Audiobooks Market Size 2025-2029

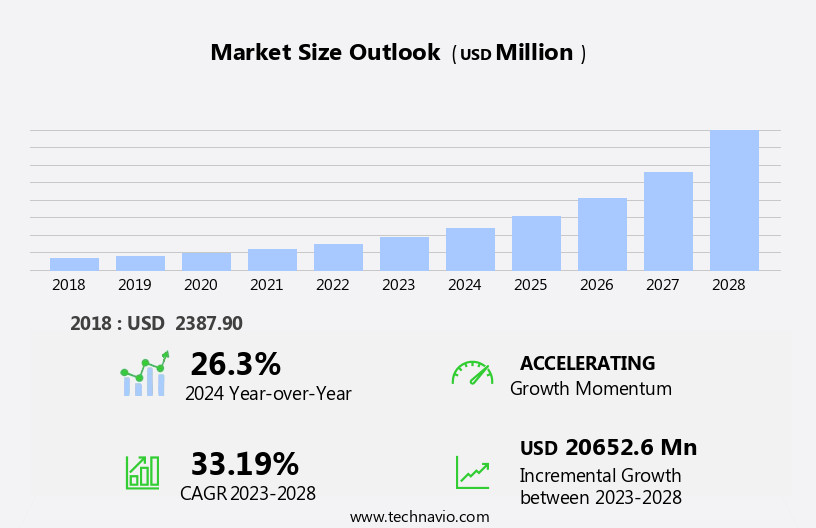

The audiobooks market size is forecast to increase by USD 29.61 billion, at a CAGR of 35.8% between 2024 and 2029.

- The audiobook market is experiencing significant growth, driven by the proliferation of smart devices and applications. This trend is expected to continue as technology advances and becomes more integrated into our homes and daily routines. However, the market faces a growing threat from opensource content, which may erode profitability for audiobook publishers and distributors.

- Additionally, partnerships with technology companies and voice assistants can help expand reach and engage new audiences. To capitalize on these opportunities and navigate challenges effectively, companies should stay abreast of technological advancements and consumer preferences, and be agile in their business strategies. Companies must navigate this challenge by focusing on the value they can provide through exclusive content, high-quality production, and innovative distribution strategies. Audiobook listener demographics are diverse, with a growing number of consumers preferring this format for personal development, entertainment, and educational purposes.

What will be the Size of the Audiobooks Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The audiobook market continues to evolve, with dynamic shifts in various sectors shaping its landscape. Audiobook subscription services are gaining traction, offering listeners unlimited access to a vast catalog for a monthly fee. Integration of audiobook podcasts expands reach and engagement, merging the worlds of audio entertainment and education. Search optimization plays a crucial role, ensuring discoverability amidst an ever-growing library. Marketing strategies adapt to this new terrain, leveraging data-driven insights and targeted campaigns. Royalty payments and genre classification systems evolve to accommodate the changing landscape. Piracy remains a persistent challenge, necessitating robust rights management solutions.

Audiobook sales figures reflect these trends, revealing a market in constant flux. Authors, reviewers, narrators, and other stakeholders adapt to these shifts, shaping the future of audiobook production and content creation. Accessibility features, software, and hardware advancements enhance user experience. Metadata standards streamline cataloging and distribution. Mastering techniques and technology innovations push the boundaries of audiobook quality. Analytics provide valuable insights into listener behavior and preferences. The audiobook market's continuous evolution underscores its resilience and adaptability, making it an exciting space for innovation and growth.

How is this Audiobooks Industry segmented?

The audiobooks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Fiction

- Non-fiction

- Channel

- One-time download

- Subscription-based

- Device

- Smartphones

- Laptops and tablets

- Personal digital assistants (PDAs)

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

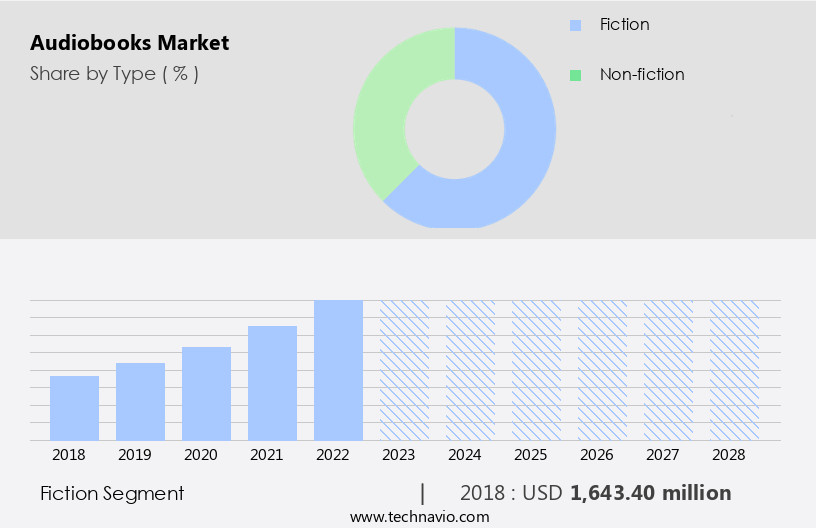

The Fiction segment is estimated to witness significant growth during the forecast period. In the dynamic audiobook market, various entities play integral roles. Fiction, a significant portion, caters to nearly 52% of U.S. Adults, or approximately 137 million people, who have listened to an audiobook as of 2024, consuming an average of 7 titles yearly. Audiobook recommendation engines suggest personalized titles based on listeners' preferences, expanding the market's reach. Audiobook platforms facilitate distribution and accessibility, while publishing houses produce content. Rights management ensures fair compensation for creators, and advertising attracts new listeners. Indexing, accessibility features, and search optimization enhance user experience. Cover design, metadata, and cataloging attract potential buyers.

Software, hardware, and technology enable production, narration, and distribution. Subscription services and podcast integration offer convenience. Analytics provide insights into listener behavior and trends. Royalty payments ensure fair compensation for authors and editors, while genre classification and piracy prevention maintain market integrity. Consumers are increasingly utilizing virtual assistant and smart speakers to access and listen to audiobooks, providing convenience and flexibility in their daily lives.

The Fiction segment was valued at USD 1.97 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

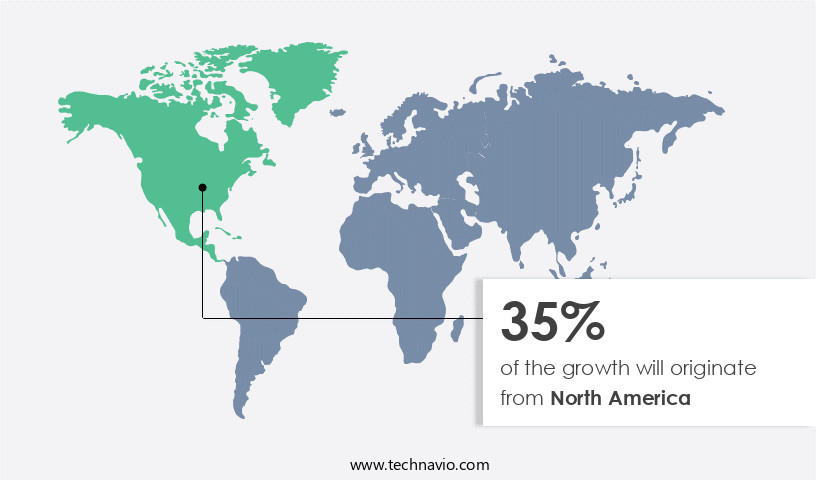

Europe is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The global audiobook market is experiencing significant growth, with North America leading the way in 2024. This dominance is driven by advanced digital infrastructure, strong consumer spending, and widespread smartphone usage. Major players like Apple, Rakuten Group, and Amazon are innovating in this space, with Amazon's Kindle Paperwhite supporting audiobook playback, merging e-reading and audio experiences. In the U.S., BYOD policies in schools are enhancing digital literacy and cutting costs, leading to increased adoption of audiobooks in education. AI-powered recommendation engines and improved mobile access are further fueling market growth. For instance, Audible is testing AI-generated tags to personalize audiobook discovery, making content more accessible and tailored to individual preferences.

Audiobook publishing, rights management, advertising, indexing, accessibility, content creation, metadata, production, narration, distribution, hardware, mastering, technology, accessibility features, analytics, subscription services, podcast integration, search optimization, marketing, royalty payments, genre classification, piracy, sales, authors, and editing are all integral components of this dynamic market. Consumers are increasingly utilizing virtual assistant and smart speakers to access and listen to audiobooks, providing convenience and flexibility in their daily lives. As consumer preferences evolve and technology advances, these entities will continue to shape the audiobook landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Audiobooks Industry?

- The expansion of the market is primarily attributed to the increasing prevalence of smart devices and related applications. Audiobooks have gained significant traction in the digital learning market due to the widespread use of mobile devices and technology. The convenience of accessing audiobooks on smartphones and tablets has made them a popular choice for learners worldwide. Audiobooks offer flexibility, enabling users to listen to content from any location and at their own pace. The demand for audiobooks is not limited to high-end devices; even consumers with budget constraints opt for audiobooks on affordable mobile devices.

- Producers employ various pricing strategies to cater to different consumer segments. Audiobook cover design is crucial to attract potential buyers, while cataloging and software help manage and organize the vast audiobook library. Metadata standards ensure consistent and accurate information about audiobooks, enhancing their discoverability. As the market for audiobooks continues to grow, it is essential for producers to focus on creating high-quality, engaging content to meet the evolving needs of learners. The production of audiobooks involves various stages, including audiobook narration, review, pricing strategies, cover design, cataloging, software, and metadata standards. Audiobook narrators bring the content to life with their voice acting skills, while audiobook reviewers ensure the quality of the final product.

What are the market trends shaping the Audiobooks Industry?

- The rising adoption of voice assistants and smart speakers signifies a notable market trend for listening to audiobooks. This innovative technology enables users to access and enjoy audiobooks through simple voice commands, adding convenience and ease to their daily lives. The market for audiobooks has experienced significant growth due to the increasing popularity of voice assistants and speakers. These devices offer users the convenience of requesting and listening to audiobooks hands-free, making them an attractive alternative to traditional books or digital libraries. Audiobook content creation, including narration and mastering, has become a priority for publishers to meet the rising demand.

- Audiobook analytics provide valuable insights into consumer behavior and preferences, allowing publishers to tailor their offerings and improve sales. Overall, the audiobook industry continues to evolve, driven by technological advancements and the convenience they offer to consumers. Audiobook metadata and distribution are also crucial elements of the market, ensuring accurate and accessible information for consumers. The latest audiobook technology enables features such as text-to-speech and adjustable playback speeds, enhancing the listening experience. Furthermore, audiobook accessibility features cater to individuals with visual impairments or reading difficulties, expanding the market's reach.

What challenges does the Audiobooks Industry face during its growth?

- The escalating risk posed by open-source content represents a significant challenge to the industry's growth trajectory. Audiobooks, a popular format for consuming literature, have seen significant market dynamics in recent times. Established companies are offering open-source audiobooks due to technological advancements and minimal market entry barriers. These businesses provide audiobooks at reduced prices or even free of charge, fueled by the expansion of digital infrastructure.

- As a result, free sources of content are increasingly preferred by users, posing a challenge to the market. Audiobook genre classification, marketing, royalty payments, and piracy continue to influence the audiobook industry. Ensuring effective search optimization and podcast integration are crucial for market success. This trend could potentially impact the demand for subscription-based audiobook services. Moreover, open educational repositories are capitalizing on the subscription model's availability, which can be costly for potential audiobook users.

Exclusive Customer Landscape

The audiobooks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the audiobooks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, audiobooks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - The company specializes in audiobooks and digital content services, operating the Audible brand, which offers a wide selection of audiobooks for personalized entertainment and knowledge enrichment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- Apple Inc.

- AudiobooksNow

- Barnes and Noble Booksellers Inc.

- BookBeat AB

- Chirp

- DOWNPOUR

- Google LLC

- Hoopla

- KUKU FM

- Libro.fm SPC.

- Open Culture LLC.

- Rakuten Group Inc.

- RBmedia

- Scribd Inc.

- Spotify Technology SA

- Storynory Ltd.

- Storytel AB

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Audiobooks Market

- In January 2024, Audible, an Amazon subsidiary, announced the launch of its new service, Audible Plus, which offers ad-free access to a vast catalog of audiobooks and podcasts for a monthly subscription fee. This expansion aimed to attract more listeners and compete effectively with other audiobook streaming platforms (Amazon PR, 2024).

- In March 2024, Hachette Livre, a leading global publisher, entered into a strategic partnership with Google to expand its audiobook distribution network. Google Books now offers audiobooks for sale and rental, giving the publisher a broader reach and increasing accessibility to its content (Google, 2024).

- In April 2025, Simon & Schuster, a major publishing company, raised USD200 million in a funding round led by Blackstone Group. The investment will be used to expand its digital content offerings, including audiobooks, and strengthen its market position (Simon & Schuster, 2025).

- In May 2025, Apple Books introduced a new feature allowing authors to offer free audiobook samples. This initiative aims to boost sales by giving potential buyers a taste of the content before making a purchase (Apple, 2025).

Research Analyst Overview

In the dynamic audiobook market, app development continues to shape the industry's landscape, offering innovative features and seamless user experiences. Audiobook libraries expand, providing listeners with diverse content choices. Feedback from community forums and reviews shape trends analysis, guiding content aggregation and retailers' decisions. Platform integration enhances accessibility, while data analysis informs marketing campaigns and consumer behavior insights. Sound design and voice acting elevate the listening experience, influencer marketing expands reach, and music licensing adds value. Content strategy, brand building, and conversion rates remain key focus areas. Email marketing and user experience optimization drive engagement, with retention rates and performance metrics under constant scrutiny.

Audiobook trends reflect a balance between technology and storytelling, shaping the future of this burgeoning medium. The Audiobooks Market is thriving, driven by rising demand and innovations across audiobook editing, audiobook mastering, and audiobook marketing. Growth in audiobook listeners has inspired audiobook authors to focus more on audiobook rights management and timely audiobook royalty payments. Challenges like audiobook piracy push the need for secure audiobook software and compatible audiobook hardware. Adhering to audiobook metadata standards, effective audiobook cataloging, and audiobook indexing enhance discoverability through audiobook search optimization. Understanding audiobook listener demographics helps tailor audiobook content categories and refine audiobook pricing strategies. Meanwhile, strategic audiobook advertising and audiobook podcast integration open new promotional avenues.

The Audiobooks Market continues to rise, driven by enhanced copyright protection and expanding networks of audiobook retailers. User-generated insights like audiobook reviews, audiobook ratings, and active audiobook community forums offer rich audiobook listener feedback, elevating the audiobook user experience. Sophisticated audiobook app development and seamless audiobook platform integration ensure accessibility. Leveraging audiobook data analysis and audiobook consumer behavior supports accurate audiobook trends analysis and fuels effective audiobook content strategy. Brands are investing in smart home audiobook marketing campaigns, dynamic audiobook brand building, and tactics such as audiobook influencer marketing, audiobook email marketing, and audiobook affiliate marketing. Improved audiobook performance metrics track audiobook conversion rates and optimize audiobook retention rates, shaping a smarter, listener-centric market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Audiobooks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 35.8% |

|

Market growth 2025-2029 |

USD 29.61 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

28.7 |

|

Key countries |

US, China, UK, Germany, Canada, Japan, France, India, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Audiobooks Market Research and Growth Report?

- CAGR of the Audiobooks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the audiobooks market growth of industry companies

We can help! Our analysts can customize this audiobooks market research report to meet your requirements.