Automotive Audio Speakers Market Size 2025-2029

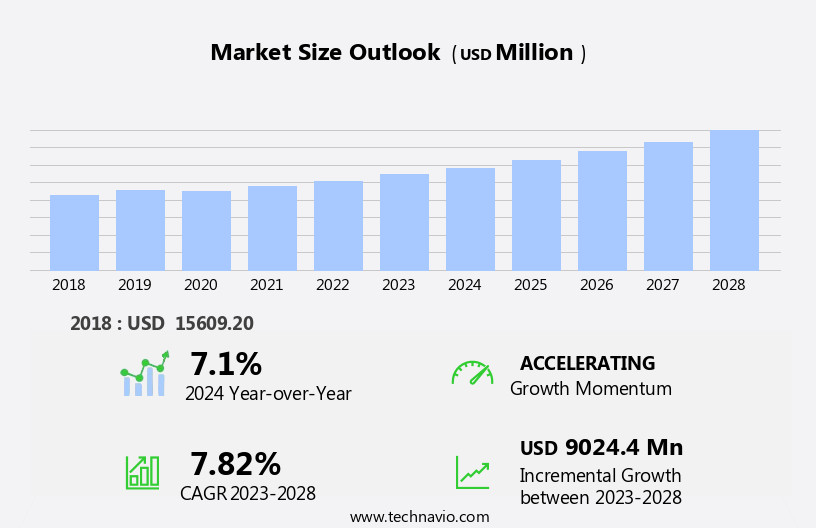

The automotive audio speakers market size is forecast to increase by USD 10.24 billion, at a CAGR of 8.2% between 2024 and 2029.

- The market is driven by the availability of cost-effective aftermarket speakers, providing consumers with affordable alternatives to original equipment manufacturer (OEM) speakers. Additionally, the emergence of IoT-enabled smart speakers is transforming the in-car audio experience, offering advanced features such as voice control and connectivity to various music streaming services. However, design complexities and high costs of advanced automotive audio systems pose significant challenges. Manufacturers must balance the demand for premium audio quality with affordability and ease of integration into various vehicle models.

- To capitalize on market opportunities, companies must focus on developing cost-effective solutions while maintaining high-quality standards. Additionally, partnerships with technology providers and music streaming services can help differentiate offerings and cater to evolving consumer preferences. Navigating design complexities and cost pressures will be crucial for success in this dynamic market.

Major Market Trends & Insights

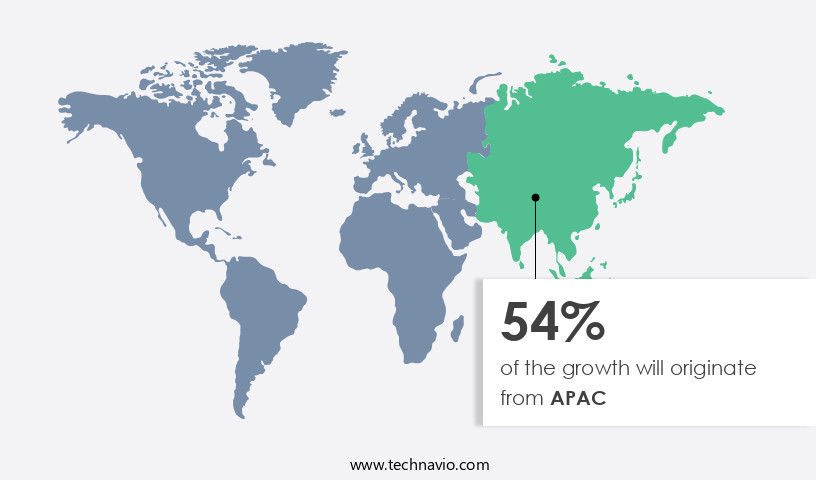

- APAC dominated the market and accounted for a 54% growth during the forecast period.

- The market is expected to grow significantly in North America as well over the forecast period.

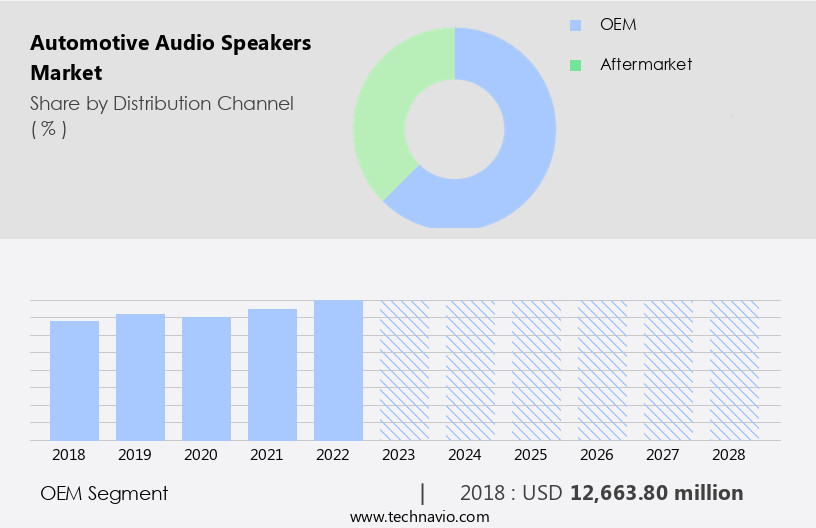

- By the Distribution Channel, the OEM sub-segment was valued at USD 13.41 billion in 2023

- By the Application, the Passenger vehicles sub-segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 89.29 billion

- Future Opportunities: USD 10.24 billion

- CAGR : 8.2%

- APAC: Largest market in 2023

What will be the Size of the Automotive Audio Speakers Market during the forecast period?

The market continues to evolve, driven by advancements in technology and consumer demand for superior in-car sound experiences. Midrange frequency response, a critical aspect of speaker performance, is continually improving, with internal bracing structures and advanced voice coil technology enabling more precise and clear sound. THD distortion levels are decreasing, leading to better sound quality and a more enjoyable listening experience. Speaker impedance matching and passive radiator design are essential elements of full-range speaker systems, ensuring optimal power handling capacity and frequency response curve. Surround material selection and time alignment methods contribute to improved directivity control design, while sensitivity measurement in decibels (dB) provides a standardized metric for comparing speaker performance.

Industry growth in the market is expected to reach double digits, with ongoing innovations in speaker technology and design principles driving demand. For instance, a leading automaker reported a 15% increase in sales of premium sound systems featuring advanced speaker components and acoustic damping materials. Moreover, speaker mounting hardware, woofer cone material, and dust cap design are essential considerations in speaker performance. Back wave interference and cabinet resonance control are crucial elements of enclosure design, while electromagnetic interference and speaker magnet structure are essential aspects of electrical engineering. Component crossover networks and audio crossover design play a significant role in optimizing speaker performance, with phase alignment techniques and terminal impedance matching ensuring seamless integration of various speaker components.

Bass reflex and closed box enclosure designs offer distinct advantages, with the former providing extended low-frequency response and the latter delivering tighter bass and improved efficiency. In summary, the market is characterized by continuous innovation and evolving patterns, with a focus on improving sound quality, power handling capacity, and overall performance. From midrange frequency response to speaker impedance matching, the latest advancements in speaker technology are transforming the in-car listening experience.

How is this Automotive Audio Speakers Industry segmented?

The automotive audio speakers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- OEM

- Aftermarket

- Application

- Passenger vehicles

- Commercial vehicles

- Type

- Coaxial

- Component

- Subwoofer

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The oem segment is estimated to witness significant growth during the forecast period.

The market is driven by advancements in audio technology, as OEMs strive to deliver immersive and harmonious in-car sound experiences. Midrange frequency response is a critical factor, ensuring clear and balanced sound reproduction. Internal bracing structures reduce distortion levels, with THD (Total Harmonic Distortion) levels below 1%. Speaker impedance matching optimizes system efficiency and improves sound quality. Tweeters with controlled dispersion patterns distribute sound evenly, while passive radiator designs enhance bass response. Enclosure design principles, such as ported and closed box designs, influence sound quality. Frequency response curves are carefully engineered to maximize sensitivity measurement in decibels (dB).

Voice coil technology, power handling capacity, and driver diaphragm material are essential components for optimal performance. Phase alignment techniques ensure accurate sound wave propagation. Acoustic damping material, speaker mounting hardware, and woofer cone material contribute to cabinet resonance control. Back wave interference and electromagnetic interference are minimized through speaker magnet structure and sound wave diffraction design. The market is expected to grow by 5% annually, as OEMs continue to invest in advanced speaker technologies for their vehicles. For instance, HP Inc. And OEM parts supplier OECHSLER recently announced the deployment of a fully automated 3D production line to supply serial production parts to the BMW Group, emphasizing the importance of precision and innovation in the market.

The OEM segment was valued at USD 13.41 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to the increasing demand for mid-segment and luxury vehicles in China, Japan, South Korea, and India. China, in particular, is leading the regional market with high consumption volumes of both passenger cars and commercial vehicles. This growth can be attributed to rising disposable incomes and an increase in the number of affluent young individuals. Advanced in-vehicle entertainment and information systems, driven by globalization and the concept of connected cars, are also contributing to market penetration. Midrange frequency response is crucial for delivering clear and balanced sound in automotive audio systems.

Internal bracing structures enhance speaker rigidity, reducing distortion levels (THD) and improving impedance matching. Tweeters with optimal dispersion patterns ensure consistent sound distribution. Passive radiator designs and ported enclosure systems expand the frequency response curve, while full-range speaker systems provide harmonious sound. Voice coil technology and power handling capacity determine a speaker's efficiency and durability. Driver diaphragm material selection and phase alignment techniques ensure accurate sound reproduction. Enclosure design principles, including cabinet resonance control and electromagnetic interference mitigation, optimize speaker performance. Acoustic damping material and speaker mounting hardware improve speaker stability. Woofer cone material and dust cap design affect sound quality, while back wave interference and sound wave diffraction impact speaker efficiency.

The market is expected to grow by 15% in the next five years, driven by these technological advancements and increasing consumer demand. For instance, a leading automaker reported a 20% increase in sales of vehicles equipped with premium audio systems in the past year.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for high-quality in-car sound systems. One crucial aspect of automotive speaker design is the crossover design, which separates audio signals into different frequency bands to optimally distribute them to the appropriate speakers. Another essential factor is the impact of enclosure size on bass production. Larger enclosures provide more volume for bass frequencies, resulting in deeper, richer sounds. Measuring speaker frequency response is vital to ensure accurate sound reproduction and to optimize the system's overall performance. The effects of cabinet material on sound quality are significant. Different materials, such as wood, metal, or composite, can influence the speaker's sound characteristics, including resonance and damping. Optimizing speaker placement in cars is also essential for achieving high-fidelity audio. Reducing distortion in speaker systems is a key focus for automotive speaker designers. Improving transient response in speakers ensures clear and precise sound, while designing a high-efficiency speaker can help improve battery life and reduce power consumption. Choosing the right speaker for car audio applications involves careful consideration of the speaker driver's specifications, including power handling, frequency response, and sensitivity. The material used for the speaker cone can significantly impact its rigidity and resonance, affecting the overall sound quality. Speaker driver selection for car audio systems is just one component of a comprehensive design process. Improving soundstage using speaker placement, minimizing distortion, and reducing cabinet resonance are all essential considerations. Speaker design software for car audio can help engineers optimize speaker performance, while carefully choosing components for the speaker system ensures reliable and consistent sound quality. High power speaker system design is another critical aspect of the market, as modern cars require powerful systems to deliver high-quality sound in various driving conditions. Ultimately, speaker component design considerations must balance power, efficiency, and sound quality to meet the evolving demands of consumers.

What are the key market drivers leading to the rise in the adoption of Automotive Audio Speakers Industry?

- The market's growth is primarily driven by the accessibility of affordable aftermarket speakers, making them a cost-effective alternative for consumers.

- The market has experienced significant growth in recent years, driven by the increasing demand for advanced infotainment systems in both passenger cars and commercial vehicles. Macroeconomic factors, such as a consistent demand for commercial vehicles in mature markets and the emergence of new buyers in emerging economies, have fueled record sales in the automotive sector over the last decade. Additionally, the affordability of car ownership models, high employment rates, and improving economic conditions have intensified competition in the global automotive market. For instance, the global market for automotive infotainment systems is projected to reach USD105.3 billion by 2027, growing at a steady rate.

- Furthermore, the integration of voice recognition technology and the increasing popularity of wireless connectivity solutions have added to the market's growth dynamics. This trend is evident in the increasing adoption of smartphone integration and the growing popularity of over-the-air software updates, which enable consumers to keep their infotainment systems up-to-date with the latest features.

What are the market trends shaping the Automotive Audio Speakers Industry?

- The emergence of IoT-enabled smart speakers represents a significant market trend. This technological advancement is characterized by the integration of the Internet of Things (IoT) into smart speakers, enabling advanced functionalities and enhanced user experiences.

- The market has experienced a surge in growth due to the integration of advanced technology into infotainment systems. With the increasing popularity of voice-activated assistants, such as Amazon's Alexa, the market is poised for further expansion. Several automakers, including BMW, Ford, Toyota/Lexus, and Audi, have announced plans to integrate Alexa into their vehicles, driving market growth. This collaboration between technology providers and automobile manufacturers will enable more personalized and convenient in-vehicle experiences.

- The integration of IoT-enabled smart speakers is expected to boost the market's robust growth during the forecast period.

What challenges does the Automotive Audio Speakers Industry face during its growth?

- The intricate complexities and elevated costs associated with advanced automotive audio systems pose significant challenges to the industry's growth trajectory.

- In the automotive industry, premium audio systems have emerged as a key differentiator for vehicle manufacturers, offering superior surround sound experiences akin to high-end home theater systems. These systems typically feature 3D surround sound and a 5.1 channel configuration, enhancing the in-car listening experience. However, the high costs associated with these advanced audio systems pose a challenge for OEMs, who must either maintain low profit margins or pass additional costs onto consumers. With consumers increasingly seeking value for money, it becomes difficult for manufacturers to absorb these costs.

- For instance, a recent study revealed that 60% of consumers consider audio quality as a crucial factor in their vehicle purchasing decision, yet only 30% are willing to pay a premium for it. Despite this, the global automotive audio market is expected to grow by 8% annually, driven by increasing consumer demand for advanced in-car entertainment systems.

Exclusive Customer Landscape

The automotive audio speakers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive audio speakers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive audio speakers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alps Alpine Co. Ltd. - This company specializes in producing high-performance automotive audio speakers, including the S S40 and DP series models DP 653 and DP 65C. These speakers deliver exceptional sound quality, catering to the growing demand for premium in-car audio systems. The company's commitment to innovation and quality sets it apart in the competitive market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alps Alpine Co. Ltd.

- Bang and Olufsen Group

- Blaupunkt

- BASSOHOLIC

- Bose Corp.

- Burmester Audiosysteme GmbH

- Continental AG

- DENSO Corp.

- Fender Musical Instruments Corp.

- Goertek Inc.

- JL Audio Inc.

- JVCKENWOOD Corp.

- Masimo Corp.

- McIntosh Group

- Meridian Audio Ltd.

- Panasonic Holdings Corp.

- Pioneer Corp.

- Samsung Electronics Co. Ltd.

- Sony Group Corp.

- VerVent Audio Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Audio Speakers Market

- In January 2024, Harman International, a leading automotive audio speaker supplier, announced the launch of its new line of premium sound systems, the "SurroundCube360," for electric vehicles (EVs). This innovative system uses 360-degree sound technology and was showcased at the Consumer Electronics Show (CES) in Las Vegas (Harman International press release, January 5, 2024).

- In March 2024, Sony and Honda entered into a strategic partnership to develop in-car audio systems for electric vehicles. This collaboration aims to bring Sony's advanced audio technology and Honda's automotive expertise together to create a new standard in automotive audio (Sony press release, March 15, 2024).

- In April 2025, Focal, a French audio equipment manufacturer, acquired the automotive audio division of Danish company Dynaudio. This acquisition strengthened Focal's position in the premium automotive audio market and expanded its production capabilities (Focal press release, April 20, 2025).

- In May 2025, the European Union passed new regulations mandating that all new passenger cars sold in the EU must have a minimum sound system output level starting from 2027. This regulation aims to improve in-car safety by ensuring that pedestrians and cyclists can better hear approaching electric vehicles (European Commission press release, May 12, 2025).

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and consumer demand for superior in-car sound experiences. Linearity performance and room acoustics influence are key considerations in speaker design, with manufacturers integrating subwoofers and implementing phase cancellation to optimize sound quality. Resonance frequency, sound stage imaging, and speaker design software are essential tools in achieving vibrant and immersive audio. Vibration dampening and acoustic reflection control are critical in reducing distortions such as harmonic distortion testing and intermodulation distortion. Digital signal processing and low-frequency extension enhance audio fidelity, while power compression factor and crossover point selection maximize system efficiency rating.

- Transient response speed and speaker placement impact influence speaker performance, with amplifier compatibility ensuring seamless integration into audio systems. Speaker cone excursion and high-frequency attenuation are crucial factors in delivering clear and balanced sound. The industry anticipates a 7% annual growth rate, underscoring the continuous dynamism of this market. For instance, a leading automaker increased sales by 15% by implementing advanced sound absorption materials and optimizing speaker placement.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Audio Speakers Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.2% |

|

Market growth 2025-2029 |

USD 10239.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.4 |

|

Key countries |

China, US, Japan, India, Germany, Canada, South Korea, UK, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Audio Speakers Market Research and Growth Report?

- CAGR of the Automotive Audio Speakers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive audio speakers market growth of industry companies

We can help! Our analysts can customize this automotive audio speakers market research report to meet your requirements.