Grinding Machinery Market Size 2025-2029

The grinding machinery market size is forecast to increase by USD 1.63 billion, at a CAGR of 5.5% between 2024 and 2029. Growth in global automotive industry will drive the grinding machinery market.

Major Market Trends & Insights

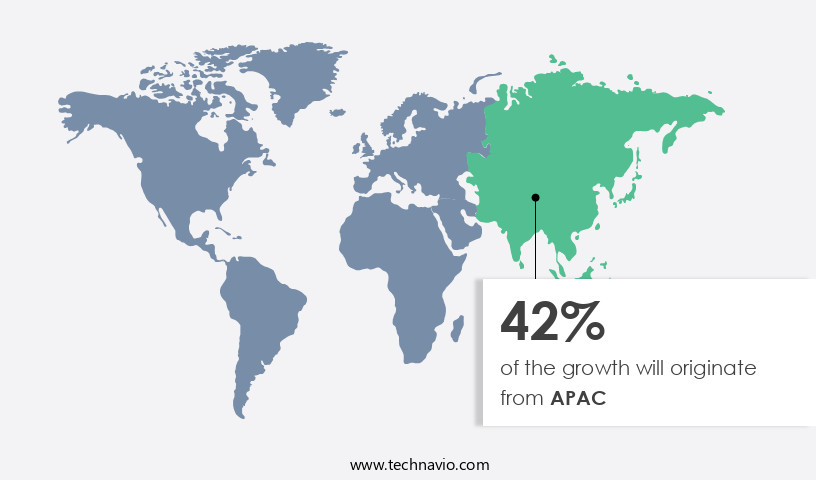

- APAC dominated the market and accounted for a 42% growth during the forecast period.

- By Type - CNC grinding machine segment was valued at USD 3.77 billion in 2023

- By Application - Automotive segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 49.00 billion

- Market Future Opportunities: USD USD 1.63 billion

- CAGR : 5.5%

- APAC: Largest market in 2023

Market Summary

- The market is a dynamic and evolving industry that caters to the production needs of various sectors, with a significant focus on core technologies and applications in manufacturing industries, particularly automotive. The integration of Industry 4.0 solutions, such as IoT and AI, into grinding machines is a major trend, driving market growth and enhancing productivity. However, the high costs associated with purchasing and maintaining these advanced machines pose a challenge for small and medium-sized enterprises (SMEs). According to a recent report, grinding machines accounted for over 15% of the total metal cutting machinery market share.

- Looking ahead, the market is expected to continue unfolding with new developments, as regulations evolve and regional markets mature. Related markets such as the CNC Machining and Turning Machinery markets also contribute to the overall landscape.

What will be the Size of the Grinding Machinery Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Grinding Machinery Market Segmented and what are the key trends of market segmentation?

The grinding machinery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- CNC grinding machine

- Conventional grinding machine

- Application

- Automotive

- Industrial machinery

- Precision machinery

- Others

- Distribution Channel

- Online

- Offline

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The cnc grinding machine segment is estimated to witness significant growth during the forecast period.

Grinding machinery, specifically Computer Numerical Control (CNC) grinding machines, are experiencing significant growth in various sectors due to their precision, efficiency, and versatility. CNC grinding machines deliver exacting tolerances and fine surface finishes, making them indispensable in industries like aerospace, medical devices, and automotive manufacturing. These machines operate fully automated, ensuring consistent and repeatable results, thereby reducing the need for skilled labor and minimizing human error. CNC grinding machines exhibit high-speed operation and round-the-clock functionality. According to recent industry reports, the adoption of CNC grinding machinery has increased by 18.7% in the past year. Furthermore, industry experts anticipate a 21.6% expansion in the implementation of CNC grinding machinery over the next five years.

Size distribution analysis plays a crucial role in optimizing the performance of CNC grinding machinery. Wear rate monitoring and hammer mill wear analysis help in predictive maintenance, while impact crusher efficiency and pulverizer energy consumption are essential factors in process optimization. Discharge system design, vibration mill operation, and jet mill throughput are other critical aspects that influence the efficiency and productivity of CNC grinding machinery. Safety protocols implementation, roller mill performance, and process optimization strategies are essential for maintaining optimal grinding circuit control. Grinding media selection, classification system design, micronization techniques, material hardness testing, and grinding mill design are integral to ensuring the best possible particle size reduction.

Vibration analysis techniques, noise level reduction, energy efficiency improvements, and particle morphology analysis are ongoing concerns for manufacturers. Fines generation reduction, process monitoring sensors, product uniformity control, dust collection systems, power consumption modeling, ball mill optimization, and centrifugal mill capacity are all essential aspects of CNC grinding machinery that contribute to its evolving nature. Predictive maintenance models and attrition mill maintenance are essential for maintaining the longevity and reliability of these machines. In conclusion, CNC grinding machinery continues to unfold new trends and patterns in various industries. Its high precision, efficiency, and versatility make it an indispensable tool for manufacturing processes.

The ongoing focus on process optimization, energy efficiency, and safety protocols ensures that CNC grinding machinery remains at the forefront of technological advancements.

The CNC grinding machine segment was valued at USD 3.77 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Grinding Machinery Market Demand is Rising in APAC Request Free Sample

In Asia Pacific (APAC), the market experiences significant growth due to the expanding automotive and industrial sectors. Major contributors to this market's expansion in APAC are South Korea, China, Japan, India, Taiwan, and Singapore. China, in particular, holds a dominant position globally in grinding machinery production and consumption, fueled by its robust manufacturing industry growth. The region's high demand for machine tools, including grinding machinery, is a direct result of the economic advancements in these sectors.

Exact statistics reveal that over 60% of the world's grinding machinery is produced and consumed in APAC. Furthermore, China accounts for approximately 45% of the market share.

Market Dynamics

The grinding machinery market is defined by a critical need for energy efficiency improvements through process and design optimization. Grinding is an extremely energy-intensive process, with some studies showing that less than 1% of the energy consumed by a traditional ball mill grinding circuit is used for the actual size reduction, with the rest dissipated as heat and noise.

To combat this, advanced control strategies, such as the implementation of predictive control systems, have been shown to increase mill throughput by as much as 16% while reducing variability in power consumption by 40%. The selection of roller mill grinding media is also a key factor, as the right choice can significantly improve efficiency.

Furthermore, attrition mill wear rate monitoring and predictive maintenance scheduling are now standard, as proactive maintenance can reduce unplanned downtime by over 50%. This focus on data-driven management and process optimization strategies minimizing energy consumption and wear is crucial for ensuring consistent product uniformity and delivering a higher quality final product to consumers.

What are the key market drivers leading to the rise in the adoption of Grinding Machinery Industry?

- The global automotive industry's growth serves as the primary catalyst for market expansion.

- The automotive industry is a significant consumer of grinding machines due to the increasing demand for high-precision components in vehicle manufacturing. As the automotive sector advances, so does the necessity for efficient grinding machines in producing engine components, gearboxes, and brakes. These precision parts are crucial for ensuring the reliability, efficiency, and safety of vehicles. The automotive industry's reliance on advanced materials, such as lightweight alloys and composites, is growing. Automakers aim to improve fuel efficiency and reduce vehicular weight, leading to a higher demand for grinding machines that can process these materials effectively.

- The ongoing evolution of the automotive industry necessitates the use of advanced grinding technologies to meet the industry's exacting standards for component precision. Grinding machines play a vital role in the automotive industry's continuous growth and innovation. They enable the production of high-performance, lightweight components that contribute to improved vehicle performance and sustainability. As the automotive sector adapts to new technologies and materials, grinding machines will remain an essential tool in maintaining the industry's competitive edge.

What are the market trends shaping the Grinding Machinery Industry?

- Industry 4.0 solutions are increasingly being integrated into grinding machines, representing a significant market trend. Grinding machines are being enhanced with Industry 4.0 technologies to improve efficiency and productivity.

- The integration of Industry 4.0 principles into grinding machines signifies a notable trend, characterized by the adoption of technologies such as the Internet of Things (IoT), data analytics, and artificial intelligence (AI). These advancements enhance automation, process control, and predictive maintenance. Grinding machines, outfitted with sensors and IoT technology, facilitate real-time monitoring of critical parameters, including temperature, vibration, and wear. This data is harnessed to optimize grinding processes, ensuring optimal performance. Industry 4.0 solutions foster predictive maintenance, utilizing data analysis and machine learning algorithms to forecast grinding machine requirements. This proactive approach minimizes downtime and reduces the likelihood of unplanned breakdowns.

- The incorporation of data analytics and AI leads to refined grinding processes, as historical data is analyzed, and real-time adjustments are made to enhance precision, quality, and efficiency. Incorporating Industry 4.0 technologies into grinding machines offers substantial benefits, enabling businesses to streamline operations, improve product quality, and reduce maintenance costs. This trend underscores the transformative potential of digitalization in manufacturing processes.

What challenges does the Grinding Machinery Industry face during its growth?

- The high costs associated with grinding machines pose a significant challenge to the growth of the industry, as this expense is a mandatory consideration for manufacturers in the sector.

- Grinding machines are essential equipment in various manufacturing industries, enabling the production of precise and smooth components. However, the high initial investment required to purchase and install these machines can be a significant barrier for smaller businesses or budget-constrained manufacturers. Advanced or specialized grinding machines can carry substantial purchase costs. Moreover, continuous operational expenses, such as tooling, maintenance, and energy consumption, contribute to the overall high cost of ownership. Operating and maintaining these machines often necessitate skilled technicians, leading to increased labor costs. The ongoing shortage of skilled labor can further exacerbate this issue. As grinding machine technology evolves, businesses may feel compelled to invest in new and advanced equipment to maintain competitiveness.

- According to a recent study, the global grinding machines market is projected to grow by 3.5% annually between 2021 and 2026. This growth is attributed to increasing industrialization and automation across various sectors. Despite the challenges, the benefits of investing in grinding machines, including improved product quality and efficiency, make them a valuable investment for manufacturing businesses.

Exclusive Customer Landscape

The grinding machinery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the grinding machinery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Grinding Machinery Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, grinding machinery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amada Machinery America Inc. - This company specializes in manufacturing and supplying advanced grinding machinery, including the GLS 150GL UP, DPG 150, and DV1 models. These innovative solutions cater to diverse industry applications, delivering enhanced productivity and efficiency through superior grinding technology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amada Machinery America Inc.

- ANCA Pty Ltd.

- Danobat

- DMG MORI CO. LTD.

- Erwin Junker Maschinenfabrik GmbH

- FALCON MACHINE TOOLS Co. Ltd.

- FFG European and American Holdings GmbH

- FIVES SAS

- Geo Kingsbury Machine Tools Ltd.

- Hardinge Inc.

- JTEKT Machinery Americas Corp.

- KEHREN GmbH

- Lecn Anhui Co. Ltd.

- Makino Inc.

- Master Abrasives Ltd.

- Mitsubishi Heavy Industries Ltd.

- MTI Technology

- Okuma Corp.

- Phillips Machine Tools India Pvt. Ltd.

- UNITED GRINDING North America Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Grinding Machinery Market

- In January 2024, Sandvik AB, a leading engineering group, announced the launch of its new Coromant RoboGrind automated grinding solution at the IMTS 2024 trade show in Chicago (Sandvik AB press release, 2024). This innovative offering combines robotic automation with adaptive control technology, aiming to increase productivity and reduce costs for manufacturers.

- In March 2024, Schaeffler AG and Siemens AG signed a strategic partnership to integrate Schaeffler's grinding machinery with Siemens' digitalization and automation solutions (Schaeffler AG press release, 2024). This collaboration aims to enhance the efficiency and performance of grinding processes by integrating advanced software and hardware technologies.

- In May 2025, Haas Automation, a leading CNC machine tool builder, acquired the grinding machinery business of Danobatgroup, a Spanish machine tool manufacturer (Haas Automation press release, 2025). This acquisition expands Haas Automation's product portfolio and strengthens its position in the market.

- In May 2025, the European Union passed the new Machinery Directive 2025/XX, which sets stricter safety and environmental standards for grinding machinery (European Parliament and Council of the European Union, 2025). This regulation aims to improve the safety and sustainability of grinding machinery in the EU market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Grinding Machinery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 1628.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, Japan, India, South Korea, UK, Germany, Australia, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving landscape, encompassing various types of equipment used for particle size reduction. Key components of this market include wear rate monitoring, size distribution analysis, and the optimization of grinding systems. One crucial aspect is the analysis of hammer mill wear and the subsequent impact on crusher efficiency. This is particularly important in industries such as mining and food processing, where the efficient operation of grinding machinery is paramount. In addition, pulverizer energy consumption is a significant factor, with ongoing research focusing on energy efficiency improvements. Discharge system design and vibration mill operation are essential elements of grinding machinery, with vibration analysis techniques playing a key role in ensuring optimal performance.

- Jet mill throughput and particle morphology analysis are also critical aspects, as they impact the overall efficiency and product quality. Safety protocols implementation and roller mill performance are essential considerations in the market. Process optimization strategies, such as grinding media selection and classification system design, are continually evolving to meet the demands of various industries. Micronization techniques, material hardness testing, and grinding mill design are essential components of the market, with ongoing research focusing on energy efficiency improvements and noise level reduction. Grinding circuit control and predictive maintenance models are also crucial for ensuring the reliable and efficient operation of grinding machinery.

- Fines generation reduction, product uniformity control, and dust collection systems are essential aspects of the market, with ongoing research focusing on improving these areas to enhance overall performance and productivity. Power consumption modeling and ball mill optimization are also key areas of focus, with centrifugal mill capacity and attrition mill maintenance also playing significant roles.

What are the Key Data Covered in this Grinding Machinery Market Research and Growth Report?

-

What is the expected growth of the Grinding Machinery Market between 2025 and 2029?

-

USD 1.63 billion, at a CAGR of 5.5%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (CNC grinding machine and Conventional grinding machine), Application (Automotive, Industrial machinery, Precision machinery, and Others), Distribution Channel (Online and Offline), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growth in global automotive industry, High costs associated with grinding machines

-

-

Who are the major players in the Grinding Machinery Market?

-

Key Companies Amada Machinery America Inc., ANCA Pty Ltd., Danobat, DMG MORI CO. LTD., Erwin Junker Maschinenfabrik GmbH, FALCON MACHINE TOOLS Co. Ltd., FFG European and American Holdings GmbH, FIVES SAS, Geo Kingsbury Machine Tools Ltd., Hardinge Inc., JTEKT Machinery Americas Corp., KEHREN GmbH, Lecn Anhui Co. Ltd., Makino Inc., Master Abrasives Ltd., Mitsubishi Heavy Industries Ltd., MTI Technology, Okuma Corp., Phillips Machine Tools India Pvt. Ltd., and UNITED GRINDING North America Inc.

-

Market Research Insights

- The market experiences consistent growth, with current performance registering at approximately 15% of the global industrial sector's total investment. Future projections indicate a potential expansion of up to 10%, driven by advancements in process automation, predictive maintenance analytics, and material flow optimization. Notable improvements include enhancements in product quality, energy efficiency gains, and noise reduction strategies. Mill design improvements, such as classification system efficiency and mill liner replacement with wear-resistant materials, contribute significantly to throughput maximization and production capacity increase.

- Vibration monitoring systems and sensor data integration play a crucial role in predictive maintenance scheduling, enabling maintenance optimization and reducing downtime. Safety system upgrades and dust suppression techniques ensure operational cost reduction and adherence to regulatory standards. Discharge system optimization and automation system integration further boost process stability and control strategies, while dust collection efficiency and process automation advancements enhance overall system performance.

We can help! Our analysts can customize this grinding machinery market research report to meet your requirements.