Aerospace Testing Market Size 2025-2029

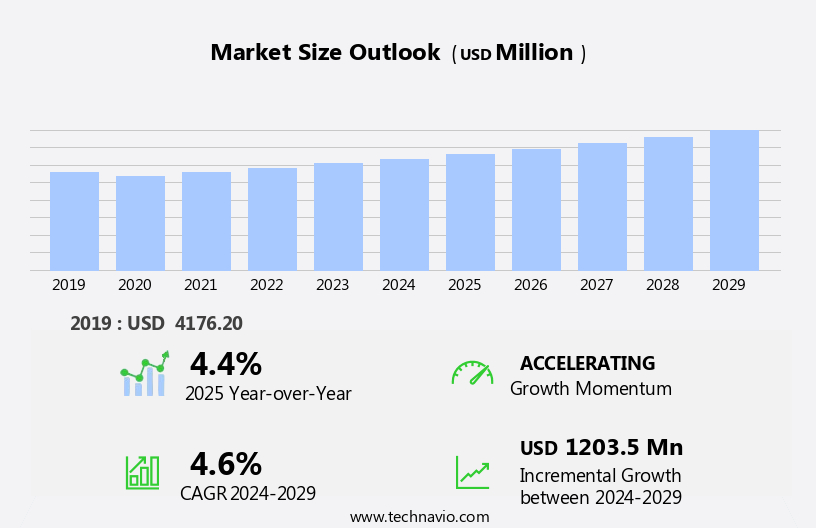

The aerospace testing market size is forecast to increase by USD 1.2 billion at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth driven by the surge in the development of electric and hybrid aircraft. This shift towards sustainable aviation is leading to an increased demand for rigorous testing to ensure the safety and efficiency of these new technologies. Another key trend is the opening of new aircraft testing labs, particularly in emerging economies, to cater to the growing demand for aerospace testing services. However, the market is not without challenges. The shortage of skilled workforce for aerospace testing poses a significant hurdle for companies looking to expand their operations. The market encompasses various types of robots, such as industrial robots, automated robots, articulated robots, and robotic arms.

- To remain competitive, it is crucial for organizations to invest in training and development programs or collaborate with educational institutions to attract and retain top talent. The use of robotics in aerospace manufacturing also includes large payloads robots for handling heavy composite materials and collaborative technology for working alongside human operators. Companies that can effectively navigate these challenges and capitalize on the opportunities presented by the growing demand for aerospace testing services are well-positioned to succeed in this dynamic market.

What will be the Size of the Aerospace Testing Market during the forecast period?

- The market encompasses the services and technologies employed to ensure the safety, compliance, and efficiency of aeronautical products in the aviation industry. Fuel-efficient aircraft and sustainable aviation solutions are driving market growth, with a focus on reducing emissions and improving air travel experience. Regulatory standards and safety protocols, including simulation tests, material testing, and systems integration, are essential to maintaining aircraft structural integrity and ensuring compliance. Climatic testing, acoustic testing, and extreme weather condition simulations are critical components of the testing process, ensuring aircraft performance under various conditions.

- Hypersonic flight and military systems also contribute to the market, requiring rigorous testing for structural components, propulsion system analysis, and high-speed impacts. Machine learning, digital twins, and AI-driven diagnostics are increasingly utilized to optimize testing processes and improve overall efficiency. The market is expected to continue expanding, supporting the development of fuel-efficient aircraft, avionics systems, and advanced aviation technologies.

How is this Aerospace Testing Industry segmented?

The aerospace testing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Commercial aircraft

- Business jets

- Helicopters

- Type

- Non-destructive testing

- Destructive testing

- Source

- In-house

- Outsourced

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- North America

By Application Insights

The commercial aircraft segment is estimated to witness significant growth during the forecast period. The commercial market is experiencing significant growth due to the expanding commercial aviation sector. The increasing demand for air travel, with passenger numbers projected to reach pre-pandemic levels by 2024, is a major growth driver. Key technologies driving market growth include air traffic management, real-time monitoring, autonomous aircraft, aircraft design optimization, composite materials, aircraft certification, aircraft noise reduction, aviation safety technology, hybrid aircraft, lightweight aircraft, aviation cybersecurity, aviation data analytics, sustainable air travel, and green aviation. Two primary types of robots used in the aerospace industry are Cartesian robots and Parallel robots. Innovations in aerospace engineering, aircraft maintenance, performance improvement, and manufacturing processes are also contributing to market growth. The market is further propelled by the development of next-generation aircraft, electric aircraft, and stress testing.

Get a glance at the market report of share of various segments Request Free Sample

The Commercial aircraft segment was valued at USD 2.88 billion in 2019 and showed a gradual increase during the forecast period.

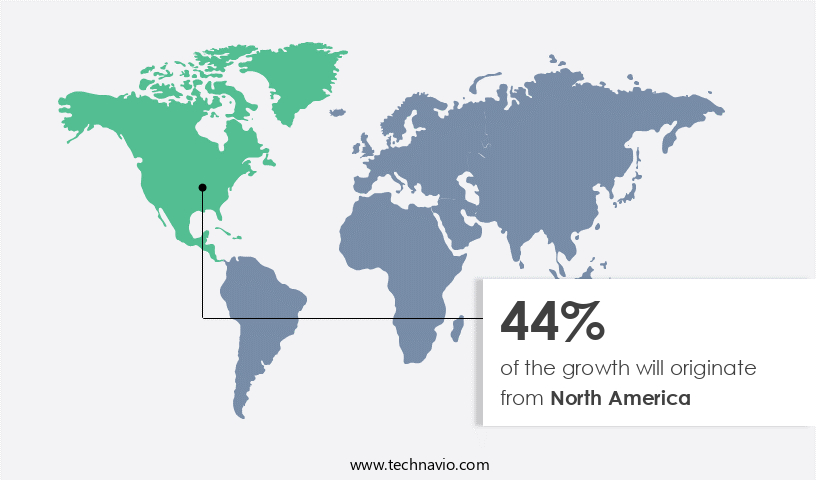

Regional Analysis

North America is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American aerospace industry is experiencing significant growth, with key players such as Boeing, Bombardier, and Lockheed Martin leading the way. The region's technologically advanced countries and mature markets, including the US and Canada, contribute to a constant demand for aftermarket services for aircraft. New aircraft production and the regular maintenance requirements of existing fleets necessitate thorough testing throughout the design, manufacturing, and operational phases. Furthermore, aviation interconnections, including air cargo and global trade, are driving the demand for aerospace robotics. Advanced technologies, such as composite materials, electric and hybrid propulsion systems, and autonomous aircraft, are increasingly being adopted, increasing the need for stringent testing to ensure safety, reliability, and performance. Aerospace engineering innovations include next-generation aircraft, flight testing, safety regulations, and sustainability initiatives like carbon emissions reduction, biofuel aviation, and sustainable aerospace technologies.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Aerospace Testing Industry?

- Surge in development of electric and hybrid aircraft is the key driver of the market. The market is experiencing significant transformation due to the emergence of electric and hybrid aircraft in the aviation industry. These new aircraft types, which differ significantly from those powered by fossil fuels, necessitate the development and implementation of novel testing methods and tools. Although larger commercial aircraft may take longer to adopt electric technologies, the shift is expected to gain momentum in the coming years, particularly for short-haul flights and specialized tasks. The testing requirements for electric and hybrid aircraft are distinct from those for traditional aircraft, necessitating specialized equipment and techniques. The evolving nature of these technologies necessitates ongoing research and innovation to ensure safety and efficiency.

- The digital transformation in aerospace is also driving the adoption of machine learning, artificial intelligence, predictive maintenance, and advanced materials for aircraft design and manufacturing processes. Aerospace testing plays a crucial role in ensuring quality assurance, performance improvement, and regulatory compliance through various testing methods, including stress analysis, thermal testing, vibration testing, fatigue assessment, and material durability assessments. The importance of safety standards, test protocols, and certification processes cannot be overstated in this industry.

What are the market trends shaping the Aerospace Testing Industry?

- Opening of new aircraft testing labs is the upcoming market trend. The market experiences growth due to the establishment of advanced testing facilities in new labs. Equipped with modern technologies, these labs broaden the scope of aerospace industry testing services. With an increasing number of testing labs, aerospace manufacturers can avail specialized testing for components, systems, and aircraft, expediting the testing process. This enhanced infrastructure facilitates shorter development cycles, adherence to stringent regulations, and fosters innovations in aviation technology. The expanded testing capacity addresses the growing demand for comprehensive and efficient testing solutions, contributing significantly to the expansion of the market.

- Regulatory compliance, safety requirements, and certification standards are key considerations in the market. Additionally, the integration of artificial intelligence, machine learning, and digital transformation in aerospace testing is expected to revolutionize the industry. The market encompasses various testing types, including flight simulation, stress analysis, thermal testing, vibration testing, fatigue assessment, material durability, aircraft safety, and certification process. Testing facilities include wind tunnels, load testing, environmental chambers, acoustic testing, and aerodynamic performance evaluation. The market caters to commercial applications, military applications, satellite launch services, and spacecraft testing.

What challenges does the Aerospace Testing Industry face during its growth?

- Shortage of skilled workforce for aerospace testing is a key challenge affecting the industry growth. The aerospace testing industry faces a critical challenge in sourcing a workforce with the specialized skills necessary for testing advanced aerospace technologies. With continuous advancements in avionics, materials science, aerodynamics, and structural engineering, the demand for workers with up-to-date knowledge and training is increasing. For instance, there is a significant shortage of avionics engineers capable of testing complex avionic systems. This shortage becomes particularly evident during the development and validation of the intricate electronic systems found in modern aircraft. The scarcity of skilled professionals in the aerospace testing sector is a significant hindrance to innovation and growth in the industry.

- Regulatory compliance and test procedures are key considerations in the market, with strict standards in place to ensure safety and performance. Test facilities, including wind tunnels, load testing, and environmental chambers, are essential for evaluating aircraft structures and components under various conditions. Aerospace engineering solutions, including precision instruments, failure analysis, and compliance testing, are critical to optimizing performance and ensuring safety. Predictive maintenance and performance improvement are also important areas of focus, with the goal of reducing downtime and improving operational efficiency. The market is dynamic and constantly evolving, with new technologies and trends emerging regularly.

Exclusive Customer Landscape

The aerospace testing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aerospace testing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aerospace testing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airbus SE - The company specializes in aerospace testing, providing expertise in five critical areas: wing design, fuel systems, landing gear, systems integration, and manufacturing.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- BAE Systems Plc

- Ball Corp.

- Bureau Veritas SA

- DEKRA SE

- Element Materials Technology

- General Electric Co.

- Groupe Industriel Marcel Dassault

- Illinois Tool Works Inc.

- Intertek Group Plc

- L3Harris Technologies Inc.

- Leonardo Spa

- Lockheed Martin Corp.

- Mistras Group Inc.

- Northrop Grumman Corp.

- Rolls Royce Holdings Plc

- RTX Corp.

- Safran SA

- Thales Group

- The Boeing Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of activities aimed at ensuring the safety, efficiency, and performance of aircraft and spacecraft. These tests play a crucial role in the product lifecycle, from design optimization and material behavior analysis to certification and regulatory compliance. Real-time monitoring and autonomous aircraft are two emerging trends in aerospace testing, with the former enabling continuous data collection and analysis, and the latter requiring rigorous testing to ensure safe and reliable operation. Composite materials, a key component in modern aircraft design, undergo extensive testing to assess their durability and structural integrity. One of the key trends driving market growth is the implementation of Industry 4.0 and digital transformation in the aerospace industry. Aircraft certification is another critical aspect of the market, with stringent safety regulations requiring extensive testing to ensure compliance.

Aviation safety technology, including cybersecurity and data analytics, is also a significant focus area, with the need to protect against potential threats and optimize operational efficiency. The use of advanced materials, such as lightweight composites and engineered solutions, is driving innovation in aerospace testing. Simulation software and digital transformation are also playing a significant role in improving performance, reducing carbon emissions, and enhancing overall operational efficiency. Environmental testing, including stress testing and thermal testing, is essential to assess the behavior of materials and components under various conditions. The aviation industry, both domestic and international, is a major contributor to this trend, with aviation policies encouraging the use of automation to improve efficiency and productivity. Manufacturing processes, including non-destructive and destructive testing, are also crucial to ensure product quality and reliability.

From hypersonic vehicle design to space tourism, the future of aerospace is filled with exciting possibilities. However, rigorous testing and certification will remain essential to ensure safety, reliability, and regulatory compliance. The market plays a vital role in ensuring the safety, efficiency, and performance of aircraft and spacecraft. This integration of traditional robots with advanced technologies such as the Industrial Internet of Things (IIoT) and data analytics is transforming aerospace manufacturing.From material behavior analysis to certification and regulatory compliance, testing is a critical component of the product lifecycle. With a focus on innovation, sustainability, and operational efficiency, the future of aerospace testing is bright, with new technologies and trends emerging regularly.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 1.20 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, Canada, China, Germany, UK, France, Japan, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aerospace Testing Market Research and Growth Report?

- CAGR of the Aerospace Testing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aerospace testing market growth of industry companies

We can help! Our analysts can customize this aerospace testing market research report to meet your requirements.