Analytics As A Service (AAAS) Market Size 2025-2029

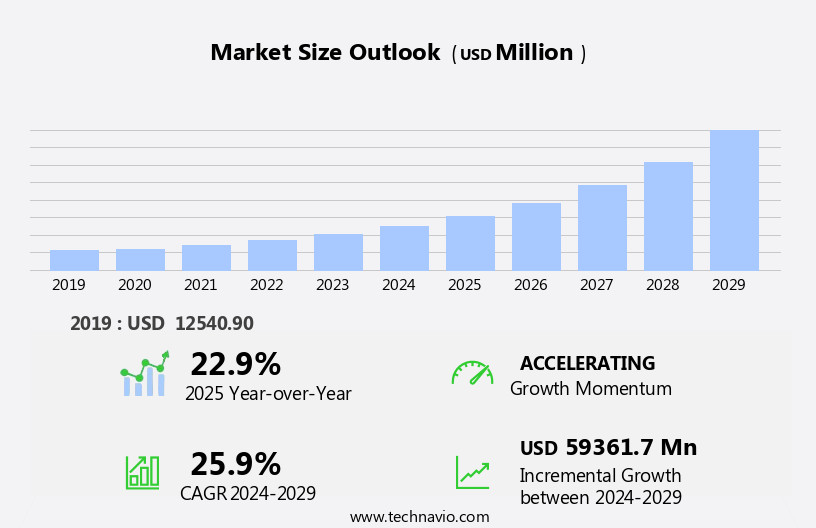

The analytics as a service (AAAS) market size is forecast to increase by USD 59.36 billion at a CAGR of 25.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing availability and complexity of data. With the proliferation of Internet of Things (IoT) devices in enterprises, there is a wave in the need for real-time data analysis and insights. However, this trend comes with challenges, particularly around data privacy and security. As businesses continue to collect and store vast amounts of sensitive information, ensuring its protection becomes a top priority. Despite these concerns, the market presents substantial opportunities for companies that can provide strong, secure, and scalable analytics solutions. Additionally, the rising use of Internet of Things (IoT) analytics in enterprises is contributing to market expansion. However, data privacy and security concerns remain a challenge for AaaS providers, necessitating strong security measures to protect sensitive information.

- By offering actionable insights and enabling data-driven decision-making, AAAS providers can help organizations optimize their operations, improve customer experiences, and gain a competitive edge. To capitalize on this market potential, businesses must navigate the evolving regulatory landscape and invest in advanced analytics technologies to meet the growing demands for data security and privacy.

What will be the Size of the Analytics As A Service (AAAS) Market during the forecast period?

- The market continues to experience strong growth, fueled by the increasing demand for advanced analytic techniques to derive insights from vast volumes of data generated by IoT devices and digital transformation initiatives. Big data and real-time analytics are key drivers, enabling businesses to make data-driven decisions in an agile and efficient manner. SAS analytics, artificial intelligence, and machine learning are integral components of AAAS offerings, providing advanced capabilities for data connectivity, data integration, and data reporting. Multi-cloud environments and data democratization are shaping the market, allowing organizations to leverage various cloud platforms and making data accessible to a broader user base.

- Generative AI and data privacy are emerging trends, offering new opportunities for enhanced data accuracy, reporting, and compliance capabilities. Despite these advancements, data integration complexities remain a challenge, requiring strong encryption and compliance capabilities to ensure data security. Overall, the AAAS market is poised for continued expansion, driven by the need for advanced analytics to make sense of the ever-growing data landscape. Big data from IoT devices and artificial intelligence (AI) and machine learning (ML) technologies are key drivers, requiring advanced query accelerators and data connectivity to multi-cloud environments

How is this Analytics As A Service (AAAS) Industry segmented?

The analytics as a service (AAAS) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Predictive analytics

- Prescriptive analytics

- Diagnostic analytics

- Descriptive analytics

- End-user

- BSFI

- Manufacturing

- Retail

- Healthcare

- Others

- Consumer

- Large enterprise

- SMEs

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- North America

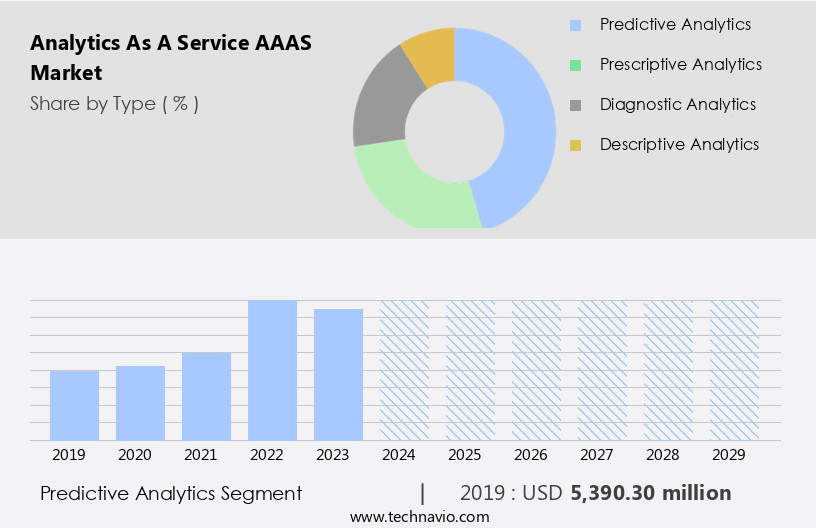

By Type Insights

The predictive analytics segment is estimated to witness significant growth during the forecast period. Predictive analytics is a specialized field of analytics that utilizes advanced artificial intelligence (AI) and machine learning techniques to make future predictions and assessments based on historical data. The adoption of predictive analytics is expanding across various industries, including finance, retail, healthcare, and manufacturing, leading to a growing demand for these solutions. Enterprises worldwide are implementing advanced analytics to enhance operational efficiency, mitigate risks, improve customer engagement, and optimize processes. The proliferation of cloud computing and AI technologies is further fueling the growth of predictive analytics. With the increasing volumes of data from multiple sources such as IoT devices, social media, and transactional systems, the need for scalable and real-time analytics solutions is becoming crucial for businesses to generate valuable insights and make data-driven decisions.

Predictive analytics capabilities, including advanced query accelerator, predictive tools, and data integration, are essential for businesses to gain a competitive edge and identify new opportunities. Additionally, data security, system integration, and performance metrics are critical considerations for organizations implementing predictive analytics solutions.

Get a glance at the market report of share of various segments Request Free Sample

The Predictive analytics segment was valued at USD 5.39 billion in 2019 and showed a gradual increase during the forecast period.

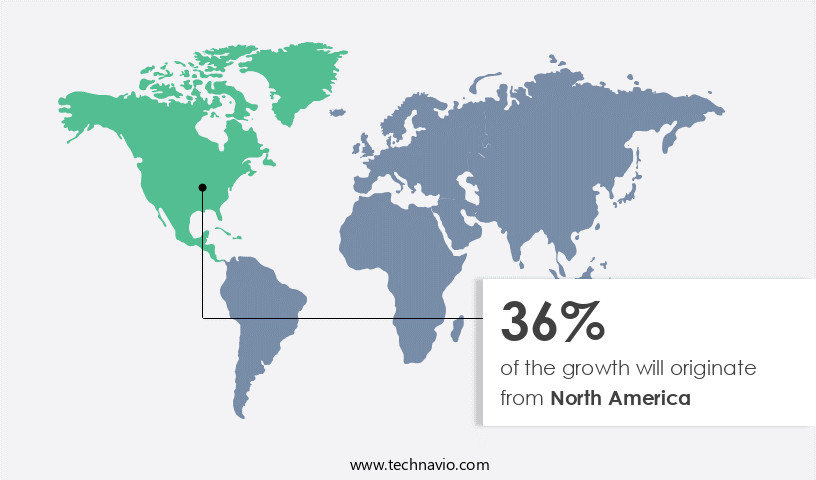

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Advanced Analytics as a Service (AAAS) is a cloud-based business solution that enables organizations to process and analyze large volumes of data in real time, using advanced query accelerator, AI, ML, and other advanced analytic techniques. The North American market, known for its high adoption rate of advanced technologies, is a significant contributor to the AAAS industry's growth. The retail sector's flourishing condition, the healthcare sector's expansion, and increasing manufacturing output are driving the adoption of AAAS solutions in the region. The healthcare sector is poised for strong growth due to the adoption of advanced medical devices by healthcare systems and compliance with regulations like the Affordable Care Act (ACA).

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Analytics As A Service (AAAS) Industry?

- Growing availability and complexity of data is the key driver of the market. The increasing volume and complexity of data in organizations are primary drivers fueling the adoption of analytics as a service (AAAS). Advanced techniques, such as machine learning (ML) and artificial intelligence (AI), enable companies to extract valuable insights from vast amounts of data, enhancing their services and business processes. From an enterprise standpoint, a significant amount of data remains untapped in their repositories due to the challenge of locating and utilizing it effectively. AAAS addresses this issue by providing intelligent data analysis solutions, unlocking valuable insights hidden within the data, and enabling businesses to make informed decisions.

- AAAS solutions offer benefits such as data democratization, data quality, decision making, operational efficiency, and business opportunities across various industries, including life sciences and retail. These solutions provide scalable, upfront investment-friendly, multi-cloud, and real-time analytics capabilities, addressing the challenges of data integration complexities and exponential increasing data from multiple sources, such as IoT devices, social media, transactional systems, and advanced analytics capabilities. Additionally, AAAS solutions offer data security, system integration, performance metrics, and digital services, making them an essential tool for large enterprises, financial institutions, and other organizations seeking to optimize processes, reduce risk, and generate business insights.

What are the market trends shaping the Analytics As A Service (AAAS) Industry?

- Rising use of IoT analytics in enterprises is the upcoming market trend. IoT analytics is a technology-driven solution that utilizes RFID, sensors, barcodes, GPS, and other technologies to monitor and manage an organization's physical assets. RFID tags, for instance, enable efficient tracking in the supply chain, particularly in the retail industry, and aid in inventory management. IoT analytics interconnects every device or asset within an organization, leading to improved business processes. Enterprises have experienced significant enhancements in their operations due to IoT analytics, as it facilitates real-time monitoring and decision-making, ensuring more effective control over business processes.

- The life sciences industry, for instance, generates vast amounts of complex data, requiring advanced analytics capabilities to ensure data quality and enable data democratization. The retail sector, on the other hand, benefits from predictive analytics to optimize inventory management, personalize customer experiences, and improve operational efficiency. The financial services industry leverages AAAS to manage credit and operational risk, while the manufacturing sector uses predictive tools to optimize production processes and improve overall performance. The adoption of cloud platforms has been a significant factor in the growth of the AAAS market. Multi-cloud solutions offer scalability, flexibility, and cost savings, making it easier for organizations to deploy analytics capabilities and generate business insights in real-time.

What challenges does the Analytics As A Service (AAAS) Industry face during its growth?

- Data privacy and security concerns is a key challenge affecting the industry growth. Data privacy and security concerns represent significant challenges for organizations as the number of connected devices and data-sharing increases. The Internet of Things (IoT) and cloud networks, in particular, necessitate a highly secure environment to prevent unauthorized access and data breaches. With the rise of IoT, the number of devices involved poses unique challenges, as inadequate security can lead to data theft. The transfer of critical data through these networks necessitates strong security measures to ensure data confidentiality, integrity, and availability. The increasing interconnectedness and data-sharing have resulted in a growing number of cybersecurity issues and data breaches. Historically, cybersecurity focused on securing a limited number of connected devices; however, the current landscape requires a more comprehensive approach to address these challenges.

- The market is also witnessing the emergence of generative AI and automation tools, which can further enhance the capabilities of AAAS platforms and enable more accurate and actionable insights. AAAS market offers significant opportunities for businesses to gain a competitive edge by leveraging advanced analytics capabilities to derive valuable insights from their data. The challenges of data integration complexities, data security, and upfront investment can be addressed through strategic planning and the adoption of scalable, cloud-based solutions. The future of AAAS lies in the continued innovation of AI and ML technologies and the ability to provide real-time insights to support data-driven decision-making.

Exclusive Customer Landscape

The analytics as a service (AAAS) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the analytics as a service (AAAS) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, analytics as a service (AAAS) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - This company delivers analytics-as-a-service, including customized managed analytics, to enable businesses in upgrading antiquated systems and reaping the rewards of data-driven models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Alteryx Inc.

- Amazon.com Inc.

- Atos SE

- Cloudera Inc.

- Google LLC

- Hewlett Packard Enterprise Co.

- Hitachi Ltd.

- Infor Inc.

- International Business Machines Corp.

- Microsoft Corp.

- MicroStrategy Inc.

- Oracle Corp.

- QlikTech international AB

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Sisense Ltd.

- Thales Group

- TIBCO Software Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to experience significant growth as businesses increasingly rely on data-driven insights to optimize operations, identify business opportunities, and make informed decisions. This trend is driven by the exponential increase in data volumes from various sources, including IoT devices, transactional systems, social media, and big data. Advanced analytic techniques, such as machine learning (ML) and artificial intelligence (AI), play a crucial role in deriving valuable insights from this data. These technologies enable real-time analytics, data accuracy, and data reporting, allowing organizations to respond quickly to market trends and customer needs. The AAAS market caters to various industries, including healthcare and retail, where specialized expertise and strong encryption and compliance capabilities are essential.

Despite the benefits, the integration of data from multiple sources and the complexity of data volumes pose challenges for organizations. Data integration complexities require advanced tools and expertise to ensure data accuracy and consistency. Moreover, data security and compliance capabilities are essential to protect sensitive data and maintain regulatory compliance. The upfront investment required for IT infrastructure and software delivery can be a barrier to entry for some organizations. However, the strategic planning and optimization of processes enabled by AAAS can lead to significant cost savings and operational efficiency in the long run. The AAAS market is expected to grow at a compound annual rate, driven by the increasing demand for data-driven decisions and the need for scalable solutions to manage the growing data volumes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 25.9% |

|

Market growth 2025-2029 |

USD 59.36 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

22.9 |

|

Key countries |

US, Canada, China, UK, Japan, Germany, India, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Analytics As A Service (AAAS) Market Research and Growth Report?

- CAGR of the Analytics As A Service (AAAS) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the analytics as a service (AAAS) market growth of industry companies

We can help! Our analysts can customize this analytics as a service (AAAS) market research report to meet your requirements.