Aramid Fiber Reinforcement Materials Market Size 2024-2028

The aramid fiber reinforcement materials market size is forecast to increase by USD 2.02 billion at a CAGR of 8.51% between 2023 and 2028. Aramid fiber reinforcement materials have gained significant traction in various industries due to their exceptional strength and lightweight properties. According to industry influencers and market research reports, key growth drivers include the increasing demand from developing countries and the high investment in the defense industry. However, challenges such as the high cost of development and quality maintenance persist. Weight reduction and energy consumption are critical factors in the selection of these materials, as they offer significant improvements in resource consumption and performance. Furthermore, the nonbiodegradable nature of aramid fibers raises concerns regarding their environmental impact. Molding processes are essential in the production of aramid fiber-reinforced materials, and their application extends to medical devices and other high-performance industries. Analysts from reputable research teams continue to monitor the market's evolution, providing valuable insights for businesses seeking to invest in this sector.

What will be the Size of the Market During the Forecast Period?

The market is witnessing significant growth due to their superior strength-to-weight ratio and high thermal stability. These properties make aramid fibers an ideal choice for various end-use industries, including aerospace and defense, transportation, and consumer goods. Segmentation of the market: the market can be segmented based on the type of aramid fibers, which include paraaramid fibers and metaaramid fibers. Paraaramid fibers are known for their high strength and heat resistance, making them popular in the aerospace and defense industries for applications such as bulletproof vests and composite materials for aircraft and military vehicles.

Moreover, metaaramid fibers, on the other hand, are used in the production of heat-resistant textiles and insulation materials. End-User Segmentation: The aerospace & defense industry is the largest end-user segment for aramid fiber reinforcement materials, due to the high demand for lightweight and strong materials in aircraft and military vehicles. The transportation industry follows closely, with the increasing use of aramid fibers in the production of composite materials for automobiles and trains. The energy systems segment is also a significant consumer of aramid fibers, with their use in the production of high-performance insulation materials for power generation and transmission.

Also, the geographic landscape of the market is diverse, with key producers and consumers located in North America, Europe, and Asia Pacific. North America is a significant market due to the presence of major aerospace and defense companies, while Europe is a key producer of aramid fibers. Asia Pacific is expected to witness the highest growth due to the increasing demand for aramid fibers in the transportation and consumer goods industries. Market Trends: The market for aramid fiber reinforcement materials is driven by factors such as the increasing demand for lightweight and strong materials in the aerospace and defense industries, the growing use of aramid fibers in the transportation industry, and the increasing demand for aramid fibers in consumer goods.

Additionally, the development of new applications for aramid fibers in the energy systems industry is expected to provide significant growth opportunities. Profitability and Competition: the market is a competitive landscape, with key players focusing on pricing, promotions, and innovation to gain a competitive edge. The market is also influenced by industry influencers and market research reports, which provide valuable insights into market trends and future growth opportunities. In conclusion, the market is a dynamic and growing industry, driven by the demand for lightweight and strong materials in the aerospace and defense, transportation, and energy systems industries. The market is segmented based on the type of aramid fibers and end-user industries, with key producers and consumers located in North America, Europe, and Asia Pacific. The market is influenced by factors such as pricing, promotions, and innovation, and is expected to witness significant growth in the coming years.

Market Segmentation

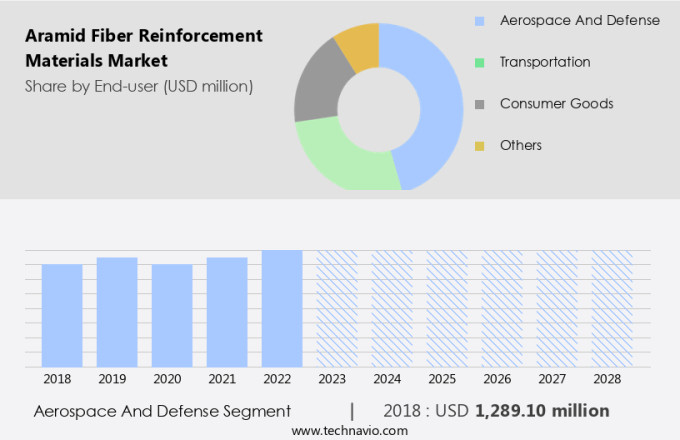

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Aerospace and defense

- Transportation

- Consumer goods

- Others

- Geography

- Europe

- Germany

- UK

- North America

- Canada

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By End-user Insights

The aerospace and defense segment is estimated to witness significant growth during the forecast period. Aramid fiber reinforcement materials have found extensive use in various industries, including electronics, transportation, and engineering. In the electronics sector, these materials are employed due to their inert, water-resistant, and corrosion-resistant properties, making them suitable for use in electrical machinery and high-speed rail applications. In the transportation industry, aramid fiber reinforcement materials are utilized in the production of composite materials, such as fiberglass, for manufacturing components in automobiles, boats, and aircraft. Aramid fibers are particularly valuable in aerospace and defense applications due to their high strength-to-weight ratio and resistance to heat and abrasive materials. These properties make aramid fiber reinforcement materials ideal for manufacturing structural components of aircraft, including nose caps, braking systems, exhaust nozzles, missile propulsion systems, thermal barriers, and ballistic protection equipment, such as bulletproof vests.

Furthermore, aramid fibers are used in the production of heat-shield systems in space shuttles due to their ability to withstand extreme temperatures and thermal shocks during re-entry into the atmosphere. The aerospace and defense industry is expected to witness significant growth during the forecast period, driven by the increasing production levels of next-generation aircraft, an increase in passenger traffic, and the development of advanced materials. Additionally, the use of carbon composites in bearing materials and pressure vessels is expected to further boost the demand for aramid fiber reinforcement materials in this sector. Overall, the advantages offered by aramid fiber reinforcement materials, including reduced weight, increased efficiency, and long service durability, make them a valuable addition to various industries, particularly in the aerospace and defense sector.

Get a glance at the market share of various segments Request Free Sample

The aerospace and defense segment was valued at USD 1.29 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

Europe is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Aramid fiber reinforcement materials experienced significant demand in Europe, leading it to become the largest and fastest-growing market in 2021. Major contributors to this growth included Germany, the UK, and Spain. The expansion can be attributed to the rising utilization of aramid fiber materials in sectors such as marine, electronics, consumer goods, and rail industries. In Europe, the commercial and defense aircraft sectors played a pivotal role in the market's growth. The European aircraft manufacturing industry is prominent in countries like the UK, Germany, France, Italy, Spain, Poland, Russia, and Sweden. By incorporating aramid fiber reinforcement materials, these industries enhance the strength, durability, and resistance to fire, heat, and chemicals in their products. This trend is expected to persist, driving the expansion of the market.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increasing demand from developing countries is the key driver of the market. Aramid fiber reinforcement materials have witnessed significant demand in various industries, including aerospace and defense, transportation, marine, and consumer goods. The aerospace and defense sector's growth is a primary driver of the market, with increasing production of aircraft in developing economies such as India, Brazil, and Iran. These countries' economic advancement, liberalization, and industrialization have led to a growth in the demand for aramid fiber reinforcement materials. Carbon fibers and aramid fibers, including paraaramid fibers and metaaramid fibers, are essential raw materials for the aerospace and defense industry due to their high strength, lightweight, and excellent thermal properties. In addition, the transportation sector's growing demand for fuel-efficient and lightweight vehicles has increased the demand for aramid fiber reinforcement materials. The Asia Pacific region, with China and India as major manufacturing hubs, is expected to dominate the market due to the increasing production of aircraft and automobiles.

Furthermore, the fiber cable system's use in various applications, such as telecommunications and power transmission, has also contributed to the market's growth. In conclusion, The market's growth is driven by the increasing demand from the aerospace and defense, transportation, marine, and consumer goods industries. The emerging economies' industrialization and economic advancement have led to a growth in demand, particularly in the Asia Pacific region.

Market Trends

The increasing investment in defense industry is the upcoming trend in the market. Aramid fiber reinforcement materials have gained significant attention in various industries due to their superior strength and lightweight properties. Industry influencers and market research reports suggest that the demand for these materials is expected to grow, particularly in sectors such as aerospace and defense, automotive, and construction. company selection for aramid fiber reinforcement materials involves careful consideration of factors such as performance, investment costs, and resource consumption.

Additionally, analysts from reputable research teams predict that the nonbiodegradable nature of aramid fibers will not hinder their market growth, as their benefits outweigh the environmental concerns. In the aerospace industry, weight reduction and energy consumption are critical factors, making aramid fiber reinforcement materials an attractive choice for manufacturers. Molding processes using aramid fibers are increasingly being adopted in medical devices due to their high strength-to-weight ratio and excellent resistance to heat and chemicals. The investment costs associated with these materials may be high, but the long-term performance benefits justify the initial expense. As countries such as the US, India, Japan, Germany, and Russia continue to increase their defense budgets, the demand for advanced military aircraft is expected to rise. This trend will further fuel the growth of the market.

Market Challenge

The high cost of development and quality maintenance is a key challenge affecting the market growth. Aramid fiber reinforcement materials have gained significant attention in various industries due to their exceptional strength and lightweight properties. Manufacturers of these materials face intense competition in the market, as outlined by Porter's Five Forces model. In the end-user segments, such as the defense industry, energy systems, and optical cables, the demand for miniaturization and high performance is driving innovation. This necessitates continuous development in aramid fiber reinforcement materials. Manufacturers must invest heavily in research and development to meet the stringent requirements of these industries. For instance, in the production of aramid fibers, specialized equipment is necessary for cutting and grinding.

Additionally, quality assurance checks are essential to maintain the integrity of the fibers, as they can degrade under UV light. These factors contribute to the increased cost of production for aramid fiber reinforcement materials.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BASF SE - The company offers aramid fiber reinforcement materials such as polysiloxanes, polyacrylates and fluorinated polyacrylates.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CTech LLC

- DuPont de Nemours Inc.

- Hexcel Corp.

- Honeywell International Inc.

- Huvis Corp.

- Hyosung Advanced Materials

- Kolon Industries Inc.

- Mersen Corporate Services SAS

- Plascore Inc.

- Prince Lund Engineering PLC

- Tayho Advanced Materials Group Co. Ltd.

- Teijin Ltd.

- Toray Industries Inc.

- X FIPER New Material Co. Ltd.

- YF International BV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Aramid fiber reinforcement materials have gained significant traction in various industries due to their exceptional properties. These high-performance fibers, including paraaramid and metaaramid, are extensively used in aerospace and defense, transportation, and marine industries. The aerospace and defense sector benefits from their lightweight, high strength, and excellent temperature resistance. In the transportation sector, aramid fibers are used in composite materials for weight reduction and improved mechanical performance in applications such as high-speed rail and carbon composites. The market for aramid fiber reinforcement materials is segmented based on end-use industries and geography. The aerospace and defense industry is a major consumer due to the requirement for lightweight, strong, and fire-resistant materials.

Moreover, the transportation sector follows closely, with applications in the automotive, marine, and high-speed rail industries. The consumer goods sector also utilizes aramid fibers in various applications, including protective clothing and medical devices. The market research reports provide insights into the profitability, pricing, promotions, and industry influencers driving the growth of the market. The Porter's Five Forces model analysis reveals the competitive landscape, with raw material availability, substitutes, and supplier bargaining power impacting the market dynamics. Aramid fibers offer superior properties, including high elastic modulus, tensile strength, abrasion resistance, and temperature resistance, making them ideal for various applications. Their nonbiodegradable nature and high investment costs are challenges for the market.

However, their inert, water-resistant, and corrosion-resistant properties make them suitable for electrical and electronics applications, including fiber cable systems, optical cables, and electrical machinery. The market research reports also cover the impact of trends such as miniaturization, electrical conductivity, and dimensional stability on the market. The reports provide insights into the design evolution, engineering analysis, and company selection for aramid fiber reinforcement materials. Other allied markets, such as bearing materials, pressure vessels, and truss members, also utilize aramid fibers for their superior mechanical properties. In conclusion, the market is driven by the demand for lightweight, high-performance materials in various industries, including aerospace and defense, transportation, and consumer goods. The market research reports offer insights into the market dynamics, trends, and growth opportunities, helping stakeholders make informed decisions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 2.02 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.67 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 35% |

|

Key countries |

US, China, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

BASF SE, CTech LLC, DuPont de Nemours Inc., Hexcel Corp., Honeywell International Inc., Huvis Corp., Hyosung Advanced Materials, Kolon Industries Inc., Mersen Corporate Services SAS, Plascore Inc., Prince Lund Engineering PLC, Tayho Advanced Materials Group Co. Ltd., Teijin Ltd., Toray Industries Inc., X FIPER New Material Co. Ltd., and YF International BV |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch