Automated Guided Vehicle (AGV) Software Market Size 2024-2028

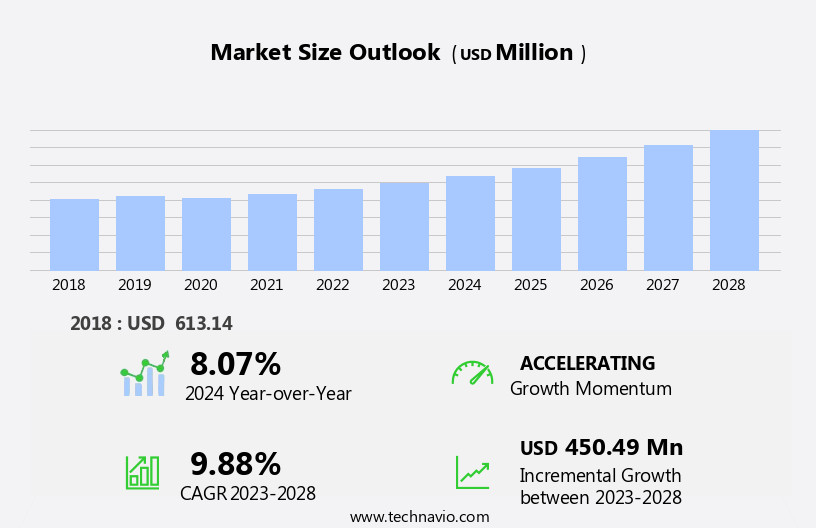

The automated guided vehicle (agv) software market size is forecast to increase by USD 450.49 million at a CAGR of 9.88% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the expanding e-commerce industry and the integration of Industry 4.0 with IoT technologies. These trends are transforming logistics and manufacturing processes, leading to increased demand for AGV systems to automate material handling and streamline operations. However, resistance to adopt new technologies related to AGV software poses a challenge for market growth. Companies must invest in education and training to overcome this obstacle and effectively communicate the benefits of AGV software to potential customers.

- By capitalizing on these market opportunities and addressing the challenges, organizations can optimize their supply chain operations, enhance productivity, and gain a competitive edge in their industries.

What will be the Size of the Automated Guided Vehicle (AGV) Software Market during the forecast period?

- The AGV software market continues to evolve, driven by advancements in technology and increasing adoption across various sectors. User experience (UX) and artificial intelligence (AI) are key focus areas, with mapping software and path planning integrating seamlessly to optimize material handling in warehouses. Predictive maintenance and hardware compatibility are essential for ensuring AGVs operate efficiently, while 3D vision and support services enhance safety and performance. Deep learning and machine learning algorithms enable AGVs to adapt to changing environments and traffic patterns. Fleet management and traffic management systems provide real-time monitoring and remote control capabilities, while cloud-based platforms offer on-demand access and scalability.

- Obstacle avoidance and safety protocols are crucial components, ensuring AGVs navigate complex warehouse environments safely. Software-as-a-service (SaaS) deployment models offer flexibility and cost savings, while laser scanning technology enhances mapping accuracy and precision. The AGV software market's continuous dynamism is reflected in its integration of UI, maintenance contracts, and advanced features like deep learning and real-time monitoring. Applications span industries, including food and beverage, where AGVs optimize inventory management and streamline production processes. In the evolving landscape, AGV software providers must stay agile, integrating new technologies and adapting to changing customer needs. The market's future promises further innovation, with ongoing advancements in AI, machine learning, and data analytics shaping the future of AGV navigation and material handling.

How is this Automated Guided Vehicle (AGV) Software Industry segmented?

The automated guided vehicle (agv) software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- In-built vehicle software

- Integrated software

- End-user

- Distribution and logistics

- Food and beverages

- Automotive

- Retail

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

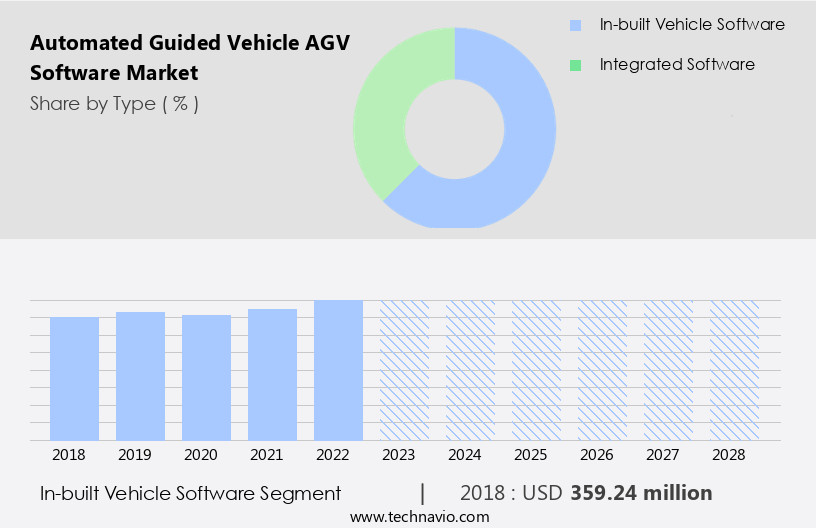

The in-built vehicle software segment is estimated to witness significant growth during the forecast period.

The in-built vehicle software market for Automated Guided Vehicles (AGVs) is experiencing significant growth, surpassing the average rate of expansion in the global market. This upward trend can be attributed to the increasing adoption of AGVs in industries such as manufacturing, distribution and logistics, retail, and automotive. AGVs, including unit load carriers, tow vehicles, pallet trucks, and assembly line machines, rely on in-built navigation and management software for guidance on the shop floor and efficient transportation operations. The software is installed directly into the AGVs and facilitates seamless interaction between the vehicle and its environment. User experience (UX) plays a crucial role in the design of AGV software, ensuring intuitive interfaces and easy-to-use features for operators.

Artificial intelligence (AI) and machine learning algorithms are integrated into the software for predictive maintenance, optimizing warehouse layouts, and enhancing fleet management. Deep learning techniques enable obstacle avoidance and traffic management, while 3D vision technology improves safety protocols and path planning. In addition, AGV software offers various deployment options, including on-premise and Software-as-a-Service (SaaS), catering to diverse industry needs. Real-time monitoring and cloud-based platforms provide valuable data analytics for continuous process improvement. Maintenance contracts and support services ensure optimal performance and longevity of the AGVs. The market is also witnessing the integration of advanced technologies like laser scanning and safety protocols to further enhance the capabilities of AGV software.

Overall, the in-built vehicle software market for AGVs is a dynamic and evolving landscape, driven by the ongoing integration of innovative technologies and the growing demand for automation in various industries.

The In-built vehicle software segment was valued at USD 359.24 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

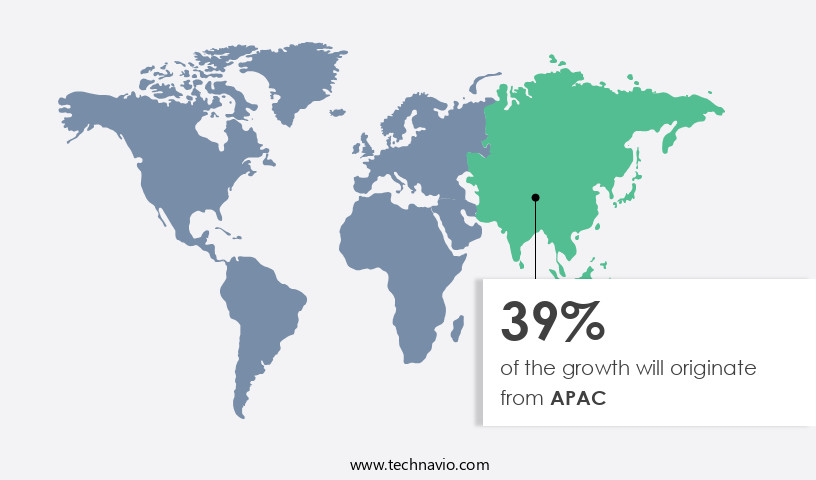

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing significant growth due to the increasing adoption of advanced technologies and the influx of small and medium-sized enterprises (SMEs) in the region. While APAC is expected to record substantial growth in the AGV software market during the forecast period, it currently lags behind North America and Europe due to the late adoption of technologies and the overall maturity of the industrial sector. China is the dominant player in the APAC AGV software market, with Japan and South Korea also making strides in industrial automation. AGV software solutions are integral to material handling and warehouse optimization, enabling efficient fleet management, traffic management, and obstacle avoidance.

User experience (UX) and user interface (UI) design play crucial roles in ensuring seamless integration with hardware, including 3D vision, laser scanning, and safety protocols. Machine learning and predictive maintenance are key features that enhance the value of AGV software, providing real-time monitoring and predictive analytics. Artificial intelligence (AI) and deep learning algorithms are increasingly being integrated into AGV software for path planning and obstacle avoidance, enhancing overall performance and safety. Support services and maintenance contracts ensure smooth operations, while software-as-a-service (SaaS) and on-premise deployment options cater to varying business needs. The food and beverage industry is a significant end-user of AGV software, with applications ranging from material handling to inventory management and fleet optimization.

The AGV software market in APAC is poised for growth, with a focus on enhancing operational efficiency, reducing costs, and improving safety. The integration of advanced technologies, such as AI, machine learning, and predictive maintenance, is expected to drive market growth and provide a competitive edge to businesses in the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automated Guided Vehicle (AGV) Software Industry?

- The e-commerce sector's continuous growth serves as the primary catalyst for market expansion.

- The global market for Automated Guided Vehicle (AGV) software is experiencing significant growth due to the expanding e-commerce sector. As more consumers opt for online shopping, businesses are expanding their order processing capabilities in warehouses and distribution centers. The number of these facilities has grown rapidly in recent years, with major markets including China, India, the US, the UK, Germany, France, and Japan. The global e-commerce industry is growing at an annual rate exceeding 10%, driven by the increasing penetration of internet connectivity and the convenience it offers. For instance, the e-commerce market in India is projected to grow at a Compound Annual Growth Rate (CAGR) of over 20% during the forecast period.

- AGV software plays a crucial role in optimizing the operations of these facilities by enabling remote control and real-time monitoring of vehicles through a cloud-based platform. Additionally, safety protocols and data analytics features enhance efficiency and productivity. Laser scanning technology ensures accurate navigation and collision avoidance, while safety protocols prevent accidents and ensure the safety of workers and goods. In conclusion, the growing e-commerce industry and the resulting expansion of warehouses and distribution centers are driving the demand for AGV software. The technology's ability to improve efficiency, productivity, and safety makes it an essential investment for businesses in this sector.

What are the market trends shaping the Automated Guided Vehicle (AGV) Software Industry?

- The integration of Industry 4.0 and the Internet of Things (IoT) is becoming a significant market trend. This convergence represents the next evolution in industrial manufacturing, enhancing operational efficiency and productivity.

- The market is experiencing significant growth in the context of the ongoing industrial revolution, with a focus on automation and data exchange in manufacturing and material handling processes. AGV systems, which utilize machine learning and artificial intelligence for navigation, are integral to this trend. These systems enable the seamless movement of materials within a factory environment with minimal human intervention. AGV software plays a crucial role in optimizing warehouse operations by integrating various machines, devices, and sensors into a unified system. This integration allows for real-time monitoring and control of the entire manufacturing process.

- Moreover, the use of mapping software and user experience (UX) design enhances the efficiency and accuracy of AGV navigation. Machine learning algorithms are employed to analyze data from various sources and make informed decisions, leading to improved productivity and reduced errors. The integration of AGV software into Industry 4.0-compliant factories also enables decentralized decision-making, further enhancing operational efficiency. In conclusion, the adoption of AGV software is a key component of the industrial revolution, providing numerous benefits in terms of material handling, warehouse optimization, and data analysis. The integration of machine learning and artificial intelligence, along with user experience design and mapping software, ensures a harmonious and immersive experience for operators and enhances overall factory performance.

What challenges does the Automated Guided Vehicle (AGV) Software Industry face during its growth?

- The implementation of new AGV software technologies encounters significant resistance within the industry, posing a substantial challenge to its growth.

- In today's business landscape, many industries, including manufacturing, retail, transportation and logistics, and healthcare, are grappling with the challenges of adopting modern technologies for warehouse management. Traditional manual methods have long been the norm, but the emergence of advanced technologies is making the transition to automated systems increasingly necessary. These new technologies bring with them a heightened level of responsibility for companies, as they must keep up with the latest innovations to remain competitive. One such technology is Automated Guided Vehicle (AGV) software. AGV systems utilize predictive maintenance capabilities to minimize downtime and maximize efficiency.

- Hardware compatibility is essential to ensure seamless integration with existing warehouse infrastructure. Advanced features such as 3D vision and deep learning algorithms enhance the system's capabilities, while user-friendly interfaces simplify operation. Moreover, robust support services are crucial to ensure the smooth functioning of AGV systems. Maintenance contracts provide peace of mind, ensuring that any issues are addressed promptly. As the adoption of AGV software continues to grow, companies must carefully consider these factors to make an informed decision and successfully implement these advanced systems.

Exclusive Customer Landscape

The automated guided vehicle (agv) software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automated guided vehicle (agv) software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automated guided vehicle (agv) software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alstef Group SAS - This company specializes in providing automated guided vehicle (AGV) systems, featuring interconnected conveyor networks and complementary technologies. These integrated solutions enhance production efficiency and support quality control processes. The AGVs navigate autonomously through the transit network, ensuring seamless material handling and optimizing overall logistics operations. By combining advanced automation with complementary systems, this company delivers comprehensive, efficient, and adaptable supply chain solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alstef Group SAS

- Balyo SA

- Daifuku Co. Ltd

- Danaher Corp.

- E80 GROUP SPA

- Gotting KG

- Honeywell International Inc.

- Hyster Yale Materials Handling Inc.

- John Bean Technologies Corp.

- KION GROUP AG

- KMH Fleet Solutions

- KUKA AG

- Murata Machinery Ltd.

- Oceaneering International Inc.

- Scott Technology Ltd.

- Seegrid Corp.

- TALUMIS BV

- TGW LOGISTICS GROUP GmbH

- Toyota Industries Corp.

- SSI Schafer IT Solutions GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automated Guided Vehicle (AGV) Software Market

- In February 2024, Swisslog, a leading global automation solutions provider, announced the launch of its new SynQ Lite software for AGVs. This lightweight and cost-effective solution aims to cater to small and medium-sized warehouses, broadening Swisslog's AGV software offerings and expanding its customer base (Swisslog Press Release).

- In May 2025, Kion Group, a leading industrial automation company, acquired the AGV software business of Dematic, a leading global supplier of automated material handling solutions. This strategic acquisition enabled Kion to strengthen its AGV software capabilities and enhance its market position (Kion Group Press Release).

- In August 2024, Siemens announced the deployment of its new AGV software, Siemens SIMATIC AGV, at a major automotive manufacturer in Europe. The advanced software features real-time data analytics and predictive maintenance capabilities, significantly improving operational efficiency and reducing downtime (Siemens Press Release).

- In November 2025, Cisco and Honeywell collaborated to integrate Cisco's IoT technology with Honeywell's Mission Critical Network Services and AGV software. This partnership aimed to provide enhanced connectivity and data analytics for AGVs, enabling real-time monitoring and predictive maintenance (Cisco Press Release).

Research Analyst Overview

The market is experiencing significant growth, driven by the increasing demand for order fulfillment and picking and packing automation in various industries. Collaborative robots (cobots) and human-robot collaboration are key trends, enabling process optimization and productivity gains through data visualization and predictive analytics. Industrial automation solutions, including AGVs, are integral to digital transformation, with fleet optimization, remote monitoring, and cost savings being major incentives. Security features, such as collision avoidance and RFID (radio-frequency identification), ensure safe and efficient operations. Smart factories leverage system integration, production efficiency, and performance tracking, while energy efficiency and remote diagnostics enhance sustainability and maintenance. Autonomous navigation and sensor fusion improve industrial robots' capabilities, enhancing assembly lines and path optimization.

AGV software market players focus on providing advanced features like real-time performance tracking, autonomous navigation, and system integration to meet evolving industry demands. Conveyor systems and supply chain management are also benefiting from AGV software's capabilities, further expanding its reach in the industrial landscape.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automated Guided Vehicle (AGV) Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.88% |

|

Market growth 2024-2028 |

USD 450.49 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.07 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automated Guided Vehicle (AGV) Software Market Research and Growth Report?

- CAGR of the Automated Guided Vehicle (AGV) Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automated guided vehicle (agv) software market growth of industry companies

We can help! Our analysts can customize this automated guided vehicle (agv) software market research report to meet your requirements.