Automotive Carbon Ceramic Brake Rotors Market Size 2024-2028

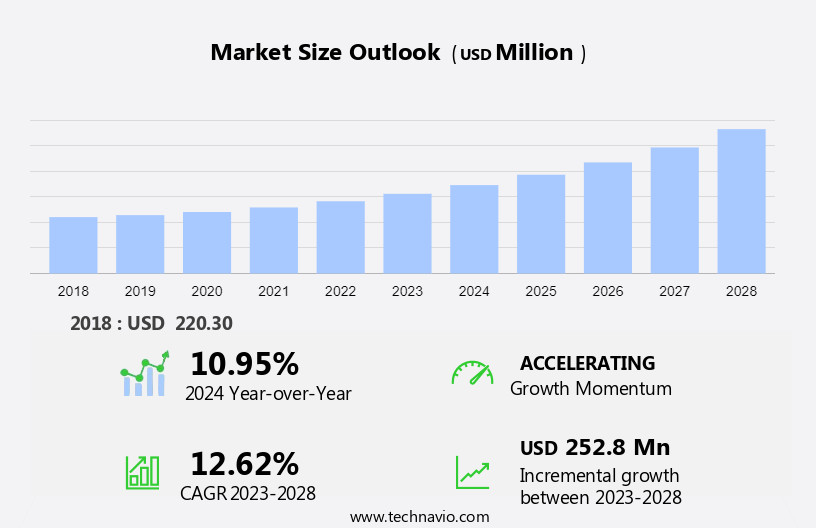

The automotive carbon ceramic brake rotors market size is forecast to increase by USD 252.8 million at a CAGR of 12.62% between 2023 and 2028.

- The market is experiencing significant growth due to the performance and fuel efficiency advantages offered by these brake components. Carbon ceramic brake rotors provide superior stopping power and durability compared to traditional iron rotors. Additionally, the development of advanced curved, air foil-shaped vanes in carbon ceramic brake calipers results in lighter weight and improved cooling efficiency. However, the high cost of automotive carbon ceramic brake rotors remains a major challenge for market growth. Despite this, the market is expected to continue expanding as automakers seek to offer high-performance options to consumers and regulatory requirements for improved vehicle safety and efficiency become more stringent.Overall, the market for carbon ceramic brake rotors is poised for continued growth due to its unique benefits and the increasing demand for advanced automotive technology.

What will be the Size of the Automotive Carbon Ceramic Brake Rotors Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for high-performance materials In the automotive sector. Carbon ceramic rotors, composed of resins, powders, and fibers, offer superior braking performance, durability, heat resistance, and corrosion resistance compared to traditional aluminum composite rotors. These advanced properties make carbon ceramic rotors an attractive option for applications in aerospace braking and high-performance vehicles, including those used in drag racing. Consumer preferences for enhanced braking performance, longevity, reliability, and wear resistance continue to drive the adoption rate of carbon ceramic rotors. The fiber state type, whether shortfiber discs or longfiber discs, further influences the market dynamics.

- Carbon ceramic rotors provide excellent thermal performance, minimizing brake fade, making them an essential component for high-performance vehicles. The market is expected to grow steadily, with continued innovation and advancements In the manufacturing processes and materials used In the production of carbon ceramic rotors.

How is this Automotive Carbon Ceramic Brake Rotors Industry segmented and which is the largest segment?

The automotive carbon ceramic brake rotors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Type

- Drilled rotors

- Slotted rotors

- Geography

- Europe

- Germany

- UK

- Italy

- North America

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By Application Insights

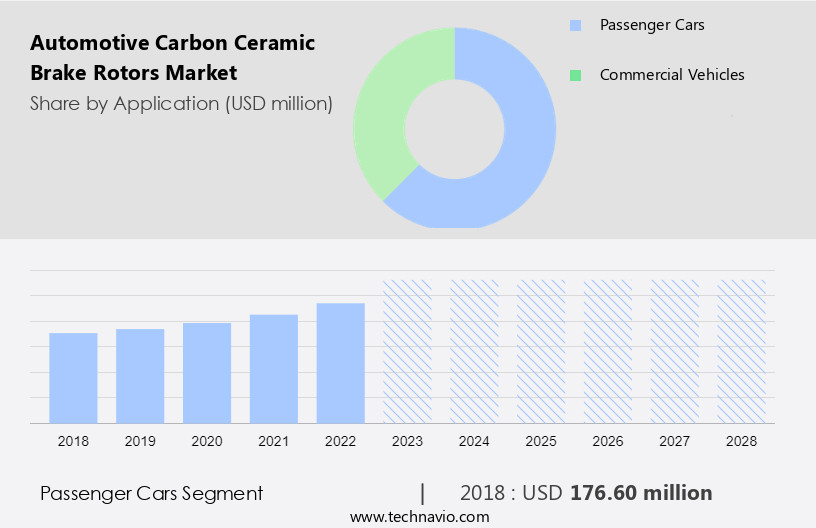

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is driven by the increasing demand for high-performance braking systems In the passenger car segment. Carbon fiber-reinforced ceramic matrix composites, which include resins, powders, and fibers, are the primary materials used in manufacturing these advanced brake rotors. These rotors offer superior braking performance, durability, and heat resistance, making them an attractive option for luxury and high-performance passenger cars. For instance, the Porsche 911 GT3 RS, a renowned sports car, utilizes carbon ceramic brake rotors for maximum braking efficiency and longevity. The automotive sector's shift towards motorsport technology and consumer preferences for enhanced transportation capabilities further fuels the market growth.

Additionally, the integration of automation and system integration in commercial and utility vehicles contributes to the market expansion. The carbon ceramic brake rotors' thermal performance, wear resistance, and mechanical properties make them a preferred choice for automotive manufacturers, including those In the F1 and motorsports industries. The economic growth and data analysis of microeconomic factors influence decision-makers In the automotive industry to invest In these high-performance braking systems.

Get a glance at the Automotive Carbon Ceramic Brake Rotors Industry report of share of various segments Request Free Sample

The Passenger cars segment was valued at USD 176.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

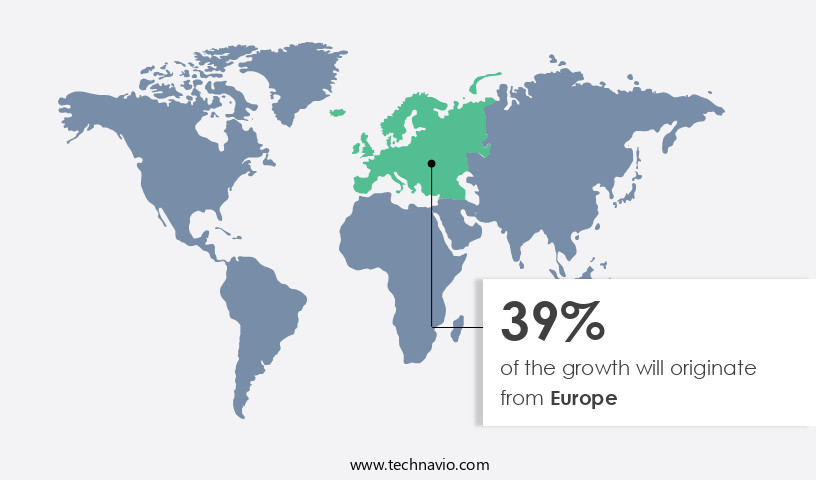

- Europe is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Europe is a key market for automotive carbon ceramic brake rotors due to the region's emphasis on high-performance vehicles and technological advancements. The European automotive sector is witnessing growth, driven by consumer preferences for luxury and sports cars. Carbon ceramic brake rotors are a popular choice for these vehicles due to their superior braking performance, lightweight design, and enhanced vehicle dynamics. These rotors offer improved heat dissipation, reducing the risk of brake fade, and offer increased durability and reliability compared to traditional aluminum or steel rotors. Additionally, the automotive industry's focus on motorsport technology and system integration further boosts the demand for carbon ceramic brake rotors.

The European market for these rotors is expected to continue growing due to economic growth, increasing consumer demand, and stringent regulations promoting carbon emissions reduction.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Carbon Ceramic Brake Rotors Industry?

Performance and fuel efficiency benefits of carbon ceramic brake pads is the key driver of the market.

- The automotive industry is experiencing significant advancements in technology, particularly In the realm of high-performance materials for automotive components. Carbon ceramic, a composite of resins, powders, and fibers, is increasingly being adopted for the production of brake rotors due to its superior heat resistance and durability. This material, which has long been utilized in aerospace braking systems, offers enhanced braking performance, longevity, and reliability compared to traditional aluminum or steel brakes. Carbon ceramic brake rotors provide superior heat dissipation capabilities, reducing the occurrence of brake fade and ensuring maximum braking efficiency. These rotors are also resistant to corrosion, making them an ideal choice for motorsports vehicles and high-performance cars.

- The automotive sector, including F1 manufacturers and racing cars, has embraced the use of carbon ceramic composite materials In their systems due to their superior mechanical properties and thermal performance. Automakers are integrating automation and advanced system integration into their production processes to meet the increasing consumer preferences for high-performance vehicles. Commercial vehicles and utility vehicles are also adopting carbon ceramic technology to improve their transportation capabilities. The economic growth and data analysis of microeconomic factors influence decision-makers In the automotive industry to invest in carbon ceramic brake rotors for their vehicles. Carbon ceramic rotors come in various fiber state types, including shortfiber discs and longfiber discs, each with unique thermal conductivity properties.

- The fiber state type selection depends on the specific vehicle's requirements and performance expectations. The use of carbon ceramic brake rotors in automotive applications is a testament to the continuous advancements in motorsport technology and the industry's commitment to delivering superior braking performance and wear resistance.

What are the market trends shaping the Automotive Carbon Ceramic Brake Rotors Industry?

Development of advanced curved, air foil-shaped vanes leading to lightweight brake calipers is the upcoming market trend.

- The market is experiencing significant growth due to the increasing demand for high-performance braking systems In the automotive sector. Carbon ceramic, a high-performance material made from resins, powders, and fibers, is increasingly being used In the production of brake rotors due to its superior heat resistance, durability, and wear resistance. This material is commonly used in aerospace braking and motorsports vehicles, including sports cars and racing cars, where maximum braking performance and longevity are crucial. Carbon ceramic brake rotors offer superior heat dissipation capabilities, reducing the risk of brake fade and improving overall braking performance. These rotors are also lighter than their aluminum or steel counterparts, contributing to improved fuel efficiency and transportation capabilities.

- The automotive industry's focus on system integration and production norms is driving the adoption of carbon ceramic brake rotors, as they offer enhanced mechanical properties and thermal performance. The use of composite carbon, such as shortfiber and longfiber discs, In the production of carbon ceramic brake rotors, provides additional benefits, including increased thermal conductivity and improved fiber state type. Automation and data analysis are also playing a significant role In the development of carbon ceramic brake rotors, allowing for more precise manufacturing processes and better decision-making for consumers. As economic growth continues, the demand for carbon ceramic brake rotors is expected to increase, particularly In the commercial vehicle and utility vehicle markets.

- The market is expected to continue its growth trajectory, driven by consumer preferences for high-performance and lightweight braking systems. Motorsport technology and the needs of F1 manufacturers are also contributing to the development and adoption of carbon ceramic brake rotors.

What challenges does the Automotive Carbon Ceramic Brake Rotors Industry face during its growth?

High cost of automotive carbon ceramic brake rotors is a key challenge affecting the industry growth.

- Carbon ceramic brake rotors, a high-performance material In the automotive sector, are renowned for their superior friction, durability, and heat resistance. Made from resins, powders, and fibers, these rotors are increasingly adopted by aerospace braking systems and high-performance vehicles, including sports cars and racing cars. The composite carbon material offers superior thermal performance, longevity, and reliability compared to aluminum or steel brakes. Carbon ceramic rotors provide excellent heat dissipation, preventing brake fade and ensuring maximum braking performance. However, their production involves complex system integration and high production norms, leading to a substantial price increase. While consumer preferences for enhanced braking capabilities continue to grow, particularly In the motorsports industry, the high cost remains a significant barrier to entry for many.

- Aluminum composite rotors offer a more affordable alternative, providing corrosion resistance and lighter weight. However, carbon ceramic rotors offer unparalleled thermal conductivity and mechanical properties, making them the preferred choice for F1 manufacturers and other high-performance applications. Despite their premium price, carbon ceramic rotors offer significant benefits, including increased production capabilities and commercial appeal. As economic growth continues to drive demand for high-performance vehicles, data analysis and microeconomic factors will play a crucial role in decision-making for automotive manufacturers and consumers alike.

Exclusive Customer Landscape

The automotive carbon ceramic brake rotors market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive carbon ceramic brake rotors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive carbon ceramic brake rotors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AISIN CORP. - The automotive carbon ceramic brake rotor market represents a significant growth opportunity In the global automotive industry. These high-performance brake components offer enhanced braking efficiency, durability, and lighter weight compared to traditional cast iron rotors. Carbon ceramic rotors are increasingly adopted by automakers for their high-performance vehicles, particularly In the luxury and sports car segments. The material's ability to dissipate heat effectively and maintain consistent braking performance under extreme conditions makes it an attractive option for high-speed applications. The market is expected to experience robust growth due to the increasing demand for fuel efficiency and improved vehicle performance. Additionally, the growing trend towards electrification In the automotive industry may create new opportunities for carbon ceramic brake rotors as they can help reduce the weight of electric vehicles, thereby improving their overall range and performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AISIN CORP.

- Akebono Brake Industry Co. Ltd.

- Alcon Components Ltd.

- Baer Inc.

- Brembo Spa

- Burg Germany GmbH

- Carbon Revolution Public Ltd. Co.

- Centric Parts

- DACC Carbon Co. Ltd.

- DIXCEL Co. Ltd.

- EBC Brakes

- Laizhou Santa Brake Co. Ltd.

- Midland Brakes Ltd.

- Performance Friction Corp.

- Rotora

- SGL Carbon SE

- Shenzhen LeMyth Technology Co. Ltd.

- Surface Transforms Plc

- TEI Racing

- Wilwood Engineering Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The carbon ceramic market for high-performance brake rotors has gained significant traction in recent years due to the material's exceptional properties. Carbon ceramic is a composite material made from resin, powders, and fibers. Its use in aerospace braking systems has paved the way for its adoption In the automotive sector. The automotive industry's shift towards carbon ceramic rotors is driven by several factors. The material's high heat resistance and durability make it an ideal choice for high-performance vehicles, such as sports cars and racing cars. Carbon ceramic rotors offer superior heat dissipation capabilities, reducing the risk of brake fade and improving overall braking performance.

Moreover, carbon ceramic rotors offer enhanced corrosion resistance, making them a popular choice for automotive manufacturers producing vehicles for harsh environments. The material's lightweight properties, due to the use of aluminum composites and aluminum or steel substrates, contribute to improved transportation capabilities and reduced fuel consumption. Consumer preferences for high-performance vehicles and the influence of motorsports technology have also played a role In the growth of the carbon ceramic rotors market. Decision-makers In the automotive sector are increasingly recognizing the benefits of carbon ceramic rotors, particularly In the production of luxury and performance vehicles. The integration of carbon ceramic rotors into commercial and utility vehicles is also gaining momentum.

The material's reliability and longevity make it an attractive option for fleet operators seeking to minimize maintenance costs and downtime. The carbon ceramic rotors market is influenced by various microeconomic factors, including production norms and system integration. The automation of manufacturing processes and the increasing use of data analysis In the automotive sector are also contributing to the market's growth. Carbon ceramic rotors come in various fiber state types, including shortfiber discs and longfiber discs. The choice between the two depends on the specific application and desired mechanical properties. Shortfiber discs offer improved thermal conductivity and wear resistance, while longfiber discs provide enhanced thermal performance and maximum braking capabilities.

The carbon ceramic rotors market is expected to continue its growth trajectory due to the increasing demand for high-performance materials In the automotive sector. The material's exceptional properties, including heat resistance, durability, and corrosion resistance, make it an attractive option for automotive manufacturers and consumers alike.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.62% |

|

Market growth 2024-2028 |

USD 252.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.95 |

|

Key countries |

US, Germany, UK, Italy, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Carbon Ceramic Brake Rotors Market Research and Growth Report?

- CAGR of the Automotive Carbon Ceramic Brake Rotors industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive carbon ceramic brake rotors market growth of industry companies

We can help! Our analysts can customize this automotive carbon ceramic brake rotors market research report to meet your requirements.