Aircraft Weather Radar System Market Size 2024-2028

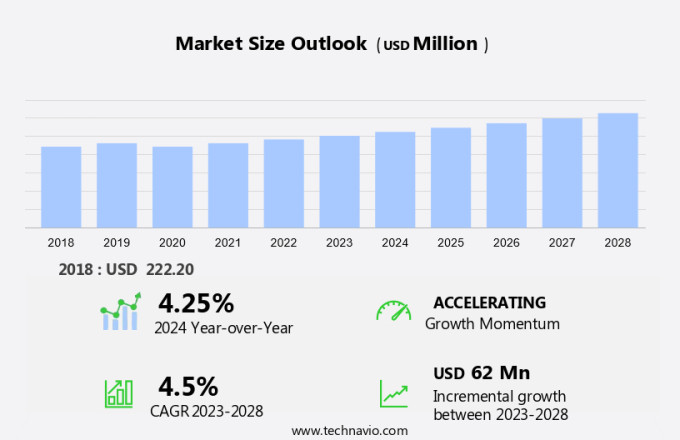

The aircraft weather radar system market size is forecast to increase by USD 62 million at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for weather surveillance radars in both commercial and military sectors. With the rise of next-generation airplanes, there is a heightened need for reliable weather information to ensure safe and efficient flight operations. Military multirole aircraft, in particular, require weather radar systems for national security and mission success. Weather surveillance radars employ Doppler weather radar technology, which utilizes the Doppler Effect to measure the velocity of precipitation particles and wind profiling. This data is essential for climate information services, enabling meteorologists to provide accurate weather forecasts and severe weather alerts. Furthermore, the integration of automatic dependent surveillance-broadcast (ADS-B) technology enhances the overall safety and efficiency of aircraft operations. Moreover, the importance of weather radar systems extends beyond aviation, as they play a crucial role in monitoring weather patterns and providing critical data for disaster management and agricultural applications.

What will be the Size of the Market During the Forecast Period?

- The market is a significant segment within the aviation industry, playing a crucial role in ensuring flight safety and operational efficiency for both civilian and military aviation. These systems enable pilots to identify and navigate through various weather conditions, thereby enhancing situational awareness and reducing the risk of accidents. Weather radar systems are essential components of modern aircraft, providing real-time weather information to pilots. These systems use radar antennas to detect and display weather patterns, including precipitation, turbulence, and wind shear, allowing pilots to make informed decisions regarding flight paths and altitude adjustments.

- The integration of advanced computer technology in weather radar systems has led to improved weather predictions and forecasting capabilities. This development has been instrumental in optimizing fleet procurement plans for airlines and aircraft orders, as well as ensuring the delivery of safer and more efficient aircraft. Aircraft weather radar systems are not only essential for passenger safety but also for military aviation. Military budgets allocate significant resources toward the development and deployment of advanced weather radar systems to ensure mission success and minimize risks during flight operations. Airport infrastructure also benefits from weather radar systems, as they provide essential weather information for air traffic control and management.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commercial aviation

- Business and general aviation

- Geography

- North America

- US

- Europe

- UK

- France

- APAC

- China

- Middle East and Africa

- South America

- North America

By Application Insights

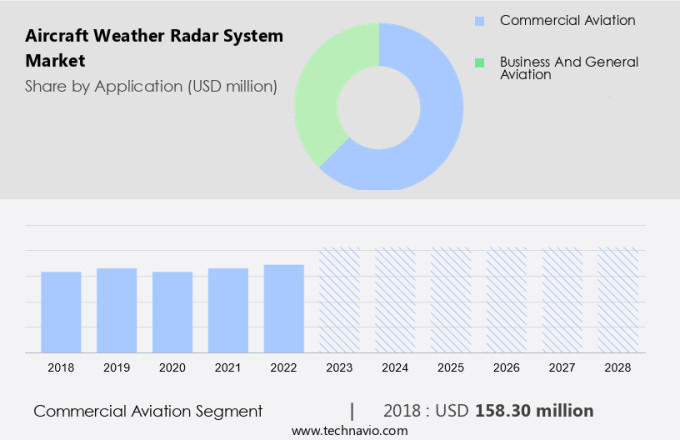

- The commercial aviation segment is estimated to witness significant growth during the forecast period.

The global market is experiencing significant growth due to several key factors. Technological advancements and the increasing travel demand are major drivers in this industry. As the commercial aviation sector focuses on reducing carbon emissions and increasing fuel efficiency, there is a growing trend towards replacing older aircraft with new, fuel-efficient models. This shift is expected to boost the market for aircraft weather radar systems in the coming years. Weather surveillance radars play a crucial role in ensuring the safety and efficiency of both military and civilian aircraft. These systems provide essential climate information services, including wind profiling and precipitation detection using Doppler weather radar technology.

Furthermore, the Doppler Effect, a critical component of Doppler radar, enables the measurement of wind speed and direction, providing valuable data for flight planning and weather forecasting. Military aircraft also rely heavily on weather radar systems for national security purposes. These systems help detect and avoid adverse weather conditions, ensuring the safety of military personnel and missions. As a result, the demand for advanced weather radar systems is expected to remain high in the defense sector.

Get a glance at the market report of share of various segments Request Free Sample

The commercial aviation segment was valued at USD 158.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

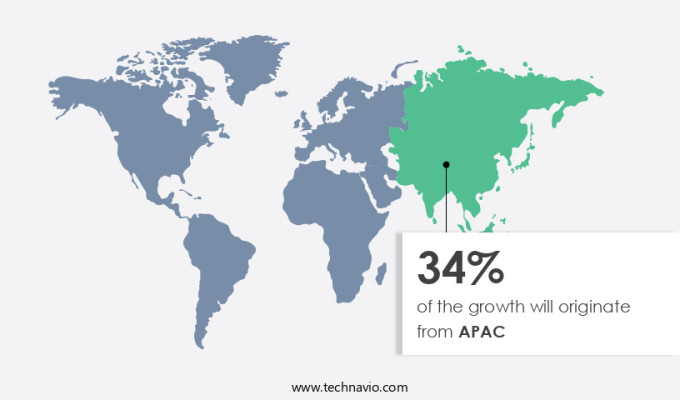

- APAC is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the expansion of the market can be attributed to the region's advanced aviation infrastructure and the presence of leading aerospace companies. These organizations invest substantially in research and development to meet the growing demand for advanced aircraft systems, including weather radar technology. The rise in global aircraft orders and deliveries, driven by fleet procurement plans, has led to significant investments in the aircraft manufacturing sector. These funds are being channeled toward the development of cutting-edge aircraft weather radar systems and related technologies. Consequently, the increasing production of new aircraft will fuel the demand for these systems in North America, thereby driving market growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Aircraft Weather Radar System Market?

The need for protection from harsh weather is the key driver of the market.

- Aircraft weather radar systems play a crucial role in ensuring the safety and comfort of passengers by detecting and avoiding adverse weather conditions during flights. Severe turbulence and hailstorms have led to injuries and damages to aircraft fuselages, highlighting the importance of accurate weather surveillance. Commercial aviation radars, an integral part of airport infrastructure, provide air domain awareness and enable pilots to strategically plan safe flight trajectories.

- These systems use weather surveillance radar to detect water droplets and measure rain intensity, translating the data into valuable weather predictions. With the increasing number of airport construction projects and the growing competition in the airline industry, the demand for advanced weather radar systems is on the rise. These systems help airlines maintain their profitability by ensuring safe and efficient operations. By providing real-time weather information, aircraft weather radar systems contribute significantly to enhancing air safety and improving the overall flying experience.

What are the market trends shaping the Aircraft Weather Radar System Market?

The incorporation of automatic dependent surveillance-broadcast is the upcoming trend in the market.

- In the realm of aviation, three essential weather aids are utilized in aircraft cockpits, commonly referred to as aircraft weather radar. These tools include: 1. Onboard radar for detecting and displaying weather phenomena 2. Lightning detectors 3. Weather radar information sourced from external satellites or other means, which is transmitted to the aircraft Automatic Dependent Surveillance-Broadcast (ADS-B) is a cutting-edge surveillance technology that enables an aircraft to determine its position via satellite navigation and transmit this information, allowing it to be tracked.

- By employing orbiting satellite systems and ground-based up-links, such as ADS-B, weather information can be sent to an aircraft in real-time, virtually anywhere globally. These advanced systems play a crucial role in enhancing air traffic safety and providing accurate weather forecasting information to aircraft fleets and airlines. By staying informed of current weather conditions, pilots can make informed decisions and ensure the safety of their passengers.

What challenges does the Aircraft Weather Radar System Market face during its growth?

Increasing safety concerns is a key challenge affecting the market growth.

- Aircraft weather radar systems play a crucial role in the aviation industry by enhancing passenger safety through real-time weather detection. However, the implementation of these systems comes with certain challenges that need to be addressed. One of the primary concerns is the high voltage and current levels required to operate radar systems, which pose a potential risk if not handled properly. It is essential to adhere to the manufacturer's instructions and maintain a safe distance from the radome storage area. Neglecting these precautions can lead to severe consequences. The safety concerns surrounding aircraft weather radar systems may hinder their widespread adoption, particularly in newer-generation aircraft.

- Military budgets also play a significant role in the market's growth as radar technology is extensively used in military applications. To mitigate the risks associated with high voltage and current levels, ongoing research and development efforts are focused on creating safer and more efficient radar systems. By addressing these challenges, the aviation industry can fully reap the benefits of this advanced technology while ensuring the highest level of passenger safety.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aerodata AG

- BAE Systems Plc

- Enterprise Electronics Corp.

- EWR Radar Systems

- GAMIC GmbH

- Garmin Ltd.

- General Dynamics Corp.

- Honeywell International Inc.

- Israel Aerospace Industries Ltd.

- L3Harris Technologies Inc.

- Leonardo Spa

- Lockheed Martin Corp.

- Northrop Grumman Corp.

- RTX Corp.

- Rheinmetall AG

- Saab AB

- Telephonics Corp.

- Thales Group

- Toshiba Corp.

- Vaisala Oyj

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Aircraft weather radar systems play a crucial role in ensuring the safety and efficiency of air traffic management. These systems provide real-time weather information to pilots and air traffic controllers, enabling them to make informed decisions regarding flight routes and take necessary precautions to avoid adverse weather conditions. Weather radar systems are essential for both commercial and military aviation, with applications ranging from flight safety and weather forecasting to air domain awareness and national security. The market for aircraft weather radar systems is driven by the increasing demand for improved weather surveillance and prediction capabilities. Newer generation aircraft and military modernization programs are also fueling the growth of this market.

Weather surveillance radars, Doppler weather radar, wind profilers, and Doppler effect-based systems are some of the key technologies driving the growth of this market. Weather information radar systems help detect various weather phenomena such as rain, snow, hail, and turbulence, providing crucial data for pilots and air traffic controllers. These systems use radar antennas and computers to process signals and provide weather predictions. The aviation industry's focus on passenger safety and airport infrastructure development is further expected to boost the demand for aircraft weather radar systems. Military aviation also relies heavily on weather radar systems for mission planning and execution, with applications ranging from climate information services to air domain awareness. The increasing military budgets for modernization programs are expected to provide significant opportunities for the growth of this market. MRO service providers and OEMs also play a crucial role in the market by providing support and maintenance services for these systems.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 62 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.25 |

|

Key countries |

US, China, UK, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch