Polysulfides Market Size 2024-2028

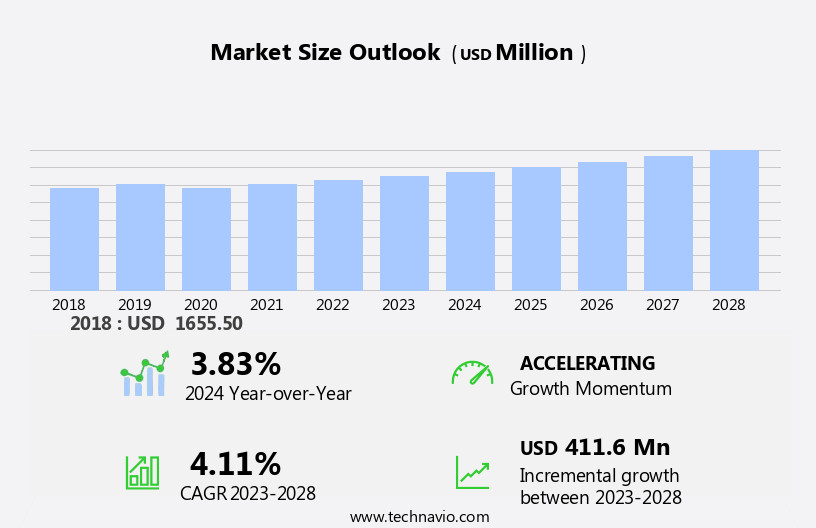

The polysulfides market size is forecast to increase by USD 411.6 million at a CAGR of 4.11% between 2023 and 2028.

- The polysulfide market is experiencing significant growth due to the increasing adoption of two-component polysulfide adhesives, sealants, and coatings in various industries. In the transport sector, polysulfides are widely used In the manufacturing of commercial vehicles and locomotives due to their excellent bonding properties and resistance to extreme temperatures. Furthermore, the focus on sustainability in construction and infrastructure development is driving the demand for polysulfide-based products as they offer long-lasting solutions with minimal environmental impact.

- In this analysis, we explore the role of polysulfides in specialty chemicals, focusing on their applications in industrial processing, protective coatings, lithium sulfur batteries, building & construction, and the electrical & electronics industry. Strict government regulations regarding the use of hazardous materials in construction and transportation are also propelling the market growth. Polysulfides are increasingly being used as alternatives to solvent-based products due to their superior performance and eco-friendliness. The market is expected to continue its upward trajectory, providing ample opportunities for key players In the adhesives, sealants, paints, and coatings industries.

What will be the Size of the Polysulfides Market During the Forecast Period?

- Polysulfides are a type of chemical compound that consists of sulfur atoms linked by sulfur-sulfur bonds. These compounds are widely used in various industries due to their unique properties, including impermeability, chemical resistance, weather resistance, tear resistance, and dimension stability. Polysulfides play a significant role in industrial processing, particularly In the production of chalcogenide materials. These materials are essential in various applications, such as infrared detectors and solar cells. Polysulfides are used as precursors in the synthesis of these materials, contributing to their high performance and stability. In the protective coatings sector, polysulfides are utilized for their excellent chemical resistance and weather resistance properties. Liquid polysulfide elastomers are commonly used as sealants and coatings in the building & construction industry, while solid polysulfide elastomers are employed In the transportation industry for their tear resistance and high temperature stability. Polysulfides also find extensive applications in the electrical & electronics industry.

- For instance, they are used as dielectric materials in capacitors and as electrolytes in batteries. In the case of lithium-sulfur batteries, polysulfides are employed as the sulfur source, which plays a crucial role In the battery's operation. The glass insulation industry is another sector that benefits from the use of polysulfides. Polysulfides are used as additives In the production of glass fibers, enhancing their dimensional stability and improving their overall performance. The analysis of polysulfides also covers their synthesis and characterization techniques. Plasma-mass spectrometry is a widely used analytical method for the determination of polysulfide compositions, while the Fenton reaction is employed for their synthesis. In summary, polysulfides are versatile chemical compounds that offer numerous benefits to various industries. Their unique properties make them indispensable in applications ranging from industrial processing to protective coatings, lithium-sulfur batteries, building & construction, and the electrical & electronics industry. As research and development efforts continue to explore new applications for polysulfides, their importance In the specialty chemicals market is expected to grow.

How is this Polysulfides Industry segmented and which is the largest segment?

The polysulfides industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Sealant

- Adhesive

- Coating

- End-user

- Automotive

- Aerospace

- Marine

- Construction

- Others

- Geography

- APAC

- China

- India

- North America

- Canada

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Application Insights

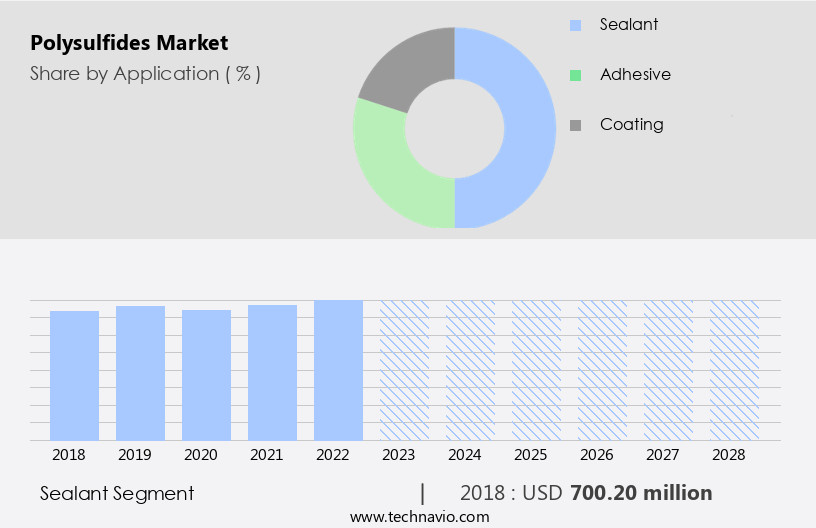

- The sealant segment is estimated to witness significant growth during the forecast period.

Polysulfide sealants, specifically liquid polysulfide elastomers, serve essential functions in various industries due to their unique properties. In the construction sector, they are widely utilized for sealing joints in structures like bridges, tunnels, and dams. Their impermeability and chemical resistance make them suitable for extreme environmental conditions, ensuring long-term protection against water intrusion and structural damage. Airports, for instance, rely on polysulfide sealants to maintain runway integrity by preventing cracks from spreading under heavy loads and temperature fluctuations. The automotive and transportation industry also greatly benefit from these chemical compounds.

Furthermore, polysulfide sealants are indispensable In the production of windshields and other automotive glass components. Their high flexibility accommodates the thermal expansion and contraction of materials while maintaining a secure bond. This ensures the longevity and safety of vehicles on the road. Sulfur atoms, the foundation of polysulfide elastomers, contribute to their superior insulating properties, making them an ideal choice for various applications. With their proven track record in delivering durability and reliability, polysulfide sealants continue to be a vital component in numerous industries.

Get a glance at the Polysulfides Industry report of share of various segments Request Free Sample

The sealant segment was valued at USD 700.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

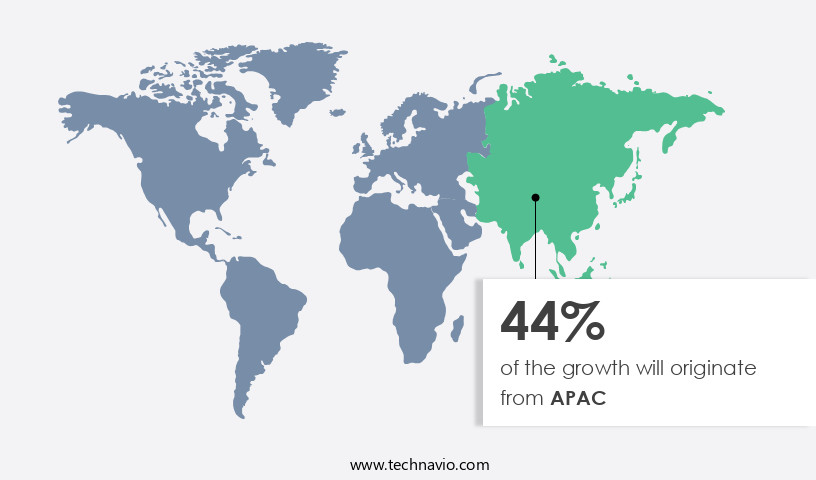

- APAC is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Polysulfides are finding extensive applications in various industries, including automotive, construction, and aerospace, leading to a significant market expansion. The increasing industrialization and infrastructure development in Asia Pacific countries, such as China, India, Japan, South Korea, and Indonesia, are key growth drivers for this market. In the automotive sector, there is a growing trend towards using advanced materials to enhance fuel efficiency and reduce vehicle weight. Polysulfides, with their superior adhesion and durability, are widely used In the formulation of coatings for industrial tank liners and aircraft fuel tanks.

Additionally, polysulfides are employed in electrical potting and petrochemical applications, further expanding their market reach. The industrial processing industry also relies on polysulfides for their excellent ductility and resistance to soil infertility, making them an essential component in various manufacturing processes. Overall, the increasing demand for polysulfides from these industries is expected to fuel market growth In the coming years.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Polysulfides Industry?

A rise in use in the transport industry is the key driver of the market.

- Polysulfides are specialty chemicals utilized in various industries for their unique properties. Industrial processing applications include the use of sodium polysulfides in the tanning industry for the production of lime-sulfur and sulfurated potash. In the building & construction sector, polysulfide elastomers are employed as protective coatings for their chemical resistance, weather resistance, high flexibility, and impermeability. Liquid polysulfide elastomers and solid polysulfide elastomers are used in insulating materials, ship-building industry, and sealing applications. Polysulfides also play a significant role in the production of lithium-sulfur batteries. In the automotive & transportation industry, polysulfide elastomers are used in the manufacture of automotive window glasses for their excellent heat insulation and high tensile strength.

- Further, polysulfide sealants and adhesives are widely used in various industries due to their excellent sealing properties. Polysulfide rubber is used as an industrial tank liner and in the production of aircraft fuel tanks. Polysulfides are also used in electrical potting and chemical compounds such as insecticides and pesticides. The rubber industry uses polysulfide elastomers for the production of commercial elastomers through crosslinking and vulcanization processes. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Polysulfides Industry?

The rising focus on sustainability is the upcoming market trend.

- Polysulfides are specialty chemicals used extensively in various industries for their unique properties. These chemical compounds, consisting of sulfur atoms linked together, offer high chemical resistance, impermeability, and weather resistance. In industrial processing, polysulfides are employed as building & construction materials, particularly in protective coatings. Liquid polysulfide elastomers and solid polysulfide elastomers are widely used for insulating materials, ship-building industry, and sealing applications. In the field of energy, lithium-sulfur batteries utilize sodium polysulfides for their cathodes. Polysulfides also play a role in the tanning industry, where they are used in lime-sulfur and sulfurated potash. Additionally, polysulfides are used in insecticides and pesticides as active ingredients.

- Moreover, commercial elastomers, such as polysulfide sealants, polysulfide rubber, and polysulfide adhesives, are essential in various industries. These materials offer high flexibility, high tensile strength, and heat insulation. Polysulfide sealants are used in coating applications, while polysulfide rubber and polysulfide adhesives are used in industrial tank liners, aircraft fuel tanks, and electrical potting. Automotive & transportation industries also utilize polysulfides in the production of automotive window glasses. Crosslinking and vulcanization processes are commonly used to enhance the properties of polysulfides in the rubber industry. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does the Polysulfides Industry face during its growth?

Stringent government regulations are a key challenge affecting the industry growth.

- Polysulfides are specialty chemicals used extensively in various industries for their unique properties. They consist of long chains of sulfur atoms and are available in both liquid and solid forms, namely liquid polysulfide elastomers and solid polysulfide elastomers. In industrial processing, polysulfides are employed as building & construction materials due to their impermeability, chemical resistance, and weather resistance. They find extensive use in protective coatings, insulating materials, and sealing applications. In the ship-building industry, liquid polysulfide elastomers are used as industrial tank liners and in the production of aircraft fuel tanks. Polysulfides also play a significant role in lithium-sulfur batteries, offering high flexibility, tensile strength, and heat insulation.

- Furthermore, they are used in the rubber industry for the production of polysulfide sealants, adhesives, and elastomers. Polysulfides are also used in the automotive & transportation sector for commercial elastomers, crosslinks, and vulcanization. In the chemical industry, they are used in the production of sodium polysulfides, lime-sulfur, and sulfurated potash. Polysulfides also find applications in insecticides and pesticides. With their unique properties, polysulfides continue to be a valuable addition to various industries, contributing to the growth of the global market. Hence, the above factors will impede the growth of the market during the forecast period

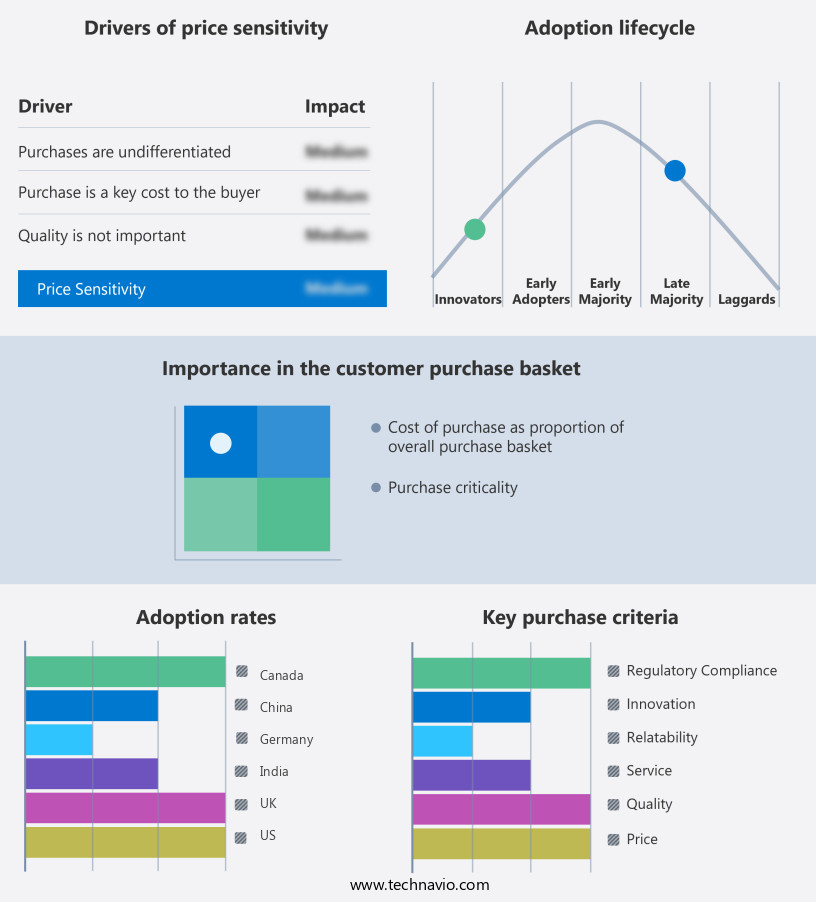

Exclusive Customer Landscape

The polysulfides market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polysulfides market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polysulfides market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akzo Nobel NV

- Arkema SA

- Chevron Phillips Chemical Co. LLC

- Huntsman Corp.

- Kazan Synthetic Rubber Plant

- Momentive Performance Materials Inc.

- Nouryon

- Robinson Brothers Ltd.

- Toray Fine Chemicals Co., Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polysulfides are specialty chemicals widely used in various industries due to their unique properties. These chemical compounds, consisting of sulfur atoms, are known for their impermeability, chemical resistance, weather resistance, high flexibility, and high tensile strength. In industrial processing, polysulfides find extensive applications in protective coatings, insulating materials, and sealants. Liquid polysulfide elastomers and solid polysulfide elastomers are popular forms of polysulfides. The former is used in building & construction, ship-building industry, and automotive & transportation sectors for sealing applications and coating applications. The latter is used in insulating materials, lithium-sulfur batteries, and protective coatings. Polysulfides are also used In the production of sodium polysulfides, which are essential In the tanning industry, lime-sulfur, and sulfurated potash.

Additionally, they find applications in insecticides and pesticides as commercial elastomers. Polysulfides' crosslinking property is utilized In the rubber industry for the production of polysulfide sealants, polysulfide rubber, and polysulfide adhesives. These materials are used in various industries, including petrochemical applications, aircraft fuel tanks, electrical potting, automotive window glasses, and industrial tank liners. Polysulfides' properties make them suitable for various applications, such as heat insulation, tear resistance, dimension stability, and chalcogenide production. They are also used in one-component and two-component adhesives, sealants, paints, coatings, commercial buildings, infrastructure, transport vehicles, locomotive industry, and metal and concrete industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

189 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.11% |

|

Market growth 2024-2028 |

USD 411.6 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

3.83 |

|

Key countries |

US, China, India, Germany, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Polysulfides Market Research and Growth Report?

- CAGR of the Polysulfides industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polysulfides market growth of industry companies

We can help! Our analysts can customize this polysulfides market research report to meet your requirements.