Cartesian Robots Market Size 2024-2028

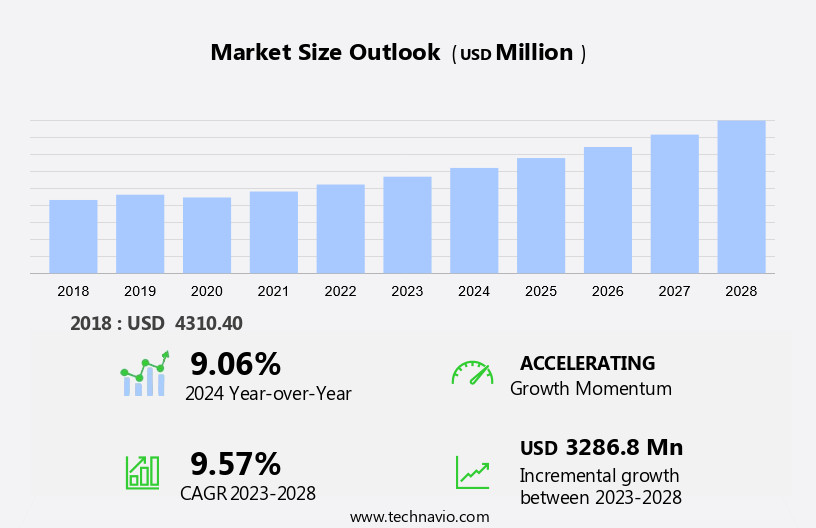

The cartesian robots market size is forecast to increase by USD 3.29 billion at a CAGR of 9.57% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for automated material handling in various industries. This trend is driven by the need for increased productivity, efficiency, and accuracy in manufacturing processes. Additionally, there is a growing focus on the use of collaborative robots, which allow for safe and flexible automation in shared workspaces. However, some challenges need to be addressed In the industrial application of Cartesian robots. These include technical issues related to precision, repeatability, and integration with other systems. Addressing these challenges will be crucial for the continued growth and success of the market.

What will be the Size of the Cartesian Robots Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for automation in various industries. These robots, also known as linear robots or robotic arms, offer scalability, precision, and repeatability, making them ideal for applications in sectors such as electronics, electrical systems, food and beverages, and automotive. Cartesian robots provide sturdiness and high payload capacity, enabling them to handle complex tasks with accuracy. The market is driven by the need for automation in manufacturing processes, particularly in industries where precision and repeatability are crucial. Mini 3D printers and pick-and-place applications are prime examples of this trend. Cartesian robots offer versatility and flexibility, allowing them to be programmed for a wide range of tasks.

- Robotic technology continues to advance, with improvements in vibration reduction and deflection control enhancing the performance of cartesian robots. These advancements enable the robots to operate in harsh environments and handle delicate components with ease. The market also caters to various industries beyond manufacturing, including storage, identification, control robots, transportation, distribution, waste handling, and more. As the market continues to evolve, cartesian robots are expected to play a key role in streamlining processes, increasing efficiency, and driving innovation.

How is this Cartesian Robots Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Automotive

- Electrical and electronics

- Chemical and petrochemical

- Food and beverage

- Others

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By End-user Insights

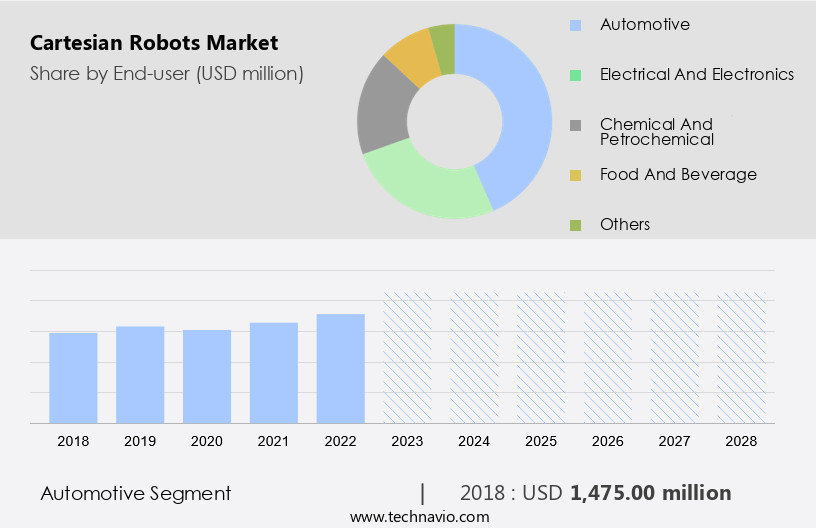

- The automotive segment is estimated to witness significant growth during the forecast period.

Cartesian robots have gained popularity in various industries due to their scalability and suitability for applications requiring precision, sturdiness, and repeatability. These robots, which include 3-axis systems, are widely adopted in sectors such as food and beverages, automotive, electronics, and electrical systems. Their advantages include high precision, accuracy, and flexibility, making them ideal for material handling, pick and place, palletizing/depalletizing, and machine tending. In the automotive sector, cartesian robots enable high-speed pick-and-place applications and improve production efficiency. For instance, TM Robotics, a subsidiary of TOSHIBA MACHINE, provided a cartesian robot cell to Dinalot, a Spanish automotive parts manufacturer, to enhance production.

Furthermore, the use of these robots also reduces the need for additional safety equipment and allows for easy integration into existing workflow processes. These robots are also employed in industries such as healthcare, aerospace, and robot-assisted automation, handling heavy loads and objects, and In the metals industry for adhesives, sealants, welding, and more.

Get a glance at the Industry report of share of various segments Request Free Sample

The automotive segment was valued at USD 1.48 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

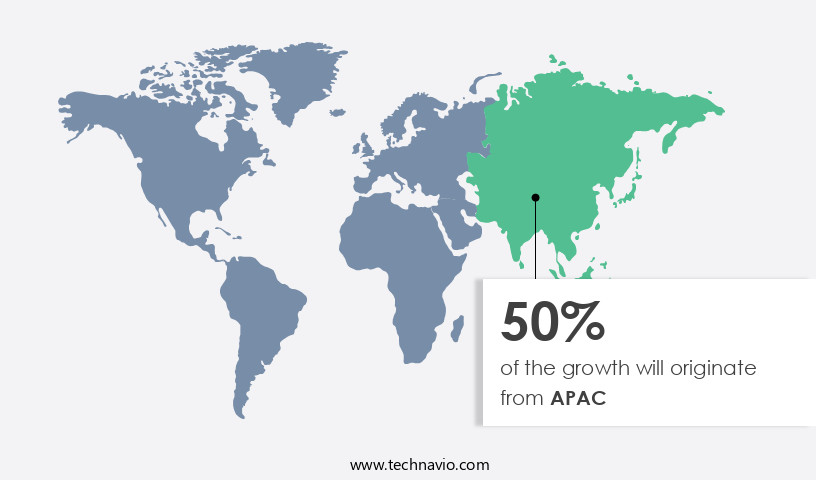

- APAC is estimated to contribute 50% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

China, Japan, and South Korea are the key markets for the cartesian robots market in APAC. Market growth in this region will be faster than the growth of the market in North America and Europe. The presence of skilled labor will facilitate the cartesian robots market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans. Hence, such factors are driving the market in APAC during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cartesian Robots Industry?

The increase in demand for automated material handling in the industrial sector is the key driver of the market.

- In today's manufacturing landscape, industrial companies are prioritizing post-manufacturing operations and seeking cost-effective solutions for material handling. The emphasis on expediting the cash cycle and enhancing customer satisfaction has led to the increasing adoption of automated material handling systems. These robots, with their strong mechanical components and high payload capacity, are becoming increasingly popular for material handling applications. Traditional manual processes, such as product transfer, picking and placing, and packaging, are labor-intensive and require significant investment in tools like forklifts, conveyors, and trucks. Cartesian robots offer precision, repeatability, and flexibility, making them a viable alternative for material handling tasks in various industries, including food and beverages, automotive, aerospace, and healthcare.

- These robots can handle heavy loads with ease and provide high-speed workflow processes, reducing manual workload and increasing efficiency. Additionally, they offer versatility, and accuracy, and can be programmed to perform complex tasks with ease. These robots are also used in sectors like warehousing, logistics, and transportation, where they excel in tasks like sorting, labeling, and palletizing/depalletizing. The adoption of cartesian robots is expected to continue to grow in sectors like electrical and electronics, chemical and petrochemical, and industrial machinery, where precision and repeatability are essential.

What are the market trends shaping the Cartesian Robots Industry?

Increased focus on the use of collaborative robots is the upcoming market trend.

- Cartesian robots, a type of 3-axis robotic arm, have gained significant traction in various industries due to their scalability and versatility. These robots, which move in a Cartesian coordinate system, are known for their precision, repeatability, and sturdiness. They are commonly used in material handling applications, including food and beverages, the automotive sector, and electronics manufacturing. Electronic systems and electrical systems have embraced these robots for their high precision and accuracy in positioning and assembly tasks. In the automotive sector, these robots are utilized In the production of electric vehicles and hybrid cars for tasks such as welding, adhesive application, and sealant dispensing.

- Robot-assisted automation has become increasingly popular in industries like healthcare, aerospace, and manufacturing. These robots offer advantages such as payload capacity, programming versatility, and flexibility. They are used in tasks like product transfer, machine tending, and palletizing/depalletizing. In the warehouse sector, Cartesian robots are employed for sorting, labeling, and identification tasks. Robotics adoption is on the rise in industries like chemical and petrochemical, transportation handling robots, and industrial machinery. These robots' ability to handle heavy loads and workflow process optimization makes them indispensable In the metals industry. Cartesian robots' benefits extend to industries like packaging and packaging, where they are used for pick and place tasks, and waste handling, where they help in product/part transfer and machine tending.

What challenges does the Cartesian Robots Industry face during its growth?

Technical challenges affecting industrial applications is a key challenge affecting the industry growth.

- In the dynamic world of industrial automation, these robots continue to gain traction due to their scalability and versatility. These 3-axis robots, also known as linear robots or X-Y-Z robots, offer precision, repeatability, and sturdiness for various applications in sectors like food and beverages, automotive, aerospace, healthcare, and material handling. The selection of these robots for manufacturing processes necessitates careful consideration of factors such as load capacity, speed, positional accuracy, travel, cost constraints, and available space. However, these robots face challenges during installation due to their limited reach around and into obstructions, necessitating a mounting frame. Moreover, these robots may not be the best choice for applications requiring additional part orientation, such as welding.

- The overall performance of these robots hinges on their actuators, which enable linear movement. In the market, these find applications in industries like electrical and electronics, chemical and petrochemical, and transportation handling. They contribute to workflow processes by automating tasks like sorting, labeling, palletizing/depalletizing, packing and packaging, product/part transfer, machine tending, and storage identification.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Robert Bosch GmbH

- Brooks Automation Inc.

- DENSO Corp.

- Gudel Group AG

- Hirata Corp.

- IAI America Inc.

- KOGANEI Corp.

- MIDEA Group Co. Ltd.

- Nidec Corp.

- OMRON Corp.

- Parker Hannifin Corp.

- Samick THK Co. Ltd.

- Seiko Epson Corp.

- SEPRO ROBOTIQUE SAS

- STON ROBOT

- TM Robotics

- Yamaha Motor Co. Ltd.

- Yaskawa Electric Corp.

- YUSHIN PRECISION EQUIPMENT CO. LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Cartesian robots have gained significant traction in various industries due to their unique capabilities and advantages. These robots, which move in a linear motion along Cartesian coordinates, offer scalability and versatility that make them suitable for a wide range of applications. One of the primary reasons for the growing popularity of these robots is their precision and sturdiness. They are designed to handle heavy loads with high accuracy, making them ideal for material handling in industries such as metals and manufacturing. In the automotive sector, these robots are used extensively for welding, adhesive application, and painting processes, where precision and repeatability are crucial.

Moreover, cartesian robots offer flexibility and adaptability, making them suitable for various applications in different industries. For instance, In the food and beverages sector, these robots are used for pick and place operations, palletizing and depalletizing, and product/part transfer. In the healthcare industry, they are used for robot-assisted surgeries and pharmaceutical manufacturing. In the aerospace industry, these robots are used for assembly and testing of components. The advantages of these robots extend beyond precision and versatility. They offer high speed and can work continuously without deflection or vibrations, which is essential for industries that require high-speed production and minimal downtime.

Furthermore, they offer easy programming and can be integrated with intelligent systems and automation, making them an attractive option for industries looking to streamline their workflow processes and reduce manual workload. These robots are also gaining popularity In the transportation sector, particularly In the areas of transportation handling robots and logistics. They are used for sorting, labeling, and palletizing, making them ideal for warehouses and distribution centers. In the waste handling industry, they are used for picking and placing heavy objects, reducing the need for manual labor and increasing efficiency. The adoption is not limited to traditional industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

153 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.57% |

|

Market Growth 2024-2028 |

USD 3.29 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.06 |

|

Key countries |

China, Japan, South Korea, Germany, and US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.