Automotive Interior Leather Market Size 2024-2028

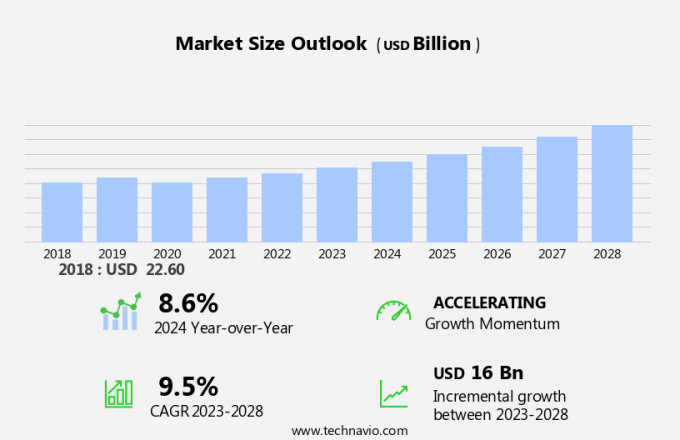

The automotive interior leather market size is forecast to increase by USD 16 billion at a CAGR of 9.5% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing production of economy-segment cars and the demand for premium car interior components. Key trends include the integration of advanced technologies such as gearboxes, consoles, entertainment systems, and instrument panels. Lightweight materials are also gaining popularity due to their cost-effectiveness and environmental benefits. For instance, thinner and more comfortable seats are being developed using composite materials and plastic polymers instead of traditional metal side plates.

- However, rising input costs from buyers pose a challenge to market growth. In the aftermarket, there is a growing preference for e-vehicles, which are expected to disrupt traditional automobile production methods and create new opportunities for leather suppliers. Overall, the market is witnessing a shift towards more sustainable and technologically advanced solutions in car interiors.

What will be the Size of the Market During the Forecast Period?

- The market is a significant segment within the automobile production industry. This market caters to the demand for high-quality materials used in upholstery applications for passenger cars and light commercial vehicles (LCVs). Leather interiors have long been synonymous with comfort, style, and premium appeal in both luxury and mid-segment cars. Genuine leather and faux leather are the two primary types of materials used in automotive interior leather applications. Genuine leather, derived from animal hides, offers superior aesthetics, durability, and breathability. On the other hand, faux leather, also known as synthetic or vegan leather, is a man-made alternative that mimics the look and feel of genuine leather while being more cost-effective and eco-friendly.

- Additionally, Advanced driver-assistance systems (ADAS) have become increasingly common in modern vehicles. These systems, which include features like lane departure warnings, adaptive cruise control, and automatic emergency braking, have led to a growing demand for automotive interior leather. Leather interiors not only enhance the overall look and feel of a vehicle but also contribute to improved comfort and style, making them an essential component in the production of both luxury and economy-segment cars. Car interior components such as seats, consoles, gearboxes, entertainment systems, and instrument panels are common applications for automotive interior leather. Seats, in particular, are a significant focus area due to their role in providing comfort and support to passengers.

- However, leather interiors offer superior comfort and durability, making them an attractive choice for both drivers and passengers. In recent years, there has been a growing trend towards the use of eco-friendly materials in the automotive industry. This includes the adoption of vegan materials and bio-degradable materials in automotive interior leather. These materials offer a more sustainable alternative to traditional leather, addressing concerns related to animal welfare and environmental impact. Vehicle emission regulations have also influenced the market. The use of polyurethane leather, a type of synthetic leather, has gained popularity due to its lower carbon footprint compared to genuine leather.

- Additionally, the adoption of advanced manufacturing techniques, such as waterless leather production, has led to a reduction in water usage and waste, making the production process more sustainable. In conclusion, the market is a dynamic and evolving industry that caters to the demand for high-quality materials used in upholstery applications for passenger cars and light commercial vehicles. The market is driven by factors such as the growing popularity of advanced driver-assistance systems, the trend toward eco-friendly materials, and the ongoing evolution of vehicle production processes. As the automotive industry continues to innovate and adapt to changing consumer preferences and regulatory requirements, the demand for automotive interior leather is expected to remain strong.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Passenger cars

- LCV

- HCV

- Geography

- Europe

- Germany

- France

- APAC

- China

- Japan

- North America

- US

- South America

- Middle East and Africa

- Europe

By Vehicle Type Insights

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The market encompasses the production and sale of leather upholstery for passenger cars, including seat covers and door panels. Consumers' increasing focus on safety and comfort in their vehicles is driving the growth of this market. Furthermore, the rising popularity of electric vehicles (EVs) is expected to boost sales of leather automotive interiors due to their premium appeal. In response to this trend, car manufacturers are prioritizing the enhancement of in-vehicle comfort, with interiors playing a significant role.

Similarly, synthetic leather, which offers a lower production cost and reduced environmental impact compared to natural leather, is gaining traction in passenger car interiors. Despite the advantages of synthetic leather, the market for natural leather interiors remains strong due to their superior comfort and style. Overall, the market is poised for growth, with a focus on providing passengers with a quiet and comfortable riding experience, even as they navigate roadways with varying noise levels and vibrations.

Get a glance at the market report of share of various segments Request Free Sample

The passenger cars segment was valued at USD 11.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The European automotive interior market is well-established and thrives due to the presence of numerous original equipment manufacturers (OEMs) and top-tier suppliers. These entities prioritize the creation of technologically advanced and efficient components to adhere to the EU's strict emission regulations. The European Union (EU) aims to reduce greenhouse gas emissions by at least 40% below 1990 levels by 2030, as per the Paris Agreement.

Consequently, automotive component manufacturers focus on component light-weighting, downsizing, and technology integration to meet these stringent emission standards. Leather alternatives, such as synthetic materials, are gaining popularity due to their environmental benefits and cost-effectiveness. However, automotive-grade leathers continue to dominate the market due to their durability and luxury appeal.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Automotive Interior Leather Market?

The rise in improved passenger car sales due to financing flexibility is the key driver of the market.

- The automotive industry's reliance on car financing and leasing solutions has been a significant catalyst for vehicle sales, including the demand for high-quality automotive interior leather. This trend, which began in the late 1910s with General Motors' establishment of a non-banking institution to support car buyers, has become a standard practice in the US, Europe, and increasingly in developing markets such as China and India. Automotive interior leather, whether genuine or synthetic, plays a crucial role in upholstery applications for luxury and premium vehicles.

- Additionally, Advanced driver-assistance systems (ADAS) are also becoming more common in cars, necessitating the use of durable and high-performing materials. As a result, the market for automotive interior leather is expected to grow steadily. The market is projected to reach a significant value by 2027, driven by increasing demand for luxury and premium vehicles. Key players in the market include companies like Johnson Controls, Adient, and Faurecia.

Keep the tone formal and informative.

What are the market trends shaping the Automotive Interior Leather Market?

Innovations in lightweight materials are the upcoming trends in the market.

- The automotive industry has witnessed a significant shift towards producing lighter vehicles in response to increasing consumer demand for improved fuel efficiency. This trend can be attributed to the rise in fuel prices over the past decade. In an effort to reduce vehicle weight, automobile producers are turning to innovative materials for car interior components.

- Additionally, gearboxes, consoles, entertainment systems, instrument panels, and other interior components are being engineered to be lighter without compromising quality. The aftermarket for automotive interior leather is also experiencing growth as consumers seek to upgrade their vehicles with premium materials. Furthermore, the advent of electric vehicles (e-vehicles) is driving demand for lightweight interiors to increase battery range and overall vehicle efficiency.

What challenges does Automotive Interior Leather Market face during the growth?

Increasing input cost pressure from buyers is a key challenge affecting market growth.

- The automotive industry underwent significant changes following the financial crisis of 2008, with North American OEMs facing financial instability and the need to cater to cost-conscious consumers. In response, OEMs shifted the cost burden and risk of component failure to tire-1 suppliers and component manufacturers. This resulted in intense pressure on these suppliers to maintain profitability while delivering top-notch materials, adhering to the strict quality control standards set by OEMs and tire-1 suppliers. In the market, suppliers face the challenge of balancing affordability with premium aesthetics. Both passenger cars and light commercial vehicles (LCVs) in various car classes, including luxury cars and mid-segment vehicles, demand improved interior designs.

- However, synthetic leather has emerged as a popular alternative due to its cost-effectiveness and durability. As a result, suppliers must invest in research and development to produce high-quality synthetic leather that mimics the look and feel of genuine leather. To remain competitive, suppliers must also keep up with evolving consumer preferences and trends. This includes offering customizable options and personalized designs to cater to the unique needs of various vehicle segments. By focusing on innovation and delivering high-quality materials, suppliers can meet the demands of OEMs and consumers alike, ensuring long-term success in the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adient Plc

- Alfatex Italia Srl

- Classic Soft Trim

- Ctl Leather Inc.

- DK Schweizer Leather Sdn Bhd

- Eissmann Automotive Deutschland GmbH

- Elmo Sweden AB

- Faurecia SA

- GRUPO ANTOLIN IRAUSA S.A.

- Gruppo Mastrotto Spa

- Katzkin Leather Inc.

- KURARAY Co. Ltd.

- Lear Corp.

- Mayur Uniquoters Ltd.

- Sage Automotive Interiors Inc.

- Scottish Leather Group Operations Ltd.

- SMS Auto Fabrics

- Toyoda Gosei Co. Ltd.

- Toyota Boshoku Corp.

- Wollsdorf Leder Schmidt and Co Ges.mbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the demand for high-quality materials in various automotive applications, including upholstery for seats, consoles, instrument panels, and car interiors in passenger cars and light commercial vehicles (LCV). Both genuine leather and synthetic leather are popular choices for automakers due to their improved aesthetics, comfort, style, and premium appeal. Advanced driver-assistance systems (ADAS) and luxury vehicles are major drivers for the market's growth. Synthetic leather, also known as polyurethane leather, offers advantages such as durability, resistance to wear and tear, and lower production costs compared to genuine leather. However, the increasing trend towards e-vehicles, fuel-efficient vehicles, and driverless vehicles may impact the demand for leather interiors.

Moreover, Vehicle production companies focus on using sustainable materials, including vegan materials and bio-degradable materials, to meet evolving consumer preferences and vehicle emission regulations. Leather alternatives, such as PU leather, are also gaining popularity due to their affordability and eco-friendliness. The market includes car class segments, such as luxury cars, mid-segment vehicles, and economy-segment cars. Car interior components, including seat belts, door panels, carpets, headliners, and center consoles, also contribute to the market's growth. The aftermarket for leather interiors is another significant area of opportunity for market participants.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.5% |

|

Market growth 2024-2028 |

USD 16 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.6 |

|

Key countries |

Germany, China, US, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch