Automotive Driver Monitoring Market Size 2024-2028

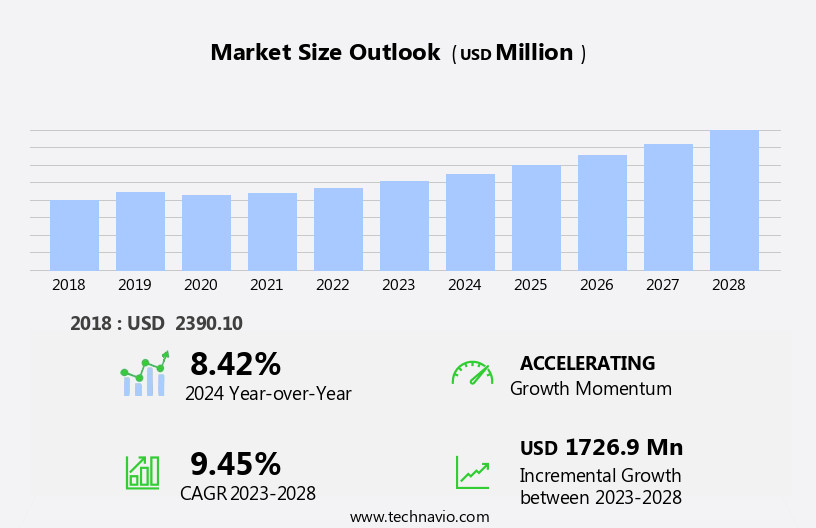

The automotive driver monitoring market size is forecast to increase by USD 1.73 billion at a CAGR of 9.45% between 2023 and 2028.

- The market is witnessing significant growth due to the safety benefits offered by in-vehicle driver monitoring systems. These systems, which include features such as drowsiness detection, attention monitoring, and facial recognition, are becoming increasingly important as road safety becomes a top priority for automakers and governments worldwide. Another key driver for the market is the continuous advances in driver-state monitoring technologies. These innovations enable more accurate and reliable detection of driver fatigue, distraction, and other potential safety risks.

- For instance, some systems use advanced machine learning algorithms to analyze facial expressions, eye movements, and other behavioral patterns to assess driver alertness. However, the market also faces challenges related to data protection and privacy concerns. As these systems collect and process sensitive information about drivers, ensuring the security and confidentiality of this data security is crucial. There have been instances of driver monitoring data being accessed without consent, leading to potential misuse or exploitation. Addressing these concerns through robust data protection policies and transparent communication with customers will be essential for market players to build trust and maintain long-term success in the market.

What will be the Size of the Automotive Driver Monitoring Market during the forecast period?

- The market continues to evolve, driven by the development of advanced technologies for self-driving vehicles and the growing emphasis on driver state sensing systems. Key players in this complex market include Renesas Electronics Corporation and Texas Instruments Incorporated, among others. The market spans various sectors, from passenger cars to heavy commercial vehicles, with applications ranging from level 4 autonomous driving to the autonomous truck market. Policies and regulations are shaping the market dynamics, with a focus on enhancing safety and reducing accidents. For instance, heart rate monitoring, eye tracking, and head pose analysis using cameras and infrared LEDs are gaining traction in the industry.

- Moreover, the integration of artificial intelligence and sensor technologies, such as ultrasonic sensors and FOVID EDME, is revolutionizing vehicle control analysis and driver health monitoring. The future outlook of the market is promising, with the increasing adoption of autonomous vehicles and the growing demand for advanced safety features. However, the high initial cost and competition scenario pose challenges to market growth. The market's structure is intricate, with OEMs, aftermarket players, and component suppliers vying for a share. Nikhil Kaitwade, a principal consultant, emphasizes the importance of driver monitoring systems in ensuring safety, especially on country roads and highways.

- The sales channel for these systems is expanding, with cloud-based systems and internet-based platforms gaining popularity. The transportation of goods is also a significant application area, with the autonomous truck market poised for growth. The historical pattern of the market shows a steady increase in demand for driver monitoring systems, driven by the need for improved safety and the increasing prevalence of self-driving vehicles. However, the market's evolution is ongoing, with new technologies and applications continually emerging. The competition scenario is intense, with companies continually innovating to stay ahead. The safety dynamics of the market are intricately linked to the development of autonomous vehicles and the implementation of safety features, such as steering wheel control analysis, facial expression analysis, and respiration rate monitoring.

How is this Automotive Driver Monitoring Industry segmented?

The automotive driver monitoring industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Driver state monitoring

- Driver health monitoring

- Application

- Commercial vehicles

- Passenger cars

- Technology

- Camera-Based

- Sensor-Based

- Hybrid Systems

- Sale Channel

- OEM

- Aftermarket

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The driver state monitoring segment is estimated to witness significant growth during the forecast period.

Driver state monitoring, an integral component of driver wellness systems, continuously assesses and identifies driver drowsiness, fatigue, and distraction. With the growing time spent behind the wheel due to increasing population and road traffic, particularly in countries like the US, China, Japan, and India, this system plays a crucial role in enhancing road safety. The global vehicle market's expansion is leading to a surge in the number of vehicles on the road, further increasing the need for advanced driver monitoring systems. The expanding road network and infrastructure improvements encourage self-drive outstation trips, necessitating constant driver attention. Light commercial vehicles and passenger cars are increasingly adopting driver state monitoring systems, integrating technologies such as head pose analysis, eye tracking, cameras, and safety dynamics.

These systems employ components like sensors, infrared LEDs, and ultrasonic sensors to monitor driver health indicators, including heart rate, skin conductance, and respiration rate. Renowned technology companies, such as Seeing Machines, Renesas Electronics Corporation, and Texas Instruments Incorporated, are key players in this market. Autonomous vehicles, including self-driving cars and trucks, are also incorporating advanced driver monitoring systems for level 3 and level 4 autonomous driving. These systems use artificial intelligence, facial expression analysis, and vehicle control analysis to ensure driver engagement and takeover readiness. Policies and regulations regarding autonomous vehicles and transportation of goods are evolving, with cloud systems and internet-based platforms facilitating real-time driver monitoring and data analysis.

The complex structure of driver state monitoring systems requires a high initial cost, but the potential for reducing accidents and enhancing overall vehicle safety justifies the investment. As the market continues to evolve, competition intensifies, with OEMs and aftermarket players vying for market share. The future outlook is promising, with advancements in vehicle propulsion, vehicle safety systems, and driver health monitoring.

The Driver state monitoring segment was valued at USD 2.07 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

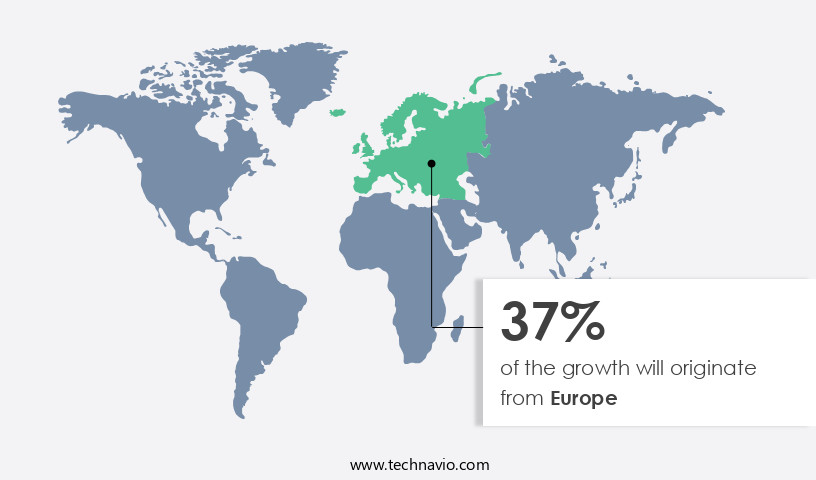

Europe is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is experiencing significant growth due to the widespread adoption of advanced driver-assisted systems and safety features in locally manufactured vehicles. Major contributors to this market include Germany, France, Italy, Spain, and the UK. These countries, known for their production of luxury and premium automobiles, exhibit the highest penetration rate of advanced safety technologies. Economic improvement in Europe is further fueling market growth. Stringent vehicle safety regulations established by the European Commission are a crucial factor driving the market's expansion. Advanced systems, such as Head Pose Analysis, Eye Tracking, and Cameras, are integrated into vehicles for Driver State Sensing, ensuring improved safety and reducing accidents.

Companies like Renesas Electronics Corporation, Texas Instruments Incorporated, and Seeing Machines are key players in the market, providing components for Driver Monitoring Systems. The market's complex structure includes Cloud Systems, Sensors, and Artificial Intelligence, all working together to enhance Vehicle Safety Systems, including those for Electric and Light Commercial Vehicles. The future outlook is promising, with advancements in technologies like Facial Expression Analysis, Heart Rate Monitoring, and Skin Conductance Monitoring. Despite the high initial cost, the competition scenario remains intense, with OEMs and Aftermarket players vying for market share. The transportation of goods and passenger cars both benefit from these safety features, making the market a significant player in the European automotive industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Driver Monitoring Industry?

- The significance of in-vehicle driver monitoring systems in enhancing road safety is the primary market driver. These systems, which employ various technologies to monitor and analyze a driver's behavior and alert them to potential hazards, have gained increasing importance due to their potential to reduce accidents and save lives. Thus, the safety benefits are the key motivating factor for the market growth in this sector.

- The market is experiencing significant growth due to the increasing prioritization of safety features in vehicles. These systems, which include Respiration Rate Monitoring and Facial Expression Analysis, play a crucial role in ensuring driver health and alertness. By monitoring driving states and physiological conditions, these systems can prevent accidents caused by exhausted or distracted drivers. Furthermore, with the rise of Electric Vehicles and the development of Level 3 Autonomous Driving, driver monitoring systems will become increasingly important for both passenger and commercial vehicles. These systems can send alerts through audio or visual means if the driver is found to be in an unfit condition to drive.

- Driver health monitoring is becoming a vital component of modern vehicles, as the well-being of drivers significantly impacts the safety of their passengers and other road users. Internet-Based Systems and Ultrasonic Sensors are some of the technologies driving the advancement of these systems. The integration of these features into vehicles enhances overall safety and provides peace of mind for consumers.

What are the market trends shaping the Automotive Driver Monitoring Industry?

- Advances in driver-monitoring systems are currently shaping the automotive market trend. This technology, which includes features such as drowsiness detection, facial recognition, and attention monitoring, is becoming increasingly important for enhancing road safety and improving the overall driving experience.

- The market is experiencing significant advancements, fueling its growth in the coming years. companies are introducing sophisticated systems that employ technologies like Head Pose Analysis and Eye Tracking for enhanced safety and control. These systems utilize cameras and sensors to monitor drivers' health and behavior, offering real-time vehicle control analysis and safety dynamics. Additionally, the integration of cloud systems and artificial intelligence (AI) enhances the functionality of these systems. However, the high initial cost associated with these technologies may pose a challenge to market growth.

- Nonetheless, the integration of advanced features like facial recognition and health monitoring is expected to attract a growing number of customers, particularly in the Light Commercial Vehicles (LCV) segment. These systems use AI to recognize driver states, intentions, and activities, ensuring a more enjoyable and secure driving experience. Consequently, The market is poised for robust expansion during the forecast period.

What challenges does the Automotive Driver Monitoring Industry face during its growth?

- Data protection and privacy concerns represent a significant challenge to the industry's growth, necessitating robust measures to safeguard sensitive information and maintain trust with customers.

- Autonomous vehicles, including self-driving cars and trucks, are revolutionizing the automotive industry with their advanced driver state sensing systems. These systems, which utilize technologies such as heart rate monitoring, FOVID eDME, and Infrared LEDs, enable Level 4 autonomous driving by continuously monitoring and analyzing the driver's condition. However, the market dynamics of this emerging technology are complex. The driver monitoring market is witnessing significant growth due to the increasing demand for self-driving vehicles and the need for enhanced safety features. According to industry reports, the autonomous truck market is expected to grow at a robust rate, while the autonomous cars market is already experiencing substantial penetration, particularly in the premium vehicle segment.

- Despite these opportunities, challenges persist. Policies and regulations regarding the use of driver monitoring systems vary across vehicle types and countries, and concerns over data privacy and cybersecurity threats can impede market growth. As the industry continues to evolve, it is crucial for key players to address these challenges and ensure the safe and secure implementation of driver monitoring systems in both self-driving cars and heavy commercial vehicles.

Exclusive Customer Landscape

The automotive driver monitoring market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive driver monitoring market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive driver monitoring market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Continental AG - The company specializes in advanced driver monitoring systems for automotive applications. One such innovation is cabin sensing technology, designed to enhance automated driving capabilities. This system utilizes sophisticated sensors to detect and analyze driver behavior, ensuring optimal safety and comfort. .

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Continental AG

- DENSO Corp.

- Intel Corp.

- Jabil Inc.

- Magna International Inc.

- Marelli Holdings Co. Ltd.

- NetraDyne Inc.

- NVIDIA Corp.

- NXP Semiconductors NV

- OmniVision Technologies Inc.

- OMRON Corp.

- Qualcomm Inc.

- Robert Bosch GmbH

- Stonkam Co. Ltd.

- Tata Elxsi Ltd.

- Tobii AB

- Toyota Motor Corp.

- Valeo SA

- Veoneer Inc.

- Visteon Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Driver Monitoring Market

- In February 2023, Bosch announced the launch of its new driver monitoring system, "Bosch Sensortec SBA60D120," which uses infrared sensors to monitor driver's vital signs and alert them if drowsiness is detected (Bosch press release). This system is expected to be integrated into various vehicle models, further expanding Bosch's presence in the market.

- In June 2024, Magna International and Intel collaborated to develop a driver monitoring system with advanced facial recognition technology. This partnership aims to create a system that can detect driver distraction and drowsiness, as well as monitor the driver's emotional state (Intel newsroom). This strategic alliance combines Magna's automotive expertise with Intel's AI capabilities, potentially leading to a more advanced and competitive driver monitoring system.

- In November 2024, Continental AG and NVIDIA announced a strategic partnership to develop an advanced driver monitoring system (ADAS) using NVIDIA's DRIVE AGX platform. This system can detect driver fatigue, distraction, and even monitor the driver's heart rate and eye movement (Continental AG press release). This collaboration represents a significant investment in the development of more advanced driver monitoring technologies, positioning Continental AG as a key player in the market.

- In March 2025, the European Union passed a regulation mandating the installation of driver monitoring systems in all new commercial vehicles starting from 2027 (European Commission press release). This regulatory approval is expected to significantly boost the demand for driver monitoring systems in the European market, as commercial vehicle manufacturers scramble to comply with the new regulations.

Research Analyst Overview

The autonomous vehicles market is experiencing significant growth, with a focus on enhancing safety features through advanced driver state sensing systems. These systems incorporate technologies such as electroencephalogram (EEG) monitoring, heart rate monitoring, and facial expression analysis to assess driver health and attention levels. Steering wheel sensors and vehicle control analysis also play a crucial role in detecting driver drowsiness and preventing accidents. Cameras, head pose analysis, and eye tracking are essential components of driver monitoring systems, providing real-time data on driver behavior and alerting when necessary. Sales channels for these systems extend beyond traditional vehicle types, with internet-based systems gaining popularity for cross-state passenger traffic.

Artificial intelligence and machine learning algorithms are increasingly being integrated into driver monitoring systems, enabling more accurate analysis of driver health and behavior. Additionally, skin conductance monitoring and respiration rate monitoring offer new insights into driver wellbeing. The integration of these safety features into autonomous vehicles is crucial as the market continues to evolve, with a focus on reducing accidents and enhancing overall driving experience. Driver monitoring systems are becoming an essential component of the autonomous vehicle ecosystem, ensuring both driver and passenger safety.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Driver Monitoring Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 1726.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.42 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, Canada, Brazil, UAE, Australia, Rest of World (ROW), Saudi Arabia, France, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Driver Monitoring Market Research and Growth Report?

- CAGR of the Automotive Driver Monitoring industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive driver monitoring market growth of industry companies

We can help! Our analysts can customize this automotive driver monitoring market research report to meet your requirements.