What is the Automotive EMI Shielding Market Size?

The automotive EMI shielding market size is forecast to increase by USD 1.03 billion, at a CAGR of 7% between 2024 and 2029. The market is experiencing significant growth due to the strong demand for electric vehicles and the high adoption of Advanced Driver-Assistance Systems (ADAS) technologies. Electric vehicles have gained popularity due to their environmental friendliness and improved performance, leading to an increased need for effective EMI shielding to ensure reliable communication between components. Furthermore, the integration of various sensors and wireless connectivity in ADAS systems necessitates the use of advanced EMI shielding materials to prevent interference and ensure system functionality. However, the design complexity of modern vehicles poses a challenge to the market, as manufacturers strive to balance the need for effective shielding with weight reduction and cost efficiency. In summary, the market is driven by the increasing demand for electric vehicles and ADAS technologies, but faces challenges related to design complexity.

What will be the size of the Market during the forecast period?

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019 - 2023 for the following segments.

- Material

- Metal-based

- Polymer-based

- Application

- Passenger cars

- Commercial vehicles

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Singapore

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- South America

- Middle East and Africa

- APAC

Which is the largest segment driving market growth?

The metal-based segment is estimated to witness significant growth during the forecast period. The automotive industry's focus on reducing carbon footprints and addressing air pollution concerns has led to a significant increase in the adoption of advanced technologies such as AI, radars, and ADAS systems. These technologies rely heavily on electronic devices, which generate electromagnetic fields (EMFs) that can interfere with each other and negatively impact performance. Emission control regulations mandate the use of effective EMI shielding to mitigate these issues and ensure compliance.

Get a glance at the market share of various regions. Download the PDF Sample

The metal-based segment was valued at USD 1.47 billion in 2019. Metal-based materials, including aluminum, copper, nickel, and various alloys, dominate the market due to their superior shielding effectiveness and reliability. Their excellent conductivity and broad frequency spectrum protection make them ideal for use in under-chassis applications and other challenging automotive environments. The growing popularity of electric vehicles (EVs) further boosts demand for Metal-based EMI shielding, as their high-voltage batteries and powerful motors require strong protection against both electric and magnetic fields to ensure optimal performance and safety. In summary, the automotive industry's shift towards advanced technologies and emission control regulations necessitates the use of effective EMI shielding solutions, with Metal-based materials being the preferred choice due to their durability, heat resistance, and long-term stability.

Which region is leading the market?

For more insights on the market share of various regions, Request Free Sample

APAC is estimated to contribute 54% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Asia Pacific region is spearheading the growth in the market, with India being a key contributor. The electric vehicle (EV) sector in India is witnessing exponential growth, fueled by government incentives, increasing environmental consciousness, and technological advancements. Initiatives like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme are designed to accelerate EV adoption, revolutionizing India's transportation sector towards sustainability and innovation. India aspires to achieve substantial EV sales in various vehicle categories by 2030, with targets set at 30% for private cars, 70% for commercial vehicles, 40% for buses, and 80% for two-wheelers and three-wheelers.

Automotive manufacturers are focusing on integrating sophisticated electronic systems, including high-voltage components, telematics, infotainment systems, and hybrid technologies, in vehicles to meet evolving consumer demands and regulatory requirements. EMI shielding, primarily made from materials like stainless steel, plays a crucial role in protecting these components from electromagnetic interference, ensuring optimal performance and safety. The increasing adoption of EVs and the stringent electromagnetic emissions regulations are expected to boost the demand for EMI shielding in the automotive industry. Heavy commercial vehicles and electric vehicles are significant end-users of EMI shielding, as they incorporate numerous high-voltage components and electronic systems. The North American market for automotive EMI shielding is also expected to grow significantly, driven by the increasing popularity of electric vehicles and the need for advanced technology in vehicles to meet stringent emissions regulations.

How do company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co. - This company offers automotive EMI shielding for automotive display systems, including conductive tapes and absorbers that provide effective grounding and shielding.

Technavio provides the ranking index for the top 20 companies along with insights on the market positioning of:

- Boyd Corp.

- East Coast Shielding

- ElringKlinger AG

- Holland Shielding Systems BV

- Integrated Polymer Solutions

- KITAGAWA INDUSTRIES America Inc.

- Laird Performance Materials

- Leader Tech Inc.

- Marian Inc.

- MG Chemicals Ltd.

- Nolato AB

- Omega Shielding Products

- Parker Hannifin Corp.

- PPG Industries Inc.

- RTP Co.

- Schaffner Group

- TE Connectivity Ltd.

- Tech Etch Inc.

- Tenneco Inc.

Explore our company rankings and market positioning. Request Free Sample

How can Technavio assist you in making critical decisions?

What is the market structure and year-over-year growth of the Market?

|

Market structure |

Fragmented |

|

YoY growth 2024-2025 |

5.6 |

Market Dynamics

The market is undergoing a significant transformation, driven by the adoption of advanced technologies and the shift towards sustainable transportation. This evolution brings about unique challenges, particularly in the realm of electromagnetic interference (EMI) and electromagnetic compatibility (EMC). EMI shielding, a crucial component in managing the electromagnetic spectrum, plays a vital role in ensuring the reliability and performance of various automotive systems. Advanced driver-assistance systems (ADAS), satellite navigation, connected car technology, autonomous driving, and sensor fusion are just a few of the technologies revolutionizing the transportation sector. These systems rely heavily on intricate wiring harnesses and an increasing number of sensors and electronic control units (ECUs). The proliferation of these components generates a significant amount of EMI, which can degrade system performance, compromise safety, and even lead to system failures. EMI shielding is essential for mitigating the negative effects of electromagnetic interference. Fiber-reinforced materials, such as shielding tapes and conductive coatings, are commonly used to provide effective EMI protection.

Further, EMI shielding plays a crucial role in ensuring the reliable operation of charging stations and EV components, such as batteries and power electronics. Moreover, the integration of autonomous driving technology and smart mobility solutions necessitates strong EMI shielding. These systems rely on complex sensor networks and wireless communication, making them particularly susceptible to EMI. Effective EMI shielding ensures the reliability and safety of these advanced systems, paving the way for the future of mobility. The automotive research community is continually exploring innovative solutions to address the challenges of EMI and EMC. Weight reduction, smart transportation, and heat generation are among the key areas of focus. Lightweight materials and design trends, such as the use of carbon fiber and advanced composites, offer potential solutions for reducing the weight of EMI shielding materials while maintaining their effectiveness. Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the primary factors driving the market growth?

Rising demand for electric vehicles is notably driving the market growth. The transition to electric and self-driving vehicles is driving growth in the market. As the automotive industry moves away from traditional combustion engine vehicles towards more sustainable and technologically advanced EVs and autonomous vehicles, the demand for effective EMI shielding solutions is increasing. The proliferation of sophisticated electronic systems in modern vehicles, including sensors, GPS, radars, LiDAR, infotainment systems, and communication systems, necessitates strong shielding solutions to mitigate electromagnetic interference and disturbances. EMI shielding is essential for various components in vehicles, such as electronic control modules, power electronics, and high-voltage systems, to ensure optimal performance and reliability. The increasing adoption of connectivity features in vehicles, including cloud computing, telematics, and Internet of Things (IoT) applications, also necessitates effective EMI shielding to prevent electromagnetic emissions and ensure reliable connectivity.

The need for EMI shielding is particularly critical in EVs, which are equipped with sensitive electronic components such as high-voltage batteries and electric motors. These components are highly susceptible to electromagnetic interference, which can lead to failures and damages. Additionally, the increasing focus on reducing carbon footprints and addressing air pollution has accelerated the adoption of EVs, further increasing the demand for EMI shielding materials and technologies. EMI shielding materials and technologies include aluminum, carbon fiber composites, nickel, copper, conductive plastics, metalized fabrics, and shielding solutions made from various metals and alloys. These materials are used to shield various components and areas in vehicles, including under chassis, engine compartment, body panels, and underbody, to ensure optimal performance and reliability. Thus, such factors are driving the growth of the market during the forecast period.

What are the significant trends being witnessed in the market?

High adoption of ADAS technologies is an emerging trend shaping market growth. The market is experiencing significant growth due to the increasing adoption of advanced driver-assistance systems (ADAS) and self-driving vehicles in the US automotive industry. These technologies, which include features such as adaptive cruise control, lane-keeping assistance, and automated parking, rely on intricate electronic systems and sensors to ensure optimal performance and reduce emissions. As the number of electronic devices in vehicles increases, the susceptibility to electromagnetic interference (EMI) and radio frequency interference (RFI) also rises. This can lead to failures in sensors, communication systems, electronic control modules, and other components, negatively impacting vehicle reliability and fuel efficiency. To address these challenges, automotive manufacturers are investing in EMI shielding solutions. These shielding materials, which include aluminum, carbon fiber, composites, copper, nickel, and stainless steel, protect electronic devices from electromagnetic disturbances and heat insulation. EMI shielding is essential for various vehicle systems, including GPS, radars, LiDAR, power electronics, and infotainment systems.

Moreover, the growing trend towards connected vehicles and the increasing adoption of electric and hybrid vehicles further boost the demand for EMI shielding. These vehicles generate significant electromagnetic emissions, which can interfere with communication systems and other electronic components. Additionally, the increasing focus on emission control regulations and the need to reduce carbon footprints make EMI shielding a critical component in modern vehicles. The market for automotive shielding is expected to grow significantly due to the increasing demand for reliable and efficient vehicles. Innovative technologies, such as metalized fabrics and conductive plastics, are being developed to provide strong shielding solutions for under-chassis and underbody applications. Furthermore, the integration of AI, cloud computing, and telematics in vehicles is driving the need for advanced shielding solutions to protect against electromagnetic interference and ensure optimal performance. Thus, such market trends will shape the growth of the market during the forecast period.

What are the major market challenges?

Design complexity hampers automotive EMI shielding demand is a significant challenge hindering the market growth. The market is experiencing significant growth due to the increasing complexity of modern vehicles and the integration of advanced technologies such as self-driving capabilities, GPS, radars, LiDAR, and connectivity features. These sophisticated electronic systems, including engine compartments, under chassis, and high-voltage components, are susceptible to electromagnetic interference (EMI) and radio frequency interference (RFI), which can lead to failures, damages, and reduced fuel efficiency. Automotive manufacturers are turning to EMI shielding solutions to mitigate these issues and ensure the reliability of their vehicles. Shielding materials, such as aluminum, carbon fiber, composites, copper, nickel, and metalized fabrics, are used to create effective shielding for various components.

EMI shielding is essential for various automotive systems, including emission control regulations, electronic control modules, power electronics, communication systems, and electric and hybrid vehicles. The integration of the Internet of Things (IoT) and cloud computing in vehicles also increases the need for effective EMI shielding. The use of AI, autonomous vehicles, and telematics further adds to the complexity of vehicle architectures, requiring strong shielding solutions. EMI shielding is crucial for thermal management, optimal performance, and ensuring the reliability of modern vehicles, particularly those with sophisticated electronic systems. Hence, the above factors will impede the growth of the market during the forecast period.

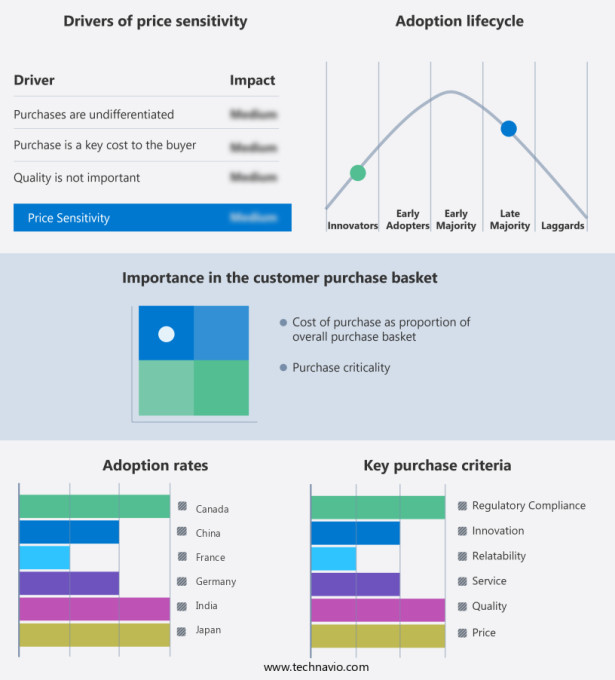

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

The market is witnessing a significant shift towards self-driving vehicles, which are increasingly relying on sophisticated electronic systems, sensors, and connectivity features. However, the proliferation of these advanced technologies in vehicles comes with its own set of challenges, one of which is electromagnetic interference (EMI) and radio frequency interference (RFI). EMI and RFI can originate from various sources, including electromagnetic noise generated by self-driving vehicle components such as sensors, GPS, radars, Lidar, and electronic control modules. These interferences can negatively impact the performance of various systems in the vehicle, leading to failures and potential safety concerns. To mitigate the effects of EMI and RFI, automotive manufacturers are turning to EMI shielding solutions. These shielding materials and technologies help in blocking electromagnetic fields and preventing interference between different components in the vehicle. Aluminum, copper, nickel, and composite materials are commonly used for EMI shielding due to their excellent conductivity and shielding properties. The use of EMI shielding is not limited to self-driving vehicles alone.

Traditional vehicles, including those with combustion engines and electric vehicles (EVs), also require EMI shielding to ensure optimal performance and reliability. EMI shielding is essential for various components in modern vehicles, including power electronics, communication systems, and high-voltage systems. The increasing adoption of IoT technologies in vehicles is another factor driving the demand for EMI shielding. With the proliferation of connectivity solutions, vehicles are becoming more interconnected, and EMI shielding is necessary to ensure reliable communication between different systems and components. Moreover, emission control regulations and the need for fuel efficiency are also driving the demand for EMI shielding. EMI shielding can help in reducing the heat generated by electronic components, thereby improving fuel efficiency and reducing carbon footprints.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2024 |

|

Historic period |

2019 - 2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market Growth 2025-2029 |

USD 1.03 billion |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 54% |

|

Key countries |

US, China, India, Japan, South Korea, Germany, Singapore, Canada, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Boyd Corp., East Coast Shielding, ElringKlinger AG, Holland Shielding Systems BV, Integrated Polymer Solutions, KITAGAWA INDUSTRIES America Inc., Laird Performance Materials, Leader Tech Inc., Marian Inc., MG Chemicals Ltd., Nolato AB, Omega Shielding Products, Parker Hannifin Corp., PPG Industries Inc., RTP Co., Schaffner Group, TE Connectivity Ltd., Tech Etch Inc., and Tenneco Inc. |

|

Market Segmentation |

Material (Metal-based and Polymer-based), Application (Passenger cars and Commercial vehicles), and Geography (APAC, North America, Europe, South America, and Middle East and Africa) |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the market forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies