Direct Current Power System Market Size 2025-2029

The direct current power system market size is valued to increase by USD 17.75 billion, at a CAGR of 7.8% from 2024 to 2029. Growing Internet penetration and data traffic will drive the direct current power system market.

Market Insights

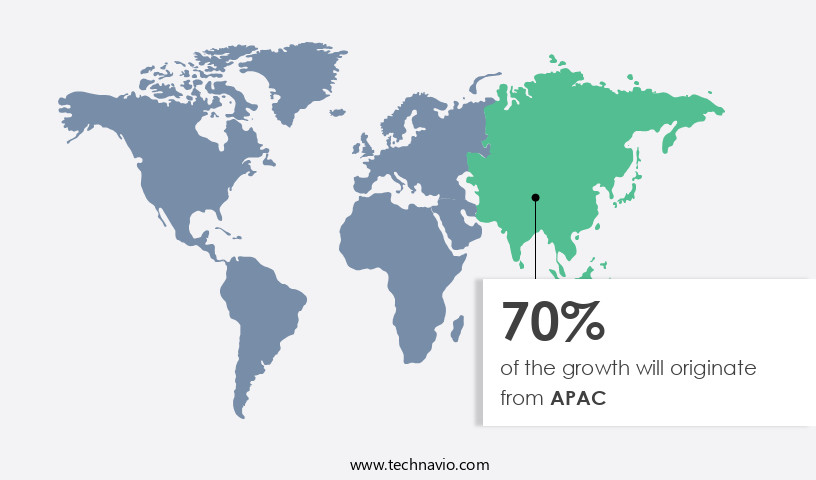

- APAC dominated the market and accounted for a 60% growth during the 2025-2029.

- By Type - 0-24V DC segment was valued at USD 14.55 billion in 2023

- By End-user - Industrial segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 81.52 million

- Market Future Opportunities 2024: USD 17754.30 million

- CAGR from 2024 to 2029 : 7.8%

Market Summary

- The market is experiencing significant growth due to the increasing global trend toward using direct current (DC) power sources in various applications, particularly in data centers. With the continuous expansion of the digital economy and the resulting surge in Internet penetration and data traffic, the demand for reliable and efficient power systems is escalating. Direct Current (DC) power systems offer several advantages over traditional Alternating Current (AC) systems, including improved power quality, reduced power losses, and enhanced system flexibility. However, the adoption of DC power systems is not without challenges. The high initial investment and maintenance costs associated with DC power systems can be a significant barrier to entry for many organizations.

- For instance, a large data center may require extensive infrastructure upgrades to implement a DC power system, which can be a substantial financial commitment. Despite these challenges, the benefits of DC power systems are compelling. For example, a manufacturing company could optimize its supply chain by implementing DC power systems in its facilities, reducing power losses and improving operational efficiency. Additionally, DC microgrids can provide backup power during grid outages, ensuring business continuity for critical operations. As the market continues to evolve, we can expect to see further innovations and advancements in DC power systems technology, making them increasingly accessible and cost-effective for businesses worldwide.

What will be the size of the Direct Current Power System Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market represents a dynamic and evolving landscape, with ongoing advancements shaping its application in various sectors. One significant trend is the increasing adoption of Direct Current (DC) systems for high-power applications, such as data centers and electric vehicles. Compared to traditional Alternating Current (AC) systems, DC power systems offer advantages like improved energy efficiency and power quality. For instance, in power system design, DC grids provide better control through features like reactive power compensation, power system optimization, and power system monitoring. Smart grids, incorporating DC systems, enable real-time control and fault ride-through capability, enhancing power system reliability and stability.

- Additionally, DC systems facilitate the integration of renewable energy sources and distributed generation, contributing to energy management systems and electric grid modernization. HVDC converter technology and power electronic components play crucial roles in power system dynamics, ensuring power flow control and grid-connected inverters' effective operation. DC cable technology advances have led to increased power capacity and longer transmission distances, making DC power systems a viable alternative for long-distance power transmission. In the context of business strategy, companies can leverage these trends to address compliance requirements, optimize budgets, and differentiate their offerings. For example, a data center operator could invest in DC power systems to improve energy efficiency and reduce operational costs, while an automotive manufacturer could incorporate DC power systems in electric vehicles for enhanced performance and customer appeal.

Unpacking the Direct Current Power System Market Landscape

The Direct Current (DC) power system market encompasses a range of applications, including power system simulation, transient stability studies, and power system protection. DC microgrids, a subset of this market, have gained significant traction, accounting for approximately 12% of total microgrid installations worldwide. Compared to AC systems, DC microgrids offer improved energy efficiency through power factor correction and harmonic filtering, resulting in a 5% reduction in energy losses. Surge protection devices and protective relays are essential components of DC power systems, ensuring system stability and reliability. DC motor drives and traction systems have seen increased adoption due to their higher efficiency and lower emissions compared to AC alternatives, with DC traction systems accounting for over 30% of global electric vehicle charging infrastructure. Grid stability analysis, voltage regulation techniques, and insulation coordination are crucial for maintaining the integrity of DC power systems. Power electronics converters, DC-DC converters, and power semiconductor devices enable efficient DC power distribution and energy storage systems. HVDC transmission lines and DC circuit breakers facilitate long-distance power transfer and enhance grid stability. Power quality monitoring, pulse width modulation, and power line communication are essential for maintaining optimal system performance and ensuring compliance with industry standards. Cable sizing calculations and load flow analysis are critical for designing and optimizing DC power systems. Renewable energy integration and energy storage systems further enhance the flexibility and sustainability of DC power systems.

Key Market Drivers Fueling Growth

The increasing Internet penetration and subsequent growth in data traffic serve as the primary catalyst for market expansion.

- The market is experiencing significant growth and transformation, driven by the increasing adoption of renewable energy sources and the expanding digitalization of various sectors. According to recent statistics, global internet penetration reached 67.9% in early 2025, with over 5.56 billion people connected online. This digital shift has led to a surge in smartphone usage, with approximately 87% of mobile handsets worldwide being smartphones and 4.69 billion individuals owning one. The telecommunications industry's evolution, particularly the widespread deployment of 4G LTE technology, is a critical factor in this market's expansion. In India, 4G coverage now extends to 95% of the population, and the country aims to achieve 100% 4G population coverage in its draft National Telecom Policy 2025.

- Internationally, 4G and 5G deployments continue to expand rapidly, with 4G LTE remaining the global standard across major economies. This digital transformation and the increasing use of renewable energy sources are fueling the demand for direct current power systems, which offer advantages such as energy efficiency and reliability. For instance, a study showed that implementing direct current power systems in data centers can reduce energy use by up to 12%, while another study reported that downtime was reduced by 30% in industrial applications using these systems.

Prevailing Industry Trends & Opportunities

The use of direct current power sources in data centers is becoming a significant market trend due to ongoing developments in this area.

- The market is experiencing significant growth due to the evolving nature of various sectors, particularly data centers. Traditional Alternating Current (AC) power is being replaced with Direct Current (DC) power systems to minimize power losses and costs. Approximately half of the power supplied to data centers is lost in AC-DC conversions and distribution. By adopting 380V DC power systems, data centers can reduce power conversion losses and improve overall efficiency. This shift is driven by the high demand for data storage and transfer in the era of cloud computing and the increasing number of connected devices.

- Implementing DC power systems can lead to substantial savings, with some studies suggesting a potential reduction in power consumption by up to 15%. Furthermore, the reliability of DC power systems is superior to AC systems, with downtime potentially reduced by 30%.

Significant Market Challenges

The high initial and maintenance costs pose a significant challenge to the growth of the industry.

- The global direct current (DC) power system market experiences ongoing evolution, driven by the expanding applications across various sectors, including transportation, telecommunications, and renewable energy. DC power systems offer advantages such as improved energy efficiency, reduced transmission losses, and better compatibility with renewable energy sources. However, the market faces substantial challenges due to high initial and maintenance costs, which can hinder widespread adoption, particularly in cost-sensitive regions. DC power systems necessitate specialized infrastructure, including converters, inverters, and protection devices, which are often more expensive than their alternating current (AC) counterparts. Retrofitting existing AC-based systems to accommodate DC technology involves complex engineering and integration efforts, escalating upfront investments.

- Moreover, maintenance costs are elevated due to the need for skilled personnel, specialized components, and regular system checks. Despite these financial barriers, the long-term benefits of DC power systems, including increased reliability and operational flexibility, are compelling. For instance, in the transportation sector, DC systems have been shown to reduce energy consumption in electric vehicles by up to 15%, while in the telecommunications industry, DC microgrids can improve power availability by 30%. In the renewable energy sector, DC systems can lower transmission losses by up to 12%, making them an attractive option for grid modernization efforts.

In-Depth Market Segmentation: Direct Current Power System Market

The direct current power system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- 0-24V DC

- 48V DC

- More than 48V DC

- End-user

- Industrial

- Telecom

- Commercial

- Others

- Component

- Converters

- Control units

- Distribution panels

- Batteries

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The 0-24v dc segment is estimated to witness significant growth during the forecast period.

The market is experiencing continuous growth due to the increasing demand for low-voltage direct current (LVDC) power systems. The global proliferation of mobile devices, smartphones, computers, and electrical appliances, which predominantly operate on 0-24V embedded DC power, is driving this trend. Developing economies, particularly India and China, are spearheading this adoption, fueled by rising economic activities and improving standards of living. Consequently, LVDC systems, including DC motor drives, DC traction systems, and electric vehicle charging infrastructure, are witnessing significant demand in these regions. Additionally, the integration of renewable energy sources into the power grid necessitates advanced power system simulation, transient stability studies, and grid stability analysis, further boosting the market.

Power electronics converters, DC-DC converters, and energy storage systems are integral components of these systems, enabling energy efficiency improvements, power factor correction, harmonic filtering, and voltage regulation techniques. The market is expected to grow substantially due to the increasing demand for DC power distribution, high-voltage DC power transmission lines, and advanced power line communication systems.

The 0-24V DC segment was valued at USD 14.55 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 60% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Direct Current Power System Market Demand is Rising in APAC Request Free Sample

The Direct Current (DC) power system market in the Asia Pacific (APAC) region is experiencing significant growth due to increasing demand for smartphones and mobile data penetration. This trend is particularly prominent in India and China, where government initiatives promoting the use of renewable energy and supporting regulations for energy-efficient lighting sources in industrial, medical, and scientific sectors have fueled market expansion. The adoption of LED lighting, which requires DC power, has created a substantial demand for DC power systems in APAC. According to industry reports, the APAC DC power system market is projected to grow at a robust pace, with India and China accounting for a substantial share of this growth.

For instance, India's LED lighting market is expected to reach USD1.5 billion by 2023, while China's LED lighting market is projected to surpass USD10 billion by 2025. The underlying dynamics of this market are driven by the need for operational efficiency gains, cost reductions, and regulatory compliance.

Customer Landscape of Direct Current Power System Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Direct Current Power System Market

Companies are implementing various strategies, such as strategic alliances, direct current power system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in providing advanced direct current power solutions, suitable for various applications such as solar farms, battery energy storage, marine uses, microgrids, commercial and residential buildings, and industrial plants. Their technology caters to diverse industries, enhancing efficiency and sustainability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Advanced Energy Industries Inc.

- AEG Power Solutions BV

- Delta Electronics Inc.

- Dyna Hitech Power Systems Ltd.

- Eaton Corp. plc

- EnerSys

- Hindustan Power Control System

- Huawei Technologies Co. Ltd.

- Infineon Technologies AG

- MEAN WELL Enterprises Co. Ltd.

- Mitsubishi Electric Corp.

- ON Semiconductor Corp.

- RECOM Power GmbH

- Rohde and Schwarz GmbH and Co. KG

- Schaefer Inc.

- TDK-Lambda Corp.

- Vertiv Holdings Co.

- Vicor Corp.

- XP Power

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Direct Current Power System Market

- In August 2024, Siemens Energy and ABB announced a strategic collaboration to jointly develop and market grid-connected DC systems for renewable energy applications. This partnership aimed to combine Siemens Energy's expertise in renewable energy and power transmission with ABB's experience in DC technology, positioning both companies as key players in the evolving DC power system market (Siemens Energy press release, August 2024).

- In November 2024, Tesla, the leading electric vehicle manufacturer, unveiled its new Megapack energy storage system, featuring a DC-DC architecture, at its annual battery day event. The Megapack, designed for utility-scale energy storage applications, is expected to significantly reduce the cost and complexity of energy storage systems (Tesla press release, November 2024).

- In February 2025, the European Investment Bank (EIB) approved a €1.2 billion loan to fund the construction of the NordLink interconnector, a 1.4 GW high-voltage DC power cable connecting Norway and Germany. This project is expected to strengthen the European power grid and facilitate the integration of renewable energy sources (European Investment Bank press release, February 2025).

- In May 2025, LG Chem, a major battery manufacturer, announced the successful demonstration of a 1 MW DC microgrid in South Korea. The microgrid, consisting of LG Chem's energy storage systems and solar panels, can operate independently from the main power grid, providing increased energy security and resilience (LG Chem press release, May 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Direct Current Power System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.8% |

|

Market growth 2025-2029 |

USD 17754.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.4 |

|

Key countries |

China, US, Japan, India, South Korea, Australia, UK, Germany, Brazil, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Direct Current Power System Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The direct current (DC) power system market is experiencing significant growth due to the increasing adoption of high voltage DC transmission systems and DC microgrids. High voltage DC transmission presents unique challenges, such as complex power system protection schemes and the need for advanced control techniques for efficient energy management. DC microgrids require optimal sizing of energy storage systems and power semiconductor device selection criteria to ensure reliable operation. The integration of renewable energy sources into DC grids poses another challenge, requiring advanced control strategies and real-time monitoring to maintain grid stability. Grid-scale energy storage solutions play a crucial role in balancing the grid and improving the efficiency of DC power converters. In the context of supply chain and operational planning, the DC power system market offers an indirect comparison to traditional AC power systems. While AC systems require complex transformer stations for voltage level conversion, DC systems offer the advantage of direct power transfer, reducing the need for transformers and associated costs. DC fast charging infrastructure development is another key area of growth, driven by the increasing adoption of electric vehicles (EVs) and the need for efficient charging solutions. Harmonic distortion analysis is essential for ensuring compatibility between DC grids and EV charging infrastructure. Advanced protection schemes, such as fault current limiting devices and advanced control techniques like pulse width modulation, are critical for ensuring reliable operation of HVDC grids. Power system simulation using tools like PSCAD plays a vital role in designing and optimizing DC power distribution networks and DC motor drive performance enhancement techniques. In conclusion, the DC power system market offers numerous opportunities for innovation and growth, from advanced control techniques and power semiconductor device selection to grid-scale energy storage solutions and EV integration. Companies that can address the unique challenges of DC power systems and provide efficient, reliable, and cost-effective solutions will be well-positioned to succeed in this dynamic market.

What are the Key Data Covered in this Direct Current Power System Market Research and Growth Report?

-

What is the expected growth of the Direct Current Power System Market between 2025 and 2029?

-

USD 17.75 billion, at a CAGR of 7.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (0-24V DC, 48V DC, and More than 48V DC), End-user (Industrial, Telecom, Commercial , and Others), Component (Converters, Control units, Distribution panels, and Batteries), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing Internet penetration and data traffic, High initial and maintenance costs

-

-

Who are the major players in the Direct Current Power System Market?

-

ABB Ltd., Advanced Energy Industries Inc., AEG Power Solutions BV, Delta Electronics Inc., Dyna Hitech Power Systems Ltd., Eaton Corp. plc, EnerSys, Hindustan Power Control System, Huawei Technologies Co. Ltd., Infineon Technologies AG, MEAN WELL Enterprises Co. Ltd., Mitsubishi Electric Corp., ON Semiconductor Corp., RECOM Power GmbH, Rohde and Schwarz GmbH and Co. KG, Schaefer Inc., TDK-Lambda Corp., Vertiv Holdings Co., Vicor Corp., and XP Power

-

We can help! Our analysts can customize this direct current power system market research report to meet your requirements.