Workspace Aggregator Market Size 2024-2028

The workspace aggregator market size is forecast to increase by USD 2.13 billion at a CAGR of 10.92% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing number of startups and small businesses is driving the demand for flexible and cost-effective workspace solutions. Additionally, the need for optimized space planning and utilization is becoming increasingly important for businesses to reduce overhead costs and improve productivity. Furthermore, integrated solutions that combine the Internet of Things (IoT), Artificial Intelligence (AI), and digital work environments are gaining popularity in modern workplaces, enhancing flexibility, productivity, and teamwork. However, a lack of adequate technological skill sets among businesses can hinder the adoption of advanced workspace aggregator solutions. This market analysis report provides an in-depth examination of these trends and their impact on the market. It also offers insights into potential challenges and opportunities for market participants. By staying informed of these trends and factors, businesses can make informed decisions and capitalize on the growing demand for workspace aggregator services.

What will be the Size of the Workspace Aggregator Market During the Forecast Period?

- The market encompasses a range of solutions that integrate and manage various digital resources, including IoT devices, AI applications, cloud-based and on-premise IT and telecom systems, and digital work environments. These solutions provide users with centralized access to corporate resources such as virtual desktops, web and client applications, and mobile apps. The market is experiencing significant growth as modern workplaces increasingly adopt integrated solutions for improved accessibility, user experience, and location independence. Key trends In the market include the integration of healthcare systems, the use of operating systems and centralized platforms, and the adoption of virtual desktops and cloud services.

- Additionally, the market is seeing increased focus on user experience and location-agnostic access to digital resources through web browsers, client apps, and mobile apps. Overall, the market is a dynamic and evolving landscape that is essential for enterprises seeking to optimize their digital environments and enhance productivity.

How is this Workspace Aggregator Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- Cloud-based

- On-premise

- End-user

- Retail

- IT and telecom

- Healthcare

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Deployment Insights

- The cloud-based segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the cloud-based segment due to the increasing adoption of cloud services among Small and Medium Enterprises (SMEs) and the expansion of cloud services in developing regions. Cloud technology enables workspace aggregators to store, share files, and manage user data, ensuring scalability and accessibility from any device. It also facilitates quick application development and deployment within existing software infrastructure for business organizations. Workspace aggregators offer a centralized platform for digital resources, including virtual desktops, on-premises software, cloud-based apps, communication tools, and on-demand meeting rooms.

These all-inclusive solutions provide user-friendly experiences, context-related safety functions, and value-added benefits, such as hyper-personalization, workspace recommendations, and frictionless integration. Additionally, the integration of financial statements, talent platforms, and physical workspace options caters to the needs of a hybrid workforce, including co-working memberships and virtual workspaces. The market's strengths include agility, mobility, and enterprises' growing need for seamless convergence of IT and telecom, healthcare, and other functional areas. However, challenges include IT security concerns, endpoint management, and the potential impact of shadow IT on computer environments. Platform-as-a-Service, digital workstations, and streaming web apps are key areas of innovation In the market.

Get a glance at the Workspace Aggregator Industry report of share of various segments Request Free Sample

The cloud-based segment was valued at USD 1.35 bn in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

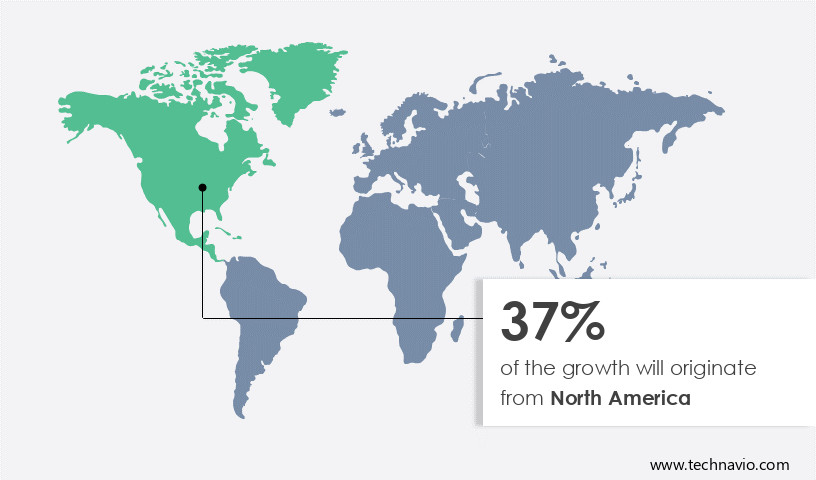

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is currently leading in terms of revenue share due to the high adoption rate among small and medium-sized enterprises (SMEs) seeking flexible workspaces for their operations. The region's growth is driven by the increasing demand for co-working spaces, urbanization, and the proliferation of startups. With nearly 40% of the US workforce expected to consist of freelancers, independent contractors, and solopreneurs by 2020, the preference for affordable and flexible workspaces continues to rise. Workspace aggregators offer integrated solutions, including IoT, AI, cloud-based, on-premise, IT, telecom, healthcare, and digital work environments, providing modern workplaces with devices, applications, accessibility, and user experience.

Furthermore, these all-inclusive solutions offer scalability, integration capabilities, and value-added benefits, such as workspace recommendations, frictionless integration, and context-related safety functions. Workspace aggregators provide a centralized platform for digital resources, virtual desktops, on-premises software, cloud-based apps, communication tools, and convergence, enabling flexibility, productivity, teamwork, and organizational agility. Workspace aggregators offer a portal-like user experience, functional areas, application delivery, and company data management, making them an essential tool for modern enterprises.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Workspace Aggregator Industry?

An increasing number of startups and the adoption of co-working is the key driver of the market.

- Workspace aggregators are revolutionizing modern workplaces by providing integrated solutions that cater to the evolving needs of businesses, particularly startups. These cloud-based and on-premise platforms offer a centralized platform for managing digital resources, including virtual desktops, on-premises software, and cloud-based apps. The convergence of IoT, AI, and telecom technologies enables user-friendly digital work environments that enhance accessibility and improve user experience. Workspace aggregators offer flexibility and productivity tools for teamwork, communication, and organization scalability. Their integration capabilities enable the seamless use of communication tools, calendars, and collaboration platforms, while also supporting physical workspace options such as co-working memberships, virtual workspaces, and on-demand meeting rooms.

- Moreover, workspace aggregators provide value-added benefits like workspace recommendations, frictionless integration, and context-related safety functions, ensuring optimum usability and value for businesses. They offer strengths in areas such as application delivery, IT security, and endpoint management, making them a vital component of IT architecture for enterprises. Innovative workspace aggregators provide all-inclusive solutions that cater to various functional areas, including finance, HR, and marketing. They offer hyper-personalization, allowing users to customize their digital workstations with streaming web apps, desktops, and agility and mobility features. By offering a portal-like user experience, these platforms enable easy configuration and portability, making them an essential business strategy for organizations with hybrid workforces.

What are the market trends shaping the Workspace Aggregator Industry?

Increased need for optimized space planning is the upcoming market trend.

- Workspace aggregators are essential tools for organizations seeking to optimize their physical and digital work environments. These solutions integrate IoT sensors, AI, and cloud-based or on-premise IT and telecom infrastructure to create digital workspaces that enhance accessibility, user experience, and productivity. With the rise of modern workplaces, the need for integrated solutions that support various devices, applications, and communication tools has become crucial. Workspace aggregators offer centralized platforms for managing digital resources, including virtual desktops, on-premises software, and cloud-based apps. They enable flexibility and teamwork by providing converged communication platforms, calendars, and on-demand meeting rooms. Additionally, they offer strengths such as scalability, integration capabilities, and all-inclusive solutions that cater to the needs of hybrid workforces.

- Moreover, workspace aggregators facilitate the use of co-working memberships, virtual workspaces, and talent platforms. They provide value-added benefits, such as context-related safety functions and optimum usability, ensuring a frictionless user experience. Lenovo Software's mobile working solutions, for instance, enable employees to access company data and work tools from any device, operating system, or location. By integrating with various devices, operating systems, and applications, workspace aggregators provide a strong and agile solution for enterprises.

What challenges does the Workspace Aggregator Industry face during its growth?

Lack of adequate technological skill sets is a key challenge affecting the industry growth.

- The market is experiencing growth as organizations seek to optimize their digital work environments for modern workplaces. IoT, AI, and cloud-based technologies are driving the convergence of IT and telecom, healthcare, and other industries towards integrated solutions. Workspace aggregators offer centralized platforms for managing digital resources, including virtual desktops, on-premises software, and cloud-based apps. However, the adoption of workspace aggregators faces challenges. End-users require adequate training to effectively use advanced features, such as AI and analytics, which some companies provide. The lack of proper training and funding for recruiting trained professionals can hinder the adoption of these solutions.

- Additionally, the complexity of integrating various devices, applications, and communication tools can pose challenges for organizations. Despite these challenges, the benefits of workspace aggregators are significant. They offer flexibility, productivity, teamwork, and scalability, making them essential for organizations seeking to manage their digital workspaces effectively. Workspace aggregators provide all-inclusive solutions, including Hyper-Personalization, workspace recommendations, and Frictionless Integration, to enhance the user experience. They offer value-added benefits, such as context-related safety functions, optimum usability, and accessibility, making them a Cutting Edge business strategy for enterprises. Workspace aggregators support various functional areas, including Application Delivery, company data, and communication platforms.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, workspace aggregator market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- Amtel Systems Corp.

- AO Kaspersky Lab

- BlackBerry Ltd.

- Cisco Systems Inc.

- Citrix Systems Inc.

- FATbit Technologies

- Gartner Inc.

- Hewlett Packard Enterprise Co.

- International Business Machines Corp.

- Ivanti Software Inc.

- Juniper Networks Inc.

- KHIKA

- Microsoft Corp.

- Oracle Corp.

- SAP SE

- ServiceNow Inc.

- Sophos Ltd.

- Splunk Inc.

- VMware Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth as organizations seek to streamline their digital environments and enhance productivity. This market encompasses a range of solutions designed to integrate and manage various digital resources, including cloud-based and on-premises applications, virtual desktops, communication tools, and physical workspace options. These solutions offer numerous benefits to modern organizations. For instance, they provide a centralized platform for accessing all digital workspaces, enabling users to work from anywhere, at any time, using a variety of devices. The convergence of IT and telecom, healthcare, and other functional areas has led to an increased demand for integrated solutions that can support the diverse needs of today's workforce.

Moreover, the user experience is a critical consideration In the selection of workspace aggregator solutions. A portal-like user experience, coupled with strong APIs, allows for frictionless integration of work tools and applications. Additionally, context-related safety functions ensure optimum usability and value-added benefits for users. The flexibility of workspace aggregators is another significant advantage. They offer scalability and integration capabilities, making it easy for organizations to add or remove workspaces as needed. All-inclusive solutions provide access to digital resources, virtual workspaces, on-demand meeting rooms, talent platforms, and financial statements, among other features. Hyper-personalization is a key trend In the market, with solutions offering workspace recommendations based on user behavior and preferences.

Furthermore, this level of customization enhances productivity and engagement, making it easier for teams to collaborate and work effectively. The market is highly competitive, with many players offering cutting-edge solutions that cater to the unique needs of different industries and organizations. Operating systems, location, and corporate resources are just a few of the factors that influence the selection of a workspace aggregator. Cloud services, web browsers, client apps, and mobile apps are essential components of workspace aggregators, enabling users to access their digital workspaces from anywhere, using any device. Native applications and web applications offer additional functionality and customization options.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.92% |

|

Market Growth 2024-2028 |

USD 2.13 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.82 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Workspace Aggregator Market Research and Growth Report?

- CAGR of the Workspace Aggregator industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution to the industry in focus on the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the workspace aggregator market growth of industry companies

We can help! Our analysts can customize this workspace aggregator market research report to meet your requirements.