Automotive OBD Dongle Market Size 2024-2028

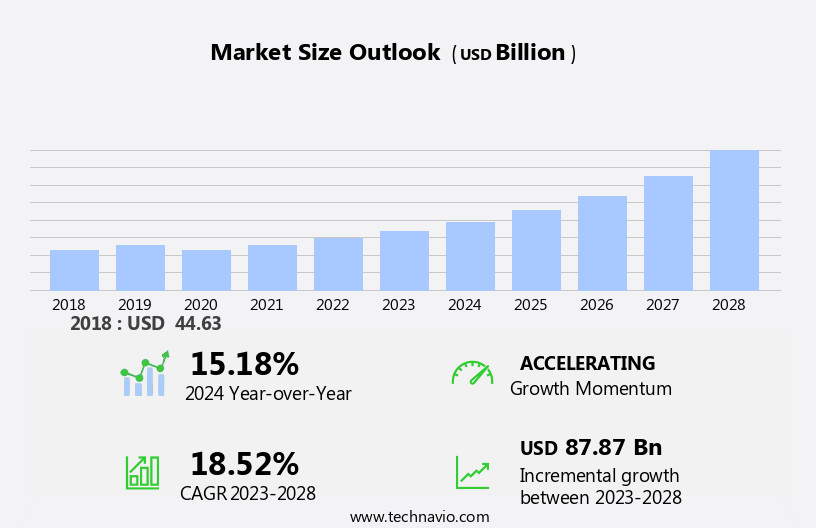

The automotive OBD dongle market size is forecast to increase by USD 87.87 billion, at a CAGR of 18.52% between 2023 and 2028.

- The global automotive OBD dongle market is experiencing steady growth, driven by increasing demand for real-time vehicle diagnostics and advancements in telematics technology. Factors such as the shift toward usage-based insurance models, which rely on OBD data to tailor premiums, and the integration of 5G technology for faster data transmission are key contributors to this expansion. These trends reflect a broader industry push for connected vehicles and smarter fleet management solutions.

- This report offers a detailed look at the market, projecting a size increase of USD 87.87 billion from 2023 to 2028, with a CAGR of 18.52%. It breaks down growth forecasts, highlighting the passenger car segment as a major driver due to rising consumer adoption in emerging markets. The report also examines key trends, like the growing use of advanced analytics in automotive telematics to enhance vehicle monitoring, alongside challenges such as privacy concerns tied to data security. Businesses can use these insights for strategic planning, client engagement, and operational improvements in a competitive automotive landscape.

- With its focus on market size, segment performance, and emerging dynamics, this report equips decision-makers with the data needed to navigate technological shifts and address privacy hurdles, ensuring they stay ahead in the global automotive OBD dongle market

What will be the Size of the Automotive OBD Dongle Market During the Forecast Period?

The market is experiencing significant growth due to the increasing demand for real-time vehicle monitoring and diagnostics. OBD dongles, which connect to the OBD port in passenger cars, enable Bluetooth and in-car Wi-Fi connectivity for engine performance analysis, fuel consumption optimization, and diagnostic trouble code identification. These devices offer preventive maintenance benefits, reducing downtime for personal vehicles and commercial fleets alike. Telematics solutions, including insurance models and telematics services, are integrating OBD dongles to enhance vehicle connectivity and improve vehicle health. The integration of advanced connectivity technologies, such as Wi-Fi and data transmission capabilities, enables mobile applications and web-based solutions for seamless vehicle diagnostics and driving experiences. OBD dongles contribute to the trend of vehicle performance optimization and fuel efficiency, making them an essential tool for automotive manufacturers and consumers alike.

How is this Automotive OBD Dongle Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Type

- Bluetooth

- WiFi

- Geography

- North America

- Canada

- US

- Mexico

- APAC

- China

- Japan

- India

- Australia

- Europe

- Germany

- UK

- France

- South America

- Middle East and Africa

- North America

By Vehicle Type Insights

The passenger cars segment is estimated to witness significant growth during the forecast period. The automotive OBD (On-Board Diagnostics) dongle market is experiencing significant growth due to the increasing demand for vehicle connectivity and diagnostics. OBD dongles enable real-time monitoring of vehicle performance data, including fuel consumption, engine performance, and diagnostic trouble codes. They come in various forms, such as Bluetooth, Wi-Fi, and cellular OBD dongles, providing flexibility for users. Telematics solutions, fleet management, and usage-based insurance models are some of the major applications driving the market's growth. Passenger cars remain the largest segment, with telematics becoming standard fitments in most vehicles. The integration of wireless communication technology, artificial intelligence, and machine learning is further enhancing the capabilities of OBD dongles.

Get a glance at the share of various segments. Request Free Sample

The passenger cars segment was valued at USD 26.49 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 29% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American automotive OBD (On-Board Diagnostics) dongle market is currently the largest globally, driven by feature enhancements and new business models that enable OEMs to generate additional revenue. With the increasing reliance on road and freight transportation, the demand for OBD dongles is expected to rise among fleet operators and managers. These devices, which can reduce emissions and enhance fuel efficiency, offer significant benefits and contribute to the development of OBD-III. The California Air Resources Board (CARB) has been spearheading the OBD-III concept for the past decade. OBD systems, which provide real-time monitoring, diagnostics, and trip tracking, are increasingly integrated with telematics solutions, wireless communication technology, artificial intelligence, and machine learning.

These advancements offer fleet management operations valuable data for preventive maintenance, usage-based insurance, and fleet optimization. OBD dongles, available through various channels such as aftermarket suppliers, retail outlets, and online platforms, support connectivity through Bluetooth, Wi-Fi, and cellular networks. Ensuring cybersecurity through encryption protocols, authentication mechanisms, and firmware updates is crucial to mitigate potential vulnerabilities, such as hacking and unauthorized access.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers for the Automotive OBD Dongle Industry?

- Usage-based insurance (UBI) model to drive utility value of OBD dongles is the key driver of the market. The market encompasses Bluetooth and Wi-Fi dongles designed for Passenger Cars to enable real-time monitoring of Engine Performance, Fuel consumption, and Diagnostic trouble codes. Telematics solutions facilitate Vehicle-to-everything communications, including road safety, Traffic management, and Smart mobility. Personal vehicles and Commercial fleets leverage these technologies for Preventive maintenance, Usage-based insurance models, and Fleet management operations. Automotive manufacturers integrate connected car technologies and Automotive IoT technologies for enhanced Vehicle connectivity and Diagnostics solutions. Wireless communication technology, such as Bluetooth and Wi-Fi, enables remote monitoring of Vehicle performance data, Fault codes, and Real-time data transmission. Machine learning and Artificial intelligence analyze this data to provide Data-driven insights for improving vehicle health, Driving experiences, and Fuel efficiency.

- Vehicle electrification and autonomous vehicles further expand the market's potential. However, concerns over Security vulnerabilities, Hacking, and Unauthorized access necessitate Cybersecurity measures, including Encryption protocols, Authentication mechanisms, and Firmware updates. Industry standards ensure compliance with Emissions standards and Environmental standards. Aftermarket suppliers offer Wired and Wireless OBD Dongles through various channels, including Online retail, Offline retail, and Independent workshops, catering to both OEM and Aftermarket channels. Insurance companies employ UBI (Usage-based insurance) to analyze Vehicle performance data for risk assessment, offering lower premiums for safe driving practices. Fleet operators benefit from Real-time data on Driving behavior, Efficiency, and Maintenance alerts, enhancing their operations.

What are the market trends shaping the Automotive OBD Dongle Industry?

- Advanced analytics on telematics data to reduce risk severity is the upcoming market trend. In the automotive industry, the integration of advanced technologies such as Bluetooth, Wi-Fi, and wireless communication is revolutionizing the way passenger cars are maintained and operated. OBD dongles, including Bluetooth OBD dongles and Wi-Fi dongles, allow real-time monitoring of engine performance, fuel consumption, and diagnostic trouble codes. Telematics solutions enable fleet management operations, usage-based insurance models, and vehicle tracking. Automotive manufacturers, independent workshops, retail outlets, and online platforms offer these diagnostic tools and services. The application of artificial intelligence and machine learning in vehicle data analysis provides data-driven insights for preventive maintenance, vehicle health, and driving behavior. Connected car technologies, such as vehicle-to-everything communications, road safety, traffic management, and smart mobility, are transforming the automotive landscape.

- Vehicle electrification and autonomous vehicles further enhance the importance of vehicle connectivity and diagnostics. Despite the benefits, concerns regarding cybersecurity vulnerabilities, hacking, and unauthorized access remain. Encryption protocols, authentication mechanisms, firmware updates, and cybersecurity measures are essential to mitigate these risks. Industry standards and regulations, such as emissions and environmental standards, are driving the demand for OBD systems and telematics solutions. Aftermarket suppliers offer various wireless and wired OBD dongles, catering to both personal vehicles and commercial fleets. Insurers and fleet operators leverage real-time data for efficiency, connectivity, and maintenance alerts. The integration of telematics services in vehicle performance data, fuel efficiency, and vehicle safety enhances the driving experience.

What challenges does the Automotive OBD Dongle Industry face?

- Privacy and hacking concerns with onboard diagnostics is a key challenge affecting the industry growth. The market encompasses various connectivity technologies, including Bluetooth, Wi-Fi, and cellular networks, for real-time monitoring and diagnostic solutions in passenger cars. OBD dongles enable access to vehicle performance data, fuel consumption, diagnostic trouble codes, and other vital information for personal vehicles and commercial fleets. Telematics solutions, such as preventive maintenance, usage-based insurance models, and fleet management operations, utilize OBD dongles for data transmission and mobile applications. Automotive manufacturers integrate OBD systems to ensure compliance with emissions and environmental standards. However, concerns regarding vehicle warranty voidance, security vulnerabilities, hacking, and unauthorized access persist, necessitating encryption protocols, authentication mechanisms, firmware updates, and cybersecurity measures.

- Industry standards continue to evolve to address these challenges and promote connectivity, data-driven insights, and smart mobility. OBD dongles come in wired and wireless formats, such as Bluetooth OBD dongles, Wi-Fi dongles, and cellular OBD dongles. These devices can be purchased through aftermarket channels, retail outlets, online platforms, independent workshops, and OEM channels. The market for OBD dongles is expected to grow significantly due to the increasing demand for vehicle connectivity, diagnostics, and telematics services. Real-time data on vehicle health, driving behavior, efficiency, and connectivity provide valuable insights for fleet operators and insurers. These data-driven insights contribute to improved vehicle safety, fuel efficiency, maintenance alerts, and overall driving experiences.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive OBD dongle market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AutoPi.io ApS

- BAFX Products

- BorgWarner Inc.

- Continental AG

- Danlaw Inc.

- Geotab Inc.

- Huawei Technologies Co. Ltd.

- Intel Corp.

- iWave Systems Technologies Pvt. Ltd.

- Legion Autodata JSC

- Moj.io Inc.

- OBD Solutions LLC

- Prizmos Ltd.

- Robert Bosch GmbH

- ShenZhen CheBoTong Technology Co. Ltd.

- TomTom NV

- Veepeak

- Verizon Communications Inc.

- Zubie Inc.

- Zymbia Interactive Technologies Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of diagnostic tools designed to connect to a vehicle's on-board diagnostics (OBD) system. These devices enable users to access real-time data on vehicle performance, identify fault codes, and monitor various parameters. The market for OBD Dongles is driven by the increasing demand for vehicle connectivity and the growing adoption of telematics solutions. The integration of wireless communication technology in OBD Dongles has been a significant trend In the market. Bluetooth and Wi-Fi dongles allow users to connect their devices to their vehicles without the need for physical cables. Cellular OBD Dongles offer remote monitoring capabilities, enabling fleet management operations to track and monitor their vehicles in real-time.

Moreover, the market caters to various customer segments, including personal vehicle owners and commercial fleet operators. Automotive manufacturers also offer OBD systems as standard equipment In their vehicles, providing an OEM channel for OBD Dongle sales. Aftermarket suppliers offer OBD Dongles through various channels, including retail outlets, online platforms, independent workshops, and fleet management solutions. The use of OBD Dongles extends beyond vehicle diagnostics. Telematics services offer data-driven insights into vehicle health, driving behavior, and fuel efficiency. Usage-based insurance models leverage OBD Dongle data to determine premiums based on actual driving behavior. Preventive maintenance alerts help vehicle owners maintain their vehicles, reducing the risk of breakdowns and increasing vehicle longevity.

Furthermore, the integration of artificial intelligence and machine learning algorithms in OBD Dongles enables predictive maintenance and real-time data analysis. Vehicle-to-everything communications offer new opportunities for road safety, traffic management, and smart mobility. The growing trend towards vehicle electrification and the increasing adoption of autonomous vehicles are also expected to drive growth in the market. However, the use of OBD Dongles also presents cybersecurity challenges. Encryption protocols, authentication mechanisms, firmware updates, and cybersecurity measures are essential to protect against hacking, unauthorized access, and cyber threats. Industry standards and regulations play a crucial role in ensuring the security and reliability of OBD Dongles.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.52% |

|

Market Growth 2024-2028 |

USD 87.87 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.18 |

|

Key countries |

China, US, Germany, Japan, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive OBD Dongle Market Research and Growth Report?

- CAGR of the Automotive OBD Dongle industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive OBD dongle market growth of industry companies

We can help! Our analysts can customize this automotive OBD dongle market research report to meet your requirements.