Airport Stands Equipment Market Size 2024-2028

The airport stands equipment market size is forecast to increase by USD 1.63 billion at a CAGR of 6.78% between 2023 and 2028. The market is experiencing significant growth due to the increasing global air traffic and the subsequent need for modernizing airport infrastructure. High-grade materials, such as aluminum alloys and composite materials, are being extensively used in the production of passenger ramps, maintenance stands, and commercial aviation structures. The long service life of these equipment types makes them a cost-effective solution for airports. Furthermore, the expansion of airports to accommodate more duty-free shops and retail spaces is driving the demand for advanced airport stands. In the United States, this trend is particularly relevant as commercial aviation continues to grow, necessitating the need for upgraded airport facilities.

Airport stands equipment plays a crucial role in ensuring the smooth arrival and departure of aircraft. These devices are integral to the operation of commercial aviation, facilitating the efficient movement of passengers and cargo. The importance of airport stands equipment extends beyond the ramp area, impacting safety, comfort, and aircraft mobility. Routine Maintenance and Inspections Aircraft engineers carry out routine maintenance on airport stands equipment to ensure their optimal performance. Regular inspections help identify potential issues and prevent any disruptions to the arrival and departure process. Safety is a top priority, and the proper functioning of airport stands equipment is essential for ensuring the safety of both passengers and aircraft. Modernization of Airports and Global Freight The modernization of airports and the increasing importance of global freight have led to advancements in airport stands equipment. Three-phase electrical systems and battery packs have replaced traditional gasoline-powered equipment, reducing emissions and increasing efficiency. Commercial Aviation and Air Traffic The commercial aviation industry relies heavily on airport stands equipment to manage the high volume of air traffic.

Additionally, efficient ground operations are essential for minimizing delays and ensuring that passengers and cargo reach their destinations on time. International Tourism and Regional Traveling Airport stands equipment plays a vital role in facilitating international tourism and regional traveling. The availability of modern and efficient airport stands equipment can significantly impact the passenger experience and the overall reputation of an airport. Military Applications Airport stands equipment is not limited to commercial aviation. Military aircraft also require ground support equipment, including power supply devices and air bridges, to ensure their efficient operation. In conclusion, airport stands equipment is an essential component of the aviation industry. Its role in ensuring the efficient operation, safety, and comfort of aircraft and passengers is vital. Regular maintenance and inspections, modernization, and the integration of advanced technologies are key to maintaining the high standards required in the aviation industry.

Market Segmentation

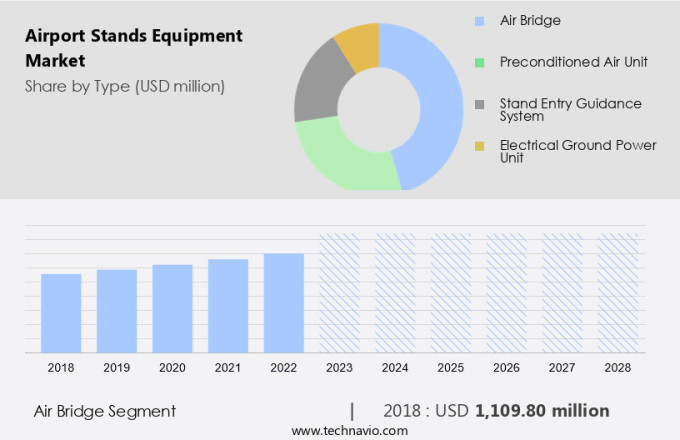

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Air bridge

- Preconditioned air unit

- Stand entry guidance system

- Electrical ground power unit

- Application

- Aircraft operations

- MRO

- Geography

- North America

- Canada

- US

- APAC

- China

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Type Insights

The air bridge segment is estimated to witness significant growth during the forecast period. Airport stands, also referred to as jet bridges or sky bridges, are essential facilities at airports that enable passengers to safely board and disembark from aircraft without stepping onto the tarmac. These structures, which can be fixed or movable, consist of enclosed walkways that connect the terminal building to the aircraft. Air bridges have become increasingly popular due to their ability to enhance the overall airport experience by reducing exposure to weather conditions and improving efficiency. Airport stands equipment, including air bridges, play a crucial role in facilitating global freight and regional traveling.

Further, the military also utilizes airport stands equipment for various purposes, including the efficient loading and unloading of cargo and personnel. Routine inspections and security measures are essential to maintaining the functionality and safety of these facilities. Power supply is another critical factor, as airport stands require a reliable and consistent power source to ensure proper operation. In the ramp area, airport stands equipment is a vital component of airport infrastructure. As air travel continues to grow, the demand for advanced and efficient airport stands equipment is expected to increase.

Get a glance at the market share of various segments Request Free Sample

The air bridge segment accounted for USD 1.11 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market is well-established, driven by the substantial aviation industry presence, particularly in the United States. Notable players from the aircraft manufacturing supply chain significantly contribute to the production of airport stands equipment in this region. Furthermore, the revitalization of the US economy has led to a ripple in domestic air travel, fueling the demand for airport stands equipment. The increasing air traffic in North America necessitates the modernization of existing airports. By 2023, US airports are projected to require approximately USD128 billion in investments for upgrades. Aluminum alloys, a crucial component in airport stands equipment, offer corrosion resistance, making them an ideal choice for this application.

Further, advancements in technology, such as machine learning, are being integrated into airport stands equipment, including boarding bridges, ground power units, VGDS, and AVGDS. These technologies enhance the functionality and efficiency of the equipment, catering to the growing demands of the aviation industry. Airport expansion projects, both brownfield and greenfield, are underway to accommodate the rising air traffic. Airport stands equipment, including landing gear access systems, are integral components of these projects, ensuring seamless aircraft turnaround and passenger boarding processes. Aerodynamic drag reduction is another essential consideration in the design and manufacturing of airport stands equipment to optimize airport operations and reduce energy consumption.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increase in global freight and passenger traffic is the key driver of the market. The demand for airport stand equipment is on the rise due to the increasing number of international travelers and the growth in cargo traffic. According to industry reports, passenger and cargo volumes at airports are projected to double by 2035, necessitating the need for efficient and reliable airport infrastructure. This includes airport stand equipment, which plays a crucial role in ensuring the safe and comfortable operation of aircraft during arrival and departure. Aircraft mobility is a key consideration for airport operators, as routine maintenance and inspections are essential to maintain the safety and efficiency of airport stands. Engineers and ground handling personnel rely on airport stand equipment to perform these tasks effectively.

As a result, the need for scheduled maintenance and upkeep of cargo aircraft and cargo stands has become increasingly important. New airport construction and expansion projects are underway to accommodate the growing number of international travelers. Airport stand equipment is a vital component of these projects, ensuring the smooth and efficient handling of passengers and cargo. With safety and comfort being top priorities, airport operators are investing in advanced airport stand equipment to meet the demands of modern air travel.

Market Trends

The rise in construction and upgradation of airports is the upcoming trend in the market. The modernization of airport infrastructure is driving the demand for advanced airport stand equipment in the commercial aviation sector. The ripple in international air travel has put pressure on airport authorities worldwide to enhance their facilities to accommodate increasing passenger traffic. To meet this demand, governments are investing substantially in airport infrastructure projects. For instance, in February 2022, the Canadian government allocated USD 2.6 million to Regina International Airport for a critical infrastructure project. Similarly, Transportation Secretary Omar Al-Ghabra announced an investment of approximately USD16 million to support the airport. High-grade materials such as aluminum alloys and composite materials are extensively used in manufacturing airport stand equipment due to their durability and lightweight properties.

Airport stands comprise essential facilities, including passenger ramps, maintenance stands, and retail spaces like duty-free shops. The market for airport stand equipment is poised for significant growth as air traffic continues to increase, and airports undergo modernization.

Market Challenge

The long service life of airport stands is a key challenge affecting the market growth. The market encompasses ground power operations and various loading processes, including cargo and passenger loading. This market caters to the demands of increasing global freight traffic and passenger traffic at airports worldwide. Airport stands equipment, such as aircraft maintenance and engine access stands, are essential for efficient aircraft operations. These stands are primarily constructed using high-quality materials, including aluminum and steel.

Moreover, some manufacturers are transitioning towards using composite materials for aircraft stands, which offer advantages such as improved efficiency, resource conservation, and resistance to corrosion, impact, and non-magnetism. Aluminum alloys, due to their superior strength, ductility, corrosion resistance, and long life, are the preferred choice for manufacturing aircraft maintenance and engine access stands. For instance, the DF071554-06 Aircraft Maintenance and Engine Access Stand is fabricated using high-grade aluminum and steel.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AERO Specialties Inc. - The company offers products such as Aircraft Tow Tugs and Pushback Tractors, Air Conditioning and Heating, Aircraft Ground Power Units and Supplies, and Aircraft Lighting.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADB Safegate BV

- ADELTE Group SL

- Cavotec SA

- Dedienne Aerospace

- DENGE

- FMT Aircraft Gate Support Systems AB

- HHI Corp.

- Holden Industries Inc.

- HYDRO Systems KG

- JETechnology Solutions

- John Bean Technologies Corp.

- Mallaghan GA Inc.

- Omega Aviation Services Inc.

- Semmco Group

- ShinMaywa Industries Ltd.

- Textron Inc.

- thyssenkrupp AG

- TREPEL Airport Equipment GmbH

- Waag

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Airport stand equipment plays a crucial role in ensuring efficient operation and safety during the arrival and departure of aircraft. Engineers conduct routine maintenance and inspections on these devices to ensure their optimal performance. The airport stands equipment market caters to the needs of commercial aviation, military, and private aircraft. Aircraft mobility is a significant consideration in airport stand equipment design, with ground power operations, cargo loading, and passenger loading essential for modern aircraft. Safety and comfort are paramount, with high-grade materials such as aluminum alloys and composite materials used in equipment construction. The global freight traffic and passenger traffic drive the demand for airport stands equipment. Routine inspections and security measures are essential to maintain the functionality and safety of these devices. Power supply options include battery packs, gasoline, diesel, and turbine engines. Airport infrastructure modernization and the increasing demand for air cargo and international tourism fuel the growth of the market. Equipment includes air bridges, preconditioned air units, and ground power units.

Further, the aviation industry's air traffic and regional traveling necessitate the use of ground handling equipment, including VGDs, AVGDs, and passenger ramps. The passenger experience is a critical factor in airport design, with stand allocation and gate allocation essential for efficient airport operations. Airport stands equipment also includes medical equipment, personal protective equipment, and business and leisure travel-related devices. The use of machine learning and advanced technologies enhances the functionality and efficiency of airport stands equipment. Airport stands equipment's corrosion resistance, engine access, and landing gear access are essential features for their longevity and functionality. The aviation industry's flight subsidies, taxes, and charges impact the market dynamics. Aerodynamic drag and the need for brownfield and greenfield projects are also factors influencing the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 16.34 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 34% |

|

Key countries |

US, China, Germany, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ADB Safegate BV, ADELTE Group SL, AERO Specialties Inc., Cavotec SA, Dedienne Aerospace, DENGE, FMT Aircraft Gate Support Systems AB, HHI Corp., Holden Industries Inc., HYDRO Systems KG, JETechnology Solutions, John Bean Technologies Corp., Mallaghan GA Inc., Omega Aviation Services Inc., Semmco Group, ShinMaywa Industries Ltd., Textron Inc., thyssenkrupp AG, TREPEL Airport Equipment GmbH, and Waag |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch