AC and DC Controllers Market Size 2024-2028

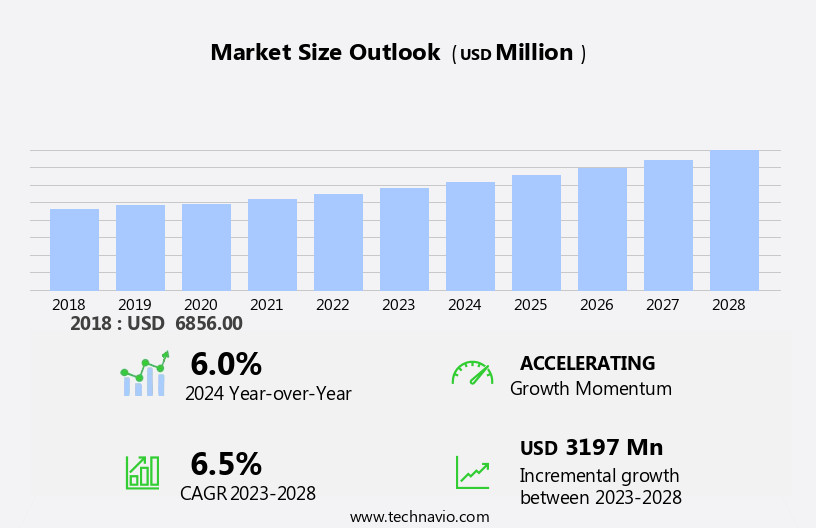

The AC and DC controllers market size is forecast to increase by USD 3.2 billion at a CAGR of 6.5% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for energy-efficient systems. The rise in the adoption of electric vehicles (EVs) is another major growth factor, as these vehicles require advanced controllers for optimal performance. However, the high development and production costs associated with AC and DC controllers pose a challenge to market growth. Energy efficiency is a key trend in various industries, leading to increased demand for AC and DC controllers that can help reduce energy consumption and costs. Additionally, the growing adoption of renewable energy sources and the need for reliable power management systems are driving market growth. Despite these opportunities, the high costs of manufacturing and producing these controllers remain a significant challenge that must be addressed to ensure market competitiveness.

What will be the Size of the AC and DC Controllers Market During the Forecast Period?

- The AC-DC controller market encompasses Control ICs that manage the conversion and regulation of AC to DC power for various electronic devices. Market dynamics include the increasing demand for low standby power and power factor adjustment to reduce energy consumption in consumer electronics, such as LED lighting, smartphones, and electric appliances. Consumer behavior shifts towards internet shopping and the proliferation of technology in healthcare and consumer goods further fuel market growth.

- Isolated AC-DC controllers are particularly relevant in industries like telecommunications and mining, where reliable power conversion is crucial. Global AC-DC controllers trade involves imports and exports of raw materials, including rectifiers, filters, and DC voltage regulators, from suppliers to manufacturers. Market trends include the development of constant DC output AC-DC converters, input voltage and output voltage adjustments, and output power optimization for diverse applications. Delta Electronics and other key players contribute to the market's technological advancements and competitive landscape.

How is this AC and DC Controllers Industry segmented and which is the largest segment?

The AC and DC controllers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- AC controller

- DC controller

- Application

- Automotive industry

- Aerospace and defense

- Consumer electronics

- Energy and utilities

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- Mexico

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- Brazil

- APAC

By Type Insights

- The AC controller segment is estimated to witness significant growth during the forecast period.

The AC controller segment of AC and DC controllers plays a crucial role in converting incoming AC power from the grid into regulated DC power for various applications. This process involves input rectification components, such as diodes or thyristors, which convert the AC voltage waveform into a pulsating DC signal. Subsequent stages of regulation and processing ensure optimal performance and reliability. AC controllers are essential in industries like Internet shopping, LED lighting, Smartphones, Electric appliances, and Electric propulsion. Isolated AC-DC controllers are particularly valuable in applications where galvanic isolation is necessary. The integration of advanced features, such as overvoltage protection and overcurrent protection, further enhances the efficiency and safety of AC controllers. The global market for AC and DC controllers is expected to grow significantly due to increasing demand for energy-efficient solutions and the proliferation of electronic devices.

Get a glance at the AC and DC Controllers Industry report of share of various segments Request Free Sample

The AC controller segment was valued at USD 4.01 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 52% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia-Pacific (APAC) region is a major market for AC and DC controllers, fueled by industrialization, urbanization, and substantial investments in sectors such as renewable energy and automotive. Notably, the automotive sector's growth is evident in Toyota Kirloskar Motor (TKM)'s expansion of its Bidadi plant in India to three-shift operations, increasing production output by over 30%. This development underscores the rising demand for AC and DC controllers In the automotive industry, particularly for electric vehicles (EVs) and hybrid models, which necessitate efficient and dependable power conversion solutions. The APAC region's dynamic growth is a significant contributor to The market.

Market Dynamics

Our AC and DC controllers market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of AC and DC Controllers Industry?

The growing need for energy-efficient systems is the key driver of the market.

- The market is witnessing significant growth due to the increasing demand for energy-efficient systems across various sectors. These controllers play a vital role in power systems by converting alternating current (AC) to Direct Current (DC), a process essential for the operation of numerous electrical and electronic devices such as LED lighting, smartphones, electric appliances, and electric vehicles. The ability to efficiently manage and regulate power conversion is crucial in meeting the rising need for energy efficiency and reducing carbon emissions. Moreover, the semiconductor sector's expansion, driven by the development of advanced Control ICs, is fueling the market's growth.

- The demand for isolated AC-DC controllers is particularly high in applications requiring power factor adjustment, such as electric propulsion, battery charging, electroplating, and vehicle electrification. In addition, the trend towards smart cities and the increasing use of renewable energy sources are further driving the market's growth. The market's dynamics are influenced by several factors, including consumer behavior, imports and exports, raw materials, and technology advancements. For instance, the rise of internet shopping and the increasing popularity of consumer goods are driving up the demand for AC-DC power supplies, rectifiers, filters, and DC voltage regulators. In the industrial sector, applications such as telecommunications, industrial robotics, medical devices, and cooling systems require AC-DC converters for power conversion.

What are the market trends shaping the AC and DC Controllers Industry?

The rise in the adoption of EVs is the upcoming market trend.

- The market is witnessing notable expansion due to the escalating adoption of electric vehicles (EVs) and the increasing demand for energy-efficient power management solutions. This trend is evidenced by several significant developments In the EV sector. This development underscores the growing affordability of EVs and the resulting rise in demand for AC-DC controllers to power various electronic devices, including LED lighting, smartphones, electric appliances, and more. Additionally, the expanding trend of vehicle electrification, smart cities, electric power steering (EPS), and renewable energy applications further boosts the market's growth. The market encompasses both isolated and non-isolated AC-DC controllers, AC-DC power supplies, and AC-DC converters.

- These components are essential for rectifying, filtering, and regulating DC voltage to constant DC output. Raw material suppliers play a crucial role In the market's growth, with input voltage and output voltage/power being critical factors in determining the performance and efficiency of AC and DC controllers. Industries such as telecommunications, industrial robotics, medical devices, and renewable energy are significant consumers of these components. The market's growth is further driven by the increasing imports and exports of these components and the technological advancements In the semiconductor sector.

What challenges does the AC and DC Controllers Industry face during its growth?

High development and production costs associated with AC and DC controllers is a key challenge affecting the industry growth.

- The market encompasses a range of advanced electronic components used to regulate and convert electrical power between AC and DC forms. These controllers are integral to the operation of various electronic devices, including LED lighting, smartphones, electric appliances, and more. Control ICs, a key component of AC-DC controllers, enable power factor adjustment and ensure efficient energy utilization. Consumer behavior trends, such as increased internet shopping and the adoption of renewable energy, are driving the demand for AC and DC controllers. Applications in sectors like electric propulsion, battery charging, electroplating, and vehicle electrification are also fueling market growth.

- Isolated AC-DC controllers are particularly important in industries like telecommunications, industrial robotics, medical devices, and renewable energy. Despite their benefits, the high costs associated with developing and producing AC and DC controllers pose a significant challenge. Advanced algorithms and control strategies necessitate substantial investments in research and development. F Input voltage and output voltage/power specifications, as well as Delta Electronics and other key players, influence the design and functionality of these controllers. Cooling types (isolated vs. Non-isolated) and applications in sectors like healthcare, consumer goods, technology, and mining further expand the market scope.

Exclusive Customer Landscape

The AC and DC controllers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the AC and DC controllers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, AC and DC controllers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Antares Technology - The company provides a versatile AC and DC relay controller featuring sixteen connection ports for interfacing with both alternating current (AC) and direct current (DC) devices.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Antares Technology

- Campbell Scientific Inc.

- Diodes Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- Monolithic Power Systems Inc.

- Mornsun Guangzhou Science and Technology Co Ltd

- NXP Semiconductors NV

- ON Semiconductor Corp.

- RECOM Power GmbH

- Renesas Electronics Corp.

- Richtek Technology Corp.

- Rockwell Automation Inc.

- ROHM Co. Ltd.

- Shenzhen Slkor Micro Semicon Co Ltd

- STMicroelectronics International N.V.

- Texas Instruments Inc.

- WINSEMI

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Understanding the Dynamics of the Global AC-DC Controllers Market The AC-DC controllers market represents a significant segment in the broader electronics industry. These controllers, which regulate the conversion of alternating current (AC) to direct current (DC) or vice versa, play a crucial role in powering various electronic devices and systems. AC-DC controllers are integral components in numerous applications, from consumer electronics like smartphones and LED lighting to industrial applications such as electric propulsion, battery charging, and electroplating. They also find extensive use in the semiconductor sector, vehicle electrification, smart cities, and healthcare and consumer goods technology. One essential feature of AC-DC controllers is their ability to provide low standby power consumption.

Moreover, with the increasing emphasis on energy efficiency and environmental sustainability, this aspect has gained significant importance. Power factor adjustment is another critical function of AC-DC controllers, ensuring optimal power usage and reducing energy losses. The consumer behavior trend towards increased internet shopping and the growing popularity of electronic devices has fueled the demand for AC-DC controllers. The same applies to the renewable energy sector, where AC-DC converters are essential for converting the variable output of renewable energy sources into a stable DC power supply for various applications. In the context of industrial applications, AC-DC controllers are essential components in telecommunications, industrial robotics, and medical devices.

Furthermore, they are also crucial In the mining industry, where AC-DC power supplies are used to power heavy machinery and equipment. The global AC-DC controllers market is characterized by a diverse range of products, including isolated and non-isolated controllers, AC-DC converters, and regulator circuits. These components vary in terms of input voltage, output voltage, and output power, catering to the specific requirements of various applications. The raw material suppliers play a vital role In the production of AC-DC controllers. Semiconductors, filters, and rectifiers are some of the essential raw materials used In the manufacturing process. The availability and pricing of these raw materials significantly impact the overall cost structure of AC-DC controllers.

|

AC and DC Controllers Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market Growth 2024-2028 |

USD 3.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.0 |

|

Key countries |

China, US, Germany, UK, Japan, Canada, Mexico, South Korea, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this AC and DC Controllers Market Research and Growth Report?

- CAGR of the AC and DC Controllers industry during the forecast period

- Detailed information on factors that will drive the AC and DC Controllers growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ac and dc controllers market growth of industry companies

We can help! Our analysts can customize this ac and dc controllers market research report to meet your requirements.