Automotive Belt Tensioner Pulleys Market Size 2025-2029

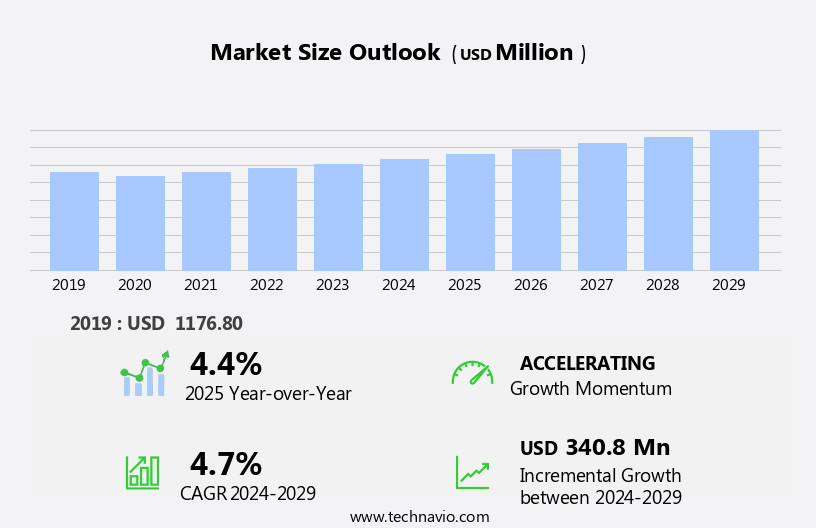

The automotive belt tensioner pulleys market size is forecast to increase by USD 340.8 million at a CAGR of 4.7% between 2024 and 2029.

- The market is experiencing significant shifts, driven by the production transition to low-cost countries and the increased use of advanced materials for vehicle component design. These trends are shaping the market's competitive landscape, with manufacturers seeking to optimize costs and enhance product performance. Moreover, the increasing adoption of electric vehicles (EVs) poses a notable challenge for the market. While the demand for traditional internal combustion engine (ICE) vehicles remains strong, the shift towards electrification is gaining momentum. As EVs do not require belt tensioners, this trend may impact the market's growth trajectory. However, the development of belt tensioners specifically designed for EVs presents an opportunity for market participants to capitalize on this emerging segment.

- In summary, the market is influenced by production cost optimization, advanced material adoption, and the growing EV market. Companies must navigate these trends and challenges to effectively capitalize on market opportunities and maintain a competitive edge.

What will be the Size of the Automotive Belt Tensioner Pulleys Market during the forecast period?

- The market continues to evolve in response to the dynamic nature of the automotive industry. With the ongoing production of passenger cars, commercial vehicles, and new car sales, the demand for these crucial components remains robust. Belt tensioner pulleys are integral to the functioning of various automotive systems, including engine power and timing mechanisms in both personal vehicles and commercial car applications. Compact cars and midsize vehicles integrate these pulleys in their serpentine belts, drive belts, and timing belts, ensuring optimal engine performance and fuel efficiency. The adoption of advanced materials and technological advancements, such as machine learning and artificial intelligence, further enhances the functionality and durability of these components.

- Emission regulations and mobility solutions have led to the emergence of electric and hybrid vehicles, necessitating the development of belt tensioner pulleys suitable for these applications. The evolving landscape of the automotive sectors also includes the integration of adjustable pivot points and spring mechanisms to cater to the diverse needs of various vehicle types. In the realm of commercial vehicles, belt tensioner pulleys play a crucial role in heavy and light commercial vehicles, ensuring reliable operation and vehicle maintenance. The continuous unfolding of market activities underscores the importance of these components in the automotive industry, as technological innovation and changing market trends shape the future of automotive design and manufacturing.

How is this Automotive Belt Tensioner Pulleys Industry segmented?

The automotive belt tensioner pulleys industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Type

- Automatic tensioner

- Manual tensioner

- Product Type

- Serpentine belt

- Timing belt

- V-belt

- Component

- Engine component

- Accessory component

- Hybrid system component

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- The Netherlands

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The passenger cars segment is estimated to witness significant growth during the forecast period.

The market caters to the demand for pulleys used in passenger cars to maintain the optimal tension in drive belts, enhancing engine performance and longevity. The increasing production of passenger cars and the expanding automotive sectors fuel market growth. Furthermore, the need for improved fuel efficiency and compliance with emission regulations propels the adoption of advanced materials and technological advancements, such as machine learning and artificial intelligence, in belt tensioner pulley designs. Commercial vehicles, including heavy and light commercial vehicles, and mobility solutions also utilize belt tensioner pulleys for their engines and timing mechanisms. Key market participants include SKF Group, Gates Corporation, Litens Automotive Group, Dayco Products, and Schaeffler AG, who innovate with adjustable pivot points, spring mechanisms, and serpentine belts to cater to various applications, including compact cars, midsize cars, and luxury vehicles.

The market for belt tensioner pulleys is poised to grow as technological advancements and changing consumer preferences drive the demand for hybrid, electric, and personal vehicles.

The Passenger cars segment was valued at USD 927.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 55% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is driven by the increasing production of passenger cars and commercial vehicles, particularly in Asia Pacific (APAC), which accounted for the largest market share in 2024. China, as a significant contributor, leads the APAC market due to the growing demand for automotive belts in passenger cars and commercial vehicles. Japan and India are also crucial players due to their high automotive production volumes. Emission regulations and technological advancements, including machine learning and artificial intelligence, are propelling the market's growth. Hybrid, electric, and fuel-efficient vehicles are increasingly popular, necessitating advanced pulley designs and drive belt tensioners. Passenger cars, midsize cars, and compact cars are major applications, with mobility solutions and vehicle maintenance being other significant areas.

The market is witnessing technological innovations, such as adjustable pivot points, timing mechanisms, and spring mechanisms, to enhance engine performance and engine power. The adoption of serpentine belts and timing belts is increasing, catering to multiple applications. The heavy commercial vehicle and light commercial vehicle segments are also growing due to the rising demand for mobility solutions and the increasing popularity of E-sharing services. Fuel efficiency and engine emissions remain key concerns, driving the use of advanced materials in pulley design. Luxury cars and personal vehicles are also adopting these technological advancements to improve engine performance and engine power. The market is expected to register the fastest growth rate in APAC during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Belt Tensioner Pulleys Industry?

- The shift towards producing goods in low-cost countries is a primary factor driving market trends. The market is experiencing significant shifts in manufacturing locations due to cost considerations. While China has been a major automotive manufacturing hub, increasing trade tensions with North America and Europe may lead to a decrease in focus on expanding production facilities there. Instead, automotive manufacturers are exploring low-cost manufacturing opportunities in countries such as Taiwan and India. Additionally, the slump in automotive demand is accelerating this trend. In the evolving automotive landscape, technology adoption is a critical driver. Hybrid vehicles and electric vehicles are gaining popularity due to their fuel efficiency and reduced engine emissions.

- Advanced materials are being used to enhance pulley design and improve performance. These trends are influencing the market dynamics in the personal vehicle and luxury car segments. The shift towards electric and hybrid vehicles is expected to continue, with technology playing a pivotal role in shaping the future of the automotive industry. The focus on reducing emissions and improving fuel efficiency is leading to the adoption of advanced technologies in belt tensioner pulleys.

What are the market trends shaping the Automotive Belt Tensioner Pulleys Industry?

- The use of advanced materials in vehicle component design is a growing market trend. This approach to manufacturing enhances vehicle performance and efficiency. (Alternatively) Vehicle component design is evolving with the increasing adoption of advanced materials, a market trend that enhances performance and efficiency.

- The automotive industry is witnessing significant advancements in mobility solutions, with a focus on enhancing engine performance and reducing vehicle weight and emissions. Timing belts and drive belt tensioners play a crucial role in ensuring the smooth operation of engine belts in both passenger cars and commercial vehicles. In response to the need for improved reliability and durability, automotive manufacturers are exploring alternative materials and production techniques. Aluminum, for instance, is being increasingly used due to its cost-effectiveness and weight-reducing properties, which contribute to better fuel efficiency and lower carbon emissions.

- Additionally, composite laminates reinforced with fiberglass, graphite, and boron are gaining popularity for their heat-resistant properties, ensuring high endurance against extreme weather conditions. These developments reflect the industry's commitment to innovation and sustainability.

What challenges does the Automotive Belt Tensioner Pulleys Industry face during its growth?

- The increasing adoption of electric vehicles (EVs) poses a significant challenge to the growth of the automotive industry, requiring innovative solutions and strategic adjustments from industry players.

- The market for belt tensioner pulleys in the automotive industry holds substantial importance due to their application in both original equipment manufacturing (OEM) and aftermarket segments. In the OEM sector, belt tensioner pulleys are a necessary component in producing new passenger vehicles, including compact and midsize cars. The demand is significant due to the large-scale production of vehicles, but revenue is largely dependent on the global automobile market. In the aftermarket, the timing belt market takes a leading position after the automotive wiper system market.

- The belt tensioner pulley is typically replaced alongside the timing belt during maintenance, making the timing belt replacement a critical factor in the growth of the aftermarket adoption. A new belt requires an accompanying new belt tensioner pulley to ensure optimal tension for efficient operations. Excessive tension on the belt can lead to premature wear and tear.

Exclusive Customer Landscape

The automotive belt tensioner pulleys market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive belt tensioner pulleys market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive belt tensioner pulleys market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB SKF - The company specializes in providing automotive belt tensioner pulleys, including the VKMCV 55005 model and those equipped with v-ribbed belts. Our offerings ensure optimal engine performance and durability. These tensioner pulleys are meticulously engineered to meet the highest industry standards, enhancing vehicle efficiency and reliability. Our commitment to innovation and quality sets US apart in the market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB SKF

- ABA Automotive

- B and B Manufacturing Inc.

- Bando Chemical Industries Ltd.

- Clark Pulley Industries Inc.

- Continental AG

- Dayco IP Holdings LLC

- Dorman Products Inc.

- Gates Industrial Corp. Plc

- General Motors Co.

- Hutchinson SA

- Kanemitsu Corporation

- KAVO B.V.

- Litens Automotive

- Standard Motor Products Inc.

- Tenneco Inc.

- The Goodyear Tire and Rubber Co.

- The Timken Co.

- Zhejiang Renchi Auto Parts Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Belt Tensioner Pulleys Market

- In February 2023, Schaeffler, a leading automotive and industrial supplier, announced the launch of its new belt tensioner pulley series, the "TEQ," designed for electric vehicles (EVs) and hybrid vehicles (HEVs) (Schaeffler press release, 2023). This innovative product line offers improved efficiency and durability, addressing the increasing demand for electrified powertrains in the automotive industry.

- In June 2024, DENSO Corporation, a major global automotive components manufacturer, entered into a strategic partnership with Contemporary Amperex Technology Co. Limited (CATL), the world's largest producer of lithium-ion batteries (DENSO press release, 2024). The collaboration focuses on the development and production of belt tensioner pulleys for electric vehicles, aiming to enhance DENSO's product offerings and strengthen its position in the EV market.

- In October 2024, Valeo, a leading automotive technology company, secured a significant investment of â¬1.2 billion from Caisse des Dépôts and the European Investment Bank to expand its production capacity for electric vehicle components, including belt tensioner pulleys (Valeo press release, 2024). This investment will enable Valeo to meet the growing demand for electrified powertrains and strengthen its market position.

- In March 2025, the European Union announced new regulations requiring all new passenger cars to be fitted with belt tensioner pulleys that meet specific emissions standards starting from 2027 (European Commission press release, 2025). This regulatory initiative aims to reduce CO2 emissions from the automotive sector and promote the adoption of more efficient belt tensioner pulley technologies.

Research Analyst Overview

The market for belt tensioner pulleys in the automotive sector experiences continuous growth, driven by the increasing production of passenger vehicles and commercial vehicles. This trend is particularly noticeable in the context of stringent engine emissions regulations, necessitating advancements in engine power and technology adoption. Product features, such as spring mechanism and adjustable pivot point, ensure optimal belt tension and longevity. Electric vehicles and their rotating shafts also require belt tensioner pulleys, expanding the market's scope. The timing mechanism plays a crucial role in maintaining the synchronization of engine belts with multiple applications. Technological advancements, including improved materials and design, further enhance the efficiency and durability of belt tensioner pulleys.

In the automotive sectors, the demand for belt tensioner pulleys remains strong, with the market showing no signs of slowing down. The integration of these components into engine systems is essential for maintaining vehicle performance and ensuring a smooth driving experience. As engine belts continue to serve various functions, the importance of reliable and efficient belt tensioner pulleys cannot be overstated.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Belt Tensioner Pulleys Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

236 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 340.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, Canada, Brazil, UAE, Australia, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Belt Tensioner Pulleys Market Research and Growth Report?

- CAGR of the Automotive Belt Tensioner Pulleys industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive belt tensioner pulleys market growth of industry companies

We can help! Our analysts can customize this automotive belt tensioner pulleys market research report to meet your requirements.