Automatic Milking Machines Market Size 2025-2029

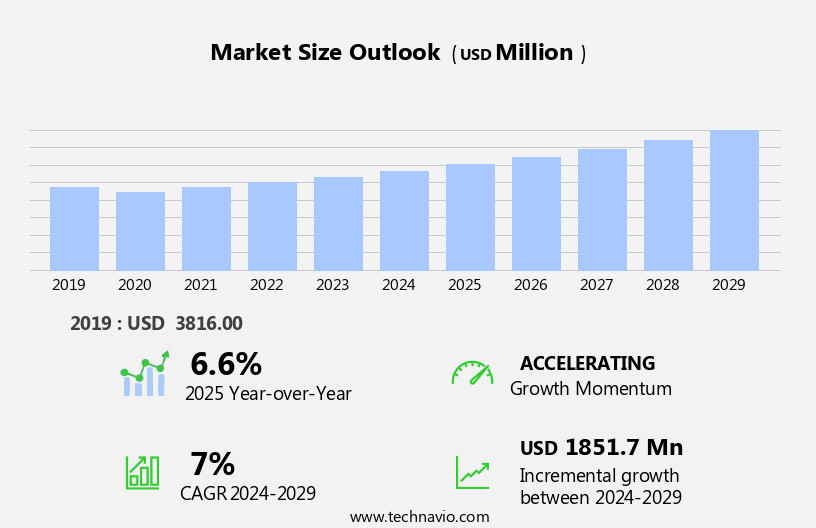

The automatic milking machines market size is forecast to increase by USD 1.85 billion at a CAGR of 7% between 2024 and 2029.

- The market is witnessing significant growth due to the increased demand for dairy products and the rising trend towards sensor-based milking systems. The demand for dairy products is on the rise, driven by the growing population and changing consumer preferences towards healthier food options. Robotic and automatic milking machines, as well as milking parlors, are more expensive than traditional automatic milking systems. Smart feeding robots are also an add-on feature that can optimize feeding schedules for dairy cattle, enhancing overall farm machinery productivity. Additionally, sensor-based milking systems are gaining popularity due to their ability to improve milk quality and productivity. However, the high investment and maintenance costs of automatic milking machines remain a challenge for market growth. Producers must carefully weigh the benefits against the costs to determine if investing In these systems is worthwhile. Overall, the market for automatic milking machines is expected to continue expanding as technology advances and production efficiency becomes a top priority.

What will be the Size of the Automatic Milking Machines Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing mechanization of dairy farms to enhance productivity and improve milk quality. With herd sizes expanding, the demand for efficient milking solutions that minimize manual labor and ensure consistent milk yield is on the rise. Automatic milking systems utilize sensors, milk analyzers, smart pulsators, and AI integration to optimize milking schedules and monitor cow health. These advanced technologies enable real-time analysis of milk nutritional values, addressing the growing consumer demand for dairy products that cater to various dietary needs, such as lactose intolerance and milk allergies.

- Moreover, milking robots, a key component of automation in dairy production, offer benefits like teat cleaning, antiseptic application, and milk collection, contributing to better cow comfort and overall milk quality. The integration of IoT technologies and robotics in milking processes enhances operational efficiency and reduces labor costs, making automatic milking machines an attractive investment for dairy farmers. Technical support and ongoing maintenance are essential considerations to ensure optimal performance and longevity of these systems.

How is this Automatic Milking Machines Industry segmented and which is the largest segment?

The automatic milking machines industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Semi-automatic

- Fully-automatic

- Mobility Type

- Stationary automatic

- Portable automatic

- Geography

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- APAC

- China

- Japan

- South Korea

- South America

- Middle East and Africa

- Europe

By Product Insights

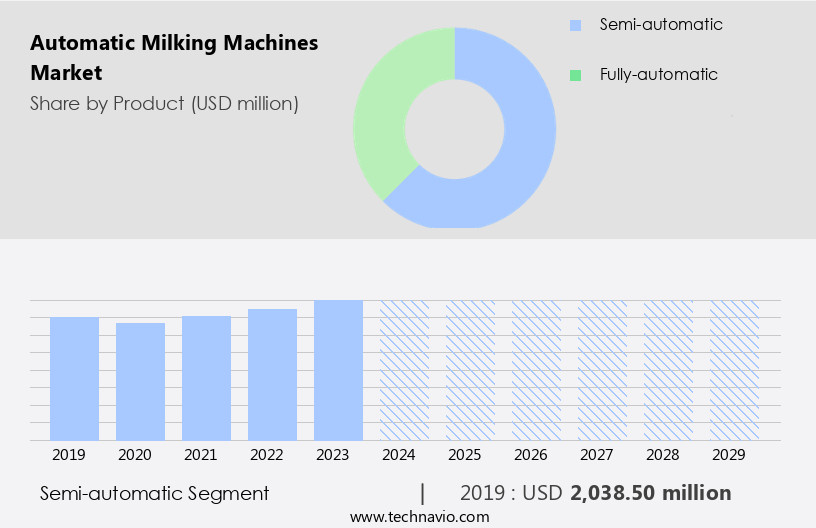

- The semi-automatic segment is estimated to witness significant growth during the forecast period.

Semi-automatic milking machines offer dairy farmers an efficient and cost-effective solution for managing milk production. These machines automate parts of the milking process while still requiring some manual intervention, making them suitable for small to medium-sized dairy farms. The benefits of semi-automatic milking machines include improved work efficiency, enhanced milk quality, and reduced labor reliance. Milk collection, teat cleaning, and antiseptic application are automated, ensuring consistent milking schedules and better cow health. Milk quality is maintained through streamlined software and sensor-based milking systems, while labor shortages and supply chain interruptions are mitigated. Key features include milk meters, milking clusters, milk point controllers, smart feeding robots, and automated milking systems.

Moreover, IoT technologies and AI integration enhance the functionality of these machines, providing real-time data and automated alerts. Technical support is available to ensure optimal machine performance and milk quality awareness is maintained. Dairy producers can increase milk yield and efficiency while producing dairy products such as cow milk, organic milk, and dairy milk production. Plant-based alternatives and nutritional values are also considered In the dairy industry, with a focus on maintaining milk quality and addressing lactose intolerance and milk allergies.

Get a glance at the Automatic Milking Machines Industry report of share of various segments Request Free Sample

The semi-automatic segment was valued at USD 2.04 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European dairy sector encompasses significant dairy farms in countries like the Netherlands, Germany, France, Italy, and the UK, housing a substantial herd size. Milk production in Europe reached 160.8 million tons in 2023, exhibiting growth. Major export markets for European dairy products include China, Algeria, and the US. The anticipated rise in demand from these countries will boost dairy production in Europe, subsequently increasing the need for automatic milking machines.

Moreover, these systems streamline milk collection, teat cleaning, and milking schedules, enhancing milk yield and cow health. Milk quality awareness is a priority, with milk meters, milk point controllers, and milk analyzers ensuring optimal milk quality. Dairy producers aim for milk efficiency and labor savings, investing in automation through milking robots, sensor-based milking, and smart feeding robots. Industrialization, IoT technologies, and AI integration are transforming the dairy industry, addressing labor shortages and supply chain interruptions.

Market Dynamics

Our automatic milking machines market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automatic Milking Machines Industry?

Increased demand for dairy products is the key driver of the market.

- The market is witnessing significant growth due to the increasing herd size in dairy farms and the rising demand for dairy products. In the US, dairy production continues to be a major industry, with a focus on improving milk yield and milk quality. Milk analyzers, sensors, smart pulsators, milk meters, milk point controllers, and milking clusters are essential components of automated milking systems, which help streamline the milking process and increase efficiency. Milking robots and sensor-based milking are becoming increasingly popular, with mobile applications allowing farmers to monitor milk production and milking schedules from anywhere.

- Moreover, the adoption of AI integration, robotics, IoT technologies, and technical support is transforming the dairy industry by reducing labor reliance and improving work efficiency. Cow health and milk quality are crucial concerns for dairy producers, and automated milking systems help maintain optimal conditions through teat cleaning, antiseptics, and real-time monitoring. The market is also witnessing an increasing trend towards organic milk production and addressing concerns related to lactose intolerance and milk allergies. Some of the prominent market players that offer automatic milking machines with biosensors are DeLaval, GEA Group, and Lely.

- Thus, despite these advancements, challenges such as labor shortages and supply chain interruptions persist, making the need for automation more pressing. Overall, the market is poised for continued growth as the dairy industry adapts to meet the evolving needs of consumers and the market.

What are the market trends shaping the Automatic Milking Machines Industry?

Rising demand for sensor-based milking is the upcoming market trend.

- Automatic milking machines have become an integral part of modern dairy farms, particularly those with larger herd sizes, to streamline milk production and ensure high-quality dairy products. These systems utilize sensor and smart technologies, such as milk analyzers and pulsators, to monitor milk yield, milk quality, and cow health. Milk quality awareness is paramount In the dairy industry, as milk with abnormalities due to lactose intolerance or milk allergies can negatively impact consumers and dairy enterprises. Manual labor for milk collection and inspection can be time-consuming and labor-intensive. Automatic milking machines address these challenges by integrating AI and robotics, enabling real-time monitoring and analysis of milk quality.

- Further, milk meters, milking clusters, milk point controllers, and smart feeding robots are essential components of these systems. IoT technologies and mobile applications enable farmers to access data on milk production, milk yield, and milk quality from anywhere, enhancing work efficiency and reducing labor reliance. Milking robots and automated milking systems are increasingly popular in industrialized dairy production, offering increased efficiency and reduced costs. Sensor-based milking ensures that only high-quality milk is collected and stored, preventing abnormal milk from entering the storage tank.

- Moreover, milk quality parameters, such as somatic cell count and nutritional values, are analyzed in real-time, ensuring the production of superior dairy products. Labor shortages and supply chain interruptions have further increased the demand for automated milking systems. With continuous advancements in technology, these systems are becoming more accessible to dairy producers, making them an essential investment for the future of the dairy industry.

What challenges does the Automatic Milking Machines Industry face during its growth?

High investment and maintenance costs of automatic milking machines are a key challenge affecting the industry growth.

- The market presents a notable challenge for dairy farms due to the substantial initial investment required for implementing these advanced systems. The cost of a single robotic milking unit ranges from USD 150,000 to USD 200,000, and for larger dairy operations with approximately 180 cows, the total investment can reach up to USD 2 million. This significant financial burden can deter many small to medium-sized dairy farms from adopting this technology. Milk production is a crucial aspect of the dairy industry, with dairy farms focusing on maximizing milk yield and milk quality. Automatic milking machines offer several advantages, including improved work efficiency, streamlined software for milking schedules, and enhanced cow health through features like teat cleaning and antiseptic application. Organic dairy production is a crucial sector, with the nutritional values of milk being a key focus.

- However, the high initial investment can lead to labor shortages and supply chain interruptions for dairy enterprises. Milk analyzers, sensors, smart pulsators, milk meters, milk point controllers, and smart feeding robots are integral components of automated milking systems. The integration of AI and robotics, IoT technologies, and technical support contribute to the overall efficiency of milk production. Milk quality awareness is a significant concern, with issues like lactose intolerance and milk allergies necessitating high milk quality standards. The dairy industry is undergoing industrialization, with a shift towards automation and mechanized milking. This trend is driven by the need for increased milk production, improved milk quality, and reduced labor reliance.

- Moreover, despite the benefits, the high initial investment remains a significant barrier for many dairy producers. Organic milk production also requires specialized equipment, further increasing the financial burden. Milk yield, nutritional values, and somatic cell count are essential factors in milk production. Automatic milking machines offer solutions to optimize these aspects while minimizing manual labor. Mobile applications and sensor-based milking systems enable farmers to monitor milk production and cow health in real-time, enhancing overall efficiency and productivity.

Exclusive Customer Landscape

The automatic milking machines market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automatic milking machines market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automatic milking machines market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Afimilk Ltd. - The company offers automatic milking machines such as Afimilk MPC.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADF Milking Ltd.

- Afimilk Ltd.

- AMS Galaxy USA

- AS SA Christensen and Co.

- Caprine Supply

- Fullwood Ltd.

- GEA Group AG

- Impact Technologies

- InterPuls Ltd.

- LAKTO Dairy Technologies

- Lely International NV

- Madison One Holdings LLC

- Merck and Co. Inc.

- Milkline

- Milkplan SA

- Prompt Equipments Pvt. Ltd.

- System Happel GmbH

- Tetra Laval SA

- Vansun Technologies Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of technologies and systems designed to streamline dairy production processes, enhancing efficiency and reducing labor reliance. These systems, which include milking robots and sensor-based milking solutions, are increasingly adopted by dairy enterprises to optimize milk collection, improve cow health, and ensure milk quality. Automatic machines offer several advantages over traditional milking methods. By minimizing manual labor and milking schedules, these systems enable dairy producers to focus on other aspects of farm management. Furthermore, the integration of advanced technologies such as IoT and AI enables real-time monitoring of milk production and cow health, leading to improved work efficiency and cost savings. The market dynamics driving the growth of the market are multifaceted. One significant factor is the increasing awareness of milk quality and the need to minimize contamination and ensure consistency. Machines offer several advantages in this regard, including teat cleaning and antiseptic application, as well as the ability to monitor milk quality in real-time. Another key factor is the growing trend towards industrialization In the dairy industry.

Moreover, with increasing demand for dairy products and the need to meet production targets, dairy enterprises are turning to automation to increase efficiency and reduce labor costs. Automatic milking machines are an essential component of this trend, enabling dairy producers to streamline their operations and improve milk yield. Moreover, the adoption of machines is not limited to large-scale dairy operations. Smaller dairy enterprises and organic milk producers are also adopting these systems to improve work efficiency and maintain high milk quality standards. In fact, the market is expected to grow significantly In the coming years, driven by the increasing adoption of these systems across the dairy industry. The market is also being driven by advancements in technology.

For instance, the integration of AI and robotics into milking systems is enabling real-time monitoring and analysis of milk production and cow health data. This information can be used to optimize milking schedules, identify potential health issues, and improve overall herd health and milk quality. Furthermore, the development of mobile applications and sensor-based milking systems is making it easier for dairy producers to monitor milk production and cow health from anywhere, at any time. This is particularly important for small-scale dairy operations, where resources may be limited, and access to technical support may be a challenge. In summary, the market is poised for significant growth In the coming years, driven by the increasing adoption of these systems across the dairy industry. The advantages offered by automatic milking machines, including improved milk quality, increased efficiency, and reduced labor reliance, make them an essential component of modern dairy production. As technology continues to advance, we can expect to see further innovations in this space, enabling dairy producers to optimize their operations and meet the growing demand for dairy products.

|

Automatic Milking Machines Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market growth 2025-2029 |

USD 1.85 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, Germany, France, Canada, China, Italy, UK, The Netherlands, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automatic Milking Machines Market Research and Growth Report?

- CAGR of the Automatic Milking Machines industry during the forecast period

- Detailed information on factors that will drive the Automatic Milking Machines growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automatic milking machines market growth of industry companies

We can help! Our analysts can customize this automatic milking machines market research report to meet your requirements.