Online Travel Booking Platform Market Size 2025-2029

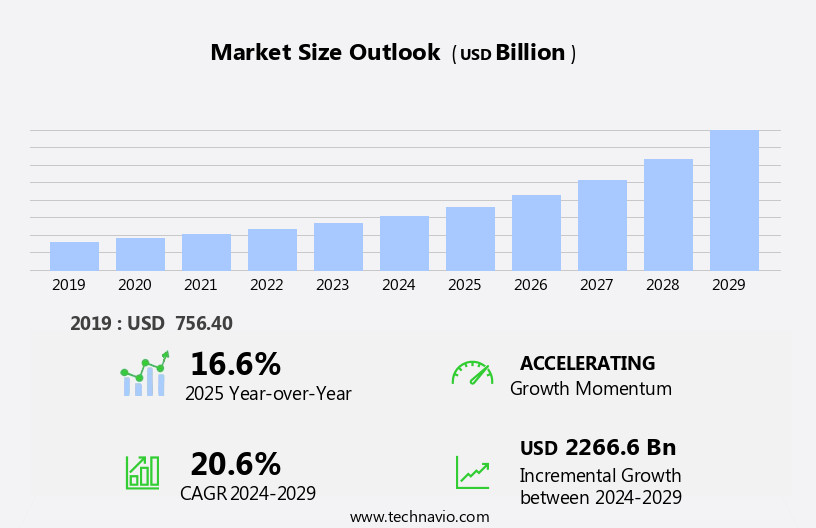

The online travel booking platform market size is forecast to increase by USD 2266.6 billion, at a CAGR of 20.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing use of the internet and smartphones for travel planning and booking. This digital shift is facilitated by the widespread adoption of online payment platforms, enabling seamless transactions and enhancing user convenience. However, the market is not without challenges. Disruptions in travel demand, such as those caused by geopolitical instability or health crises, pose a threat to market growth. Companies must remain agile and adapt to these uncertainties by diversifying their offerings and exploring new markets.

- Additionally, maintaining strong customer relationships through personalized services and competitive pricing is crucial for market success. As the market continues to evolve, players must stay informed of emerging trends and consumer preferences to capitalize on opportunities and navigate challenges effectively.

What will be the Size of the Online Travel Booking Platform Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The online travel booking market continues to evolve, driven by advancements in technology and shifting consumer preferences. Mobile apps have become a dominant force, offering convenience and ease of use for travelers on-the-go. Customer lifetime value and inventory management are key focus areas for players in this sector, with third-party providers and package deals playing essential roles in expanding offerings. Social media marketing and activity bookings are emerging trends, while destination marketing and rating systems enhance the user experience. Search functionality, churn rate, and metasearch engines are crucial components of price comparison and booking engines. Data analytics, sorting algorithms, and loyalty programs help optimize performance and retain customers.

Real-time availability, dynamic pricing, and fraud detection are essential for securing transactions in the ever-changing market. Flight bookings, car rentals, and hotel reservations are core offerings, with API integrations and visa assistance adding value. Revenue management, conversion rates, user experience, and website design are critical factors influencing customer acquisition and retention. Travel agents and tour operators are adapting to the digital landscape, while recommendation engines and user reviews shape the future of personalized travel experiences. Data privacy and security protocols are seamlessly integrated into the market's ongoing dynamics, ensuring a secure and trustworthy environment for all stakeholders.

How is this Online Travel Booking Platform Industry segmented?

The online travel booking platform industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Platform

- Mobile/tablet

- Desktop/laptop

- Type

- Packages

- Direct

- End-user

- Leisure

- Business

- Mode Of Booking

- Direct

- Third-party

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Platform Insights

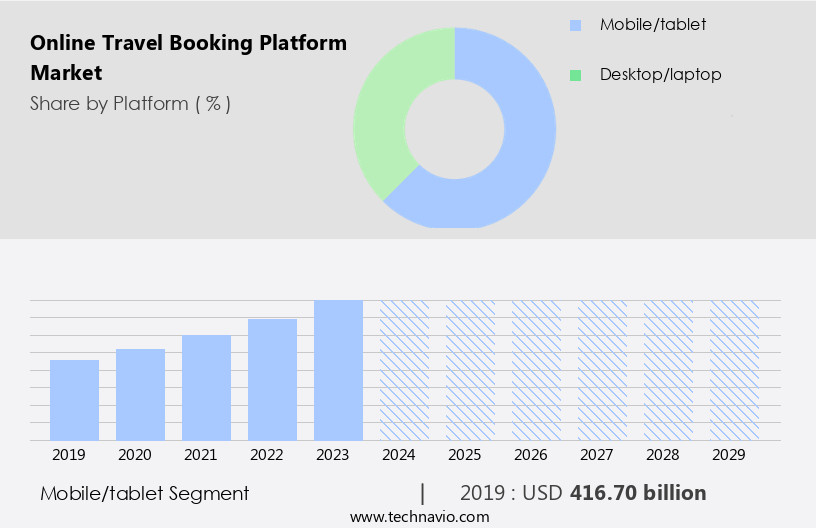

The mobile/tablet segment is estimated to witness significant growth during the forecast period.

The online travel booking market in the US is experiencing dynamic trends, with mobile apps emerging as a preferred choice for customers. Filtering options and search functionality enable users to find deals and packages tailored to their preferences. Customer lifetime value is a crucial metric for revenue management, while inventory management ensures real-time availability of flights, hotels, and activities. Third-party providers expand offerings, and social media marketing boosts customer engagement. Destination marketing and activity bookings cater to niche travelers, while rating systems and user reviews foster trust. Metasearch engines and price comparison tools help consumers compare deals, and email marketing maintains customer relationships.

Loyalty programs and dynamic pricing offer personalized incentives. Flight bookings and car rentals are integral components, with booking engines and API integrations streamlining processes. Fraud detection and visa assistance ensure secure transactions. Cloud computing and data analytics optimize performance, while conversion rates and user experience are essential for customer acquisition. Hotel reservations and travel agents cater to various segments, and recommendation engines suggest tailored travel packages. Customer support and booking confirmation are essential for retention. Currency exchange and cancellation policies address customer convenience, while database management and travel insurance ensure data security. Affiliate marketing and payment gateways expand reach, and user behavior and search engine optimization enhance online presence.

Data privacy and security protocols prioritize customer trust.

The Mobile/tablet segment was valued at USD 416.70 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

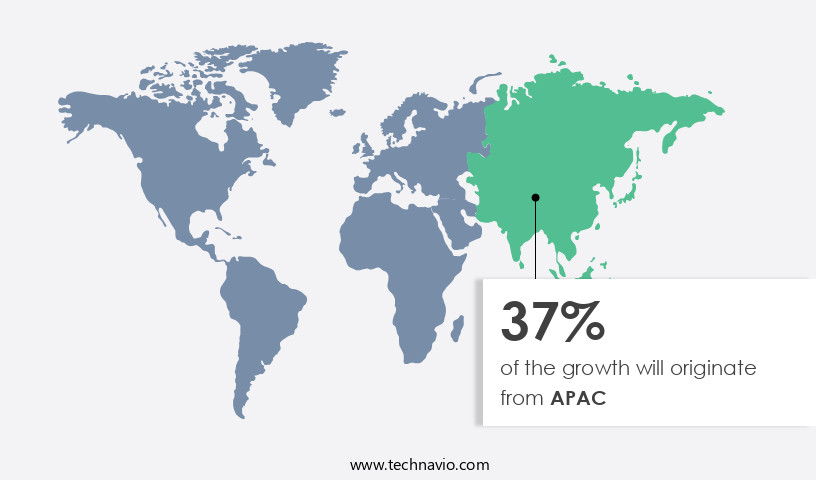

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in the Asia Pacific (APAC) region. China, Japan, India, Malaysia, Australia, and Singapore are key contributors to the market's revenue. The region's expanding Internet and smartphone penetration have fueled the preference for online travel bookings. Additionally, the population of baby boomers, the rise in micro trips, and the growth of packaged tours are further driving demand. To cater to this increasing demand, various features have become essential for online travel booking platforms. These include filtering options for customized searches, mobile apps for on-the-go bookings, and inventory management for real-time availability.

Third-party providers, package deals, and social media marketing are also popular strategies to attract customers. Customer lifetime value, loyalty programs, and user reviews are crucial factors in retaining customers. Real-time availability, dynamic pricing, and booking confirmation are essential for a seamless user experience. Flight bookings, car rentals, and hotel reservations are common services offered, with revenue management and visa assistance adding value. Metasearch engines, price comparison, email marketing, and marketing automation help in customer acquisition. Data analytics, sorting algorithms, and recommendation engines aid in performance optimization and user segmentation. API integrations, fraud detection, and payment gateways ensure secure transactions.

Currency exchange, cancellation policies, and database management are essential for managing diverse travel-related data. Travel insurance, affiliate marketing, and itinerary management are additional services that add value to the platform. The market is also embracing cloud computing, website design, and user interface improvements to enhance the overall user experience. In conclusion, the market is evolving with a focus on customer convenience, real-time availability, and data-driven insights. The market is expected to continue growing, driven by increasing Internet penetration, changing travel trends, and the continuous innovation in technology and user experience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and competitive the market, consumers seek convenience, affordability, and a wide range of options to plan their journeys. These platforms offer features like real-time flight and hotel price comparisons, customizable travel itineraries, and seamless integration with payment systems. Travelers can explore multiple destinations, compare deals, and secure reservations all in one place. Additionally, the market caters to diverse preferences with inclusive options for budget, luxury, and adventure travel. Users appreciate the flexibility to modify bookings, receive instant confirmations, and access customer support. The market continues to evolve, incorporating innovative technologies like artificial intelligence and virtual reality, enhancing the user experience and shaping the future of travel planning.

What are the key market drivers leading to the rise in the adoption of Online Travel Booking Platform Industry?

- The significant expansion of internet and smartphone usage serves as the primary catalyst for market growth.

- The global online travel booking market has experienced remarkable growth in the last decade due to the widespread availability of Internet connectivity and the increasing usage of smartphones. Governments in countries such as China, India, Japan, the US, and the UK have provided free Wi-Fi networks, making the Internet accessible in various public places. The proliferation of smartphones and free Wi-Fi services has led to a significant increase in the number of Internet users, particularly among rural populations and those with lower income. In this context, the market has become an essential component of the travel industry.

- These platforms offer visa assistance, user experience optimization, booking volume management, hotel reservations, itinerary management, and user reviews. Cloud computing technology has enabled these platforms to offer seamless performance and scalability, enhancing user experience. Travel agents and tour operators have also adopted these platforms to expand their reach and improve conversion rates. Average order values have increased due to the convenience and ease of use offered by these platforms. Performance optimization and website design have become critical factors in retaining users and attracting new ones. User reviews play a vital role in influencing booking decisions, making it essential for platforms to maintain a harmonious and immersive user interface.

What are the market trends shaping the Online Travel Booking Platform Industry?

- The increasing adoption of online payment platforms is a significant market trend. This shift towards digital transactions reflects the growing preference for convenience and security among consumers.

- The online travel booking market is driven by several factors, including user interface advancements, customer segmentation, and recommendation engines. Customer acquisition cost is a significant concern for market players, necessitating effective marketing strategies such as search engine optimization, marketing automation, and affiliate marketing. Currency exchange functionality is essential for global customers, and cancellation policies are crucial for ensuring customer satisfaction. Database management is crucial for handling vast amounts of customer data, while travel insurance offers additional revenue opportunities. Payment gateways must prioritize security to address concerns related to online transactions.

- User behavior analysis is vital for personalized offerings and improving customer experience. Data privacy regulations, such as GDPR and CCPA, require strict adherence to protect user information. Overall, these factors contribute to the dynamic growth and evolution of the market.

What challenges does the Online Travel Booking Platform Industry face during its growth?

- The disruption in travel demand poses a significant challenge to the industry's growth trajectory.

- The market experiences significant challenges due to disruptions in travel demands caused by economic fluctuations, changing consumer preferences, and geopolitical tensions. Economic downturns can decrease discretionary spending, making consumers less likely to book vacations or business trips. Volatile fuel prices and travel restrictions in certain regions can also increase travel costs, deterring potential travelers. Moreover, consumer behavior is evolving, with a growing preference for personalized and experiential travel over traditional package tours. This shift necessitates platforms that offer more customized travel options, posing a challenge for companies relying on standardized offerings.

- To address these challenges, it is crucial for online travel booking platforms to prioritize security protocols, ensuring customer data protection and maintaining trust in the digital booking process. Additionally, platforms that can adapt to evolving consumer preferences and offer personalized and immersive travel experiences are likely to thrive in this dynamic market.

Exclusive Customer Landscape

The online travel booking platform market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online travel booking platform market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, online travel booking platform market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airbnb Inc. - This company provides an innovative online platform for securing accommodations and hosting, enhancing user experience and broadening travel options through advanced search algorithms and intuitive design.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbnb Inc.

- BlueStar Air Travel Services I Pvt. Ltd.

- Booking Holdings Inc.

- DirectVision SRL

- eDreams ODIGEO

- Expedia Group Inc.

- Fareportal Inc.

- Happyeasygo Group

- Hopper Inc.

- Hostelworld.com Ltd.

- Kiwi.com sro

- lastminute.com NV

- MakeMyTrip Ltd.

- OneTwoTrip Ltd.

- Thomas Cook India Ltd.

- Travelopro

- Trip.com Group Ltd.

- TripAdvisor Inc.

- TUI AG

- Yatra Online Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Online Travel Booking Platform Market

- In January 2024, Expedia Group announced the acquisition of Travelocity from NBCUniversal for USD280 million, expanding its portfolio of travel brands and strengthening its position in the online travel booking market (Expedia Group Press Release, 2024). In March 2024, Booking.Com, a leading online travel agency, launched its new "Genius 2.0" loyalty program, offering members personalized discounts, free upgrades, and other perks, aiming to enhance user experience and boost customer retention (Booking.Com Press Release, 2024).

- In May 2024, Agoda, a prominent online hotel booking platform owned by Booking Holdings, secured a strategic partnership with Marriott International to offer Marriott Bonvoy loyalty program members exclusive discounts and promotions, expanding its collaboration with major hotel chains (Agoda Press Release, 2024). In January 2025, Google unveiled Google Travel, an integrated travel search engine, allowing users to compare flights, hotels, and packages from multiple providers, marking a significant entry into the online travel booking market (Google Press Release, 2025).

Research Analyst Overview

- In the dynamic online travel booking market, Virtual Reality (VR) and Augmented Reality (AR) technologies are transforming the customer experience, enabling immersive visualizations of destinations and accommodations. Subscription models are gaining traction, offering travelers flexibility and cost savings. Artificial Intelligence (AI) is revolutionizing the industry with predictive analytics for personalized recommendations, automated customer service, and price optimization. Risk management solutions are integrating Big Data analytics to mitigate potential threats and ensure business continuity. Sustainability is a growing concern, with carbon footprint reduction initiatives and ethical tourism practices becoming essential. Marketing campaign management, voice search, and mobile payments are essential tools for reaching and engaging customers.

- Dynamic packaging, yield management, and sales forecasting are key strategies for optimizing revenue. Blockchain technology and data visualization enhance security and transparency, while multi-lingual support broadens market reach. A/B testing and business intelligence (BI) enable data-driven decision-making. Influencer marketing and loyalty programs foster customer loyalty and advocacy. Overall, the online travel booking market is a vibrant and evolving landscape, driven by technology, customer expectations, and the pursuit of sustainable and personalized travel experiences.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Online Travel Booking Platform Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.6% |

|

Market growth 2025-2029 |

USD 2266.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.6 |

|

Key countries |

US, China, Japan, Canada, India, UK, Germany, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Online Travel Booking Platform Market Research and Growth Report?

- CAGR of the Online Travel Booking Platform industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the online travel booking platform market growth of industry companies

We can help! Our analysts can customize this online travel booking platform market research report to meet your requirements.