5G Chipset Market Size 2024-2028

The 5g chipset market size is forecast to increase by USD 42.91 billion at a CAGR of 17.3% between 2023 and 2028.

What will be the Size of the 5G Chipset Market During the Forecast Period?

How is this 5G Chipset Industry segmented and which is the largest segment?

The 5g chipset industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- RFICs

- Modem

- End-user

- Mobile devices

- Telecommunication infrastructure

- Non-mobile devices

- Automobile

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- North America

By Type Insights

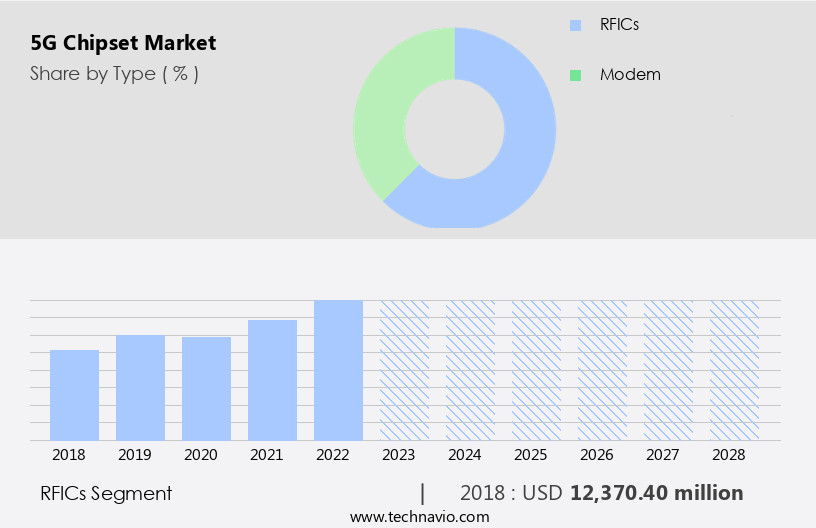

- The rfics segment is estimated to witness significant growth during the forecast period.

Radio-frequency integrated circuits (RFICs) play a vital role In the market, facilitating wireless communication by converting analog and digital signals. These components are integral to 5G infrastructure, powering applications from smartphones and base stations to IoT devices. The market for RFICs is expanding due to the growing demand for high-speed, low-latency 5G networks. Key industries, such as automotive and industrial IoT, are driving this trend, necessitating advanced connectivity solutions. GCT Semiconductor's recent partnership with a leading infrastructure provider to develop Fixed Wireless Access (FWA) technology using their 5G modem chipset and RFIC solutions underscores this need. The market is characterized by its emphasis on high throughput, low latency, and mm Wave Technology.

As 5G networks continue to roll out, RFICs will remain essential for delivering the high-speed, efficient connectivity that powers the digital transformation across various industries.

Get a glance at the 5G Chipset Industry report of share of various segments Request Free Sample

The RFICs segment was valued at USD 12.37 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market holds substantial growth potential for 5G chipsets, fueled by the extensive rollout of 5G networks and the increasing adoption of 5G-enabled devices. In the US and Canada, over 300 million people, accounting for approximately 90% of the population, are covered by low-band 5G services from leading providers. Mid-band 5G coverage ranges from 210 to 300 million people. The deployment of mmWave technology in major urban areas underscores the region's dedication to advancing 5G infrastructure. With extensive network coverage, the demand for 5G chipsets in various devices, including consumer electronics, automotive, and industrial applications, is on the rise.

Key industries, such as automation and the Internet of Things (IoT), are poised to benefit from the high-speed internet, low-latency infrastructure, and enhanced security offered by 5G technology. Semiconductor manufacturers, including MediaTek, are addressing design challenges, such as frequency bands, compact form factors, and data capacity, to deliver high-throughput, low-latency 5G chipsets for various applications. Strategic collaborations between semiconductor device manufacturers, smartphone OEMs, telecom players, and automotive manufacturers are driving innovation and customization in 5G chipsets. The regulatory landscape and geographic segmentation are also influencing the market dynamics.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of 5G Chipset Industry?

Smart city projects is the key driver of the market.

What are the market trends shaping the 5G Chipset Industry?

Launch of innovative 5G chipsets is the upcoming market trend.

What challenges does the 5G Chipset Industry face during its growth?

Production challenges is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The 5g chipset market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the 5g chipset market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, 5g chipset market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ASR Microelectronics Co. Ltd - The company specializes in providing advanced 5G chipset solutions for various applications, including 802.11 wireless LAN systems, access points, routers, wireless routers, and more. These chipsets enable seamless integration of 5G technology into these devices, enhancing their capabilities and improving connectivity. With a focus on innovation and performance, the company's offerings cater to the growing demand for faster and more reliable wireless communications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASR Microelectronics Co. Ltd

- Broadcom Inc.

- Fujitsu Ltd.

- Huawei Technologies Co. Ltd.

- Infineon Technologies AG

- Intel Corp.

- Marvell Technology Inc.

- MediaTek Inc.

- Micron Technology Inc.

- Murata Manufacturing Co. Ltd.

- Nokia Corp.

- Qorvo Inc.

- Qualcomm Inc.

- Realtek Semiconductor Corp.

- Samsung Electronics Co. Ltd.

- Skyworks Solutions Inc.

- Sony Group Corp.

- STMicroelectronics International N.V.

- ZTE Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global market for 5G chipsets is experiencing significant growth as the next generation of cellular technology gains momentum. This technology, which promises high-speed internet, improved network coverage, and low-latency infrastructure, is poised to revolutionize various industries, from consumer electronics to automotive and industrial IoT. The demand for 5G chipsets is driven by several factors. The increasing adoption of automotive applications, such as connected cars and autonomous vehicles, necessitates the need for high-speed, low-latency connectivity. Furthermore, the rise of the Internet of Things (IoT) and the increasing number of connected devices require efficient data transmission and processing capabilities. The design challenges associated with 5G chipsets are numerous.

The technology relies on millimeter wave technology, which operates at higher frequencies than previous generations. This requires compact form factors and high efficiency to minimize power consumption and heat generation. Moreover, the data capacity and connectivity experience demanded by 5G applications necessitate dynamic resource allocation, edge computing, and security enhancement. Leading manufacturers of semiconductor devices are investing heavily In the development of 5G chipsets. These companies are collaborating strategically to address the design challenges and offer customized solutions to meet the specific needs of various industries. For instance, Mediatek, a leading semiconductor manufacturer, has announced the development of a 5G chipset that supports both sub-6GHz and mmWave frequencies, offering high throughput and low latency.

The market is also witnessing the emergence of 5G modems and modem chipsets, which are essential components of 5G networks. These devices enable enhanced mobile broadband, ultra-reliable communications, and low latency communications, making them crucial for various applications, including smartphone OEMs, telecom players, and smart city projects. The geographic segmentation of the market is diverse, with various regions investing in urban infrastructure to support the deployment of 5G networks. Telecom operators are also participating in spectrum auctions to secure the necessary frequencies for 5G connections. The IP multimedia subsystem (IMS) is expected to play a significant role In the deployment of 5G networks, enabling real-time, multimedia communication and enabling the automation industry to digitalize and transform.

The automotive sector is also a significant contributor to the growth of the market. The increasing number of automotive plants and the shift towards smart manufacturing and automation are driving the demand for high-speed, low-latency connectivity. The use of 5G technology in automotive applications is expected to lead to improved safety, efficiency, and convenience, making it a game-changer for the automotive industry. In conclusion, the market is witnessing significant growth as the technology gains momentum. The demand for high-speed internet, network coverage, and low-latency infrastructure is driving the development of 5G chipsets, which are essential for various applications, including consumer electronics, automotive, and industrial IoT.

The challenges associated with the design and development of 5G chipsets are numerous, but leading semiconductor manufacturers are investing heavily to address these challenges and offer customized solutions to meet the specific needs of various industries. The future of the market looks promising, with numerous opportunities for growth and innovation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.3% |

|

Market growth 2024-2028 |

USD 42906 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.8 |

|

Key countries |

US, China, Germany, UK, France, Canada, Japan, South Korea, Taiwan, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this 5G Chipset Market Research and Growth Report?

- CAGR of the 5G Chipset industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the 5g chipset market growth of industry companies

We can help! Our analysts can customize this 5g chipset market research report to meet your requirements.