What is the Automotive Load Floors Market Size?

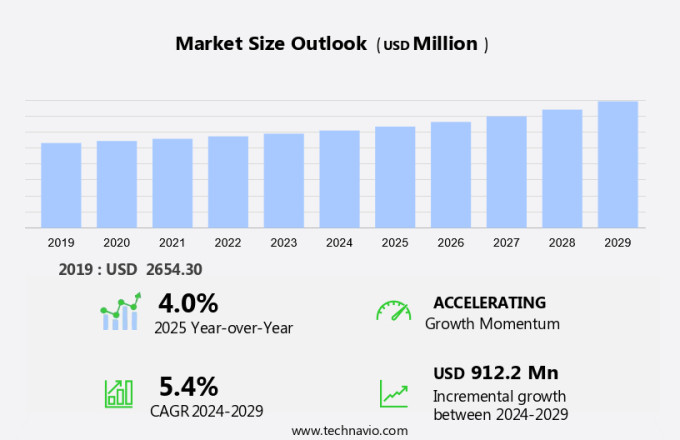

The automotive load floors market size is forecast to increase by USD 912.2 million, at a CAGR of 5.4% between 2024 and 2029. The automotive load floors market is experiencing significant growth due to several key factors. The increasing sales of SUVs and pickup trucks, driven by consumer preferences for larger vehicles, is a major market driver. Another trend influencing market growth is the adoption of twin-sheet thermoforming in the production of load floors, which offers advantages such as improved strength and reduced weight. However, the market is also facing challenges from stricter pollution regulations against diesel engines, which may limit the use of these vehicles and, in turn, impact the demand for load floors. Overall, the market is expected to witness steady growth in the coming years as these trends and challenges shape the industry landscape.

What will be the size of the Market during the forecast period?

Request Free Automotive Load Floors Market Sample

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019 - 2023 for the following segments.

- Material

- Hardboard

- Fluted polypropylene

- Others

- End-user

- Passenger cars

- Commercial vehicles

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

Which is the largest segment driving market growth?

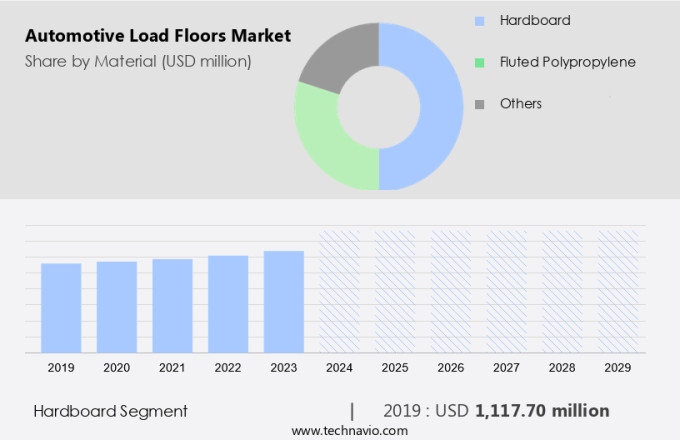

The hardboard segment is estimated to witness significant growth during the forecast period. In the automotive industry, load floors play a crucial role in enhancing the functionality and utility of passenger cars and commercial vehicles. One popular material used in the manufacturing of these load floors is hardboard, which offers several advantages. Hardboard is made from compressed wood fibers, resulting in a dense and smooth surface that is capable of supporting and distributing the weight of various loads in the cargo area. This material's sturdiness and resilience make it an ideal choice for a wide range of applications. For instance, many passenger automobiles, such as the Toyota RAV4, incorporate hardboard load floors that not only serve a practical purpose but also contribute to the vehicle's overall aesthetic appeal.

Get a glance at the market share of various regions. Download the PDF Sample

The hardboard segment was valued at USD 1.12 billion in 2019. Moreover, the trend towards zero-emission electric vehicles and lightweight automotive components is driving the demand for lightweight materials like hardboard in the automotive load floor market. Materials like expanded polypropylene and PU (polyurethane) are also gaining popularity due to their lightweight properties and excellent load-carrying capability. These materials are not only eco-friendly but also help in reducing the overall weight of the vehicle, thereby improving its fuel efficiency and reducing emissions. In summary, hardboard and other lightweight materials are essential components of automotive load floors, providing a sturdy platform for cargo while contributing to the vehicle's overall functionality and design. The growing demand for zero-emission electric vehicles and lightweight components is expected to fuel the growth of the automotive load floor market in the coming years.

Which region is leading the market?

For more insights on the market share of various regions, Request Free Sample

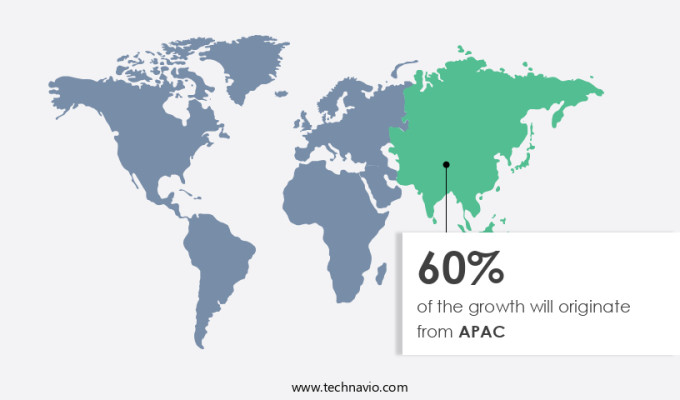

APAC is estimated to contribute 60% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Asia Pacific market holds a substantial share in the global automotive load floors industry. This growth can be attributed to the expanding commercial vehicle sector and favorable government policies. In India, for instance, commercial vehicle sales experienced a considerable uptick in the second quarter of 2024. This growth was primarily due to the high replacement demand and ongoing infrastructure projects. Around 234,000 trucks and buses were sold in the local market during the June quarter, representing a 4.5% increase compared to the 224,000 vehicles sold in the same period the previous year. This trend underscores the escalating need for resilient and efficient load floor solutions that cater to the heavy-duty demands of commercial automotive vehicles.

Moreover, automotive manufacturing in the region is thriving, with mid-size cars and commercial vehicles being the major contributors to the market's growth. Incentives such as road toll exemptions and the adoption of lightweight materials like polypropylene have further fueled the demand for automotive load floors. As a result, industry players are focusing on enhancing the durability and functionality of their offerings to meet the evolving needs of the automotive sector. The increasing consumption of automotive vehicles in the region is expected to continue driving the growth of the market in the Asia Pacific region.

How do company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ABC Technologies Inc.: The company offers automotive load floors that are lightweight, resilient, and can be customized to fit individual vehicle needs.

Technavio provides the ranking index for the top 20 companies along with insights on the market positioning of:

- ASG Group Ltd.

- Auria Solutions

- Autoneum Holding Ltd.

- con-pearl GmbH

- Covestro AG

- Gemini Group Inc.

- Grudem

- Huntsman Corp.

- IDEAL Automotive GmbH

- Magna International Inc.

- Nagase America LLC

- SA Automotive Ltd.

- UFP Technologies Inc.

- Woodbridge Foam Corp.

Explore our company rankings and market positioning. Request Free Sample

How can Technavio assist you in making critical decisions?

What is the market structure and year-over-year growth of the Market?

|

Market structure |

Fragmented |

|

YoY growth 2024-2025 |

4.0 |

Market Dynamics

The market is evolving with the rise of green vehicle technology and electric vehicle (EV) adoption. As demand for sustainable materials increases, manufacturers are focusing on durable automotive materials like polypropylene load floors and composite panel applications to enhance automotive interior design and reduce vehicle weight. The integration of lightweight vehicle design supports automotive weight reduction and carbon footprint reduction, aligning with zero-emission vehicle and eco-friendly vehicles goals.Innovations in EV cargo solutions and cargo transportation are driven by lightweight load floors and load floor technology, offering improved car interior space and luggage transportation options. With vehicle conversion and alternative fuel vehicles gaining traction, the market is poised for growth. Vehicle safety enhancements and government regulation continue to shape future of mobility and emission reduction strategies, positioning the automotive load floors market as a key player in clean transportation solutions. Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the primary factors driving the market growth?

The rise in sales of SUVs and pickup trucks is the key factor driving the market growth. The market is experiencing significant growth due to the increasing sales of commercial vehicles, such as SUVs and pickup trucks. These types of vehicles require load floor systems with high load-bearing capacity and luggage load-carrying capability. Automakers are responding to this trend by developing advanced load floor solutions using lightweight materials, such as expanded polypropylene (EPP) and thermoplastic olefin (TPO). For instance, post-processed TPO load floor systems offer wipe-clean materials, making them ideal for commercial vehicles. Moreover, the shift towards zero-emission electric vehicles (EVs) is also influencing the market. Automakers are focusing on producing ultra-lightweight panels using composites, such as glass fiber reinforced polypropylene (GFPP) and polyurethane (PU) materials. These lightweight automotive components help reduce CO2 emissions and improve the overall fuel efficiency of the vehicle.

Further, the market is expected to grow significantly in the coming years, with automobile manufacturing companies investing heavily in the development of advanced load floor systems. In addition, the increasing demand for freight transportation and heavy-duty commercial vehicles is also contributing to the market growth. The automotive trunk and load floor market is expected to reach new heights, with sliding load floors and composite panels becoming increasingly popular due to their high strength and durability. The global market is expected to continue its growth trajectory, driven by the increasing demand for versatile and full load floor solutions for commercial vehicles and passenger automobiles alike. The market is expected to remain competitive, with key players focusing on innovation and price competitiveness to gain a larger market share. Thus, such factors are driving the growth of the market during the forecast period.

What are the significant trends being witnessed in the market?

Adoption of twin-sheet thermoforming is the primary trend shaping the market growth. The market is experiencing a notable transition towards twin-sheet thermoforming technology in the production of load floor systems. This trend is fueled by the escalating demand for durable, lightweight, and high-performance load floors in both commercial and passenger vehicles. Twin-sheet thermoforming is a technique that concurrently heats and shapes two plastic sheets, which are subsequently fused into a single, strong component. This methodology provides several benefits over conventional manufacturing methods, such as increased structural integrity, weight reduction, and enhanced load-bearing capacity. Leading automotive manufacturers are integrating twin-sheet thermoformed load floors into their vehicle designs to cater to evolving market preferences. For instance, the Ford TRANSIT Cargo Van employs this technology to create a cargo area that is both robust and lightweight. This innovation is particularly relevant for zero-emission electric vehicles (EVs) and hybrid electric vehicles (HEVs), as weight reduction is crucial for optimizing battery efficiency and improving overall vehicle performance.

Moreover, the shift towards automotive electrification and the increasing demand for lightweight automotive components are driving the growth of the load floors market. The adoption of advanced materials, such as expanded polypropylene (EPP), thermoplastic polyolefin (TPO), and composite materials, is also contributing to the market expansion. These materials offer excellent load-carrying capability, durability, and resistance to impact and wear, making them ideal for use in load floors. Government incentives, such as tax breaks and preferential parking access, are further fueling the demand for lightweight and eco-friendly automotive components, including load floors. As the automotive industry continues to evolve, the focus on reducing CO2 emissions, improving fuel efficiency, and enhancing vehicle performance is expected to drive the growth of the load floors market. Additionally, the increasing popularity of mid-size cars and light commercial vehicles is creating new opportunities for load floor manufacturers. The increasing demand for commercial and passenger vehicles with improved load-bearing capacity, durability, and reduced weight is further fueling the market expansion. Thus, such trends will shape the growth of the market during the forecast period.

What are the major market challenges?

Pollution regulations against diesel engines is the major challenge that impedes market growth. The market is experiencing significant growth due to the increasing demand for lightweight and durable load floor systems in both passenger and commercial vehicles. These load floor systems are essential for enhancing the luggage load-carrying capability of vehicles, particularly in commercial transport vehicles that carry heavy freight. Automakers are turning to advanced materials such as expanded polypropylene (EPP), thermoplastic olefin (TPO), and composite materials like glass fiber reinforced polypropylene (GFPP) and polyurethane (PU) for manufacturing lightweight automotive components. Zero-emission electric vehicles (EVs) and hybrid electric vehicles (HEVs) are also driving the market for automotive load floors. These vehicles require ultra-lightweight panels to reduce overall vehicle weight and improve energy efficiency.

For instance, preferential parking access, CO2 emissions tax exemptions, and road toll exemptions are some incentives offered by governments to encourage the adoption of lightweight vehicles. The increasing consumption of mid-size cars and automobiles, as well as the automobile manufacturing industry's focus on reducing CO2 emissions, are expected to provide significant opportunities for market growth. The market is expected to continue its growth trajectory, with a focus on developing innovative and cost-effective load floor solutions. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. The market forecast report focuses on adoption rates in different regions based on penetration and market trends. Furthermore, the market research and growth report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

The automotive industry is witnessing a significant shift towards sustainable transportation solutions, with electric vehicles (EVs) and hybrid vehicles leading the charge. This transition is not only driven by the need to reduce carbon emissions but also by the increasing demand for eco-friendly automotive materials and advanced vehicle design. One area of focus in this regard is the development of sustainable load floors for electric and hybrid vehicles. Load floors, a crucial component of vehicle design, are essential for cargo space optimization and weight reduction. Traditional load floors have been made of heavy materials such as steel, leading to increased vehicle weight and decreased fuel efficiency. However, the evolution of automotive material innovation is bringing about a change in this landscape. Sustainable materials like polypropylene (PP) are increasingly being used in the production of load floors. PP-based load floors offer several advantages, including durability, lightweight, and recyclability. These load floors contribute significantly to vehicle weight reduction, thereby improving overall vehicle efficiency.

Moreover, the trend towards zero-emission vehicles is driving the demand for eco-friendly automotive materials. EV interior design is focusing on using sustainable materials to create a clean and green vehicle experience. Lightweight vehicle components, such as composite load floors, are being adopted to reduce the overall weight of EVs and improve their range. The future of transportation lies in sustainable automotive manufacturing and design. Advanced automotive materials, including those used in load floor production, are key to achieving this goal. Lightweight vehicle components, such as composite load floors, are becoming increasingly popular due to their strength, durability, and reduced weight. Cargo management and optimization are crucial considerations in the design of EVs and hybrid vehicles. Load floor solutions that offer efficient cargo space utilization are in high demand. Innovations in load floor design, such as modular and configurable load floors, are addressing this need. These load floors offer flexibility in cargo configuration, making them ideal for compact cars and small vehicles. The adoption of electric vehicles is on the rise, driven by increasing environmental consciousness and government incentives.

Further, the automotive industry is responding to this trend by focusing on the development of sustainable automotive materials and advanced vehicle design. The future of transportation is green, and load floors are playing a crucial role in this transition. In conclusion, the automotive industry is witnessing a paradigm shift towards sustainable transportation solutions. The development of eco-friendly load floors is a key component of this transition. Innovations in materials, such as PP-based load floors, and design, such as modular and configurable load floors, are driving the future of automotive load floor solutions. The focus on sustainable automotive manufacturing and the adoption of advanced automotive materials are essential to achieving a cleaner and greener future for transportation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019 - 2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 912.2 million |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 60% |

|

Key countries |

China, US, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ABC Technologies Inc., ASG Group Ltd., Auria Solutions, Autoneum Holding Ltd., con-pearl GmbH, Covestro AG, Gemini Group Inc., Grudem, Huntsman Corp., IDEAL Automotive GmbH, Magna International Inc., Nagase America LLC, SA Automotive Ltd., UFP Technologies Inc., and Woodbridge Foam Corp. |

|

Market Segmentation |

Material (Hardboard, Fluted polypropylene, and Others), End-user (Passenger cars and Commercial vehicles), and Geography (APAC, Europe, North America, South America, and Middle East and Africa) |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies