Business Travel Market Size 2025-2029

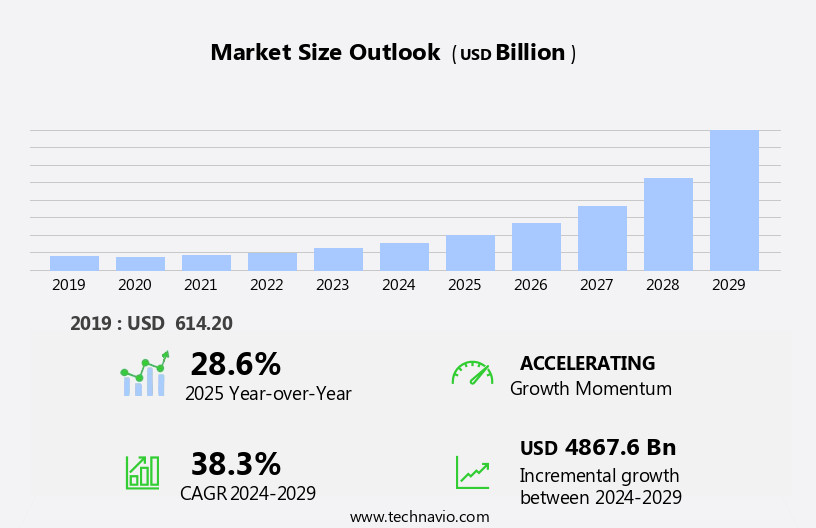

The business travel market size is forecast to increase by USD 4867.6 billion, at a CAGR of 38.3% between 2024 and 2029.

- The market is experiencing significant shifts, driven by the increasing adoption of advanced technologies and the evolving preferences of consumers. Technological innovations, such as online travel agencies and digital booking platforms, are revolutionizing the way businesses plan and manage their travel arrangements. This trend is further fueled by the growing popularity of online video conferencing platforms, enabling remote work and virtual meetings, thereby reducing the need for extensive business travel. Meanwhile, challenges persist in the form of data security concerns and complex travel policies. With the rise of digital booking platforms, ensuring secure transactions and protecting sensitive business data becomes paramount.

- Additionally, managing complex travel policies across diverse teams and locations can be a daunting task, requiring robust solutions to streamline the process and maintain compliance. Companies seeking to capitalize on the opportunities presented by the evolving business travel landscape must focus on addressing these challenges effectively, while leveraging technology to enhance travel management efficiency and productivity.

What will be the Size of the Business Travel Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping the landscape across various sectors. Premium economy travel and loyalty programs are increasingly popular, offering enhanced comfort and rewards for frequent business travelers. Flight booking and travel procurement platforms streamline the process, while travel agent services provide expert assistance. Eco-friendly travel options gain traction, aligning with sustainability initiatives. Travel reporting and analytics enable effective business travel management, ensuring policy compliance and cost control. Business class travel, travel concierge services, and ground transportation options cater to the needs of corporate travelers.

Travel technology advances, integrating travel policy compliance, travel risk management, and expense management systems. Bleisure travel, frequent flyer programs, travel rewards, and travel technology further enrich the business travel experience. The ongoing unfolding of market activities underscores the importance of staying informed and adaptable in this ever-evolving landscape.

How is this Business Travel Industry segmented?

The business travel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Marketing

- Internal meeting

- Trade show

- Product launch

- Type

- Travel fare

- Lodging

- Dining

- Others

- Service Type

- Transportation (Air, Rail, Car)

- Accommodation

- Meetings and Events

- Booking Type

- Online Travel Agencies

- Direct Bookings

- Corporate Travel Management Companies

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

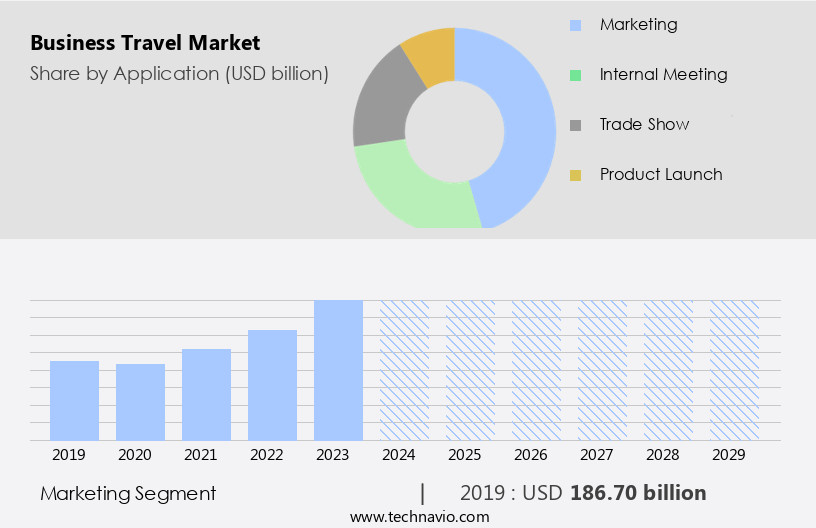

By Application Insights

The marketing segment is estimated to witness significant growth during the forecast period.

Business travel plays a pivotal role in the international marketing efforts of both small and large enterprises. This involves employees traveling to overseas markets to promote products and services, expand customer bases, and build brand reputation. Travel itinerary management and security are essential considerations to ensure the safety and productivity of business travelers. Duty of care and traveler tracking are crucial components of travel risk management, while travel insurance provides financial protection. Travel consolidators offer cost savings through bundled services, including flights, ground transportation, hotels, and car rentals. Carbon offsetting and eco-friendly travel options are increasingly important for companies committed to sustainability.

Travel data analytics enable businesses to make informed decisions on travel procurement and policy compliance. Premium economy travel and business class offerings cater to the needs of frequent travelers, while loyalty programs and travel rewards provide incentives. Travel technology, including travel booking platforms and expense management systems, streamline the travel process. Airport lounges and travel concierge services enhance the travel experience. First class travel and corporate travel policies cater to executives and high-value clients, while travel spend management ensures budget control. Ground transportation and hotel booking are essential components of business travel. Sustainability in travel is a growing trend, with companies focusing on reducing their carbon footprint and promoting eco-friendly practices.

Travel risk management is a priority, with travel safety a key concern. Companies must balance the need for cost savings with the duty of care to their employees. Travel agent services offer expertise and convenience, while travel policy compliance ensures regulatory adherence. Bleisure travel, or combining business and leisure travel, is a growing trend. Frequent flyer programs and travel rewards offer incentives for loyalty. In conclusion, business travel is a vital component of international marketing strategies, enabling companies to expand their reach and build brand reputation. Travel management companies offer a range of services to help businesses navigate the complexities of business travel, from itinerary management and security to sustainability and cost savings.

The Marketing segment was valued at USD 186.70 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in the Asia Pacific (APAC) region, which holds the largest revenue share. Companies are prioritizing employee comfort and productivity, leading to an increasing focus on enhancing business travel experiences. In APAC, there is a trend towards self-planning for business travel, with employees utilizing pre-approved lists or making unrestricted bookings for flights and hotels. Favorable airfares, driven by the growing leisure markets in India and China, are further fueling market expansion. Travel itinerary management, travel security, and duty of care are essential considerations for businesses, leading to the adoption of travel consolidators and travel management companies.

Travel technology, including travel booking platforms and expense management systems, streamlines the process and ensures policy compliance. Sustainability in travel, such as carbon offsetting and eco-friendly options, is gaining importance, with loyalty programs and travel rewards incentivizing eco-conscious choices. Travel risk management, including ground transportation, hotel booking, and airport lounges, prioritizes traveler safety. Premium economy travel, business class, and first class options cater to varying budgets and preferences. Corporate travel policies and spend management ensure cost-effectiveness while maintaining a balance between affordability and employee satisfaction.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and ever-evolving business landscape, the importance of seamless and efficient travel arrangements cannot be overstated. The market caters to professionals on the move, offering solutions tailored to their unique needs. From corporate housing and flights to ground transportation and event planning, this market encompasses a wide range of services. Business travelers prioritize convenience, flexibility, and cost-effectiveness. They seek solutions that streamline their journeys, allowing them to maximize productivity and minimize downtime. The market responds with innovative offerings such as mobile apps, loyalty programs, and integrated travel management systems. Additionally, sustainability and wellness are increasingly important considerations, with eco-friendly options and wellness initiatives gaining traction. Overall, the market is a vibrant and competitive space, driven by the evolving demands of modern business and the relentless pursuit of efficiency and innovation.

What are the key market drivers leading to the rise in the adoption of Business Travel Industry?

- The relentless advancements in technology serve as the primary catalyst for market growth.

- The market is driven by technological innovations that streamline the process for travel agents and their clients. Solutions such as travel itinerary management, travel security, and duty of care are increasingly important for businesses. Travel consolidators offer access to comprehensive data analytics, enabling companies to compare reservation options and make informed decisions. Traveler tracking ensures the safety and security of employees during business trips. Moreover, advancements in artificial intelligence (AI) have automated the travel booking process, saving time and energy. For instance, Hilton Hotels uses robotic concierges to answer queries, while companies like Mezi provide personal travel assistants for efficient business travel bookings.

- Travel insurance is another essential component of business travel, protecting companies and their employees from unforeseen circumstances. Carbon offsetting is also gaining popularity, allowing businesses to reduce their carbon footprint while traveling. Overall, these technological solutions enhance the business travel experience, making it more efficient, convenient, and secure.

What are the market trends shaping the Business Travel Industry?

- The increasing trend among consumers to make travel bookings through online agencies is a significant market development. This preference for digital platforms reflects the growing demand for convenience and efficiency in the travel industry.

- The market is witnessing significant growth as more companies turn to online portals for organized booking processes. Upside, a travel platform, caters specifically to business travelers, offering exclusive deals and loyalty programs. Their VIP program allows for pre-launch sign-ups and provides a free USD150 card from major brands with each travel package purchase, attracting over 5,000 corporate clients. Additionally, booking.Com offers customized booking options based on business trip types. Travel concierge services and eco-friendly travel options are also becoming increasingly popular, enhancing the overall travel experience for business travelers. Flight booking through travel procurement systems and travel agent services remain essential for businesses seeking efficient and cost-effective solutions.

- Premium economy travel and business class options continue to be in demand, emphasizing comfort and productivity during business trips. Travel reporting tools enable companies to monitor and manage their travel expenses effectively. Overall, the market is evolving to meet the unique needs of corporate clients, offering immersive and harmonious travel experiences.

What challenges does the Business Travel Industry face during its growth?

- The increasing adoption of online video conferencing platforms poses a significant challenge to the expansion of the industry, as more businesses and individuals turn to virtual communication solutions.

- The market is experiencing significant shifts due to the increasing adoption of technology for communication and cost savings. With the widespread use of video conferencing platforms like Zoom, Google Meet, and others, many corporations are opting for virtual meetings and conferences instead of in-person business travel. This trend, accelerated by the pandemic, offers cost advantages for companies seeking to reduce travel expenses. Moreover, advancements in online banking, phone calls, emails, and video conferencing enable efficient and cost-effective communication and transactions. The convenience and accessibility of real-time communication opportunities are driving companies to adopt various communication technologies, including video conferencing through platforms such as Skype, FaceTime, Google Meet, and Zoom.

- Another trend gaining traction in the business travel sector is travel policy compliance and sustainability. Companies are focusing on implementing travel policies that promote sustainable practices, such as carbon offsetting, eco-friendly accommodations, and ground transportation. Frequent flyer programs and travel rewards continue to influence corporate travelers' decisions, but their importance is shifting as companies prioritize cost savings and sustainability. In conclusion, the market is undergoing transformative changes as technology and cost considerations reshape the landscape. The adoption of video conferencing platforms, advancements in communication technologies, and a growing emphasis on travel policy compliance and sustainability are key trends shaping the future of business travel.

Exclusive Customer Landscape

The business travel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the business travel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, business travel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ADTRAV Corp. - Business travelers can benefit from our comprehensive services, including around-the-clock assistance, flexible booking options, VIP amenities, and real-time travel alerts.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADTRAV Corp.

- Airbnb Inc.

- American Express Global Business Travel GBT

- ATG Travel Worldwide BV

- BCD Travel Services BV

- Booking Holdings Inc.

- Christopherson Business Travel

- CWT Global BV

- Direct Travel Inc.

- Fareportal Inc.

- FCM Travel Solutions

- Flight Centre Travel Group Ltd.

- JPMorgan Chase and Co.

- JTBUSA Inc.

- MakeMyTrip Ltd.

- Omega World Travel Inc.

- Travel Leaders Group Holdings LLC

- UNIGLOBE Travel International Limited Partnership

- Walmart Inc.

- WexasA Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Business Travel Market

- In January 2024, Marriott International announced the launch of its new travel platform, "Marriott Bonvoy Travel Co.", aiming to streamline business travel booking and management for its loyalty program members (Marriott International, 2024). This platform offers personalized travel recommendations, real-time rewards, and integrated expense tracking.

- In March 2024, American Express and Microsoft formed a strategic partnership to enhance corporate travel management solutions by integrating American Express's business travel and expense management services with Microsoft Teams and Outlook (American Express, 2024). This collaboration aims to improve productivity and streamline communication for business travelers.

- In May 2024, Amadeus, a leading travel technology provider, acquired TravelClick, a global provider of hotel marketing, revenue management, and reservation solutions, for approximately USD1.5 billion (Amadeus, 2024). This acquisition strengthened Amadeus's position in the hospitality technology market and expanded its offerings to hotels.

- In February 2025, the European Union passed the "Digital Green Certificate" regulation, enabling free movement across EU borders for vaccinated individuals, recovered COVID-19 patients, or those with negative test results (European Union, 2025). This initiative significantly boosted the business travel sector, as it facilitated safe travel and reduced quarantine requirements.

Research Analyst Overview

- In the dynamic the market, global travel management companies play a pivotal role in ensuring compliance through rigorous audits. Negotiated rates, travel budgeting, and supplier relationship management are key areas of focus for these firms. Travel digital payment methods and policy enforcement are also critical elements of effective business travel programs. Employee travel satisfaction is a significant trend, with companies prioritizing travel booking workflows that cater to their preferences. Travel policy automation and data privacy are essential for maintaining security and ensuring compliance with regulations. Travel technology integration, including API integration and mobile travel apps, streamlines processes and enhances efficiency.

- Travel program ROI and optimization are top priorities, with travel approval processes and virtual travel assistants facilitating cost savings and spend reduction. Regional travel management and travel program evaluation are crucial for businesses with diverse travel needs. Travel forecasting and analytics dashboards provide valuable insights for travel cost savings and program effectiveness. Contract management and travel booking APIs further optimize travel programs and enhance supplier relationships. Business travel trends continue to evolve, with a growing emphasis on travel data security, travel preferences analysis, and travel policy enforcement. Travel compliance, employee satisfaction, and cost savings remain the cornerstones of successful business travel programs.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Business Travel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 38.3% |

|

Market growth 2025-2029 |

USD 4867.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

28.6 |

|

Key countries |

US, China, Japan, Germany, India, UK, Canada, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Business Travel Market Research and Growth Report?

- CAGR of the Business Travel industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the business travel market growth of industry companies

We can help! Our analysts can customize this business travel market research report to meet your requirements.