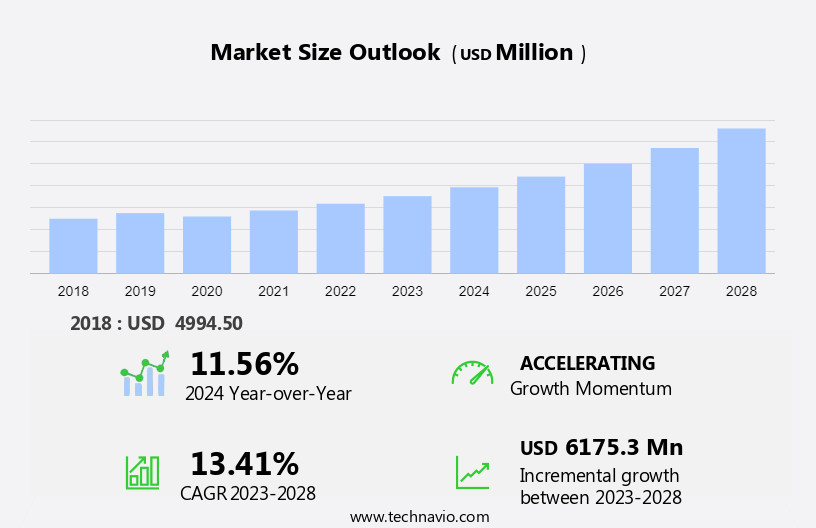

The wood-plastic composites market size is forecast to increase by USD 6.18 billion at a CAGR of 13.41% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. One major factor driving market expansion is the increasing need for compliance with regulations, particularly those related to the use of sustainable materials (green building) in construction and manufacturing. As hardwood prices continue to rise, the cost-effective and eco-friendly nature of wood-plastic composites makes them an attractive alternative.

- Additionally, quality assurance and consumer perception are becoming increasingly important In the industry. Manufacturers are focusing on improving product durability and enhancing the overall consumer experience to boost sales. These trends are shaping the future of the market and are expected to continue influencing its growth In the coming years.

What will be the Size of the Wood-Plastic Composites Market During the Forecast Period?

- The wood-plastic composite (WPC) market encompasses the production and application of materials that combine the natural beauty and aesthetic appeal of wood with the practical properties and durability of plastic. This market has gained significant traction due to its ability to reduce carbon footprint and contribute to environmental sustainability. WPCs offer numerous benefits, including flexibility, weather resistance, and mechanical strength, making them suitable for various applications, such as building structures, temporary installations, underwater structures, bridges, and roofs. These composites exhibit excellent biodegradability, using plant-based fibers and biodegradable polymers, while maintaining low density and low CO2 emission. WPCs are also known for their comfortable and beautiful appearance, as well as their longevity and stiffness.

- In the automotive industry, WPCs have been adopted for their lightweight properties and acoustic performance, contributing to the production of more eco-friendly vehicles. Overall, the WPC market is experiencing steady growth, driven by the increasing demand for sustainable and durable materials in various industries.

How is this Wood-Plastic Composites Industry segmented and which is the largest segment?

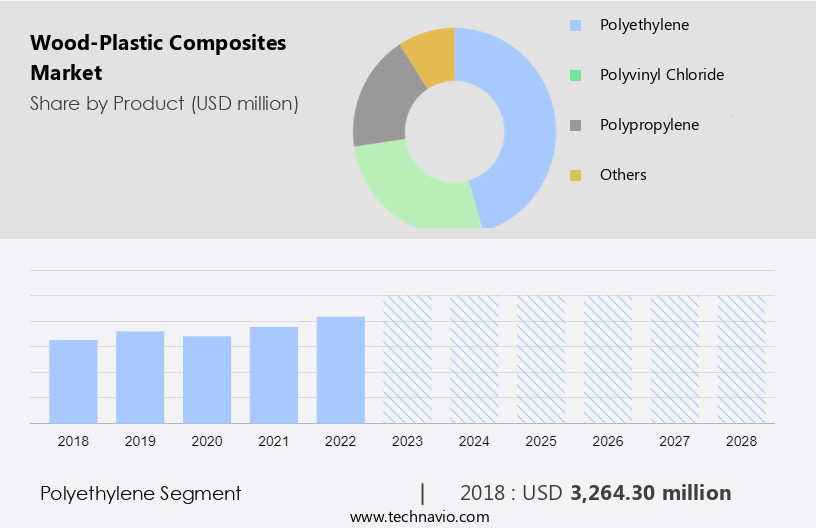

The wood-plastic composites industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Polyethylene

- Polyvinyl chloride

- Polypropylene

- Others

- End-user

- Building and construction

- Automotive

- Industrial and consumer goods

- Others

- Geography

- North America

- US

- APAC

- China

- India

- Europe

- Germany

- France

- Middle East and Africa

- South America

- North America

By Product Insights

The polyethylene segment is estimated to witness significant growth during the forecast period. Wood-Plastic Composites (WPCs), made from the combination of wood fibers and thermoplastic polymers such as polyethylene (PE), offer desirable physical and aesthetic properties for various applications. PE WPCs, specifically, provide superior strength, structural hardness, and water resistance due to the unique molecular arrangement of PE and wood fibers. These properties make PE WPCs ideal for use in building structures, temporary installations, underwater structures, bridges, roofs, terraces, paths, garden products, and consumer goods. The increasing demand for sustainable, eco-friendly materials in industries like automotive and construction is driving the growth of the PE WPC market. PE WPCs offer several advantages, including durability, longevity, flexibility, and weather resistance.

Additionally, they are biodegradable, made from plant-based fibers, and have low CO2 emission. PE WPCs are used in diverse applications, such as furniture, door panels, seat cushions, cabin linings, backrests, dashboards, and flooring solutions. The market for PE WPCs is expected to grow significantly due to their high demand, mechanical strength, acoustic performance, and material weight advantages. The production cost, fuel consumption, and protective coatings (like water-resistant coatings) are factors influencing the market growth. PE WPCs offer a solution for reducing the carbon footprint and meeting environmental regulations while maintaining the desired properties for various applications.

Get a glance at the market report of various segments Request Free Sample

The Polyethylene segment was valued at USD 3.26 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Wood-Plastic Composites (WPC) market in North America is experiencing notable growth due to increasing demand from the automotive and construction industries. The US, being a significant market for automotive manufacturers in North America and a leading country in automotive technology, is a major contributor to this growth. With a large consumer base and high disposable income, the US drives the sales of automobiles, necessitating automotive OEMs to expand their production capabilities. In the construction sector, WPCs offer physical, aesthetic, and practical properties, including durability, longevity, flexibility, weather resistance, and biodegradability. These composites are used in various applications, including building structures, temporary installations, underwater structures, bridges, rooftops, terraces, paths, garden products, and consumer goods.

WPCs are made from plant-based fibers and biodegradable polymers, ensuring low density and CO2 emission. Manufacturers like Advanced Environmental Recycling Technologies, Trex Company, Fiberon, and The AZEK Company produce WPCs for diverse applications. WPCs offer mechanical strength, acoustic performance, and material weight advantages, making them a sustainable green material in various industries. Despite their benefits, WPCs may crack, fade, or warp under extreme conditions, necessitating protective products. The market growth is influenced by factors such as material weight, production cost, fuel consumption, passenger safety, and shatterproof performance. WPCs are used in furniture, door panels, seat cushions, cabin linings, backrests, dashboards, and flooring solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Wood-Plastic Composites Industry?

- Need for compliance with regulations is the key driver of the market.Wood-Plastic Composites (WPCs) are gaining popularity as a sustainable green material in various industries due to their desirable physical and aesthetic properties. However, the environmental concern regarding their carbon footprint is a significant challenge. To address this issue, researchers are focusing on producing WPCs from recycled raw materials, reducing the need for virgin materials and decreasing the overall carbon footprint. The production of WPCs involves the use of biodegradable polymers, plant-based fibers, and additives. These materials offer durability, longevity, flexibility, weather resistance, and biodegradability, making them suitable for various applications, including building structures, temporary installations, underwater structures, bridges, rooftops, terraces, paths, garden products, and consumer goods.

Despite their advantages, WPCs have a higher production cost compared to traditional materials. However, the potential benefits in terms of mechanical strength, acoustic performance, and material weight make up for the additional cost. Furthermore, the use of WPCs in passenger safety applications, such as shatterproof performance and extreme temperature changes, is a growing trend In the automotive industry. The disposal phase of WPCs is an essential consideration In their lifecycle assessment. Energy recovery from combustion is a common method for disposal. Overall, WPCs offer a promising solution for reducing the carbon footprint in various industries while maintaining the required practical and aesthetic properties.

What are the market trends shaping the Wood-Plastic Composites market?

- Increasing prices of hardwood is the upcoming market trend.Wood-Plastic Composites (WPCs) have gained significant traction in various industries due to their eco-friendly production and superior physical and aesthetic properties. As the carbon footprint of traditional wood production becomes a concern, WPCs offer a sustainable alternative. In the automotive sector, WPCs provide durability, longevity, and flexibility, making them ideal for producing comfortable and beautiful car components, such as door panels, seat cushions, and cabin linings. Moreover, WPCs exhibit weather resistance, making them suitable for use in building structures, temporary installations, underwater structures, bridges, rooftops, terraces, paths, and garden products. Their mechanical strength, acoustic performance, and biodegradability add to their appeal.

The use of plant-based fibers and biodegradable polymers in WPC production reduces the reliance on toxic chemicals, contributing to their eco-friendliness. WPCs also offer low density and low CO2 emission, making them a preferred choice for those seeking sustainable green materials. Despite their benefits, WPCs face challenges, such as potential cracking, fading, and warping. However, protective products and water-resistant coatings mitigate these issues. The high demand for WPCs is driven by their versatility, as they are used in various applications, from consumer goods to building and construction. The market for WPCs is expected to grow due to their superior properties, such as shatterproof performance, extreme temperature changes resistance, and compatibility with polyethylene and polyvinyl chloride thermoplastics.

Additionally, WPCs offer fuel consumption savings, as they require less energy in production compared to traditional wood. In summary, WPCs offer a sustainable and cost-effective alternative to traditional wood, with numerous applications across various industries. Their eco-friendly production, durability, and versatility make them a preferred choice for those seeking a high-performance, low-maintenance material.

What challenges does the Wood-Plastic Composites Industry face during its growth?

- Quality assurance and consumer perception is a key challenge affecting the industry growth.The wood plastic composites (WPC) market presents a promising potential as a sustainable, eco-friendly alternative to traditional wood in various industries. WPCs offer several advantages, including durability, longevity, flexibility, and weather resistance. However, consumer perception poses a challenge to the market's growth. Although WPCs have superior physical and practical properties, such as mechanical strength, acoustic performance, and biodegradability, some consumers may perceive them as counterfeit wood. This perception, coupled with the higher production cost and potential use of toxic chemicals, may deter the market's expansion. Moreover, the use of plant-based fibers and biodegradable polymers in WPC production aligns with the growing trend towards reducing carbon footprint and minimizing the use of non-renewable resources.

Despite these challenges, the demand for WPCs in building structures, temporary installations, underwater structures, bridges, roofs, terraces, paths, garden products, and consumer goods continues to increase. WPCs are used extensively In the production of automobiles, furniture, door panels, seat cushions, cabin linings, backrests, dashboards, and various flooring solutions. WPCs offer shatterproof performance, extreme temperature changes resistance, and low density, making them an attractive option for various applications. However, issues such as cracking, fading, and warping may arise, necessitating the use of protective products and regular maintenance. Water-resistant coatings and polyvinylchloride thermoplastics are commonly used to enhance the durability and longevity of WPCs. Overall, the WPC market's growth is driven by its potential as a sustainable green material, offering durability, practicality, and aesthetic appeal while minimizing the use of toxic chemicals and reducing carbon emissions.

Exclusive Customer Landscape

The wood-plastic composites market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wood-plastic composites market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wood-plastic composites market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AIMPLAS - Wood-Plastic Composites (WPC) market growth is driven by the increasing demand for sustainable and durable materials in various industries, including construction, automotive, and consumer goods. WPCs offer several advantages, such as improved strength, resistance to weathering, and reduced maintenance requirements compared to traditional materials.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AIMPLAS

- Axion Structural Innovations LLC

- Beologic N.V.

- Cargill Inc.

- Compagnie de Saint Gobain

- CRH Plc

- Dow Chemical Co.

- Fkur Kunststoff GmbH

- Fortune Brands Innovations Inc.

- Guangzhou Kindwood Co. Ltd.

- Hardy Smith Designs Pvt. Ltd.

- JELU WERK J. Ehrler GmbH and Co. KG

- Meghmani Organics Ltd.

- PolyPlank AB

- RENOLIT SE

- Shanghai Seven Trust Industry Co. Ltd.

- The AZEK Co. Inc.

- Trex Co. Inc.

- TVL Engineers Pvt. Ltd.

- UFP Industries Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Wood-plastic composites (WPC) have emerged as a promising alternative to traditional building and construction materials, offering a unique blend of physical and aesthetic properties. This material, which combines the natural beauty of wood with the durability and practical benefits of plastic, has gained significant traction in various industries due to its sustainability and eco-friendliness. The production of WPC involves the use of plant-based fibers, such as wood flour or sawdust, and biodegradable polymers. The result is a material that boasts high mechanical strength, stiffness, and longevity, making it an ideal choice for a wide range of applications. WPC's practical properties make it a popular option for use in building structures, temporary installations, underwater structures, bridges, and roofs.

Its durability and resistance to weathering, cracking, fading, and warping make it an excellent alternative to traditional materials like wood and concrete. Moreover, WPC's flexibility and compatibility with various coatings, such as water-resistant coatings, enhance its versatility. It can be used in various applications, from garden products to furniture, flooring solutions, and even In the automotive industry for door panels, seat cushions, cabin linings, backrests, and dashboards. Despite its numerous advantages, WPC production involves the use of some toxic chemicals. However, the industry is continuously striving to develop more sustainable and eco-friendly production methods. For instance, the use of low-density WPC and biodegradable polymers can help reduce the carbon footprint of this material.

The demand for WPC is on the rise due to its potential as a sustainable green material. Its low CO2 emission, shatterproof performance, and extreme temperature changes resistance make it an attractive alternative to traditional materials. Additionally, its acoustic performance and material weight make it an excellent choice for various applications, including consumer goods and industrial applications. However, the production cost and fuel consumption associated with WPC production remain challenges for the industry. Continuous research and development efforts are being made to address these challenges and make WPC a more cost-effective and sustainable option for businesses and consumers alike.

In conclusion, WPC is a versatile and sustainable material that offers numerous benefits, including durability, longevity, and eco-friendliness. Its potential applications are vast, ranging from building and construction to consumer goods and automotive industries. Despite some challenges, the future of WPC looks bright, with continuous research and development efforts aimed at making it a more cost-effective and sustainable option for businesses and consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.41% |

|

Market growth 2024-2028 |

USD 6175.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.56 |

|

Key countries |

US, China, Germany, France, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wood-Plastic Composites Market Research and Growth Report?

- CAGR of the Wood-Plastic Composites industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wood-plastic composites market growth of industry companies

We can help! Our analysts can customize this wood-plastic composites market research report to meet your requirements.