Automotive Emblem Market Size 2024-2028

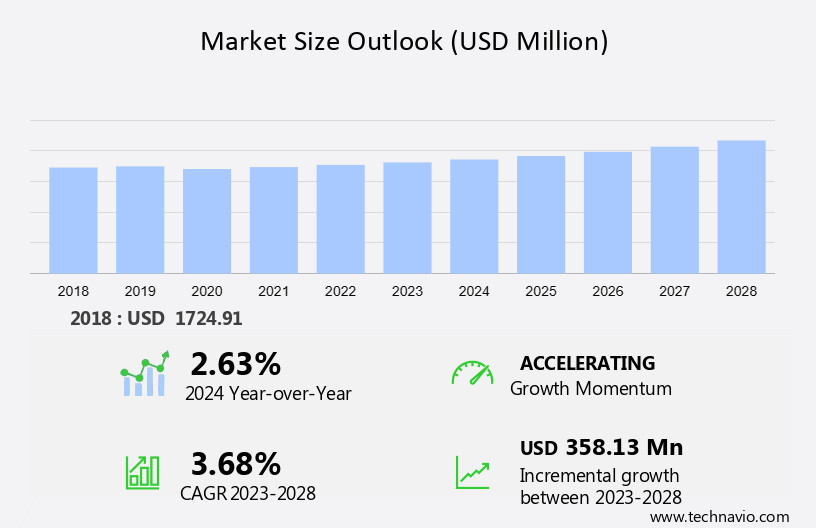

The automotive emblem market size is forecast to increase by USD 358.13 million at a CAGR of 3.68% between 2023 and 2028.

- The market is witnessing significant growth due to several key trends. One of these trends is the increasing use of new, high-quality materials to create emblems, resulting in enhanced durability and aesthetics. Another trend is the growing adoption of retractable mascots on bonnets, which adds a distinctive and premium look to vehicles. Manufacturing techniques like Stamping, Die-Casting, and injection molding are used to produce these emblems. The OEM and aftermarket segments cater to various vehicle types, including luxury cars, Sports cars, and other passenger vehicles. Additionally, changing branding nomenclature is also driving market growth as automakers seek to differentiate themselves from competitors and create unique brand identities. These trends are expected to continue shaping the market in the coming years.

What will be the Size of the Automotive Emblem Market During the Forecast Period?

- The market encompasses a diverse range of symbols and badges used to enhance vehicle aesthetics and signify brand recognition. This market caters to various segments, including passenger cars, platinum type, silver type, and bespoke emblems. Automotive emblems are applied to various parts of a vehicle, such as grills, bumpers, license plates, and interior trim pieces. Materials used in manufacturing these emblems include plastic, chrome-plated, and even LED lighting, smart sensors, and augmented reality elements.

- The market is driven by the growing trend towards vehicle personalization and customization, particularly among younger consumers. Automotive manufacturing industry advancements, such as the integration of luxury features in mass-market vehicles, further fuel the demand for high-end automotive emblems. Overall, the market is a significant and dynamic sector, continuously evolving to meet the changing needs and preferences of consumers.

How is this Automotive Emblem Industry segmented and which is the largest segment?

The automotive emblem industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- OE fittment

- Aftermarket

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

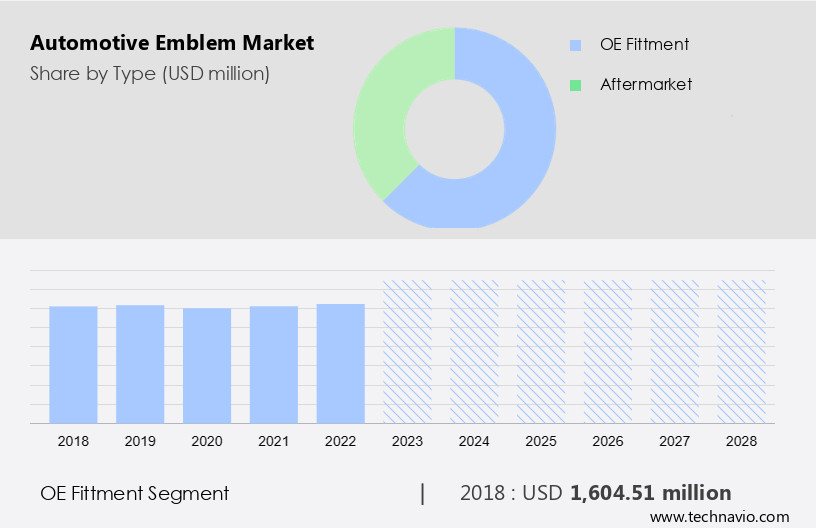

- The OE fittment segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the Original Equipment (OE) segment, which held the largest market share in 2023. Passenger cars and other vehicles' increasing adoption for daily commuting and long-distance travel fuel the demand for exhaust systems, thereby boosting the market for automotive emblems. Although the OEM segment may witness limited developments compared to the aftermarket segment, its dominant position is attributed to the continuous sales of new vehicles. Furthermore, sport motorcycle and car OEMs are expected to offer automotive emblems as factory fitments or optional accessories to cater to racing enthusiasts' demands during the forecast period. The aftermarket segment, characterized by continuous advancements in materials and designs, is also gaining traction due to the rising trend of vehicle personalization and customization among younger consumers seeking self-expression, uniqueness, and increased vehicle aesthetics.

Technological advancements, such as LED lighting, smart sensors, augmented reality elements, and functionality/visibility enhancements, are further driving market growth. The automotive manufacturing industry's shift towards Plastic, Grills, Bumpers, Interior trim pieces, Chrome-plated, and Luxury materials for automotive emblems is also contributing to the market's expansion. Electric Vehicles, Two-Wheelers, Metallic, and Non-Metallic emblems are also gaining popularity. Online aftermarket platforms offer a convenient and accessible solution for car owners to purchase and install custom automotive emblems. The market is expected to grow significantly due to the increasing demand for automotive technology and the desire for personalization and customization.

Get a glance at the market report of share of various segments Request Free Sample

The OE fittment segment was valued at USD 1.60 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

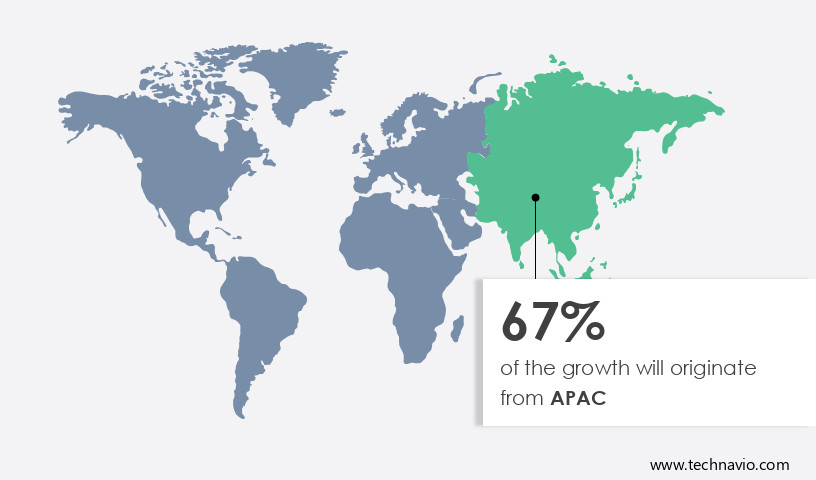

- APAC is estimated to contribute 67% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is primarily driven by China, South Korea, and Japan. China, with its significant investments in infrastructure and a large passenger car market, is a major contributor to the growth of the automotive industry and subsequently, the demand for emblems. Japan and South Korea, home to key automakers, provide a favorable business environment and infrastructure for automotive production. Given their prominent role in the global automotive landscape, we anticipate APAC to lead the growth in The market, with trends including Platinum Type, Silver Type, LED lighting, smart sensors, augmented reality elements, and customization for passenger cars, luxury cars, sports cars, electric vehicles, two-wheelers, and various vehicle components such as Plastic Grills, Bumpers, Interior trim pieces, and Chrome-plated parts. Automotive personalization and brand recognition continue to be essential factors for car owners, with online aftermarket platforms offering a wide range of options for Chrome Type, Metallic, and Non-Metallic emblems, produced via Stamping, Die-Casting, and Injection Molding for both OEM and Aftermarket applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Emblem Industry?

Growing use of new, high-quality materials to create emblems is the key driver of the market.

- The market is experiencing growth due to the adoption of high-quality materials in emblem production. companies are utilizing expensive materials such as Platinum Type, Chrome Type, and Metallic to create unique and visually appealing emblems for Passenger Cars, Luxury Cars, Sports Cars, Electric Vehicles, and Two-Wheelers. This trend is increasing consumer demand for vehicle personalization and self-expression, as well as enhancing brand recognition and vehicle aesthetics. Moreover, the competition in the Automotive Manufacturing Industry is intensifying, with OEMs implementing strategies to differentiate their offerings. Innovative designs, LED lighting, smart sensors, and augmented reality elements are being integrated into automotive emblems, providing functionality, visibility, safety, and sophistication.

- The aftermarket sector is also thriving, with Online Platforms offering a wide range of customization options for Car Owners. The introduction of new vehicle segments, such as Plastic, Grills, Bumpers, and Interior trim pieces, is expanding the market scope. companies are employing various manufacturing techniques, including Stamping, Die-Casting, and Injection Molding, to cater to the diverse needs of consumers. The Aftermarket sector is also witnessing significant growth, with OEMs and Aftermarket Players offering a wide range of options for consumers. Thus, the market is witnessing growth due to changing consumer preferences, the introduction of new technologies, and the increasing competition in the Automotive Sector. companies are focusing on offering unique, high-quality, and functional emblems to gain a competitive edge in the market.

What are the market trends shaping the Automotive Emblem Industry?

Growing use of retractable mascots on bonnets is the upcoming market trend.

- Automotive emblems play a pivotal role in vehicle design, serving as a brand's visual identity and enhancing vehicle aesthetics. Most manufacturers place their emblems on grilles or hoods as badges or logos. A select few, such as Rolls Royce, utilize flying mascots for a more distinctive representation of their brand. These emblems can be categorized into ABS Type, Platinum Type, Silver Type, and others based on material. Plastic, Metallic, and Non-Metallic are common materials used. Manufacturing techniques include Stamping, Die-Casting, and Injection Molding. Automotive emblems cater to various segments, including Passenger Cars, Luxury Cars, Sports Cars, Electric Vehicles, and Two-Wheelers.

- Younger consumers increasingly value self-expression, uniqueness, and personalization, driving demand for customization and augmented reality elements, LED lighting, smart sensors, and functionality. Enhanced visibility and safety features are essential for automotive technology. The Automotive Manufacturing Industry continues to innovate, offering advanced systems and features. Car owners can purchase OEM (Original Equipment Manufacturer) or aftermarket emblems through Online aftermarket platforms. Chrome Type emblems convey luxury and sophistication, while Platinum and Silver Types add an elegant touch. In summary, automotive emblems contribute significantly to brand recognition and vehicle personalization, making them an essential aspect of the automotive industry.

What challenges does the Automotive Emblem Industry face during its growth?

Changing branding nomenclature is a key challenge affecting the industry growth.

- The market is experiencing a shift in branding trends, with some Original Equipment Manufacturers (OEMs) moving away from traditional emblems, particularly at the rear end of vehicles. This change may hinder the market's expansion during the forecast period. Emblems are crucial for brand recognition and vehicle aesthetics. Historically, they have been positioned at the front, often on grilles, and the rear, typically on bumpers or boot lids. However, recent developments in automotive technology have led to innovative designs, such as LED lighting, smart sensors, augmented reality elements, and functionality. These advancements prioritize visibility, safety, and uniqueness, appealing to younger consumers seeking self-expression and sophistication.

- The automotive manufacturing industry responds by offering personalization options through various production methods like plastic, grills, bumpers, interior trim pieces, chrome-plated, and luxury cars, sports cars, electric vehicles, and two-wheelers. Manufacturing techniques include stamping, die-casting, and injection molding for both OEM and aftermarket applications.

Exclusive Customer Landscape

The automotive emblem market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive emblem market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive emblem market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- PremiumEmblem Co. Ltd.

- Pretty Shiny Gifts

- Santosh Export

- Thomas Fattorini Ltd.

- Tokai Rika Co. Ltd.

- Zanini Auto Group S.A.

- Billet Badges Inc.

- BrandCrowd

- CarBeyondStore

- Elektroplate

- EmblemArt Inc.

- EuroBadgez

- Ikonic Badges

- LaFrance Corp.

- Lapeer Plating + Plastics Inc.

- Lewis Banks Ltd.

- Metalic Impressions Pvt. Ltd.

- Toyoda Gosei Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of products that cater to the desire for brand recognition and vehicle aesthetics in the global automotive industry. These emblems come in various types, including Abs Type and Platinum Type, each offering distinct visual characteristics. Brand recognition plays a pivotal role in the automotive industry, with consumers often associating specific emblems with luxury, sophistication, and performance. Vehicle personalization and customization have become increasingly popular trends, particularly among younger consumers seeking self-expression and uniqueness. Automotive emblems can be found on various parts of a vehicle, such as grills, bumpers, and interior trim pieces.

They can be made from various materials, including plastic, chrome-plated metals, and even LED lighting, smart sensors, and augmented reality elements. The functionality of these emblems extends beyond mere visual appeal, with some providing enhanced visibility, safety, and automotive technology integration. The automotive manufacturing industry has embraced the trend towards personalization, with OEMs offering an array of emblem options for their vehicles. However, the aftermarket also presents a significant opportunity, with online platforms enabling car owners to purchase and install custom emblems that cater to their unique preferences. The market for automotive emblems is vast and diverse, encompassing luxury cars, sports cars, electric vehicles, and even two-wheelers. The materials used to manufacture these emblems vary, with techniques such as stamping, die-casting, and injection molding employed to create both metallic and non-metallic options. The demand for automotive emblems is driven by the desire for vehicle personalization and the role they play in enhancing brand recognition. As consumer preferences continue to evolve, the market is expected to remain a dynamic and innovative sector within the global automotive industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.68% |

|

Market growth 2024-2028 |

USD 358.13 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.63 |

|

Key countries |

US, China, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Emblem Market Research and Growth Report?

- CAGR of the Automotive Emblem industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive emblem market growth of industry companies

We can help! Our analysts can customize this automotive emblem market research report to meet your requirements.