4K TV Market Size 2024-2028

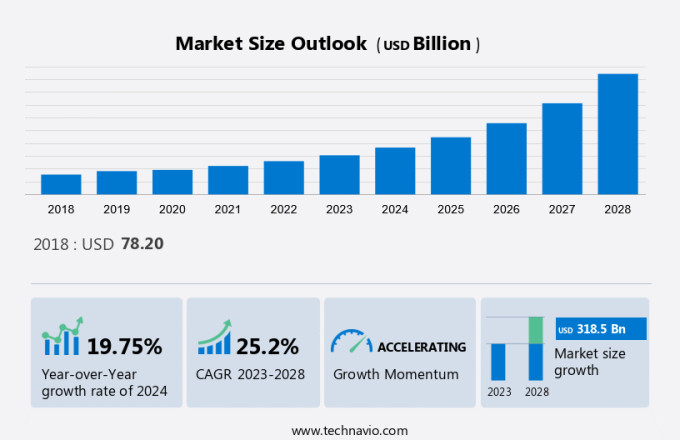

The 4K TV market size is estimated to grow by USD 318.5 billion at a CAGR of 25.2% between 2023 and 2028. The market's growth is influenced by several factors, including the increasing preference for large-display televisions as well as smart TV, ongoing product innovation driving portfolio expansion and premium product offerings, and the rising significance of online sales channels. These factors collectively contribute to the market's expansion, with consumers showing a strong inclination towards larger screen sizes for enhanced viewing experiences. Additionally, continuous advancements in technology and product features lead to a wider range of options for consumers, including premium offerings such as Ultra HD TVs that cater to specific needs and preferences. The growing prominence of online sales channels further boosts market growth by providing convenient access to a broader customer base. As these trends continue, the market for large-display televisions is poised for significant expansion.

What will be the size of the 4K TV Market During the Forecast Period?

To learn more about this 4K TV market report, View Report Sample

4K TV Market Segmentation

The 4K TV market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Type Outlook

- 52-65 inches type

- Below 52 inches type

- Above 65 inches type

- Application Outlook

- Residential

- Commercial

- Industrial

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

By Type

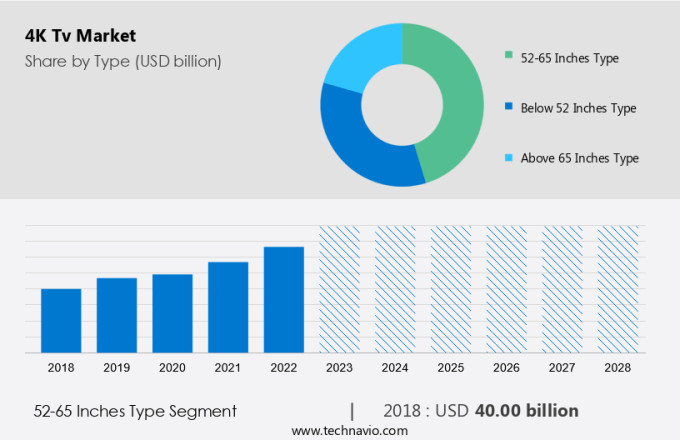

The market share growth by the 52-65 inches type segment will be significant during the forecast period. The adoption of 4K TVs of this size will be influenced by the rise in disposable income in developing nations during the forecast period. Consumer spending has increased as a result of the rise in disposable income, which has also increased demand for consumer electronics like 4K TVs.

Get a glance at the market contribution of various segments. View the PDF Sample

The 52-65 inches type segment was valued at USD 40 billion in 2018. Smart 4K TVs are one of the most popular products in middle-class markets such as India. The ownership and viewing habits of India's expanding TV universe have been influenced by the country's growing number of nuclear families. The average size of a TV in nuclear families across the nation has increased to 52-65 inches as a result of these developments. Moreover, the demand for 52-65 inches 4K TVs will grow rapidly in developing nations due to rising disposable income and the evolution of average-sized TV sets during the forecast period.

By Region

For more insights on the market share of various regions, Download PDF Sample now!

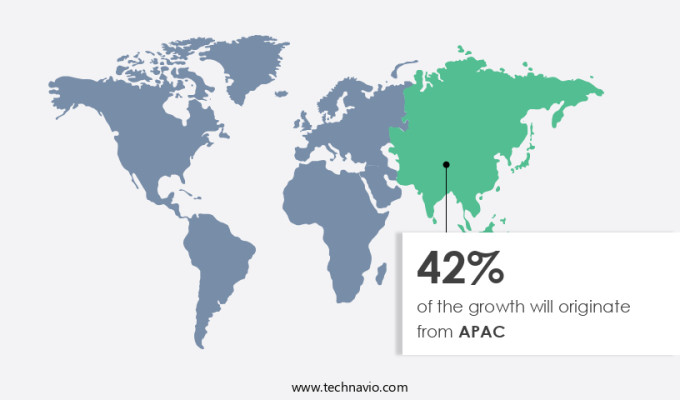

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

APAC is anticipated to become a high-potential market for 4K TVs during the forecast period. The major market contributors in the region are nations like India, China, Japan, and South Korea. The adoption of 4K TVs in APAC is anticipated to increase due to the presence of strong companies, rising 4K TV demand in these nations, and expanding use of smart classrooms. Hence, such factors are driving the market in APAC during the forecast period.

4K TV Market Dynamics

The market is witnessing significant growth driven by the demand for television sets offering Ultra High Definition (UHD) with screen sizes ranging from less than 55 inches to 62 inches. Consumers seek high-performance 4K TV for deep blacks, vibrant colours, and rapid response times. These TVs, equipped with advanced graphics engines and graphic processors, deliver high-quality images and support digital media and digital content. The 4K TV market also includes Super UHD (SUHD) TVs, providing superior viewing experiences. The proliferation of high-speed internet further enhances the market, enabling seamless streaming of high-quality data for unparalleled visual experiences on HD devices. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. In the growing 4K TV market, consumers are seeking compatibility with a wide range of devices, including blu-ray players, cameras, and projectors. Screen size options, like the popular 62 inches, offer enhanced visuals, while monitors, laptops, and tablets integrate seamlessly, providing versatile options for home entertainment setups.

Our researchers analyzed the data with 2023 as the base year and the key drivers, trends, and challenges.

Key Market Driver

The rising popularity of large-display televisions is notably driving market growth. In 2018, a 40-inch television was the standard size across the globe. However, the majority of retailers now provide televisions with screens larger than 80 inches. In 2019, 25% of televisions sold (more than half of all sales) were 50 inches or larger. For screens 36 inches or larger, consumers are likely to choose a UHD/4K television over an HD model during the forecast period. Customers will indeed have a better experience with a UHD television than they would with a screen smaller than 36 inches due to the higher resolution it offers. UHD televisions provide enhanced viewing experiences with their larger screen sizes, allowing for high-quality images, vibrant colors, and rapid response times, enhancing the overall visual experience for viewers.

The increasing acceptance of video walls as a viable option is another factor promoting the expansion of this market. To give the impression of one large screen, video walls are made up of several monitors arranged in a row. They have superior qualities and are increasingly used as digital signage in manufacturing facilities, in addition to their use in large settings. Flexible video deployments that offer numerous advantages are valuable to businesses across a range of industries. Large-area displays, like video walls, are used in manufacturing facilities to deliver real-time information via digital solutions and provide data on inventory, daily output levels, and more. These factors are likely to drive 4K TV market growth during the forecast period.

Significant Market Trends

The demand for smart TVs is an emerging trend in the market. Smart TVs also referred to as hybrid TVs or connected TVs have interactive Web 2.0 features built right into them. The 4K resolution is a feature of the most recent smart TVs. During the forecast period, the rising demand for such smart TVs as well as curved TVs will favorably affect the expansion of the global 4K TV market.

Smart features are becoming more valued as necessities, which has caused consumers' preferences to change and led to a self-sustaining demand for integrated internet streaming capabilities. Several retailers also offer smart UHD TVs. Important market players like LG and Samsung offer Android smart TVs. Different-sized LED and OLED Android smart TVs are available from Sony Group Corp. Smart TVs are now widely available on par with regular TVs, which has helped them become commonplace items in major cities, small towns, and tier-II cities. This trend will continue to contribute to 4K TV market growth during the forecast period.

Major Market Challenge

The lack of 4K content is a major challenge impeding market growth. The advanced 4K HDR OLED technology and X1 Extreme processor used in the AF8 series are designed to give users the best experience possible. Studios must use 4K-capable equipment, which is still being developed, to film content that can be viewed in 4K. The lack of content, however, may make purchasing a 4K TV a disadvantage.

Although companies are working to integrate 4K into their platforms, the high cost of these 4K videos prevents many users from viewing them. Its titles are purchased without a resolution quality option, allowing customers with the right audiovisual (AV) setups and quick internet connections to stream 4K content. In-home capabilities and content distribution are the main problems with 4K and 8K resolutions. Many owners of 4K UHD devices are unable to access this content because broadcasters have not yet produced 4K content. The significant financial investment required to contribute and distribute 4K UHD is the main cause of this gap. Operators might not be motivated to shorten the replacement lifecycle to offer customers a 4K UHD set-top box (STB). Therefore, the gap between the demand for UHD TVs and the supply of content will hinder 4K TV market growth during the forecast period.

Customer Landscape

The 4K TV market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggards's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the 4K TV market research and growth report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Market Customer Landscape

Who are the Major 4K TV Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Skyworth Group Ltd. - The company primarily engages with the manufacturing and sales of consumer electronic products and upstream accessories. The key offerings of the company include a 4K TV built with 2nd generation AIPQ image quality adjustment which improves picture quality by optimizing every detail and pixel of the picture.

The 4K TV market trends report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Apple Inc.

- Elitelux Australia

- Haier Smart Home Co. Ltd.

- Hisense International Co. Ltd.

- Koninklijke Philips NV

- LG Electronics Inc.

- MIRC Electronics Ltd.

- Panasonic Holdings Corp.

- Roku Inc.

- Samsung Electronics Co. Ltd.

- Sharp Corp.

- Sichuan Changhong Electric

- Sony Group Corp.

- TCL Electronics Holdings Ltd.

- Toshiba Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Developments and News

-

In November 2024, Samsung launched a new series of 4K TVs equipped with AI-powered upscaling technology that enhances the viewing experience by converting lower-resolution content into near-4K quality. This innovation caters to consumers seeking superior picture quality in every viewing experience, boosting the appeal of 4K TVs.

-

In October 2024, LG unveiled its latest 4K OLED TV lineup, featuring thinner designs and improved brightness levels. The new range focuses on delivering unparalleled contrast ratios and color accuracy, responding to the growing demand for high-end, immersive home entertainment solutions.

-

In September 2024, Sony introduced a 4K TV with advanced gaming features, including support for 120Hz refresh rates and low latency, designed to enhance the gaming experience. This launch aims to tap into the increasing demand for 4K TVs tailored to the needs of gamers, offering seamless compatibility with the latest gaming consoles.

-

In August 2024, TCL released an affordable line of 4K LED TVs aimed at budget-conscious consumers, providing high-quality viewing experiences without the premium price tag. This move expands the availability of 4K TVs to a wider audience, making 4K technology more accessible to mainstream consumers.

Market Analyst Overview

The 4K TV market is driven by the demand for sharper visuals and improved viewing experiences. With the rise of entertainment platforms and streaming services, consumers seek 4K TVs to enjoy high-quality content. These TVs cater to content creators and viewers alike, offering high dynamic range (HDR) and quantum dot (QLED) technologies for enhanced contrast and color accuracy. Compared to standard Full HD TVs, 4K TVs deliver superior image quality with technologies like LCD and IPS panels. They are part of a broader trend in customer electronics towards high-quality images and data, providing an exceptional viewing experience across devices such as monitors, smartphones, laptops, tablets, projectors, and blu-ray players, especially for Ultra-high-definition content.

The 4K TV market is expanding rapidly, driven by demand for high-performance 4K TV models with superior resolution and immersive viewing experiences. Featuring ultra high definition (UHD) and super UHD (SUHD) technology, these television sets deliver deep blacks, vibrant colours, and high quality images across a range of screen sizes, including popular 62 inches screen size options. Customers are attracted to smart features, HD devices, and enhanced graphics engines, which offer rapid response times and high quality data transmission. With advancements in graphic processors and customer electronics, 4K TVs provide unparalleled picture quality for digital media consumption. The rise of high-speed internet further supports streaming, making Television a central entertainment hub. Superior television quality continues to redefine customer expectations in the 4K TV market.

The market is thriving, offering consumers an improved viewing experiences with high quality images that bring media and entertainment to life. With screen sizes ranging from inches, these monitors deliver stunning clarity and detail, making them ideal for home theaters and gaming. High quality data is streamed seamlessly, enhancing the experience of watching movies on Blu-ray players or binge-watching shows on laptops and tablets. The advanced technology used in 4K TVs also supports cameras for video conferencing and other applications, making them versatile tools for work and play. Whether you're projecting content onto a large screen or watching it up close, 4K TVs offer unparalleled visual fidelity that sets a new standard for media consumption. The 4K TV market is expanding rapidly, offering various devices for enhanced viewing experiences. Consumers can now connect a blu-ray player, camera, or projector to their 4K TVs, while monitors, laptops, and tablets complement their setups. Popular screen sizes, including 62 inches, cater to diverse preferences, providing improved entertainment for all.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 25.2% |

|

Market growth 2024-2028 |

USD 318.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

19.75 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 42% |

|

Key countries |

China, US, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Apple Inc., Elitelux Australia, Haier Smart Home Co. Ltd., Hisense International Co. Ltd., Koninklijke Philips N.V., LG Electronics Inc., MIRC Electronics Ltd., Panasonic Holdings Corp., Roku Inc., Samsung Electronics Co. Ltd., Sharp Corp., Sichuan Changhong Electric Co. Ltd., Skyworth Group Ltd., Sony Group Corp., TCL Electronics Holdings Ltd., Toshiba Corp., VIZIO Holding Corp., Vu Television, Westinghouse Electric Corp, and Xiaomi Communications Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market forecasting, market report, market forecast , Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our 4K TV market forecast report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this 4K TV Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2028.

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this 4K TV market research report to meet your requirements. Get in touch