Anticoagulant Reversal Drugs Market Size 2025-2029

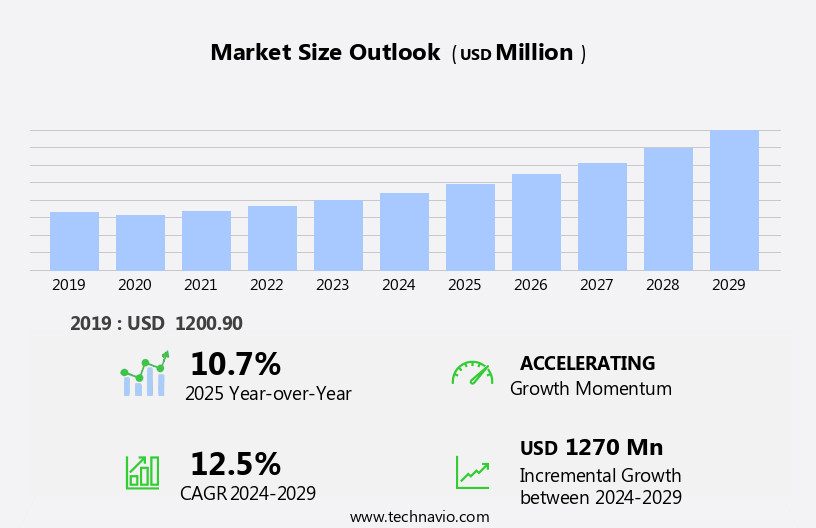

The anticoagulant reversal drugs market size is forecast to increase by USD 1.27 billion at a CAGR of 12.5% between 2024 and 2029.

What will be the Size of the Anticoagulant Reversal Drugs Market During the Forecast Period?

How is this Anticoagulant Reversal Drugs Industry segmented and which is the largest segment?

The anticoagulant reversal drugs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Hospital pharmacy

- Retail pharmacy

- Online pharmacy

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Distribution Channel Insights

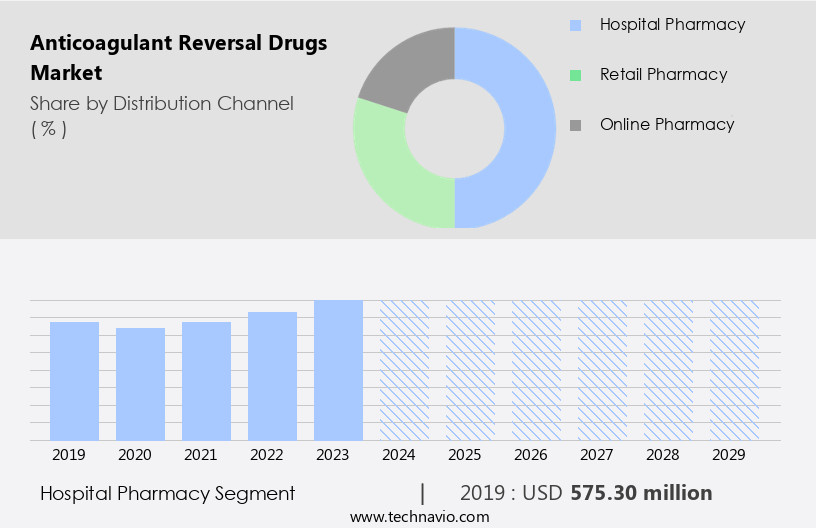

- The hospital pharmacy segment is estimated to witness significant growth during the forecast period.

Anticoagulant reversal drugs are primarily distributed through hospital pharmacies due to the high prevalence of serious conditions requiring these medications. Hospitalizations for cardiovascular diseases, such as atrial fibrillation, coronary artery disease, and ischemic stroke, drive the demand for anticoagulant reversal drugs in this sector. Uncontrolled bleeding in emergency situations is another significant factor contributing to market growth. Factor Xa inhibitors, including antidotes like andexanet alfa, play a crucial role in reversing the effects of these anticoagulants. Antimicrobial resistance and the importance of antimicrobial stewardship in healthcare systems are increasing concerns, leading to the development of innovative treatments. Parathyroid hormone and novel reversal agents, such as idarucizumab, are also gaining popularity due to their potential benefits in managing bleeding risks associated with anticoagulant use.

The market for anticoagulant reversal drugs is expected to grow significantly due to the increasing prevalence of thromboembolic disorders, including deep vein thrombosis and venous thromboembolism. Healthcare professionals are continually seeking effective treatment options to mitigate bleeding risks and improve patient outcomes. The revenue pockets for anticoagulant reversal drugs lie In the treatment of cardiovascular diseases and thrombosis. Trade regulations and research and development efforts are essential factors influencing market growth.

Get a glance at the Anticoagulant Reversal Drugs Industry report of share of various segments Request Free Sample

The Hospital pharmacy segment was valued at USD 575.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

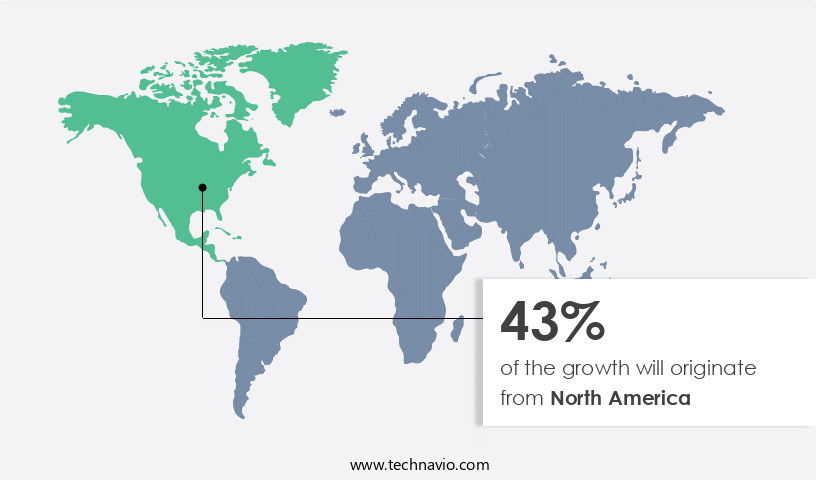

- North America is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is projected to lead The market due to favorable reimbursement policies and advanced healthcare infrastructure. The COVID-19 pandemic's impact on this market is anticipated to be substantial, as a study published In the American Journal of Hematology revealed that COVID-19 patients admitted with severe complications had elevated levels of Factor V, increasing the risk of blood clots. Anticoagulant reversal drugs, such as Andexanet alfa, Idarucizumab, and Parathyroid hormone, play a crucial role in managing bleeding risks associated with anticoagulant use in healthcare settings. These drugs are essential in treating thromboembolic disorders, including deep vein thrombosis and atrial fibrillation, caused by cardiovascular conditions and antibiotics.

Antimicrobial resistance and antimicrobial stewardship are essential considerations In the use of these drugs, as they can contribute to bleeding events and financial burden. Innovative treatments, such as Factor Xa inhibitors, are under development to optimize patient outcomes and address the challenges posed by anticoagulant classes. Regulatory approvals and value chain optimization are crucial factors driving the growth of the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Anticoagulant Reversal Drugs Industry?

Increasing prevalence of coagulation disorders is the key driver of the market.

What are the market trends shaping the Anticoagulant Reversal Drugs Industry?

Increasing focus on emerging economies is the upcoming market trend.

What challenges does the Anticoagulant Reversal Drugs Industry face during its growth?

Stringent regulatory reforms due to severe risks associated with reversal of anticoagulation is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The anticoagulant reversal drugs market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the anticoagulant reversal drugs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, anticoagulant reversal drugs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Amboss GmbH - Anticoagulant reversal drugs are essential for counteracting the effects of anticoagulant therapies in cases of bleeding complications or emergency situations. These drugs play a crucial role in restoring hemostasis and preventing excessive bleeding. Some commonly used anticoagulant reversal agents include Vitamin K, Prothrombin Complex Concentrates (PCCs), and Factor VIIa. Vitamin K acts by enhancing the activity of coagulation factors In the liver, while PCCs provide a pool of coagulation factors to replace those inhibited by anticoagulants. Factor VIIa, a recombinant protein, directly activates the coagulation cascade. The use of anticoagulant reversal drugs requires careful consideration and monitoring due to their potential risks and interactions with other medications. The market for these drugs is driven by the increasing prevalence of anticoagulant therapy use, particularly In the aging population and those with cardiovascular diseases. Additionally, the growing awareness and availability of effective reversal agents contribute to the market's growth.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amboss GmbH

- Amneal Pharmaceuticals Inc.

- AstraZeneca Plc

- Bausch Health Companies Inc.

- Boehringer Ingelheim International GmbH

- Covis Pharma GmbH

- CSL Ltd.

- GoodRx Holdings Inc.

- Midas Pharma GmbH

- Pfizer Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The anticoagulant reversal drug market represents a significant and growing segment withIn the healthcare industry. Anticoagulant drugs, which are used to prevent and treat various thromboembolic disorders, including deep vein thrombosis and pulmonary embolism, have become essential in managing cardiovascular conditions such as atrial fibrillation and other cardiovascular diseases. However, these drugs carry the risk of bleeding events, which can lead to adverse patient outcomes and increased financial burden on healthcare systems. Anticoagulant reversal drugs are essential in mitigating the risks associated with anticoagulant therapy. These drugs work by counteracting the anticoagulant effect, allowing for timely and effective management of bleeding events.

Factor Xa inhibitors, a common class of anticoagulant drugs, have gained significant attention due to their efficacy and popularity. The development of innovative treatments In the anticoagulant reversal drug market is driven by several factors. The rise of antimicrobial resistance and the importance of antimicrobial stewardship have led to a growing need for effective and efficient treatments for bleeding events. Additionally, the increasing prevalence of thromboembolic disorders and the associated healthcare costs have made the development of novel reversal agents a priority for pharmaceutical companies and healthcare professionals. The value chain optimization of anticoagulant reversal drugs involves various stakeholders, including hospital pharmacies, diagnostic laboratories, and healthcare systems.

Trade regulations and product approval processes also play a crucial role In the market's dynamics. The anticoagulant reversal drug market is characterized by ongoing research and development efforts to improve patient outcomes and reduce the financial burden of bleeding events. Parathyroid hormone, for instance, has shown promise in reversing the effects of anticoagulant drugs by promoting bone metabolism and improving hemostasis. Other novel reversal agents, such as Factor VIIa and activated prothrombin complex concentrates, are also being explored for their potential in anticoagulant reversal. The use of anticoagulant reversal drugs is not without challenges, however. Bleeding risks, although manageable, remain a concern, and the financial burden of these drugs can be significant.

As such, the market's growth is influenced by factors such as product pricing, reimbursement policies, and patient access to these treatments. In conclusion, the anticoagulant reversal drug market is an essential component of the healthcare industry, providing vital solutions for managing bleeding events associated with anticoagulant therapy. The market's growth is driven by ongoing research and development efforts, the increasing prevalence of thromboembolic disorders, and the need to mitigate the risks and financial burden of bleeding events. The market's dynamics are influenced by various factors, including regulatory approvals, pricing, and patient access.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.5% |

|

Market growth 2025-2029 |

USD 1270 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

10.7 |

|

Key countries |

US, Germany, Canada, China, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Anticoagulant Reversal Drugs Market Research and Growth Report?

- CAGR of the Anticoagulant Reversal Drugs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the anticoagulant reversal drugs market growth of industry companies

We can help! Our analysts can customize this anticoagulant reversal drugs market research report to meet your requirements.