Automotive Headliner Market Size 2024-2028

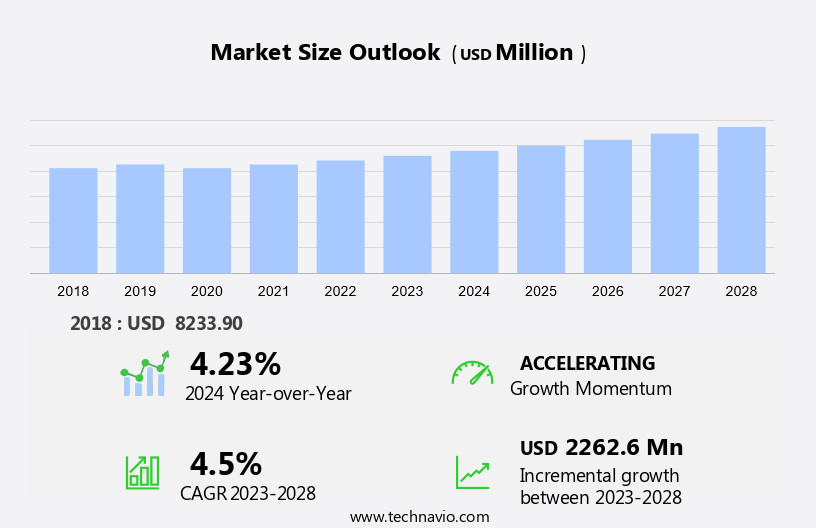

The automotive headliner market size is forecast to increase by USD 2.26 billion, at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One of the primary drivers is the increasing focus on safety features in vehicles, leading to the integration of headliners with shock absorption properties. Additionally, the automotive industry's shift towards advanced interior wiring systems necessitates the use of headliners that can accommodate these wires without compromising aesthetics or functionality. Moreover, the market is witnessing a trend towards the use of various headliner types and material types based on vehicle type.

- For instance, solar glass headliners are gaining popularity in vehicles with automotive sunroofs, offering enhanced comfort and energy efficiency. However, fluctuations In the prices of raw materials pose a challenge to market growth. To mitigate this, manufacturers are exploring alternative materials and production methods to maintain competitiveness. Overall, the market is poised for continued expansion as the automotive industry embraces smart cabin innovations.

What will be the Size of the Automotive Headliner Market During the Forecast Period?

- The market is a significant component of the automobile industry, focusing on the production and supply of headliners for various vehicle types. Headliners are essential elements of a vehicle's interior, providing comfort, safety, and aesthetic appeal. Headliners are made up of two primary components: the inner rigid substrate and the outer material. The inner rigid substrate, often made of plastic or metal, provides structure and support to the headliner. The outer material, typically fabric or polyester, covers the inner substrate and offers a comfortable surface for passengers. An inner foam backing is often added for additional comfort and shock absorption. Automotive headliners play a crucial role in vehicle safety. They protect the interior from external elements such as sunlight, rain, and wind. In addition, they help insulate the vehicle, reducing noise and maintaining a comfortable temperature.

- Headliners are used in various types of vehicles, including passenger vehicles and commercial vehicles. Passenger vehicles, such as sedans, SUVs, and luxury cars, prioritize comfort and aesthetics. Commercial vehicles, on the other hand, require headliners that can withstand heavy use and extreme conditions. The market caters to diverse consumer needs and spending power. For instance, luxury cars may feature headliners made of premium materials like leather or suede, while commercial vehicles may opt for more durable and cost-effective options. Solar glass and sunroofs are increasingly popular features in modern vehicles. Headliners for these vehicles must be designed to accommodate these features, ensuring proper insulation and UV protection. The weight of the headliner material is a critical consideration In the automotive industry. Lightweight materials, such as plastic or thin fabrics, reduce the overall weight of the vehicle, improving fuel efficiency and reducing emissions. The market is a dynamic and evolving industry.

How is this Automotive Headliner Industry segmented and which is the largest segment?

The automotive headliner industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Geography

- APAC

- Europe

- North America

- South America

- Middle East and Africa

By Application Insights

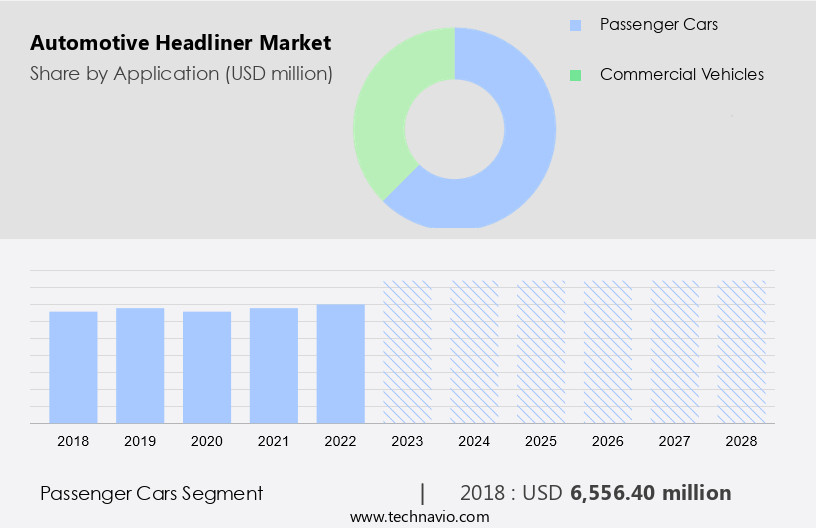

The passenger cars segment is estimated to witness significant growth during the forecast period. The market is witnessing growth due to the increasing popularity of passenger vehicles, particularly SUVs. SUVs account for a significant market share, with approximately 74% of models featuring sunroofs, air conditioning ducts, and intricate wire harnesses for various systems. These vehicles require advanced headliner designs to accommodate these features.

The demand for SUVs is increasing due to their versatility and safety features. Headliners in SUVs must absorb shock effectively due to their larger size and weight. They also need to accommodate various wiring systems for lighting, air conditioning, and other features. Additionally, the use of solar glass in sunroofs necessitates advanced headliner technologies for optimal performance. Research and development In the automotive industry are focused on creating multi-functional headliners to meet the evolving needs of consumers. These advancements include improved shock absorption, enhanced safety features, and sleek designs that blend seamlessly with the interior of the vehicle.

Get a glance at the market report of share of various segments Request Free Sample

The passenger cars segment was valued at USD 6.56 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

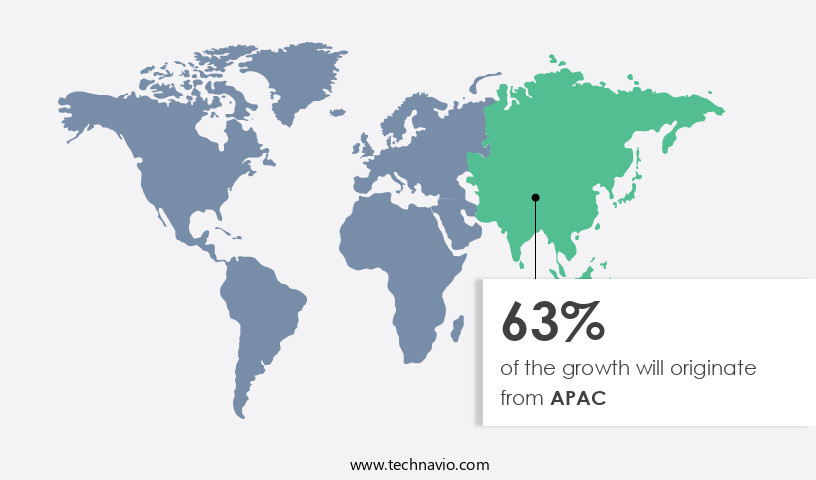

APAC is estimated to contribute 63% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific is projected to expand at a faster pace than the global market due to several factors. The population in this region is growing rapidly, leading to an increased demand for personal transportation. Urbanization is another significant factor driving the market growth, as more people move to cities and require vehicles for commuting. Additionally, there is a rising preference for luxury vehicles and SUVs in countries like China, which is influencing automakers to offer advanced facilities In their vehicles, including premium headliners.

These headliners not only enhance the aesthetic appeal of the vehicle but also provide essential functions such as insulation and concealing wires. The large production volumes in this region enable Original Equipment Manufacturers (OEMs) to achieve economies of scale and cost advantages. Therefore, the market for automotive headliners in Asia Pacific is expected to experience significant growth during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Headliner Industry?

- Globalization of vehicle development platforms is the key driver of the market. In the automotive industry, Original Equipment Manufacturers (OEMs) are embracing shared vehicle interior design platforms to cater to diverse customer segments and vehicle classes. By creating a common platform, OEMs can manufacture in large quantities and adapt it to various vehicle types. This strategy offers several benefits, including cost savings across the production chain, product differentiation from competitors, expansion into new market segments, prolonging the lifecycle of existing automobile platforms, and adaptability to evolving consumer preferences.

- This approach also presents opportunities for headliner material suppliers, enabling them to cater to multiple OEMs. It streamlines manufacturing processes and leads to cost savings, and as lifestyles and customer tastes evolve, OEMs remain agile in their offerings.

What are the market trends shaping the Automotive Headliner Industry?

- Smart cabin innovations in automotive industry is the upcoming market trend. The automotive industry has witnessed significant advancements in vehicle interior design and technology over the past decade, moving beyond the use of basic materials in entry-level segments. The focus has shifted towards creating comfortable and aesthetically pleasing cabin interiors, as automakers strive to make vehicles akin to living spaces. In the era of autonomous technology, innovations in this area are increasingly crucial. Automotive interior design offers vast opportunities for enhancement in terms of aesthetics, safety, comfort, and entertainment. New technologies, such as 3D-laminated glass, haptic sensors, and augmented reality heads-up displays, are being integrated into vehicle design considerations.

- The inner rigid subtract is being replaced with advanced materials, while the outer material is upgraded to enhance comfort and style. Inner foam backings are being used to improve acoustic performance and insulation. The roof, a critical component of the vehicle interior, is being designed with these advancements in mind. Fabric selection plays a significant role in enhancing the overall cabin experience. Automakers are focusing on using high-quality, durable, and breathable fabrics to ensure passenger comfort. The integration of these advanced materials and technologies is expected to transform the automobile industry, providing passengers with a more enjoyable and comfortable driving experience.

What challenges does the Automotive Headliner Industry face during its growth?

- Fluctuations in the prices of materials is a key challenge affecting the industry growth. The market experiences significant revenue and profitability, influenced by various factors such as raw material pricing and regulations. Raw material pricing plays a crucial role in determining the operating and net income of headliner manufacturers. The price of selective textile fabrics, plastic injection grain, petroleum-resins, and metals used in headliner production can impact the average selling price (ASP) of headliners and subsequently affect demand. Most original equipment manufacturers (OEMs) secure close-ended supply contracts, shielding them from market price fluctuations.

- However, suppliers providing raw materials to Tier-1 players may adjust their pricing based on the open market. Lightweight vehicles, including sunroof systems, are gaining popularity due to increasing investments in low-carbon emitting vehicles and regulatory policies. Lightweight materials, such as those used in headliners, contribute to reducing vehicle weight and enhancing fuel efficiency. The market's future growth is expected to be driven by these trends and the increasing demand for sustainable and eco-friendly solutions.

Exclusive Customer Landscape

The automotive headliner market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive headliner market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive headliner market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acme Auto Headlining Co.

- AFF Group

- Atlas Roofing Corp.

- Freudenberg and Co. KG

- Glen Raven Inc.

- Grupo Antolin Irausa SA

- Hayashi Telempu Co. Ltd.

- Howa Co. Ltd.

- Inteva Products LLC

- Kasai Kogyo Co. Ltd.

- Lear Corp.

- MGC Manufacturing Inc.

- Motus Integrated Technologies

- SA Automotive Ltd.

- Sage Automotive Interiors Inc.

- Shawmut LLC

- Toyota Boshoku Corp.

- UGN Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the demand for comfortable and safe interiors in various types of vehicles. Headliners, which are the ceiling coverings in automobiles, play a crucial role in providing insulation, shock absorption, and interior styling. They come in different types, including those made of fabric with an inner foam backing and outer material, and inner rigid subtract designs. The market for automotive headliners is driven by factors such as consumer spending power, population growth, and urbanization. The increasing popularity of luxury cars and the demand for lightweight, fuel-efficient vehicles are also key trends In the market. Headliners are essential for both passenger and commercial vehicles, with various material types, such as polyester and plastic, used based on the vehicle type and consumer preferences.

Also. the market witnessing the increasing adoption of solar glass and sunroofs, which require specialized headliners. The headliner market faces challenges from regulations and policies regarding vehicle weight and emissions, leading to investments in lightweight and low-carbon emitting materials. The coronavirus pandemic and resulting lockdowns have impacted the production and installation of headliners due to disrupted factories and workforces. Despite these challenges, the market is expected to continue growing due to the increasing demand for comfortable and safe vehicle interiors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 2.26 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, Japan, US, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Headliner Market Research and Growth Report?

- CAGR of the Automotive Headliner industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive headliner market growth of industry companies

We can help! Our analysts can customize this automotive headliner market research report to meet your requirements.