Grinding Wheel Market Size 2025-2029

The grinding wheel market size is forecast to increase by USD 6.29 billion, at a CAGR of 5.2% between 2024 and 2029. The market witnesses significant growth, driven primarily by the constant demand from the oil and gas industries for grinding and machining applications. This sector's relentless expansion is fueled by the increasing focus on automation and efficiency in drilling and production processes.

Major Market Trends & Insights

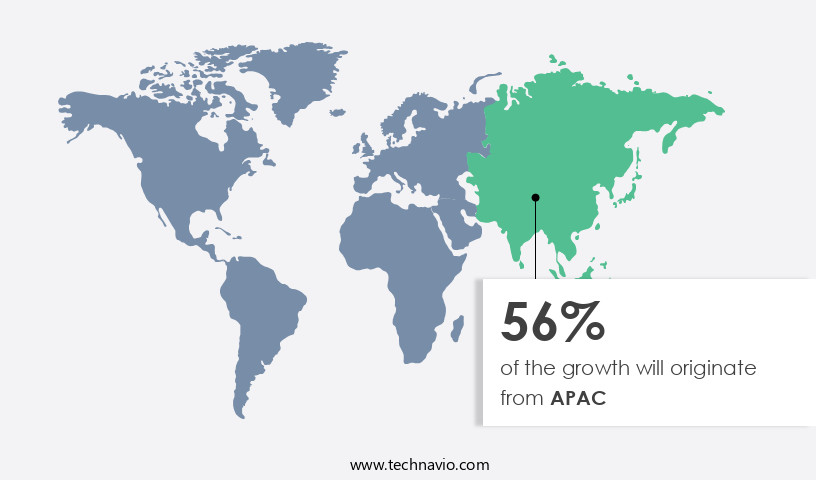

- APAC dominated the market and contributed 56% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

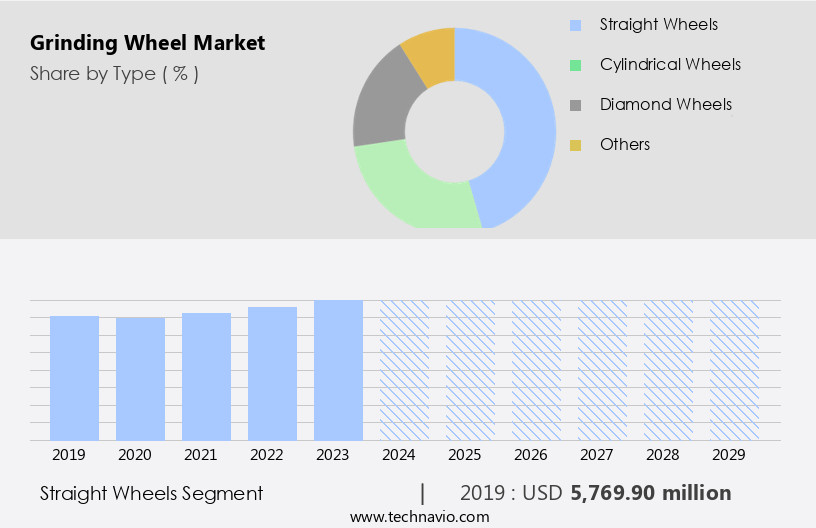

- Based on the Type, the straight wheels segment led the market and was valued at USD 6.48 billion of the global revenue in 2023.

- Based on the Material, the artificial abrasives segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 46.67 Million

- Future Opportunities: USD 6.29 Billion

- CAGR (2024-2029): 5.2%

- APAC: Largest market in 2023

The integration of artificial intelligence and advanced system solutions into grinding processes enhances productivity and accuracy, further boosting market growth. However, operational challenges persist, including supply chain inconsistencies and regulatory hurdles impacting adoption. The grinding wheel industry must navigate these obstacles by implementing robust supply chain management strategies and complying with stringent regulations. By addressing these challenges, market participants can capitalize on the lucrative opportunities presented by the oil and gas sector and the ongoing digital transformation in manufacturing processes. Companies that successfully navigate these challenges will position themselves for long-term success in the market.

What will be the Size of the Grinding Wheel Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the diverse applications across various sectors. Grinding wheels, an essential component of precision grinding processes, undergo constant development to meet the evolving demands of surface finishing. Grinding wheel standards, such as those set by organizations like the American National Standards Institute (ANSI) and the European Committee for Standardization (CEN), play a crucial role in ensuring consistency and safety. CNC grinding machines, which utilize automated processes, have become increasingly prevalent in industrial settings, driving the need for grinding wheel advancements. Manufacturers continue to innovate, introducing new materials like vitrified bonded wheels and ceramic abrasives, as well as automated grinding systems that optimize grinding wheel speed and efficiency.

The ongoing research in grinding wheel technology pushes the boundaries of material removal, with developments in high-speed grinding, diamond grinding wheels, and coated abrasives. Grinding wheel thickness, diameter, and grade are essential factors in achieving optimal grinding performance. Safety considerations, such as grinding wheel arbor design and wear prevention, are also crucial. The market for grinding wheel suppliers and distributors remains competitive, with various players offering solutions tailored to specific industries and applications. Grinding operations span various sectors, including automotive, aerospace, and heavy machinery, among others. Cutting tools and grinding wheels work in tandem to ensure efficient material removal and precise surface finishes.

The ongoing development of grinding wheel technology and the evolving market dynamics continue to shape the industry landscape.

How is this Grinding Wheel Industry segmented?

The grinding wheel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Straight wheels

- Cylindrical wheels

- Diamond wheels

- Others

- Material

- Artificial abrasives

- Natural abrasives

- Application

- Metalworking

- Woodworking

- Automotive

- End-use Industry

- Manufacturing

- Construction

- Oil and Gas

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The straight wheels segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 6.48 billion in 2023. It continued to the largest segment at a CAGR of 4.79%.

In the realm of industrial manufacturing, grinding wheels play a pivotal role in surface finishing and material removal. These wheels, available in various forms such as straight, cylindrical, and centerless, cater to diverse grinding operations. Straight wheels, a common style, are employed extensively in cylindrical, centerless, and surface grinding processes. Their application spans across numerous industries, including automotive, aerospace, and shipbuilding, where they contribute significantly to the production of intricately shaped components. Bonded abrasives, including resinoid and vitrified bonded wheels, form the backbone of grinding wheel technology. Grinding wheel regulations ensure safety and efficiency in their usage.

Research and development efforts continue to enhance grinding wheel life, diameter, thickness, and speed, with advancements in ceramic abrasives, diamond grinding wheels, and coated abrasives. CNC grinding machines and automated grinding systems further streamline the grinding process. Grinding wheel safety is a paramount concern, with regulations governing their use and continuous research aimed at improving safety features. Innovations in grinding wheel technology include creep feed grinding, electroplated wheels, and high-speed grinding. Grinding wheel suppliers and distributors play a crucial role in ensuring the availability and accessibility of these essential industrial components. Grinding operations are integral to industries that rely on precision and consistency, such as industrial machinery manufacturing.

Cutting tools, too, often employ grinding processes to maintain their sharpness and effectiveness. Grinding wheel standards ensure consistency and quality across the industry, while grinding wheel efficiency and development continue to evolve with technological advancements. In summary, grinding wheels are indispensable in manufacturing processes, with straight wheels being a versatile and widely used option. The growth of industries that utilize grinding processes will continue to fuel the demand for these essential industrial components.

The Straight wheels segment was valued at USD 5.77 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 56% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the APAC region estimates to be around USD 9.67 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The global grinding wheels market is experiencing significant growth, with APAC leading the way due to increasing industrial and economic development in the region. Many manufacturing companies in APAC are investing heavily to incorporate grinding wheel technology into their processes, enabling them to produce high-quality goods more efficiently. The automotive, aerospace, and defense industries, which hold a substantial share in APAC, are driving the demand for grinding wheels. In 2023, APAC accounted for a majority of the global vehicle assembly market, highlighting the extensive use of grinding wheels in this sector. Grinding wheel innovations, such as creep feed grinding, automated grinding systems, and high-speed grinding, contribute to the market's advancements.

Companies focus on developing grinding wheels with improved efficiency, longer life, and enhanced safety features. Bonded abrasives, including resinoid and vitrified bonded wheels, and various abrasive materials, such as ceramic and diamond, cater to diverse grinding applications. Grinding wheel manufacturers continue to invest in research and development to introduce new products and meet the evolving demands of various industries. CNC grinding machines, centerless grinding, and electroplated wheels are some of the emerging trends in the market. The grinding operations involve various grinding wheel grades, thicknesses, and diameters, ensuring optimal material removal for different applications. Cutting tools and surface finishing are integral to the grinding process, with grinding wheel standards and regulations ensuring safety and quality.

The market's future lies in continuous innovation, improved efficiency, and meeting the evolving demands of various industries.

Market Dynamics

"The global Grinding Wheel Market is driven by increasing demand for precision grinding in automotive and aerospace manufacturing, with Asia-Pacific leading due to its significant market share."

- Rahul Somnath, Assistant Research Manager, Technavio

The global grinding wheel market is fueled by technological innovation in grinding wheels and increasing electric vehicle production, enhancing demand from automotive and aerospace sectors. Material innovations for abrasives, including composite materials in grinding wheels and synthetic diamond wheels, alongside cubic boron nitride (CBN) wheels, drive high-performance grinding solutions and chemically resistant wheels. Environmentally friendly grinding solutions emphasize sustainability in abrasive manufacturing within the abrasive tools industry. The precision grinding wheels market thrives on precision machining operations, surface finishing techniques, and tool sharpening with grinding wheels. Resin bonded grinding wheel and surface grinding wheel applications highlight market segmentation in abrasives and growth drivers in grinding wheel market.

What are the key market drivers leading to the rise in the adoption of Grinding Wheel Industry?

- The oil and gas industries' unwavering demand serves as the primary driver for market growth.

- Grinding wheels play a crucial role in precision surface finishing within the oil and gas industries, particularly in upstream operations. The market for grinding wheels is influenced by various factors, including grinding wheel regulations, wear, and innovation. Compliance with regulations is essential to ensure safety and quality in the manufacturing, maintenance, and repair of oil and gas components. Grinding wheel wear is a significant concern due to the abrasive nature of the materials being ground. To address this, research and development efforts are focused on enhancing grinding wheel life and improving bonded abrasive technology.

- The grinding wheel arbor and diameter are also critical considerations in the selection and application of grinding wheels. As the oil and gas industry recovers from the recent downturn, there is a renewed emphasis on grinding wheel innovation to increase efficiency and productivity.

What are the market trends shaping the Grinding Wheel Industry?

- The integration of artificial intelligence (AI) and system integration is currently a significant market trend. This fusion of technologies is transforming industries by enhancing operational efficiency and productivity.

- Grinding wheels play a crucial role in various grinding operations, particularly in cylindrical grinding applications. One advanced grinding technique is creep feed grinding, which involves continuous contact between the grinding wheel and the workpiece, ensuring efficient material removal. Grinding wheel safety is paramount in such processes, and resinoid bonded wheels are commonly used due to their superior bond strength and ability to maintain wheel shape. Grinding wheel thickness is a critical factor in achieving optimal grinding performance. Thinner wheels provide better control and precision, while thicker wheels offer increased durability and productivity. Grinding wheel distributors and suppliers play a vital role in ensuring businesses have access to high-quality grinding wheels for their operations.

- Artificial intelligence (AI) is increasingly being integrated into modern grinding machinery to enhance efficiency and productivity. AI machines can analyze data from sensors within the grinding machinery and measurement equipment, making decisions such as adjusting feed rates to prevent thermal damage or initiating a change point in a feed cycle. These advancements can help reduce human intervention, improve consistency, and increase overall productivity in grinding operations. AI's ability to continuously perform repetitive tasks without human intervention can lead to significant cost savings and increased competitiveness for businesses in various industries. By leveraging AI technology, grinding operations can become more harmonious, efficient, and strike a balance between productivity and quality.

What challenges does the Grinding Wheel Industry face during its growth?

- The growth of the industry is significantly impacted by operational challenges, which represent a major hurdle in this sector.

- Grinding wheels play a crucial role in the manufacturing industry by providing a smooth finish to surfaces through the process of abrasion. However, the generation of heat during grinding can lead to thermal effects that impact both the grinding wheel and the workpiece. The thermal effect on the grinding wheel can result in the development of grinding cracks, which appear at right angles to grinding marks. The accumulation of these cracks necessitates the replacement of grinding wheels, thereby increasing costs. On the other hand, the thermal effect on the workpiece is more pronounced since it retains most of the heat produced during the grinding operation.

- These thermal effects can impact the quality of the finished product and may require additional processing to rectify. Advancements in grinding wheel technology, such as the use of vitrified bonded wheels, ceramic abrasives, and automated grinding systems, have helped mitigate the thermal effects. Additionally, CNC grinding machines with precise control over grinding wheel speed have also contributed to reducing thermal damage. Grinding wheel manufacturers continue to invest in research and development to create grinding wheels with improved thermal properties and longer lifespan. Automated grinding systems with real-time temperature monitoring and control further enhance the efficiency and productivity of the grinding process.

- In conclusion, understanding the thermal effects of grinding and implementing appropriate measures to mitigate them is essential for maintaining the quality and efficiency of manufacturing processes. Grinding wheel advancements and technological innovations continue to play a significant role in addressing these challenges.

Exclusive Customer Landscape

The grinding wheel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the grinding wheel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, grinding wheel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in manufacturing and supplying a diverse range of grinding wheels under esteemed brand names 3M Cubitron, Scotch Brite, and 3M Silver.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Andre Abrasive Articles

- ATLANTIC GmbH

- AWUKO Abrasives Wandmacher GmbH & Co. KG

- Camel Grinding Wheels Works Sarid Ltd.

- DEERFOS Co. Ltd.

- DSA Products Ltd.

- Ekamant

- Grindwell Norton Ltd.

- Klingspor AG

- Koki Holdings Co., Ltd.

- KOVAX Corporation

- Murugappa Group

- Noritake Co., Limited

- Pferd Inc.

- Robert Bosch GmbH

- Sak Abrasives Limited

- Saint-Gobain Abrasives

- SHIN-EI Grinding Wheels MFG. Co., Ltd.

- Tyrolit Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Grinding Wheel Market

- In January 2024, Sandvik AB, a leading engineering group, announced the launch of its new line of high-performance grinding wheels, the CoroMill 390, designed for heavy-duty machining applications (Sandvik AB Press Release, 2024). This innovative product expansion aimed to cater to the increasing demand for efficient and durable grinding solutions in the manufacturing sector.

- In March 2025, Caterpillar Inc. and 3M collaborated to develop advanced grinding wheel technologies for the mining industry. This strategic partnership combined Caterpillar's mining expertise with 3M's grinding wheel technology, aiming to enhance productivity and reduce downtime (Caterpillar Inc. Press Release, 2025).

- In July 2024, Norton Abrasives, a Saint-Gobain company, acquired the grinding wheel business of the German firm, Komet Schleiftechnik GmbH. This acquisition expanded Norton's product portfolio and strengthened its position in the European market (Saint-Gobain Press Release, 2024).

- In October 2025, the European Union introduced new regulations on the use and disposal of grinding wheels containing hazardous materials. These regulations aimed to minimize the environmental impact and improve workplace safety in the manufacturing sector (European Union Regulation, 2025). Companies in the market responded by investing in research and development of eco-friendly and safer alternatives.

Research Analyst Overview

- The market encompasses a diverse range of selection, processes, and applications. With increasing focus on grinding wheel maintenance and optimization, market participants are exploring innovative ways to enhance grinding wheel performance and design. Grinding wheel technology continues to evolve, with advancements in materials, equipment, and automation driving cost savings and sustainability. Quality remains a top priority, as grinding wheel manufacturers strive to meet the demands of various industries for superior grinding wheel solutions.

- Grinding wheel price and availability are key factors influencing market trends, with ongoing efforts to improve grinding wheel customization and address the challenges of grinding wheel sustainability. Overall, the future of the grinding wheel industry holds promising opportunities for growth and development.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Grinding Wheel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 6292.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

China, US, Germany, UK, Japan, India, France, South Korea, Canada, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Grinding Wheel Market Research and Growth Report?

- CAGR of the Grinding Wheel industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the grinding wheel market growth of industry companies

We can help! Our analysts can customize this grinding wheel market research report to meet your requirements.